[ad_1]

Justin Sullivan/Getty Photographs Information

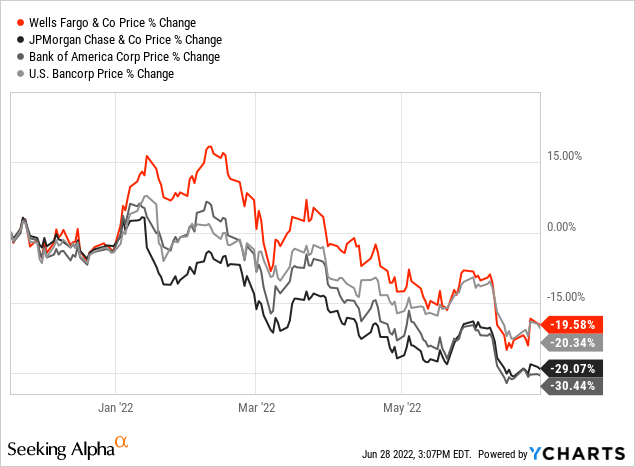

In November 2021, when my final article about Wells Fargo (NYSE:WFC) was printed, I thought of lots of the main U.S. banks to be a greater funding and the headline was “Decide a competitor as a substitute”. Since then, Wells Fargo has gotten about 20% cheaper and that is likely to be an excellent incentive to think about the inventory as an excellent funding now. Nevertheless, all the opposite main U.S. banks declined relatively steep as nicely. On the one hand which means that Wells Fargo would have been a greater choose in November 2021 – because it carried out higher. Alternatively, different banks is likely to be an analogous good funding proper now as they’re additionally buying and selling for very low P/E ratios.

Within the following article, I’ll have a look at Wells Fargo as soon as once more, speak about the newest stress check outcomes and ask the query as soon as once more if Wells Fargo is an effective funding or if we must always relatively select one other financial institution (mixed with the query if we must always spend money on banks in any respect proper now).

Outcomes

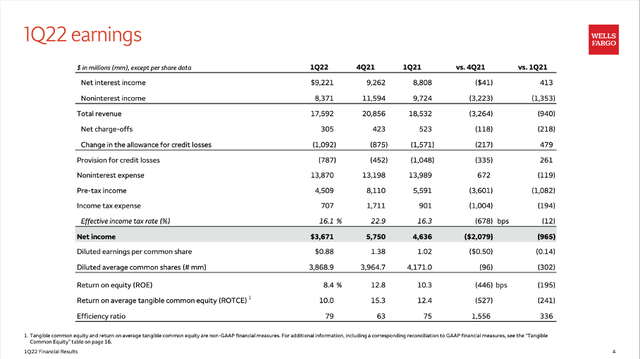

Let’s begin by trying on the final quarterly outcomes: Wells Fargo’s efficiency within the final quarter was stable, however not nice. Within the first quarter of fiscal 2022, Wells Fargo might enhance its web curiosity revenue from $8,808 million in the identical quarter final yr to $9,221 million this quarter – a rise of 4.7% YoY. Nevertheless, noninterest revenue declined from $9,724 million in Q1/21 to $8,371 million in Q1/22 – a decline of 13.9% YoY. Consequently, whole income declined from $18,632 million in the identical quarter final yr to $17,592 million this quarter and diluted earnings per share declined 13.7% YoY from $1.02 to $0.88.

Wells Fargo Q1/22 Presentation

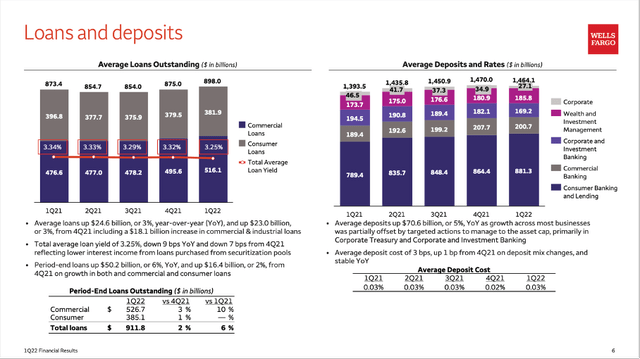

And when trying on the ends in extra element, we will additionally concentrate on loans and deposits. Whereas common loans excellent might enhance 2.6% quarter-over-quarter and a couple of.8% year-over-year, common deposits might enhance 5.1 % year-over-year however declined 0.4% quarter-over-quarter.

Wells Fargo Q1/22 Presentation

It is a image that isn’t untypical, and we see related outcomes for another banks. Nevertheless, Wells Fargo has been lagging particularly with its common deposits in the previous couple of years and couldn’t match the efficiency of different banks, which might be nonetheless a results of the scandals a number of years in the past.

Stress Take a look at Outcomes

Not too long ago, the FED additionally launched its 2022 stress check outcomes and all 34 banks handed the check – even within the severely opposed state of affairs. In its press launch, the FED states:

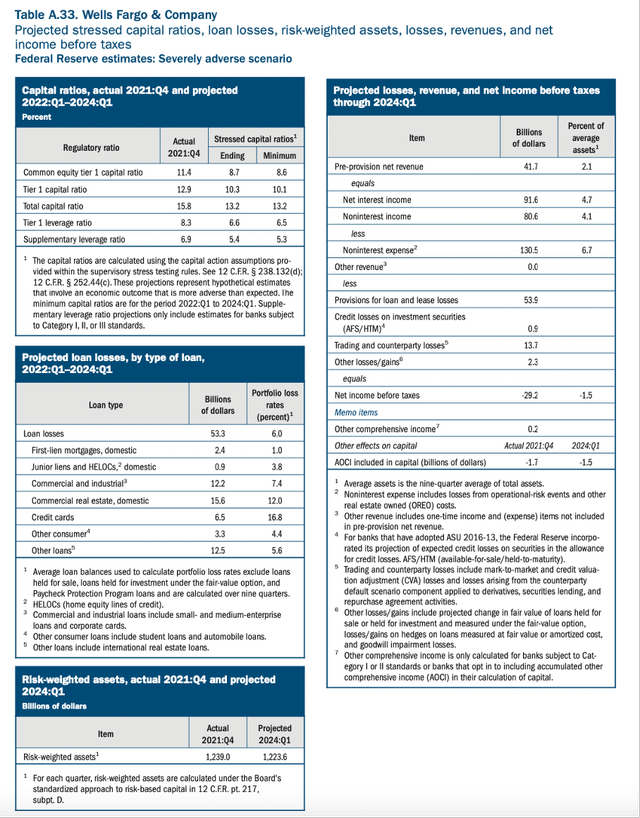

All banks examined remained above their minimal capital necessities, regardless of whole projected losses of $612 billion. Below stress, the mixture widespread fairness capital ratio-which supplies a cushion in opposition to losses-is projected to say no by 2.7 proportion factors to a minimal of 9.7 p.c, which remains to be greater than double the minimal requirement.

As one of many greatest banks (by asset) in america, Wells Fargo additionally should take part within the stress check. The simulation is projecting Wells Fargo’s widespread fairness tier 1 capital ratio to say no from 11.4% (in This autumn/21) to a minimal of 8.6% and the tier 1 capital ratio to say no from 12.9% in This autumn/21 to a minimal of 10.1%. Mortgage losses for Wells Fargo are estimated to be round $53 billion within the extreme opposed state of affairs.

FED Stress Take a look at 2022 Outcomes

I consider that banks in america are much less dangerous than earlier than the Nice Monetary Disaster and we most likely will not see an analogous disaster once more, however previous recessions and bear markets additionally confirmed us that analysts, traders in addition to the FED typically are inclined to underestimate the dangers and infrequently do not appear to completely bear in mind how interconnected the monetary world is. And the extraordinarily complicated monetary world is commonly resulting in chain reactions. Whereas I do not suppose we are going to see an analogous disaster as 15 years in the past, I do not wish to rule out that banks would possibly get in hassle once more – and with a possible recession on the horizon we ought to be cautious.

Recession

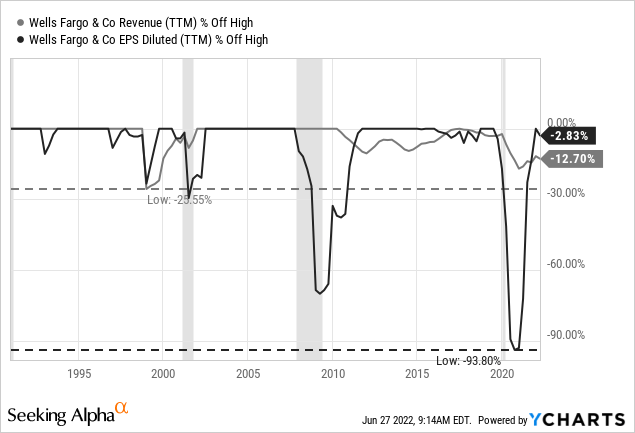

In a current article about U.S. Bancorp (USB), I argued that we must always not purchase the inventory proper earlier than a recession. And I might make an analogous argument for Wells Fargo (and most different banks). When trying on the efficiency of Wells Fargo throughout the previous couple of recessions, we must always not count on such a terrific efficiency for Wells Fargo through the subsequent recession.

Wells Fargo truly carried out surprisingly nicely through the Nice Monetary Disaster – not less than when taking a look at income. Nevertheless, we should remember that Wells Fargo was buying Wachovia at the moment, and it was fairly straightforward to extend income because of the acquisition. Earnings per share however declined relatively steeply in every of the final three recessions and we should assume an analogous efficiency through the subsequent recession.

Previously, Wells Fargo was one among Warren Buffett’s favourite banking shares – and the explanations had been the secure efficiency and perhaps decrease danger taking than different banks. Nevertheless, that modified in the previous couple of years and because the scandals it looks like Wells Fargo is a special financial institution and we severely should query if the standing as stable and well-run financial institution is justified. At the least Berkshire Hathaway (BRK.B) appears to have a transparent reply as Buffett and Munger offered off the final remaining shares lately.

Dividend

Like most different banks, Wells Fargo can be paying a quarterly dividend. Whereas a lot of the different main U.S. banks solely froze the dividend initially of the COVID-19 disaster, Wells Fargo reduce its dividend fairly steeply from $0.51 per quarter earlier than the disaster to $0.10. In the previous couple of quarters, Wells Fargo elevated the dividend once more, however $0.25 per quarter remains to be under the pre-crisis stage. That is at present leading to an annual dividend of $1.00 and a dividend yield round 2.6%.

Nevertheless, when evaluating the dividend to earnings per share of the final 4 quarters ($4.87), we get a payout ratio of solely 21% and such a low payout ratio ought to allow administration to extend the dividend within the coming quarters (not less than in concept).

Not Investing in Banks Proper Now

In my final article about U.S. Bancorp, I argued that I’m nonetheless a bit torn between two totally different factors of view. On the one hand, there are the stormy clouds Jamie Dimon talked about lately and we will see america on the eve of a recession. Alternatively, U.S. banks may very well be a terrific long-term funding over the following few a long time (contemplating the extraordinarily low P/E ratios proper now in addition to the potential of rising rates of interest). In my final article about U.S. Bancorp, I wrote the next:

On the one hand, I see the stormy clouds within the not too distant future, and I count on the inventory to carry out probably not nicely throughout a bear market. When taking a look at the previous couple of recessions, U.S. Bancorp often declined about 50% throughout a recession (and bear market) and in case of the Nice Monetary Disaster, the inventory declined even 75%. And we should count on an analogous decline within the subsequent recession (and bear market).

(….)

So, I’m torn between seeing banking shares (together with U.S. Bancorp) as a stable long-term funding and assuming that we’d like persistence because the time to purchase isn’t now. U.S. Bancorp is a stable long-term funding because of the broad financial moat banks often have and the justified hypothesis that rates of interest would possibly rise once more over the following two or three a long time making banks extra worthwhile once more.

In my view, we’re mainly on the peak (contemplating debt and asset costs) or the underside (contemplating rates of interest) of a long-term cycle (which is often taking 70-100 years). No person is aware of how lengthy we are going to keep near zero p.c rate of interest (the occasions might already be over now, or it might take a number of extra years), however in the end rates of interest will rise once more.

What’s true for U.S. Bancorp can be true for Wells Fargo. In lots of points the 2 banks are fairly related. Each are among the many main U.S. banks and each will revenue (or be burdened) in an analogous approach from the FED’s selections.

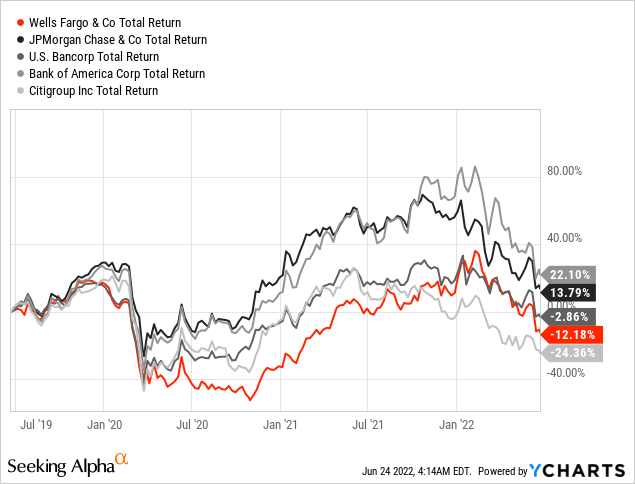

And if I used to be to spend money on U.S. banks, I nonetheless do not wish to choose Wells Fargo for a number of totally different causes. Not solely did Wells Fargo’s inventory underperform a lot of the giant U.S. banks within the final three years (solely Citigroup (C) carried out worse). Wells Fargo did additionally not handle to achieve earlier all-time highs once more. Whereas banks like JPMorgan Chase (JPM), Financial institution of America (BAC) or U.S. Bancorp managed to achieve pre-COVID-19 highs once more, Wells Fargo nonetheless is underperforming.

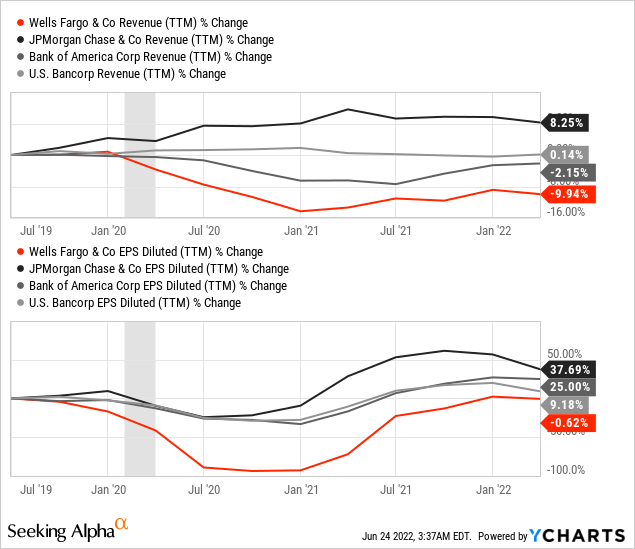

And when taking a look at income in addition to earnings per share, Wells Fargo barely managed to get them on the identical stage as earlier than the COVID-19 disaster. JPMorgan Chase for instance managed to elevated earnings per share 38% and Financial institution of America elevated earnings per share 25%.

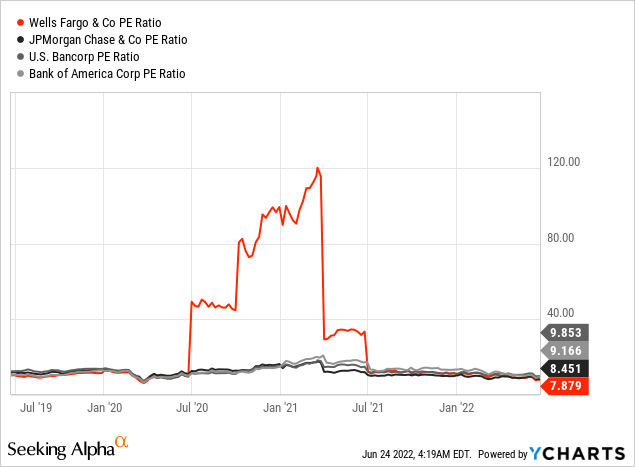

And an underperformance previously doesn’t essentially result in an underperformance sooner or later. However since all the main banks are buying and selling for related low P/E ratios proper now, there may be not a lot purpose to decide on the financial institution which has not solely to wrestle with macroeconomic challenges (like all different banks) however can be battling its personal points and was due to this fact underperforming within the current previous.

Wells Fargo appears low-cost (with a P/E ratio round 8) and it additionally appears to be the most cost effective among the many main U.S. banks, nevertheless it additionally has hassle performing. Nevertheless, most different main banks are additionally relatively low-cost and banks like JPMorgan Chase, U.S. Bancorp, or Financial institution of America additionally buying and selling for single digit P/E ratios proper now.

Wells Fargo might return to earlier “efficiency ranges” and in such a state of affairs it might be relatively low-cost. However we additionally have to be skeptical proper now, if Wells Fargo can carry out at an analogous stage as again then. The scandal is already a number of years in the past, and Wells Fargo remains to be struggling and has hassle to return to earlier efficiency ranges.

Conclusion

Like I used to be relatively cautious in my final article about U.S. Bancorp, I might even be relatively cautious about investing in Wells Fargo proper now. In my view, we must always wait the following few quarters and can most likely get a lot of the main U.S. banks even cheaper because the upcoming recession is a large danger for banking shares. And even when I might purchase a serious U.S. financial institution proper now, it might not be Wells Fargo – regardless of the inventory buying and selling for a fair decrease P/E ratio than is friends.

[ad_2]

Source link