[ad_1]

WendellandCarolyn/iStock Editorial by way of Getty Photos

As most of , the merger of Marathon Petroleum (NYSE:MPC) and Andeavor in 2018 created the biggest US refiner with services on the Gulf Coast, the Mid-Continent, and the West Coast. Such a broad and geographically numerous footprint permits MPC to optimize feedstock and export refined merchandise to the worldwide market. Given the comparatively low value of home pure gasoline as in comparison with a lot of the remainder of the world (and particularly Europe), these exports are at a aggressive benefit. Meantime, sanctions on Russian oil exports are pushing up the worth of diesel in lots of components of the world – one other tailwind for MPC. Nevertheless, regardless of the comparatively bullish macro-environment, it might seem that MPC will proceed to tremendously over-emphasize share buybacks, as in comparison with dividends instantly into the pockets of its strange shareholders.

Funding Thesis

The macro funding thesis for the refining corporations is pretty simple. After a giant drop in refined merchandise as a result of pandemic, the “opening-up” of the worldwide financial system as a consequence of widespread vaccination, Covid-19 remedies, and the overall impression that the world is simply going to must be taught to dwell with the virus, has led to a powerful bounce-back in demand. Airline visitors has introduced again jet-fuel demand, and there may be robust demand for diesel within the trucking sector. Meantime, the summer season driving season is more likely to be big as pent-up residents have a powerful want to get out and luxuriate in life.

Certainly, the EIA weekly petroleum report for the week ending April fifteenth confirmed home refinery utilization was 91% – up from the low 70s in the course of the pandemic. Gasoline inventories decreased by 0.8 million barrels final week and at present sit ~3% under the 5-year common for this time of 12 months. Distillate gasoline inventories had been down by 2.7 million barrels final week and are ~20% under the 5-year common for this time of 12 months whereas jet gasoline provided was up 15.7% over the identical 4-week interval of final 12 months and virtually all the most important airways not too long ago reported robust demand going ahead.

Meantime, comparatively low feedstock prices within the US proceed to favor US refiners. That’s particularly the case relating to producing diesel, since a lot of the sanctioned Russian oil is heavy crude that has the next distillate break up.

Earnings

For MPC particularly, This autumn refinery utilization was 94%, and the quarter was led by its Gulf Coast refineries – its largest regional capability: USGC margin was up $648 million (+40%) as in comparison with Q3 (see the This autumn EPS report and slide 11 of the This autumn presentation). Different highlights embrace:

- This autumn web revenue of $774 million ($1.27 per diluted share).

- Returned ~$3 billion of capital by way of share buybacks since Oct 31; accomplished ~55% of $10 billion repurchase program by way of Jan 31; introduced a brand new, incremental $5 billion repurchase authorization.

- Introduced 2022 MPC standalone capital spending outlook of $1.7 billion; ~50% of progress capital for Martinez refinery conversion.

- The Martinez renewable fuels undertaking is predicted to have a complete value of $1.2 billion; ~$300 million has been spent thus far, $700 million is projected for 2022, and $200 million for 2023.

Given the surge in pure gasoline costs in Europe as in comparison with the US, MPC can leverage its Gulf Coast manufacturing for the worldwide export market. Certainly, on the This autumn convention name, Brian Partee, Senior VP of MPC’s International Clear Merchandise, mentioned:

After which our export enlargement as effectively. We have been actually targeted on our enlargement of our export guide. And particular to our export guide, we’re actually targeted on extra delivered cargoes. So we’re shifting additional down the worth chain, increased margin seize. So we have had a whole lot of success in rising that line of our enterprise.

Meantime, the Speedway deal is now within the rearview mirror, and the proceeds have – along with the large inventory buyback plan – enabled MPC to scale back its web debt to capital ratio to 21%. That mentioned, Speedway was a secure supply of money move and leaves MPC way more depending on refining & midstream.

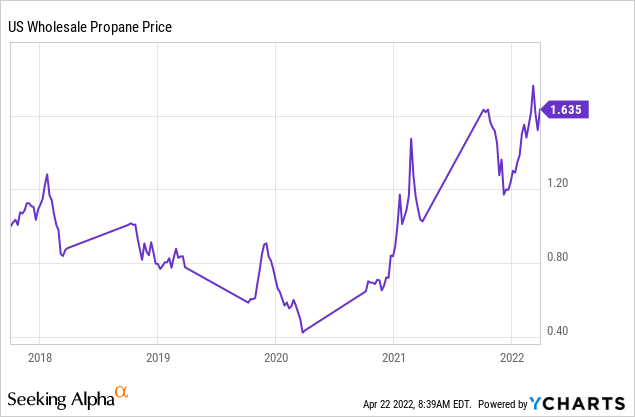

Contemplating the massive midstream enterprise MPC has by way of its MPLX (MPLX) MLP, which pays quarterly distributions as much as MPC, the comparatively robust worth of wholesale propane is one other good tailwind:

Shareholder Returns

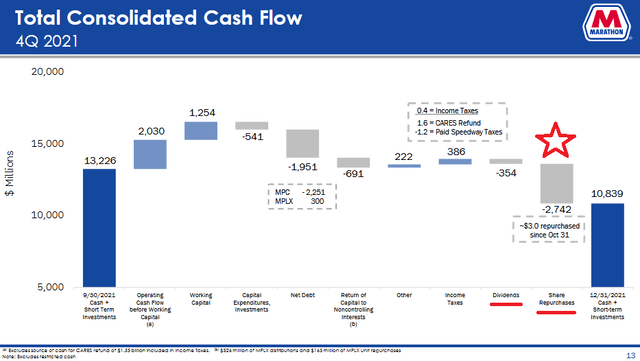

As talked about earlier, MPC is utilizing the overwhelming majority of the $21 billion in proceeds from the sale of Speedway for inventory buybacks. As might be seen under, MPC is actually “Buyback Heavy, Dividend Mild”:

MPC

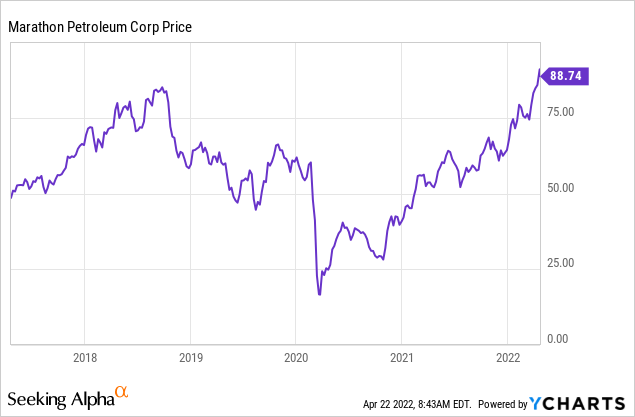

Observe that in This autumn alone, the $2.742 billion MPC spent on share buybacks was a whopping 7.7x the $354 million the corporate allotted to the dividend. In my guide, the strange shareholder is getting short-changed right here. That’s particularly the case, for my part, contemplating that the corporate is arguably shopping for again shares in the course of the up-cycle given the 5-year share worth chart:

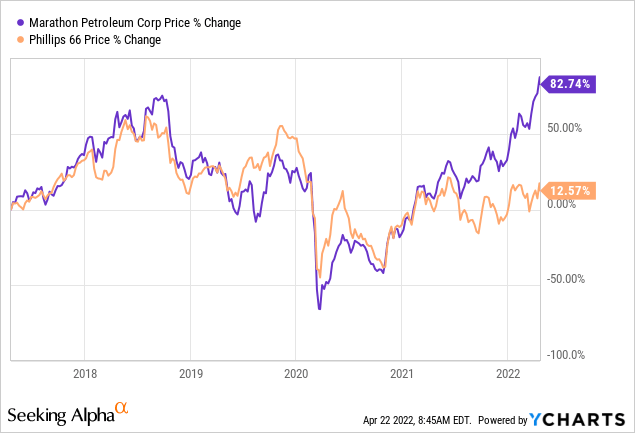

Consequently, the present $2.32/share dividend yields solely 2.6%. That compares to see Phillips 66 (PSX), which pays a $3.68/share annual dividend and yields 4.3%. That mentioned, observe that shares of MPC have left PSX within the mud over the previous 5-years:

Nevertheless, I feel that’s extra of a purpose to be bullish on PSX this present day than it’s to be on MPC.

Abstract & Conclusion

MPC’s inventory has actually benefited from the reopening theme, decrease relative feedstock prices, and large share buybacks: the inventory has gained 66% over the previous 12 months. Nevertheless, the strange shareholder is incomes a low dividend whereas the corporate tremendously over-emphasizes inventory buybacks. At this level within the cycle, PSX seems like the higher worth. Not solely is PSX’s dividend yield considerably increased (4.3% versus 2.6%), however PSX’s ahead P/E of 10.6x compares very favorably to that of MPC (12.4x). Meantime, PSX can also be considerably extra diversified than is a Speedway-less MPC: it has a thriving advertising enterprise and, with CPChem (its 50/50 JV with Chevron (CVX)), a world-class chemical compounds phase as effectively. Certainly, PSX is now a lot much less depending on refining than is MPC, with ~50% of normalized EBITDA now coming from its midstream & chemical compounds segments. That being the case, one would assume PSX deserves the premium that the market is awarding to MPC. That being the case, I charge MPC a HOLD.

[ad_2]

Source link