CHUNYIP WONG/E+ through Getty Pictures

Thesis

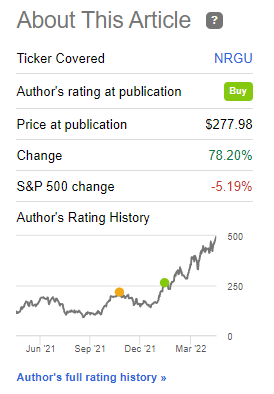

The BMO MicroSectors U.S. Huge Oil Index 3X Leveraged ETN (NYSEARCA:NRGU) is an exchange-traded be aware that has as its goal giving an investor 3 times the day by day efficiency of the Solactive MicroSectors U.S. Huge Oil Index. In January, we wrote an article the place we have been bullish on NRGU given the incipient structural bull market in commodities. NRGU is a leveraged product, thus catered to stylish traders usually, and never appropriate for buy-and-hold portfolios. When shopping for a leveraged product, an investor must set clear revenue targets and exit the commerce when these targets are met. A have a look at the historic efficiency for NRGU showcases that the product can have very deep drawdowns that may exceed -50%.

Whereas we don’t assume oil costs and implicitly oil equities are going to break down within the close to future, we do nonetheless really feel that after a +78% return in three months, we wish to take revenue on the NRGU product and look forward to a market pull-back to re-enter the commerce. We’re due to this fact completely satisfied to file our 78% revenue for the commerce and transfer to Maintain on NRGU, eying an oil market pullback pushed by the ceasing of the Ukraine battle as a great re-entry level for the ETN.

Efficiency

Our proposed commerce for NRGU is up greater than +78% since our Purchase score.

Writer January 2022 Ranking (Looking for Alpha)

An investor who would have bought NRGU after our article in January would have virtually doubled their cash. This excellent end result stems from a rally in vitality firms’ equities and the 3x leverage embedded within the product. Leveraged ETNs are instruments usually geared in direction of subtle traders since they enlarge each positive aspects and losses. To that finish, we are able to see the super pull-back for NRGU in December 2021 after being up greater than +50% for the yr.

NRGU 1-12 months Efficiency (Looking for Alpha)

NRGU is a good buying and selling instrument, however don’t consider it as an instrument you can maintain endlessly and that may generate super returns. Commodities and commodity equities are cyclical devices, and when long run outcomes for NRGU, we are able to clearly see why 3x leveraged merchandise ought to solely be used as buying and selling instruments.

5-12 months Whole Return (Looking for Alpha)

Throughout the Covid disaster, the car misplaced virtually all of its worth as a result of leveraged return profile.

Holdings

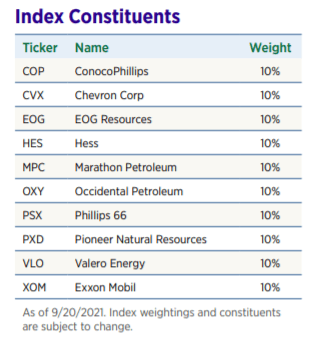

The fund mirrors the Solactive MicroSectors U.S. Huge Oil Index, which has the next composition.

Index Composition (BMO)

The portfolio is at the moment composed of the most important North American Oil & Gasoline majors, with each built-in operations in addition to extra specialised gamers. Observe that no European Oil & Gasoline majors are current on this portfolio, which means that the returns for the product have been insulated from the Ukraine/Russia battle and the numerous write-downs we’ve seen for the likes of Shell (SHEL) and BP (BP) on the again of their Russia enterprise.

We additionally just like the equal weight 10% allocation for every identify. Any such portfolio construct ensures that the product continually captures the upside for the laggards, reasonably than being obese the best-performing momentum names. We really feel that within the vitality house the steadiness sheet mend and long term efficiency is a two-horse race, the place among the higher managed firms having already reached extraordinarily sturdy valuations, whereas among the laggards will catch up through efficiency as oil costs keep at elevated ranges.

Composition Danger Components

A) Yield – the fund doesn’t supply any dividend yield, therefore it is rather completely different than holding a portfolio of the above ten names outright.

B) Financing Fees – given its 3x leverage, the fund has to pay sure financing prices to Financial institution of Montreal. Absent any strikes within the underlying portfolio, an investor will lose cash given worth erosion from these prices.

C) Zero Restoration – given 3x leverage on day by day index transfer, the ETN can lose its complete worth, in contrast to holding the shares outright.

D) Name Proper – Financial institution of Montreal can name the notes previous to maturity date, which might imply that if an investor is underwater from a complete return perspective, that loss would all of a sudden turn out to be realized.

Conclusion

NRGU is an ETN from the leveraged product suite. The car provides 3x the day by day return of ten massive North American Oil & Gasoline firms. NRGU has had an excellent efficiency in 2022, being up greater than +78% since our Purchase score in January 2022.

As with every leveraged product, NRGU is just not a purchase and maintain instrument however a buying and selling instrument for use for shorter time-frames. We’re due to this fact completely satisfied to file our 78% revenue for the commerce and transfer to Maintain on NRGU, eying an oil market pullback pushed by the ceasing of the Ukraine battle as a great re-entry level for the ETN.