[ad_1]

Printed on March thirty first, 2022, by Quinn Mohammed

3M Firm (MMM) is an enormous producer, which is closely diversified throughout product segments, and has a robust world presence. The corporate is a Dividend King, because it has elevated its dividend for 64 consecutive years.

The corporate has a excessive yield of three.9%, nicely above its trailing decade common. This might be one indicator that the corporate is presently buying and selling at a reduction. Nonetheless, this is only one element in a sea of knowledge.

We now have created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You possibly can obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics akin to dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we’ll analyze manufacturing behemoth 3M Firm.

Enterprise Overview

3M is a number one world producer, with operations in additional than 70 nations. The corporate has a product portfolio comprised of over 60,000 gadgets, that are offered to clients in additional than 200 nations. These merchandise are used day by day in houses, workplace buildings, colleges, hospitals, and others.

The corporate’s historical past could be traced again to 1902, when it was often known as Minnesota Mining and Manufacturing. Right this moment, 3M dominates in 4 important enterprise segments.

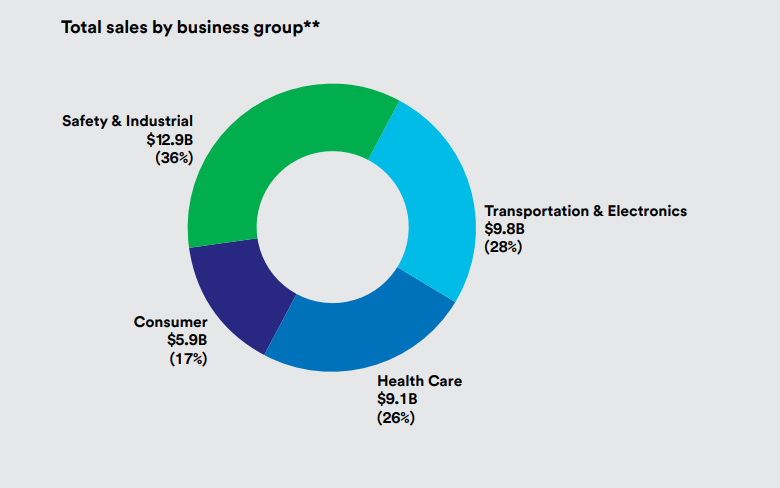

The Security & Industrial section produce private security gear, industrial adhesives & tapes, abrasives, and provide chain administration software program.

The Transportation & Electronics section serves automotive and digital EOM clients, by producing gadgets akin to fibres and circuits.

The Healthcare section develops medical and surgical merchandise, well being info methods, and oral care expertise.

The Client division sells stationary & workplace provides, residence enchancment and residential care merchandise, and protecting supplies.

Supply: 2021 Annual Report

3M reported This autumn and FY 2021 outcomes on January twenty fourth. For 2021, income grew 9.9% to $35.4 billion. Earnings-per-share of $10.12 was an 8% improve from the prior yr. Adjusted EPS rose 14% although, from $8.85 in 2020 to $10.12 in 2021.

The corporate generated adjusted free money stream of $6 billion in 2021. 3M decreased web debt by greater than $1 billion in comparison with 2020. Internet debt decreased from $13.7 billion to $12.6 billion by finish of yr 2021.

3M additionally returned $5.6 billion to shareholders by the use of dividends and share repurchases.

Management supplied 2022 steerage and sees complete gross sales progress of 1% to 4%, natural gross sales progress of two% to five%, and earnings-per-share of $10.15 to $10.65. Our 2022 EPS estimate is presently $10.24.

Development Prospects

With so many merchandise in so many alternative sectors, 3M has the flexibility to give attention to the precise progress channels when it’s advantageous. The corporate should allocate their capital and sources to what’s most engaging on the time.

The corporate is presently prioritizing their investments in giant, fast-growing sectors which have favorable components all throughout the globe. Some examples are automotive expertise, residence enchancment, private security, healthcare, and electronics.

The corporate is firing on all cylinders, with important progress in its automotive electrification platform, biopharma enterprise, and residential enchancment enterprise. All 4 enterprise segments noticed excessive single-digit natural gross sales progress in 2021. These segments ought to all proceed to develop meaningfully.

Moreover, 3M is prone to make strategic acquisitions, akin to with the almost $7-billion acquisition of Acelity, a number one world medical expertise firm that manufactures wound care and specialty surgical merchandise. 3M additionally determined to divest and mix their meals security enterprise with Neogen in 2021.

Aggressive Benefits & Recession Efficiency

3M’s expertise and mental property are its most important aggressive benefits. These distinctive benefits have paved the best way for 3M to lift its annual dividend for greater than 60 years with out fail.

3M has greater than 50 expertise platforms and a crew of scientists devoted to producing innovation. Innovation has afforded 3M the flexibility to acquire over 100,000 patents all through its historical past, which retains many would-be-competitors at bay.

3M continues to speculate closely in analysis and improvement. The corporate goals to spend round 6% of annual gross sales on R&D. In 2021, the corporate spent $2.0 billion on R&D.

The corporate has executed so nicely in creating new merchandise that roughly 30% of annual gross sales got here from merchandise which didn’t exist 5 years in the past. 3M has established itself as an business chief throughout its product segments. The corporate has remained worthwhile, even all through recessions, which might, partly, be credited to their aggressive benefits.

Listed beneath are 3M’s adjusted earnings-per-share outcomes earlier than, throughout and after the Nice Recession:

- 2006 adjusted earnings-per-share: $5.06

- 2007 adjusted earnings-per-share: $5.60 (10.7% improve)

- 2008 adjusted earnings-per-share: $4.89 (12.7% lower)

- 2009 adjusted earnings-per-share: $4.52 (7.6% lower)

- 2010 adjusted earnings-per-share: $5.75 (27.2% improve)

- 2011 adjusted earnings-per-share: $5.96 (3.7% improve)

Simply because the corporate remained worthwhile, doesn’t imply it’s immune from recessions, and its earnings-per-share fell in 2008 and 2009. Nonetheless, the constant profitability afforded the corporate the flexibility to proceed growing the dividend. And EPS bounced again as early as 2010 and continued rising.

Dividend Evaluation

3M is a Dividend King and has raised its dividend for 64 years straight. The newest improve was a penny 1 / 4 improve, which represents a 0.7% increase. Nonetheless, 3M has raised its dividend at a compound annual progress fee of almost 10% within the final ten years, which is robust for such a mature firm. However this has slowed because the 5-year CAGR for the dividend is 4.9%.

3M pays an annual dividend of $5.96, and on the present share worth, has a excessive yield of three.9%. The corporate has a ten-year trailing common payout ratio of 53%, which isn’t too regarding. Nonetheless, the payout ratio has been creeping up slowly.

For 2022, we anticipate a payout ratio of about 58%. Contemplating the corporate’s dividend progress has slowed, however the chance for mid-single digit earnings progress continues to be intact, the payout ratio ought to lower within the medium time period.

The corporate’s 3.9% dividend yield is sort of a bit increased than its trailing decade common of two.8%, which can point out shares are buying and selling at a reduction.

Closing Ideas

3M is an enormous firm with a world presence, and consequently, it’s pretty reliant on the general financial system. Whereas the corporate can really feel the impacts of recessions and financial weak spot, its sturdy aggressive benefits afford it the flexibility to stay extremely worthwhile.

This profitability and power of the corporate have allowed it to lift its dividend yearly for the final 64 years. We anticipate a discount within the payout ratio going ahead as earnings outpace the slowing dividend progress. This prudence on the firm causes us to consider the corporate may have little drawback persevering with on this unbelievable dividend improve streak.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link