[ad_1]

gchapel/iStock through Getty Pictures

The Q1 Earnings Season for the Silver Miners Index (SIL) begins subsequent month, and one of many first firms to launch its preliminary Q1 outcomes was First Majestic Silver (NYSE:AG). The corporate noticed sturdy development year-over-year, helped by the newly acquired Jerritt Canyon [JC] Mine. Nonetheless, consolidated manufacturing did fall sharply vs. This autumn 2021. The excellent news is that manufacturing will enhance because the 12 months progresses, with significant development in consolidated gold manufacturing on deck. Nonetheless, with First Majestic buying and selling at greater than 3.0x P/NAV, I nonetheless do not see any margin of security to justify coming into new positions right here at US$12.60.

First Majestic Silver Operations (Firm Presentation)

First Majestic Silver launched its preliminary Q1 outcomes final week, reporting quarterly manufacturing of ~7.22 million silver-equivalent ounces [SEOs], consisting of ~58,900 ounces of gold and ~2.61 million ounces of silver. This was an enormous enchancment from the ~4.54 million SEOs produced within the year-ago interval. The majority of this development stems from the acquisition of a brand new ~120,000-ounce every year gold asset, the Jerritt Canyon Mine in Nevada. Let’s take a better take a look at the quarter beneath:

Manufacturing

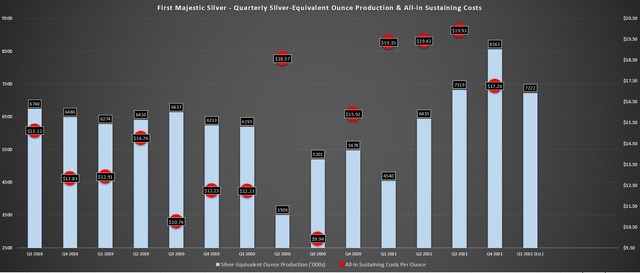

Wanting on the chart beneath, we are able to see that web optimization manufacturing elevated sharply on a year-over-year foundation however did see a significant step down vs. This autumn 2021 ranges, sliding greater than 14% to ~7.22 million SEOS (This autumn 2021: ~8.56 million SEOs). The decline in manufacturing was associated to decrease throughput at its Mexican operations, which had been affected by elevated absenteeism ranges in early Q1 as a result of COVID-19. Happily, this did not result in a lot of a decline at Santa Elena, which is benefiting from a better proportion of mill feed from its higher-grade close by Ermitano Mine that is now in manufacturing. Nonetheless, it did put a pointy dent in output at its different two Mexican operations.

First Majestic – Consolidated Silver-Equal Manufacturing & AISC (Firm Filings, Creator’s Chart)

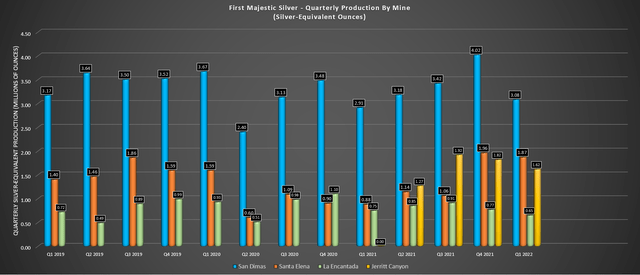

Wanting on the quarterly operations beneath, we are able to see that San Dimas noticed a 24% decline in manufacturing on a sequential foundation to ~3.08 million SEOs, associated to decrease throughput and grades. Throughout Q1, San Dimas processed 5% fewer tonnes at a lot decrease grades, with a mean grade of 282 grams per tonne of silver and three.09 grams per tonne of gold. This in contrast unfavorably to grades of 347 grams per tonne of gold and three.09 grams per tonne of silver in This autumn 2021. In the meantime, at La Encantada, we noticed the same image, with throughput declining greater than 6%, with grades sliding practically 10%, from 117 grams per tonne of silver to 108 grams per tonne of silver in Q1 2022.

Quarterly Silver-Equal Manufacturing by Operation (Firm Filings, Creator’s Chart)

Happily, whereas these two operations dragged down consolidated manufacturing, Santa Elena had a robust quarter, with Ermitano starting to drag vital weight. This was evidenced by the asset rising manufacturing from ~453,500 ounces of silver and ~6,300 ounces of gold in Q1 2021 to ~337,200 ounces of silver and ~19,600 ounces of gold in Q1 2022. This was regardless of decrease throughput year-over-year, with the numerous enhance in gold manufacturing because of the a lot increased gold grades at Ermitano, which made up 43% of throughput, with ~114,200 tonnes coming from Ermitano of the ~201,900 tonnes processed.

First Majestic famous in its ready remarks that it has begun development of the LNG powerplant enlargement and powerline at Santa Elena, offering low-cost clear energy to the Ermitano Mine. This may even assist the ability necessities for the dual-circuit installations for finger grinding to enhance restoration charges. Based mostly on estimated FY2022 manufacturing, this asset ought to produce upwards of 6.6 million SEOs at a mean price of simply over $16.00/oz, which might examine favorably to ~5.04 million SEOs in FY2021 at a mean price of $19.20 per silver-equivalent ounce final 12 months.

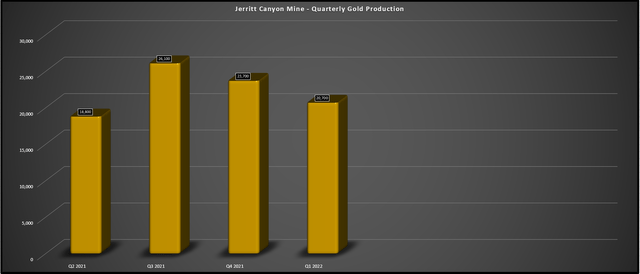

Jerritt Canyon Mine

Shifting to Nevada to First Majestic’s second pillar for development, it was a gradual begin to the 12 months, which the corporate famous was impacted by harsh climate in January that led to fewer tonnes processed. Because the chart beneath exhibits, Jerritt Canyon had a comparatively tender quarter in Q1, contributing simply ~20,700 ounces, or ~16.9% of its annual manufacturing steering mid-point. The weaker manufacturing was as a result of considerably fewer tonnes processed at decrease grades, with simply ~230,000 tonnes processed at a mean grade of three.30 grams per tonne of gold. This in contrast unfavorably to ~256,400 tonnes processed in This autumn 2021 at 3.41 grams per tonne of gold.

Jerritt Canyon Mine – Gold Manufacturing (Firm Filings, Creator’s Chart)

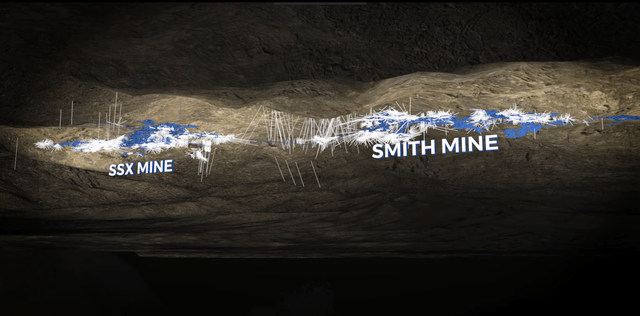

Whereas this gradual begin to the 12 months is disappointing, the remainder of the 12 months ought to look significantly better. It is because the corporate is out of the winter season, it is working to ramp up its West Technology underground mine that ought to start contributing mill feed by Q3, and it is efficiently related its SSX and Smith Mines. Lastly, it is also trying to rehabilitate the Saval II underground mine, offering one more supply of mill feed down the highway. Between simpler exploration with an exploration to float to discover between the 2 mines, much less floor haulage after connecting SSX and Smith, and the power to use the surplus capability on the mill, I stay cautiously optimistic about this asset.

Jerritt Canyon – SSX & Smith Mines (Firm Presentation)

Thus far, there is not any query that operations at Jerritt Canyon have been excessive price and comparatively low quantity, which could make it very tough to justify the acquisition. Nonetheless, with ~1.45 million tonnes of capability on the mill and simply over ~900,000 tonnes (63%) of capability presently getting used, there is a chance to extend manufacturing meaningfully at little further price. After rising the denominator and optimizing the asset, this could assist to enhance prices meaningfully at Jerritt Canyon from the $2,048/oz all-in sustaining prices final 12 months and greater than $1,500/oz this 12 months.

It is also vital to notice that FY2021 was a 12 months of funding with the tailings enlargement and roaster upgrades, which made prices artificially excessive within the interval. However, with a better denominator (manufacturing profile), and assuming First Majestic is profitable in filling the mill, we may see manufacturing enhance to greater than 185,000 ounces by 2024 with all-in sustaining prices nearer to $1,400/oz, assuming inflationary pressures do not worsen sector-wide. Whereas this might nonetheless characterize above-average prices relative to an estimated business AISC of $1,200/oz (2023), this asset would nonetheless generate significant working money move if the gold worth can proceed to hang around above the $1,850/oz degree.

Jerritt Canyon Operations (Firm Presentation)

Progress

Though the Q1 manufacturing figures had been disappointing, and First Majestic’s AISC margins are prone to are available beneath $4.50/oz in Q1, prices and manufacturing will enhance because the 12 months progresses. That is primarily based on elevated contribution from Ermitano, a return to extra regular operations in Mexico (much less COVID-19 absenteeism), and a rise in processing charges at Jerritt Canyon with the West Technology underground coming on-line.

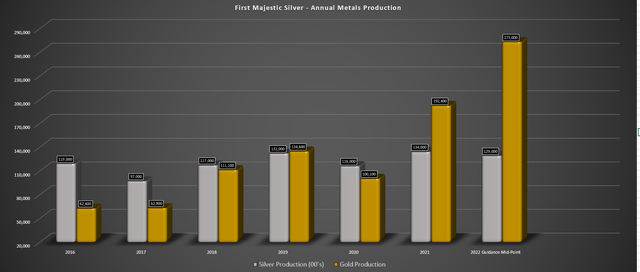

Consolidated Annual Manufacturing & Steering (Firm Filings, Creator’s Chart)

Because the chart exhibits, that is anticipated to push gold manufacturing up by greater than 40% year-over-year if First Majestic can meet its steering mid-point of ~273,000 ounces. This may greater than offset the low single-digit decline in annual silver manufacturing. Assuming Jerritt Canyon’s optimization is profitable, it ought to assist preserve gold manufacturing above the 270,000-ounce mark for the foreseeable future. The important thing, nonetheless, will probably be persevering with to increase the mine life at First Majestic’s San Dimas Mine and its quick mine life at La Encantada as a result of, in any other case, the upper gold manufacturing will probably be partially offset by declining silver manufacturing.

Because it stands, San Dimas has a mine lifetime of fewer than 5 years primarily based on reserves and an assumed ~950,000 tonnes every year throughput price. In the meantime, La Encantada has a mine lifetime of barely two years primarily based on reserves, which is kind of quick. I’m assured that First Majestic can lengthen mine lives previous 2026 and 2023 at these two belongings, respectively, however the important thing will probably be if new reserves will be added at comparable grades. If grades can’t be maintained although, we may see barely decrease manufacturing and at increased prices.

Valuation & Technical Image

Based mostly on ~266 million totally diluted shares and a share worth of US$12.60, First Majestic trades at a market cap of ~$3.35 billion. This determine dwarfs my estimate of the corporate’s mixed Undertaking After-Tax NPV (5%) of ~$1.0 billion. It is value noting that this doesn’t embrace any potential impacts from the tax dispute with the Servicio de Administracion Tributaria, the income service of the Mexican Authorities. Therefore, even with out factoring in any potential detrimental impacts from this dispute, the inventory trades at over 3.0x P/NAV. It is a steep worth to pay for any treasured metals title, even when it advantages from increased leverage as a result of its silver publicity.

In actual fact, if we examine this valuation to extra diversified and higher-margin names like Barrick Gold (GOLD) and Agnico Eagle (AEM) or higher-margin silver firms like Hecla (HL), First Majestic trades at greater than twice the common P/NAV a number of of those friends. This does not imply that the inventory cannot go increased, and this web asset worth could also be undervaluing Jerritt Canyon, provided that I’ve not assigned a lot worth till we begin to see the fruits of the optimization work. Nonetheless, because it stands, and with a comparatively quick reserve life at two of its belongings, First Majestic ranks excessive on development however low on worth.

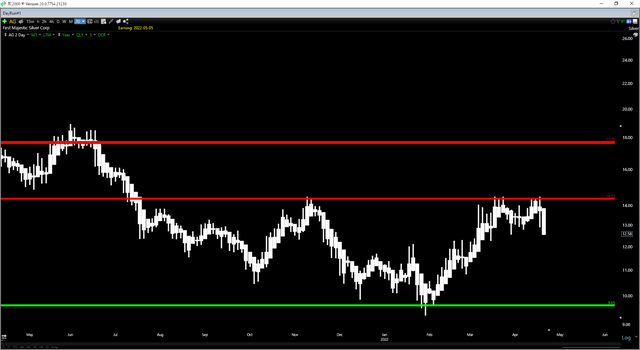

AG Day by day Chart (TC2000.com)

Shifting to the technical image above, this confirms that we have not hit a low-risk purchase zone but, with First Majestic sitting within the higher portion of its buying and selling vary, even after its latest pullback. That is primarily based on the truth that the inventory has $1.75 in potential upside to its newly confirmed resistance degree of $14.20 – $14.35. In the meantime, the inventory has roughly $2.95 in potential draw back to its assist at $9.65. The result’s a present reward/threat ratio of 0.59 to 1.0, which is effectively beneath my shopping for standards.

Typically, in terms of mid-cap producers with common or below-average jurisdictional profiles, I want a minimal reward/threat of 4.5 to 1.0 to justify coming into new positions. Therefore, for First Majestic to drop into a possible purchase zone, the inventory would wish to slip beneath $10.35. At these ranges, I’d nonetheless not see a conservative backdrop from a valuation standpoint, provided that I see a conservative honest worth for the inventory beneath US$9.00. Nonetheless, I’d view this as a good entry from a swing-trading standpoint.

Jerritt Canyon Operations (Firm Presentation)

First Majestic Silver had a gradual begin to the brand new 12 months, however as steering exhibits, the corporate is about to develop manufacturing meaningfully in 2022. So, whereas it is easy to get hung up on the Q1 outcomes, I believe it is higher to have a look at the large image, which is increased manufacturing and strong exploration upside at Ermitano/Jerritt Canyon. Having mentioned all that, I see a conservative honest worth beneath $9.00 for First Majestic Silver, making it laborious to justify proudly owning the inventory from an funding standpoint. So, for me to get within the inventory, I would wish to see it dip beneath $10.35 per share, the place it could enter a purchase zone from a swing-trading standpoint.

[ad_2]

Source link