niphon/iStock through Getty Pictures

We’ve just lately addressed the high-yield sector’s sturdy credit score fundamentals and traditionally engaging valuations. We’ve additionally proven that yield to worst has been a dependable indicator of return over the following 5 years. Now, we’re turning the highlight on yet one more fascinating improvement within the high-yield market: an inverted yield curve.

It is sensible that longer-maturity bonds sometimes present greater yields than shorter-term bonds. In any case, extra unhealthy issues can occur in an extended interval than a shorter one, and visibility is poorer for the following 10 years than for tomorrow. Traders anticipate to be paid for these dangers.

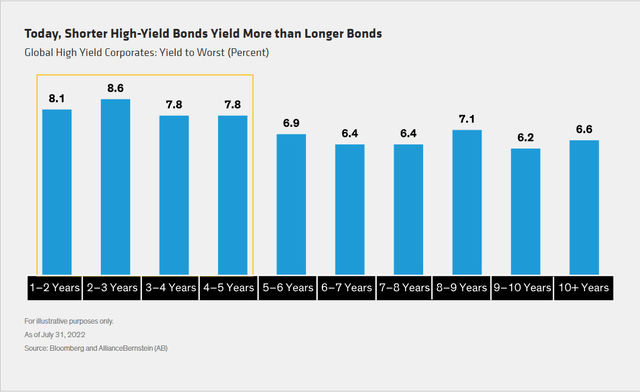

However in an uncommon aberration, short-term high-yield debt is at the moment yielding considerably greater than longer-term debt (Show, above). An inverted high-yield curve is nice information for high-yield bond traders who’re involved about near-term market volatility.

Even in regular instances, a shorter-duration high-yield technique can present excessive ranges of earnings with decrease volatility than an intermediate-duration technique. Traditionally, a shorter high-yield strategy has offered about 85% of the earnings of a longer-maturity mandate, with about half the typical month-to-month drawdowns.

However with the high-yield curve inverted, as it’s in the present day, traders are being paid extra to take much less danger. We predict that’s an earnings alternative value sizing up.

The views expressed herein don’t represent analysis, funding recommendation or commerce suggestions and don’t essentially signify the views of all AB portfolio-management groups. Views are topic to alter over time.

Authentic Submit

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.