Introduction

Welcome to the qualifying spherical of the 2022 US Funding Olympics.

The aim of the video games is easy: beat the S&P 500, both by producing increased returns or enjoying soiled and going for increased risk-adjusted returns.

Let the video games start!

{Qualifications}

Just like the 2022 Winter Olympics in Beijing, the US Funding Olympics will not be straightforward to qualify for. Mutual funds are robotically barred from participation: Their charges are simply too excessive for them to have a practical shot towards the S&P 500. Hedge funds have even increased charges and theoretically ought to be hedged, to allow them to’t compete with the inventory market both. In truth, the one securities able to matching the index are exchange-traded funds (ETFs).

To date, there are eight ETF contestants representing three themes:

- Good Cash (GVIP, GURU, GFGF, and ALFA): These ETFs mimic the trades of well-known traders and mutual and hedge fund managers. Their pitch is excessive alpha at low charges.

- Crowd Intelligence (BUZZ and SFYF): Shares are chosen primarily based on the knowledge and sentiment of the group.

- Synthetic Intelligence (AI, AIEQ and QFRT): The equities in these ETFs are chosen by AI packages. Within the case of AIEQ, IBM’s well-known Large Watson makes the picks.

Though inexpensive than the typical mutual or hedge fund, the ETFs have charges of 64 foundation factors (bps) and will not be low-cost in comparison with low-cost index trackers. However then once more, top-notch efficiency isn’t free.

Regardless of their up to date themes, our ETFs have but to resonate a lot with the funding group. Their cumulative belongings below administration (AUM) are solely $700 million, regardless that some have monitor information going again to 2012. However then once more, who doesn’t love cheering for the underdog?

Good Cash, Crowd Intelligence, and AI ETFs AUM, in US Thousands and thousands

Good Cash, Crowd Intelligence, and AI ETFs: Efficiency

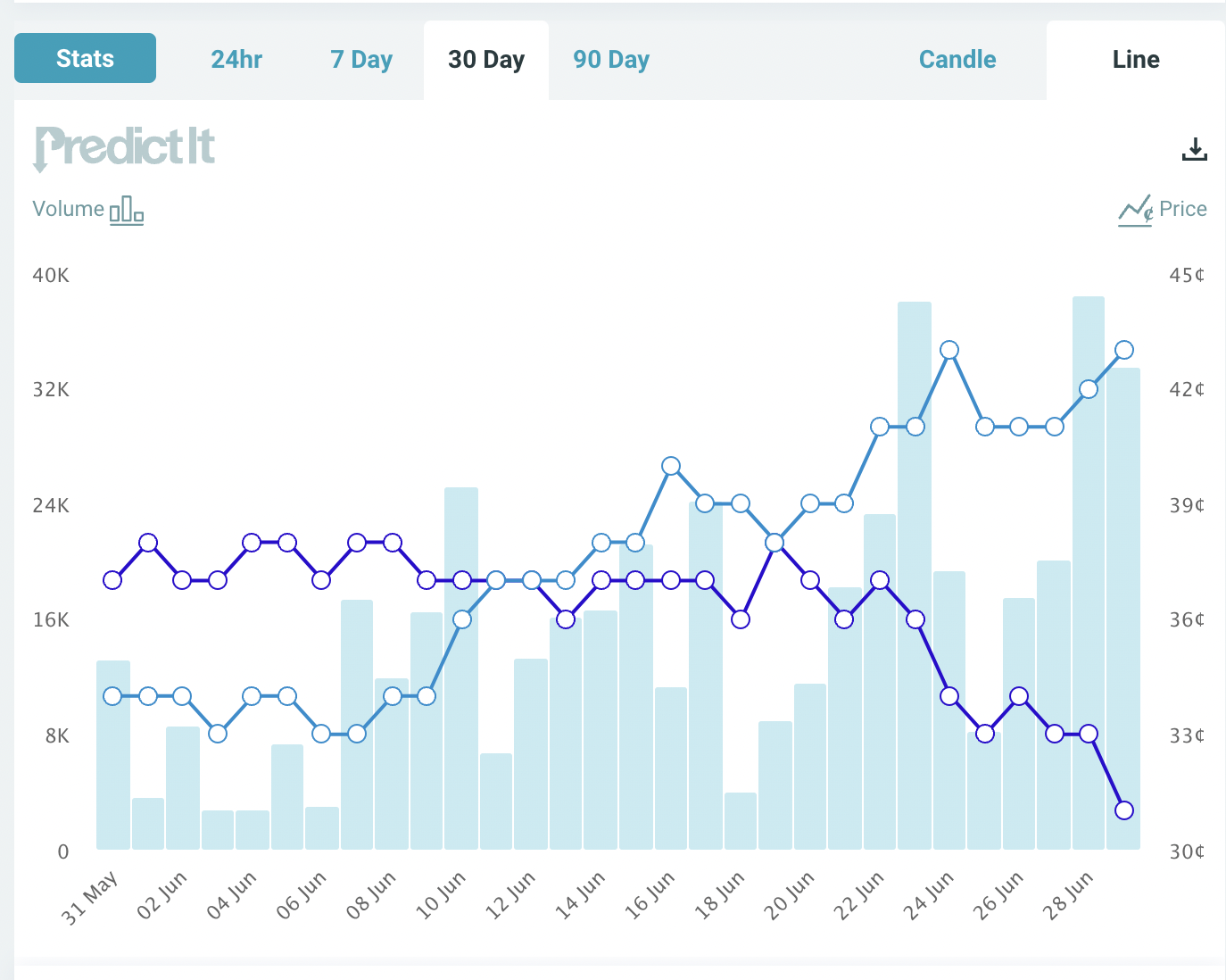

So how did our eight ETFs fare towards the S&P 500? We created equal-weighted indices for the three teams, with Good Cash’s monitor document going again to 2012, AI’s to 2016, and Crowd Intelligence’s to 2019.

Since all spend money on US shares, all of them carried out in step with the S&P 500. Some have crushed the benchmark every now and then however not constantly. The judges will not be particularly impressed.

Outperforming the S&P 500: Good Cash, Crowd Intelligence, and AI ETFs

In fact, the Olympics, like finance, is all about information and particulars. Eyeballing an funding’s chart isn’t a very scientific strategy to efficiency analysis. The judges wish to know what kind of alpha our rivals have generated since their inception. Good Cash yielded a damaging alpha of -3.0% every year since 2012, Crowd Intelligence -7.2% per 12 months since 2019, and AI -0.9% since 2017.

A cynic may say the sensible cash isn’t that sensible, the group not that sensible, and AI not that clever.

Alpha Technology: Good Cash, Crowd Intelligence, and AI ETFs

Higher at Danger Administration?

However earlier than eliminating all these contestants from medal rivalry, our judges study their risk-management traits. Our ETFs might not have the longest monitor information, however all of them skilled the final extreme inventory market shock: the COVID-19 disaster. So how did they do?

Good Cash and Crowd Intelligence fell additional than the S&P 500 in March 2020, whereas AI did marginally higher. Maybe people are overrated and AI is healthier in danger administration?

Much less Draw back? Most Drawdowns throughout 2020 COVID-19 Disaster

Though decrease drawdowns might assist traders persist with an funding technique, on a stand-alone foundation, they aren’t particularly useful metrics. In spite of everything, money would outperform in a down market too, however it’s unlikely to beat the benchmark over time. So the judges flip to risk-adjusted returns and the Sharpe ratio.

AI beat Good Cash and Crowd Intelligence, however none of our contenders generated increased Sharpe ratios than the S&P 500. Which means none of them qualify to advance.

Higher Danger-Adjusted Returns? Sharpe Ratios, 2019–2021

Additional Ideas

Though these ETFs had distinct flavors, they exhibited comparable conduct: In truth, all of them outperformed the S&P 500 in 2020. The query is why.

An element publicity evaluation reveals that they’ve nearly similar exposures: damaging publicity to worth and optimistic publicity to the scale and momentum components. Our rivals had been all chubby outperforming small-cap development shares.

Good cash traders like hedge funds might not respect that the group is selecting up the identical threat publicity as they’re. They usually all could be stunned that the AI ETFs are too.

The appropriate issue publicity might help outperform the S&P 500 over time, however it doesn’t resemble alpha. In truth, it’s the funding world equal of doping. Particularly when hidden inside thematic merchandise.

Although it wouldn’t have mattered on this spherical, it might have been trigger for disqualification.

Up to now, the S&P 500 is thrashing the sector.

For extra insights from Nicolas Rabener and the FactorResearch staff, join their e mail publication.

For those who appreciated this publish, don’t neglect to subscribe to the Enterprising Investor.

All posts are the opinion of the writer. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially mirror the views of CFA Institute or the writer’s employer.

Picture credit score: ©Getty Photographs / imagedepotpro

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can document credit simply utilizing their on-line PL tracker.