[ad_1]

Printed on March tenth, 2022 by Bob Ciura

Warren Buffett, Chairman and CEO of Berkshire Hathaway (BRK.B), is known as the Oracle of Omaha. Given his investing observe file, this fame is well-earned.

Berkshire Hathaway has an fairness funding portfolio price greater than $330 billion, as of the tip of the 2021 fourth quarter. In flip, Buffett’s private web price exceeds $100 billion, making him one of many richest people on the planet.

You may see all of Warren Buffett’s inventory holdings (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Over Buffett’s life and profession, he has supplied many bits of knowledge alongside the best way. Traders could be well-advised to study from the Oracle of Omaha.

With this in thoughts, this text summarizes Warren Buffett’s prime 20 quotes on investing and finance.

The article is organized by class. Click on on a bit to learn it instantly, or learn the entire article so as:

20 Warren Buffett Quotes On Investing and Finance

Quote #1

For the primary Warren Buffett quote, we chosen one which sums up his funding technique:

“We choose such investments on a long-term foundation, weighing the identical elements as could be concerned within the buy of 100% of an working enterprise:

(1) favorable long-term financial traits;

(2) competent and trustworthy administration;

(3) buy value engaging when measured towards the yardstick of worth to a personal proprietor; and

(4) an business with which we’re acquainted and whose long-term enterprise traits we really feel competent to evaluate.”

The above is the fundamental ‘secret system’ to Warren Buffett’s $100+ billion fortune.

Quote #2

Warren Buffett is a long-term investor. Three of his longest-term holdings are proven beneath:

- American Categorical (AXP): 1st buy in 1964

- Coca-Cola (KO): 1st buy in 1988

- Wells Fargo (WFC): 1st buy in 1989

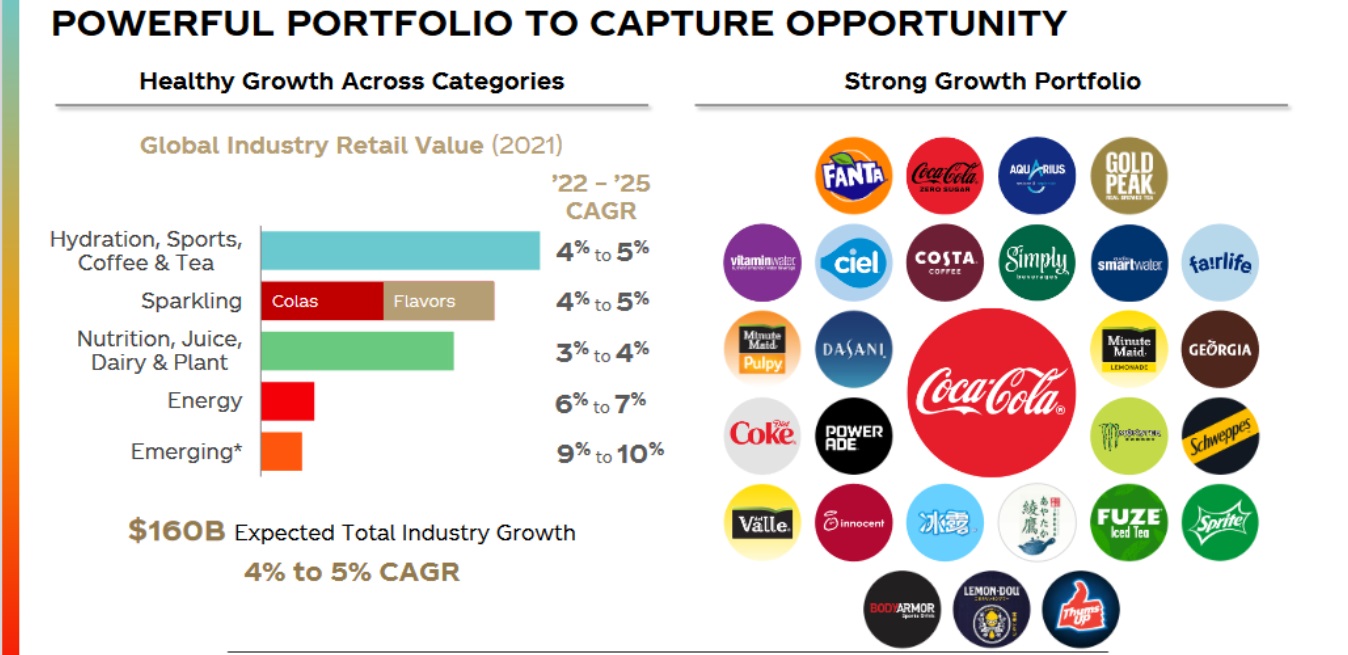

Over time, these corporations have grown to turn into giants of their respective industries. For instance, Coca-Cola is the biggest non-alcoholic beverage firm on this planet.

Supply: Investor Presentation

“I by no means try and earn money on the inventory market. I purchase on the idea that they might shut the market the subsequent day and never reopen it for 5 years.”

This quote reveals Warren Buffett thinks in investing time frames of at the least 5 years. However his holding interval is ideally for much longer…

Quotes #3 & #4

“Solely purchase one thing that you simply’d be completely blissful to carry if the market shut down for 10 years.”

&

“When you aren’t keen to personal a inventory for 10 years, don’t even take into consideration proudly owning it for 10 minutes”

These quotes reveals {that a} 10 12 months holing interval is admittedly what it is best to search for when inspecting shares to purchase.

Quotes #5 & #6

However even 10 years is just too quick a time interval for excellent companies.

“Once we personal parts of excellent companies with excellent managements, our favourite holding interval is ceaselessly.”

&

“Time is the buddy of the fantastic firm, the enemy of the mediocre.”

You shouldn’t purchase simply any enterprise and maintain it for the long-run. Companies with sturdy aggressive benefits and high quality managements are most popular long-term holdings.

Quote #7

Nice companies stand up to the check of time. Time itself has been very favorable to the inventory market.

“Over the long run, the inventory market information might be good. Within the twentieth century, the USA endured two world wars and different traumatic and costly army conflicts; the Melancholy; a dozen or so recessions and monetary panics; oil shocks; a fly epidemic; and the resignation of a disgraced president. But the Dow rose from 66 to 11,497.”

The quote above reveals the highly effective tailwind of financial progress that pushes steady companies to ever better heights.

Quote #8

One benefit of purchase & maintain investing is decrease taxes. Whenever you don’t promote your holdings, the cash you would have paid in capital beneficial properties tax is left compounding in your funding.

“Charlie and I might observe a buy-and-hold coverage even when we ran a tax-exempt establishment.”

Tax benefits are usually not the main purpose why Warren Buffett (and Charlie Munger) favor to carry nice companies for the long term.

The compounding results (the ‘snowball impact’) of enterprise progress are reward sufficient, regardless of tax benefits.

Quotes #9 by #12

The 4 quotes beneath use analogies and metaphors to elucidate the ability of long-term investing.

“Somebody’s sitting within the shade at this time as a result of somebody planted a tree a very long time in the past.”

&

“Calling somebody who trades actively out there an investor is like calling somebody who repeatedly engages in one-night stands a romantic.”

&

“Profitable Investing takes time, self-discipline and persistence. Irrespective of how nice the expertise or effort, some issues simply take time: You may’t produce a child in a single month by getting 9 girls pregnant.”

&

“Purchase a inventory the best way you’d purchase a home. Perceive and prefer it such that you simply’d be content material to personal it within the absence of any market.”

The quote about not producing a child in a month by getting 9 girls pregnant is very poignant. It drives residence the purpose that a number of mediocre short-term investments are usually not the identical as one well-timed long-term funding.

This brings up one other facet of Warren Buffett’s success…

Solely make investments when the perfect alternatives current themselves – and ignore all the things else.

Alternatives are available in waves. These ‘waves’ coincide with recessions (that are mentioned later on this article). Dry spells are normally throughout protracted bull markets – when nice companies are usually not buying and selling at a reduction.

Quotes #13 & #14

The 2 Warren Buffett quotes beneath elaborate additional on the disparity between motion and outcomes.

“You solely need to do a only a few issues proper in your life as long as you don’t do too many issues flawed.”

&

“It’s not essential to do extraordinary issues to get extraordinary outcomes.”

Quote #15

You don’t need to be an skilled on each inventory to seek out nice companies buying and selling at honest or higher costs.

The simpler an funding is, the much less room for error in your evaluation. Equally, sticking to investing in companies you perceive reduces investing errors.

Warren Buffett calls sticking with what staying in your “circle of competence”.

“What an investor wants is the flexibility to appropriately consider chosen companies. Word that phrase ‘chosen’: You don’t need to be an skilled on each firm, and even many. You solely have to have the ability to consider corporations inside your circle of competence. The dimensions of that circle will not be crucial; figuring out its boundaries, nonetheless, is important.”

Quote #16

Everybody is aware of at the least one ‘know-it-all’. If you wish to make investments properly, don’t be a know-it-all.

“There’s nothing flawed with a ‘know nothing’ investor who realizes it. The issue is if you find yourself a ‘know nothing’ investor however you assume one thing.”

If you don’t know a lot about investing, don’t idiot your self. As an alternative, make investments on this planet’s finest dividend paying companies by top quality dividend ETFs.

Quote #17

Warren Buffett is extremely sensible. However genius will not be a requirement to appreciate distinctive investing outcomes.

“You don’t must be a rocket scientist. Investing will not be a sport the place the man with the 160 IQ beats the man with 130 IQ.”

Quote #18

Understanding the bounds of your circle of competence is extra necessary than being sensible and pondering your circle of competence contains all shares. There’s no mistaking Buffett’s enterprise genius. However even Buffett doesn’t assume he can precisely assess all companies.

“We make no try to choose the few winners that can emerge from an ocean of unproven enterprises. We’re not sensible sufficient to do this, and we all know it. As an alternative, we attempt to apply Aesop’s 2,600-year-old equation to alternatives by which we’ve got affordable confidence as to what number of birds are within the bush and when they may emerge.”

As an alternative of taking pointless dangers, put money into nice companies you perceive once they go on sale.

Quote #19

Traders may be divided into two broad classes:

- Backside up buyers

- Prime down buyers

Prime down buyers search for quickly rising industries or macroeconomic tendencies. They then attempt to discover good investments that can capitalize on these tendencies.

Backside up buyers do they actual reverse. They search for particular person funding alternatives regardless of business or macroeconomic tendencies.

Warren Buffett desires to put money into nice companies. He’s a backside up investor.

“The important thing to investing will not be assessing how a lot an business goes to have an effect on society, or how a lot it’ll develop, however somewhat figuring out the aggressive benefit of any given firm and, above all, the sturdiness of that benefit.”

Understanding the aggressive benefit of a enterprise requires a sufficiently developed understanding of the operations of a enterprise.

Quote #20

“Be fearful when others are grasping and grasping solely when others are fearful.”

It’s not simple to purchase nice companies when they’re down. That’s as a result of the zeitgeist is decidedly towards shopping for – shares turn into undervalued as a result of the final consensus is destructive. Clever buyers revenue from irrational fears.

Paying too excessive a value is an investing threat that may be averted (for probably the most half) by staying disciplined.

Closing Ideas

Warren Buffett is arguably the best investor of all time. You may see Buffett’s 20 most owned shares right here to see real-world examples of what he invests in.

Over Buffett’s profession, he has proven that he invests in corporations that share a couple of key qualities.

Basically, Buffett has invested in lots of corporations which have sturdy aggressive benefits, long-term progress potential, and robust administration groups.

We consider the highest-quality dividend progress shares possess most of the traits that Buffett seems to be for.

The next Positive Dividend databases comprise probably the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link