[ad_1]

Updated on October 5th, 2022 by Quinn Mohammed

Cincinnati Financial (CINF) has a dividend track record that few companies can rival.

The company has increased its cash dividend for 61 consecutive years, making it one of just 13 stocks in the entire market with a dividend increase streak of at least 60 years.

That puts Cincinnati Financial among the elite of Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years.

You can see the full list of all 45 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus metrics that matter such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Dividend Kings have the longest track records when it comes to rewarding shareholders with rising dividends.

Cincinnati Financial has a relatively “boring” business model. But insurance stocks are among the best stocks for long-term dividend growth investors.

Cincinnati Financial stock has a 3.0% dividend yield, which is significantly above the ~1.7% average yield of the S&P 500 Index.

Thanks to its strong business model, healthy payout ratio, and its strong balance sheet, the insurer has ample room to keep raising its dividend for many more years.

And shares appear to be slightly undervalued right now, meaning investors interested in total returns may find this time to be a buying opportunity.

Business Overview

Cincinnati Financial is a property-and-casualty (P/C) insurance company founded in 1950.

It offers business, home, auto insurance, and financial products, including life insurance, annuities, property, and casualty insurance. It is headquartered in Ohio and is trading with a market capitalization of $14.5 billion.

The company has operations in 46 states. The company also has more than 1,945 agency relationships with 2,786 locations as of June 30th, 2022.

Source: Investor Presentation

As an insurance company, Cincinnati Financial makes money in two ways.

First, it earns income from the insurance premiums of the policies it sells to its customers.

Second, it also earns investment income by investing its float, i.e., the money it receives from its customers minus the amount it pays out in claims.

This is why the insurance business can be so lucrative–insurers generate a large amount of float, which can be invested with a high rate of return, thus generating compounded returns.

On the other hand, the P/C insurance business can be especially tricky for investors.

Some insurers are often tempted to reduce the premiums they charge in order to entice more customers and thus enhance their market share. During favorable years, in which catastrophic losses are low, these insurers will post high levels of profits.

However, a year with high catastrophic losses will inevitably show up at some point and will erase the profits of all the previous years if the insurers have not followed a prudent underwriting policy.

This means that investors should evaluate P/C insurers based on their long-term performance.

Cincinnati Financial is better than average in this respect when compared to its peers.

In the last five years, the company has posted a combined ratio of 6.5 percentage points better (lower) than that of its peers.

Source: Investor Presentation

The combined ratio is the primary index of performance of P/C insurers, as it is the ratio of the amount of claims paid to the amount of premiums received. As this definition shows, the lower the combined ratio, the better.

Cincinnati Financial has managed to maintain a superior combined ratio thanks to the predictive modeling tools and analytics it uses as well as data management in order to determine the probability of each catastrophic event and thus set the appropriate price for each customer.

The superior underwriting policy of Cincinnati Financial is evident not only from its superior combined ratio but also from its exceptional dividend growth record.

As catastrophic losses are very volatile in nature, they are incredibly high in a few adverse years.

Consequently, it is nearly impossible for most insurers to grow their dividends during these few rough years.

Cincinnati Financial is a bright exception to this rule, as it has raised its dividend for 61 consecutive years. This is a testament to its prudent underwriting policy and the long-term perspective of its management.

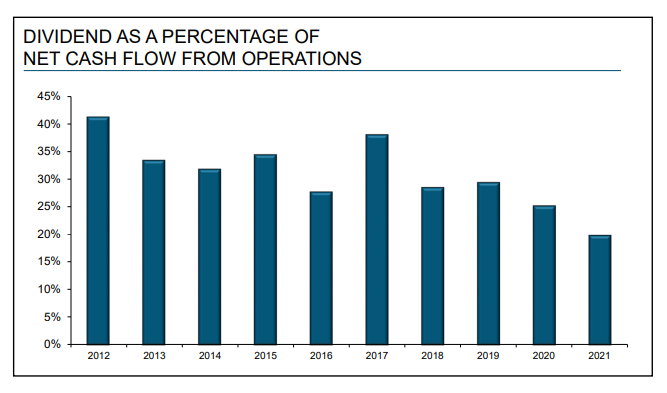

Another factor behind the exceptional dividend record of Cincinnati Financial is the healthy payout ratio that the company has always targeted in order to create a wide margin of safety for its dividend.

Source: Investor Presentation

Thanks to its healthy payout ratio and its financial strength, the insurer can keep raising its dividend for many more years.

In the 2022 second quarter, revenues declined 64% year over year. However, earned premiums were up 11% year over year.

For the first six months of 2022, total revenues fell 55% compared to the first six months of FY 2021. Non-GAAP operating income per share decreased 29% over the first six months to $2.23 per share.

Company book value decreased 10% year-over-year to $66.30.

Growth Prospects

A rough year every few years should be expected in this business. But investors should focus on the long-term prospects of P/C insurers, and we believe that the future growth prospects of Cincinnati Financial are intact.

We expect 6% annual earnings-per-share growth over the next five years for Cincinnati Financial.

Management targets a 10% to 13% average annual growth rate over the next five years. As per its definition, the growth rate is equal to the growth rate of the book value per share plus the dividends paid to the shareholders.

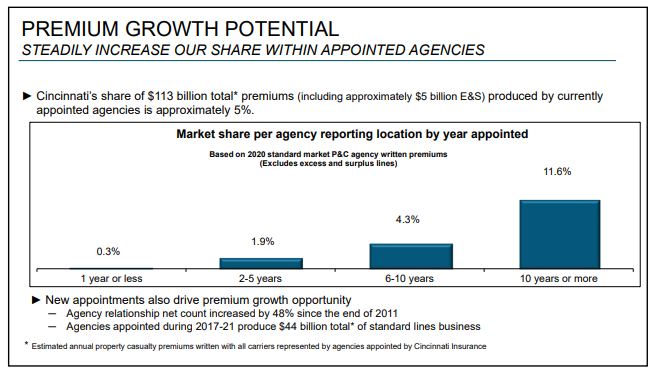

It aims to achieve a 10% to 13% growth rate over the next five years, primarily via new agency appointments and premium growth in the already appointed agencies.

As shown in the chart below, Cincinnati Financial has consistently increased its market share in its agencies over time.

Source: Investor Presentation

Its market share remains low in the first five years from the appointment of each agency, but then it rises significantly and thus contributes to significant premium growth.

On the other hand, the company generates a great portion of its earnings from its investment gains, and thus it is highly sensitive to the prevailing interest rates and the stock market performance.

Notably, Cincinnati Financial is a somewhat aggressive investor, with 42.4% of its investment portfolio being invested in common equities.

Remarkably, 28% of its stock portfolio is invested in technology stocks. However, this is about in line with the weighting of the S&P 500, which holds 27% of technology stocks. Cincinnati’s top holdings are Apple, Microsoft, UnitedHealth, AbbVie, and Accenture.

However, this strategy renders the company vulnerable to a potential bear market.

Competitive Advantages & Recession Performance

Cincinnati Financial boasts of the great relationships it has with most of its agents, which help the insurer earn access to the best accounts of its agents.

In addition, it has a good reputation for its financial strength and its efficient procedures in claim payments. These features provide some sort of competitive advantage.

On the other hand, this competitive advantage is narrow. The P/C insurance is characterized by intense competition, which has heated more than ever in recent years.

Warren Buffett has repeatedly stated that the best days for insurers belong to the past due to the current intense competition.

Moreover, Cincinnati Financial is vulnerable to recessions due to its high exposure to the stock market and its sensitivity to interest rates.

During recessions, interest rates remain depressed and thus take their toll on the insurer’s bond portfolio yield.

However, Cincinnati Financial’s ability to generate strong cash flow, and maintain profitability even during recessions, has allowed it to raise its dividend for six decades.

Valuation & Expected Returns

We expect Cincinnati Financial to generate earnings-per-share of $4.95 this year. As a result, the stock is trading at a forward price-to-earnings ratio of 18.8. This is below our fair value P/E of 20.0.

As a result, it appears that the stock is slightly undervalued right now.

If the stock reaches our fair valuation level over the next five years, it will benefit from a 1.2% annualized gain in its returns due to the expansion of its earnings multiple.

We also expect 6.0% annual EPS growth over the next five years while the stock also offers a 3.0% dividend yield.

The stock will likely offer 9.7% average annual returns over the next five years.

Final Thoughts

Cincinnati Financial is a high-quality P/C insurer. The exceptional dividend record of the company, with 61 consecutive years of raises, is a testament to its disciplined underwriting policy.

And the stock is somewhat undervalued right now, but not to a great degree.

As a result, the stock makes for a strong holding but is not attractive enough for a buy rating right now.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link