[ad_1]

Updated on September 27th, 2022 by Bob Ciura

Insurance companies often produce a high level of profits each year, because they make money in two ways. First, insurance companies collect premium income on the policies they underwrite.

Second, they are able to make money by investing the large sums of accumulated premiums that have not been paid out as claims.

Due to this, insurance companies have been among the most rewarding to own over the past several decades. In fact, many of the Dividend Aristocrats and Dividend Achievers are in the insurance industry.

You can download our Excel spreadsheet list of nearly 200 insurance stocks (with important metrics that matter such as P/E ratios and dividend yields) for free by clicking the link below:

The insurance industry has created many great fortunes. That’s because it’s slow changing and highly profitable, if the business is done well. Investing in insurance stocks is how Shelby Davis made $900 million from $50,000 starting in his late 30’s.

In recent years, the insurance industry (and other parts of the financial sector like banks) have struggled from low interest rates, which narrow the spread between what insurance companies can earn on their invested capital, versus what they pay out in claims.

In turn, higher interest rates would be a positive catalyst for insurance stocks, which would see their net investment income rise.

Still, there are a number of insurers that look attractively priced today that are poised to deliver strong total annual returns over the next five years. This article will rank the top 5 insurance stocks now, in order of expected total annual returns.

Table Of Contents

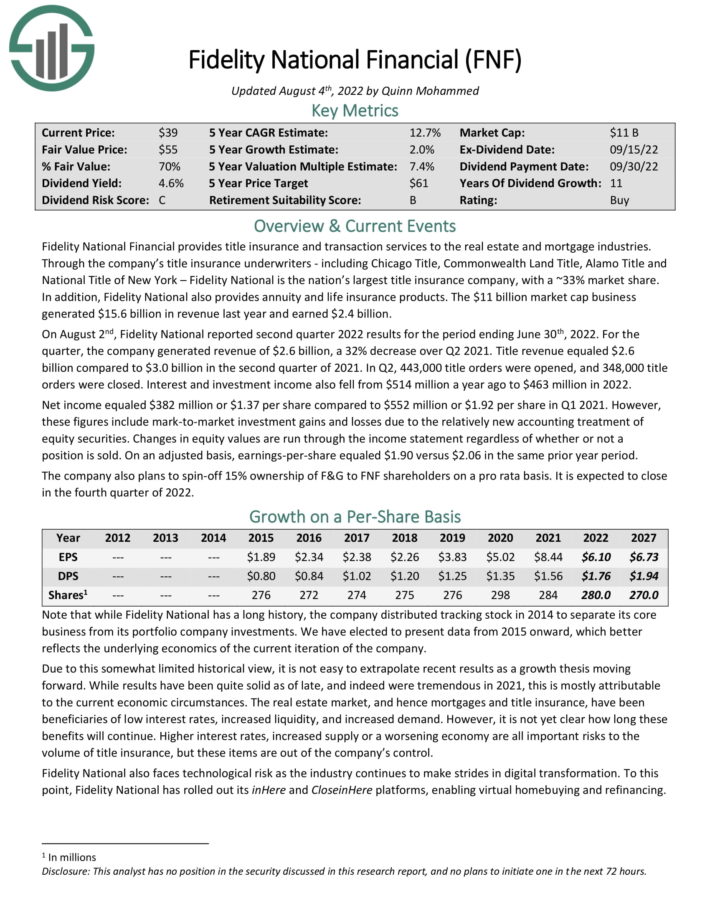

Best Insurance Stock #5: Fidelity National Financial (FNF)

- 5-year expected annual returns: 14.9%

Fidelity National Financial provides title insurance and transaction services to the real estate and mortgage industries. Through the company’s title insurance underwriters – including Chicago Title, Commonwealth Land Title, Alamo Title and National Title of New York – Fidelity National is the nation’s largest title insurance company, with a ~33% market share.

Source: Investor Presentation

In addition, Fidelity National also provides annuity and life insurance products. The company generated $15.6 billion in revenue last year and earned $2.4 billion.

On August 2nd, Fidelity National reported second quarter 2022 results for the period ending June 30th, 2022. For the quarter, the company generated revenue of $2.6 billion, a 32% decrease over Q2 2021. Title revenue equaled $2.6 billion compared to $3.0 billion in the second quarter of 2021. In Q2, 443,000 title orders were opened, and 348,000 title orders were closed. Interest and investment income also fell from $514 million a year ago to $463 million in 2022.

Net income equaled $382 million or $1.37 per share compared to $552 million or $1.92 per share in Q1 2021. On an adjusted basis, earnings-per-share equaled $1.90 versus $2.06 in the same prior year period.

Click here to download our most recent Sure Analysis report on FNF (preview of page 1 of 3 shown below):

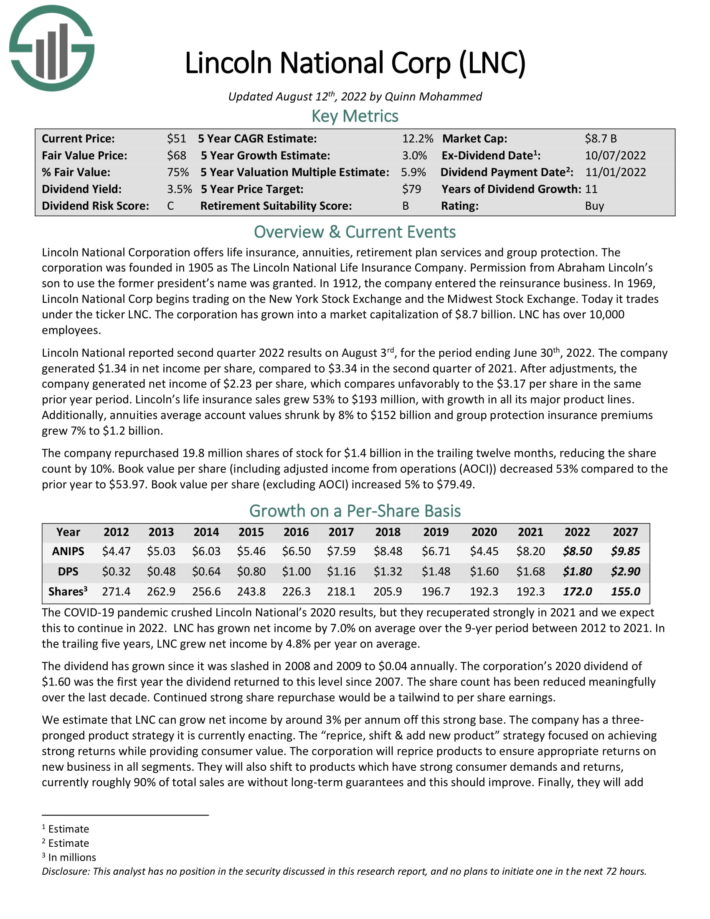

Best Insurance Stock #4: Lincoln National Corp. (LNC)

- 5-year expected annual returns: 15.6%

Lincoln National Corporation offers life insurance, annuities, retirement plan services and group protection. The

corporation was founded in 1905 as The Lincoln National Life Insurance Company.

Lincoln National reported second quarter 2022 results on August 3rd, for the period ending June 30th, 2022. The company generated $1.34 in net income per share, compared to $3.34 in the second quarter of 2021. After adjustments, the company generated net income of $2.23 per share, which compares unfavorably to the $3.17 per share in the same prior year period. Lincoln’s life insurance sales grew 53% to $193 million, with growth in all its major product lines.

Additionally, annuities average account values shrunk by 8% to $152 billion and group protection insurance premiums grew 7% to $1.2 billion.

The company repurchased 19.8 million shares of stock for $1.4 billion in the trailing twelve months, reducing the share count by 10%. Book value per share (including adjusted income from operations (AOCI)) decreased 53% compared to the prior year to $53.97. Book value per share (excluding AOCI) increased 5% to $79.49.

Click here to download our most recent Sure Analysis report on LNC (preview of page 1 of 3 shown below):

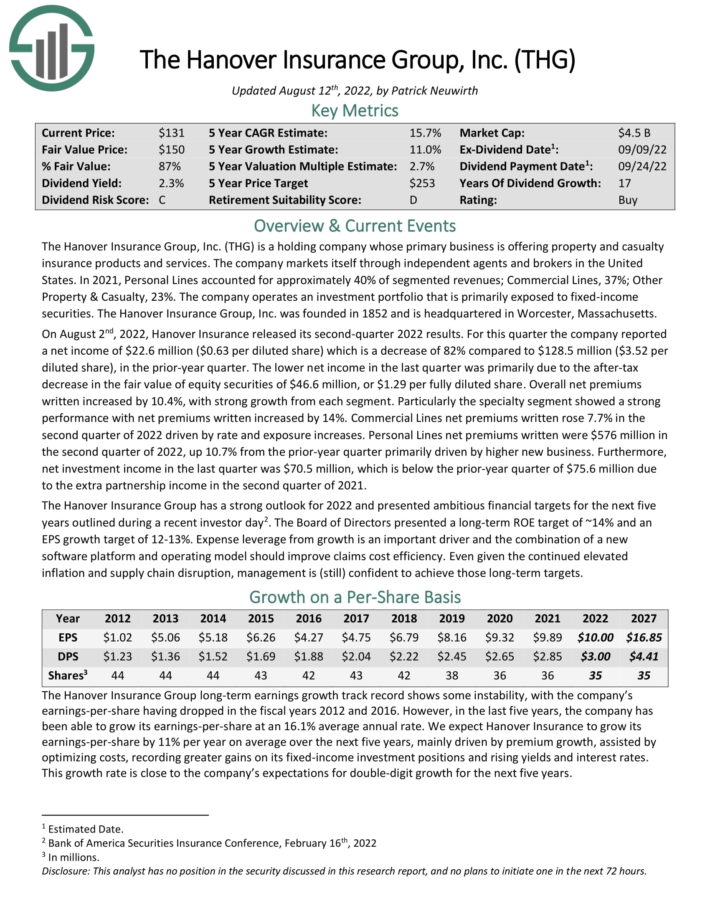

Best Insurance Stock #3: The Hanover Insurance Group (THG)

- 5-year expected annual returns: 16.3%

The Hanover Insurance Group is a holding company whose primary business is offering property and casualty insurance products and services. The company markets itself through independent agents and brokers in the United States. In 2021, Personal Lines accounted for approximately 40% of segmented revenues; Commercial Lines, 37%; Other Property & Casualty, 23%.

Source: Investor Presentation

On August 2nd, 2022, Hanover Insurance released its second-quarter 2022 results. For this quarter the company reported a net income of $22.6 million ($0.63 per diluted share) which is a decrease of 82% compared to $128.5 million ($3.52 per diluted share), in the prior-year quarter. The lower net income in the last quarter was primarily due to the after-tax decrease in the fair value of equity securities of $46.6 million, or $1.29 per fully diluted share. Overall net premiums written increased by 10.4%, with strong growth from each segment.

Furthermore, net investment income in the last quarter was $70.5 million, which is below the prior-year quarter of $75.6 million due to the extra partnership income in the second quarter of 2021.

The Hanover Insurance Group has a strong outlook for 2022 and presented ambitious financial targets for the next five years outlined during a recent investor day. The Board of Directors presented a long-term ROE target of ~14% and an EPS growth target of 12-13%.

Click here to download our most recent Sure Analysis report on THG (preview of page 1 of 3 shown below):

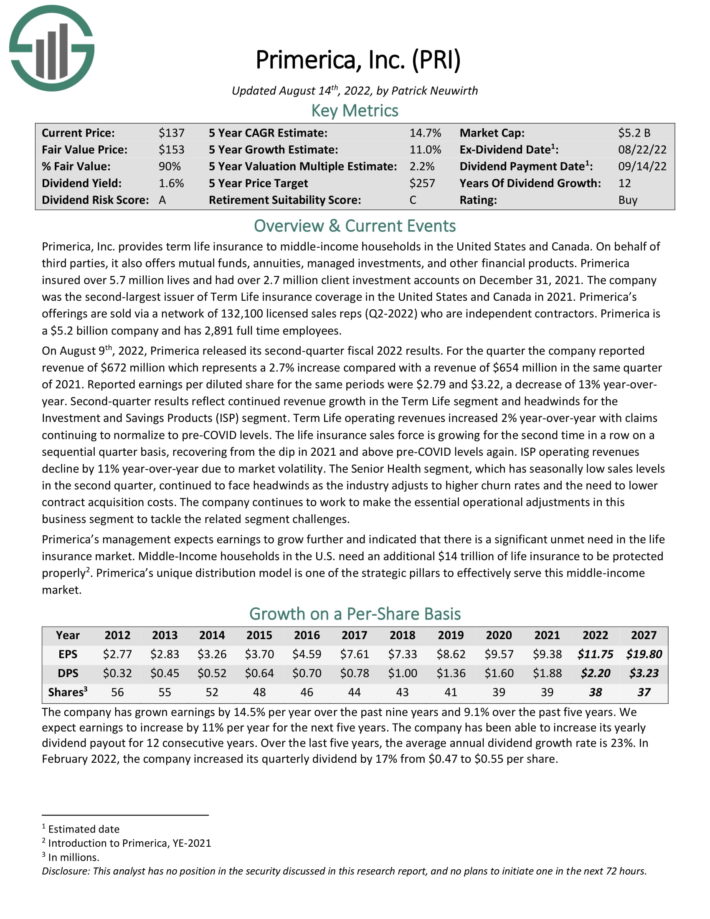

Best Insurance Stock #2: Primerica Inc. (PRI)

- 5-year expected annual returns: 17.3%

Primerica, Inc. provides term life insurance to middle-income households in the United States and Canada. On behalf of third parties, it also offers mutual funds, annuities, managed investments, and other financial products. Primerica insured over 5.7 million lives and had over 2.7 million client investment accounts on December 31, 2021.

On August 9th, 2022, Primerica released its second-quarter fiscal 2022 results. For the quarter the company reported revenue of $672 million which represents a 2.7% increase compared with a revenue of $654 million in the same quarter of 2021. Reported earnings per diluted share for the same periods were $2.79 and $3.22, a decrease of 13% year-over-year.

Second-quarter results reflect continued revenue growth in the Term Life segment and headwinds for the Investment and Savings Products (ISP) segment. Term Life operating revenues increased 2% year-over-year with claims continuing to normalize to pre-COVID levels.

ISP operating revenues decline by 11% year-over-year due to market volatility. The Senior Health segment, which has seasonally low sales levels in the second quarter, continued to face headwinds as the industry adjusts to higher churn rates and the need to lower contract acquisition costs. The company continues to work to make the essential operational adjustments in this business segment to tackle the related segment challenge.

Click here to download our most recent Sure Analysis report on PRI (preview of page 1 of 3 shown below):

Best Insurance Stock #1: Equitable Holdings Inc. (EQH)

- 5-year expected annual returns: 25.9%

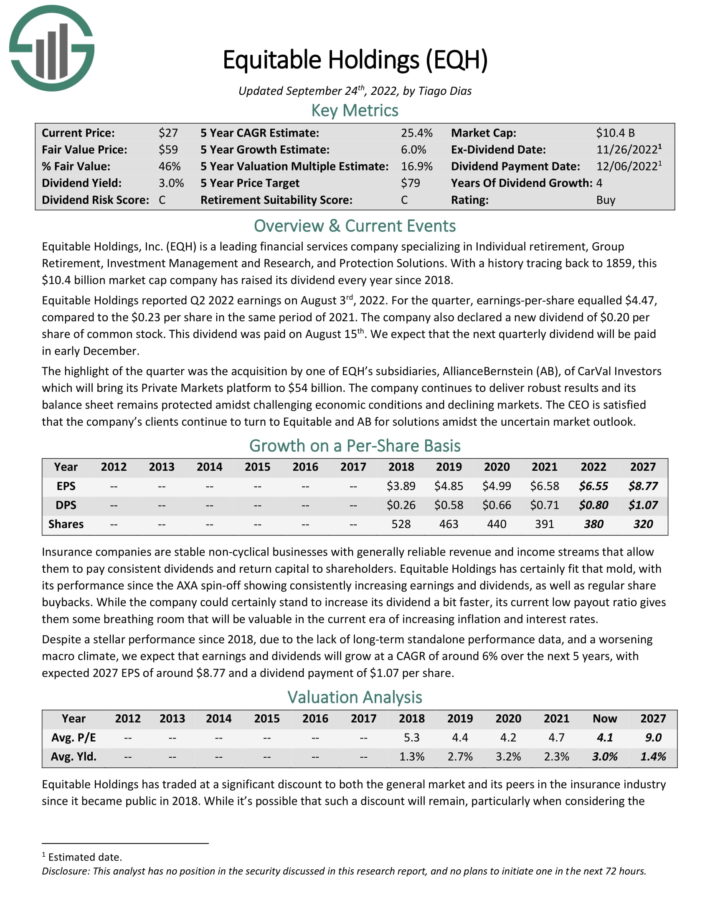

Equitable Holdings, Inc. is a leading financial services company specializing in Individual retirement, Group Retirement, Investment Management and Research, and Protection Solutions.

Source: Investor Presentation

Equitable Holdings reported Q2 2022 earnings on August 3rd, 2022. For the quarter, earnings-per-share equaled $4.47, compared to the $0.23 per share in the same period of 2021. The company also declared a new dividend of $0.20 per share of common stock. This dividend was paid on August 15th. We expect that the next quarterly dividend will be paid in early December.

The highlight of the quarter was the acquisition by one of EQH’s subsidiaries, AllianceBernstein (AB), of CarVal Investors which will bring its Private Markets platform to $54 billion. The company continues to deliver robust results and its balance sheet remains protected amidst challenging economic conditions and declining markets.

Click here to download our most recent Sure Analysis report on EQH (preview of page 1 of 3 shown below):

Final Thoughts

Insurance is often considered to be a boring industry, but investors looking for solid annual returns and dividend income should consider insurance stocks. Many insurance stocks have increased dividends for at least a decade. Some have done so for multiple decades.

Not only has nearly every company on this list exhibited a pattern of steady dividend growth for many years, all have an above-market average dividend yield as well. As a result, these stocks are appealing for income investors.

Investors looking for exposure to this industry could see strong returns from these top 5 insurance stocks.

Further Reading: Learn how Shelby Davis went from $50,000 to $900 million investing mainly in insurance stocks starting at the age of 38.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link