Published on November 24th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth nearly $300 billion as of the end of the 2022 third quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. Buffett (and other institutional investors) must periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of September 30th, 2022, Buffett’s Berkshire Hathaway owned about 60 million shares of Taiwan Semiconductor Manufacturing (TSM) for a market value of $4.12 billion. Taiwan Semiconductor represents about 1.2% of Berkshire Hathaway’s investment portfolio.

This article will analyze the semiconductor company in greater detail.

Business Overview

Taiwan Semiconductor Manufacturing is the world’s largest dedicated foundry for semiconductor components. The company is headquartered in Hsinchu, Taiwan.

American investors can purchase an ownership stake in Taiwan Semiconductor through American Depository Receipts (ADR) on the New York Stock Exchange, where they trade under the ticker TSM with a market capitalization of US$400 billion.

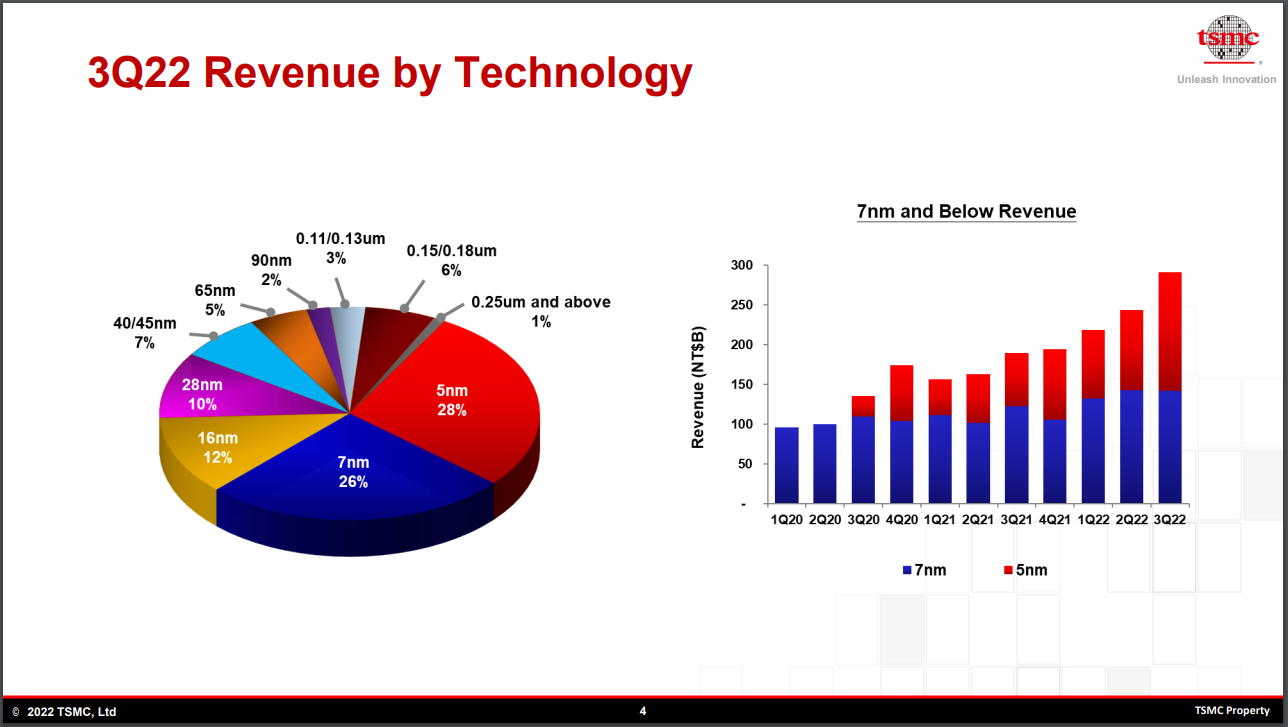

Source: Investor Presentation

On October 13th, 2022, Taiwan Semiconductor reported third quarter 2022 results. Revenue rose 48%, and earnings-per-share increased 80% over the prior year’s quarter due to sustained strength in demand for 5-nanometer and 7-nanometer technology.

The company generated $1.79 in earnings per ADR, which beat analyst estimates by $0.11. Revenue also surpassed estimates by $1.14 billion, as the company achieved revenue of $20.23 billion.

Taiwan Semiconductor posted substantial gains in margins compared to the previous year. Gross margin equaled 60.4% (up 9.1 percentage points (ppts)), operating margin was 50.6% (up 9.4 ppts), and net profit margin was 45.8% (up 8.1 ppts).

We estimate that Taiwan Semiconductor can generate $6.00 in earnings-per-share for the fiscal year 2022.

Growth Prospects

Taiwan Semiconductor has generated incredible growth over the last decade. The company is the leader in the semiconductor manufacturing industry.

The company has compounded its adjusted earnings-per-share by 16.0% per year over this period, which is impressive. It’s unlikely that we’ll see that growth going forward as the company’s sheer size makes it more challenging to generate massive year-over-year gains.

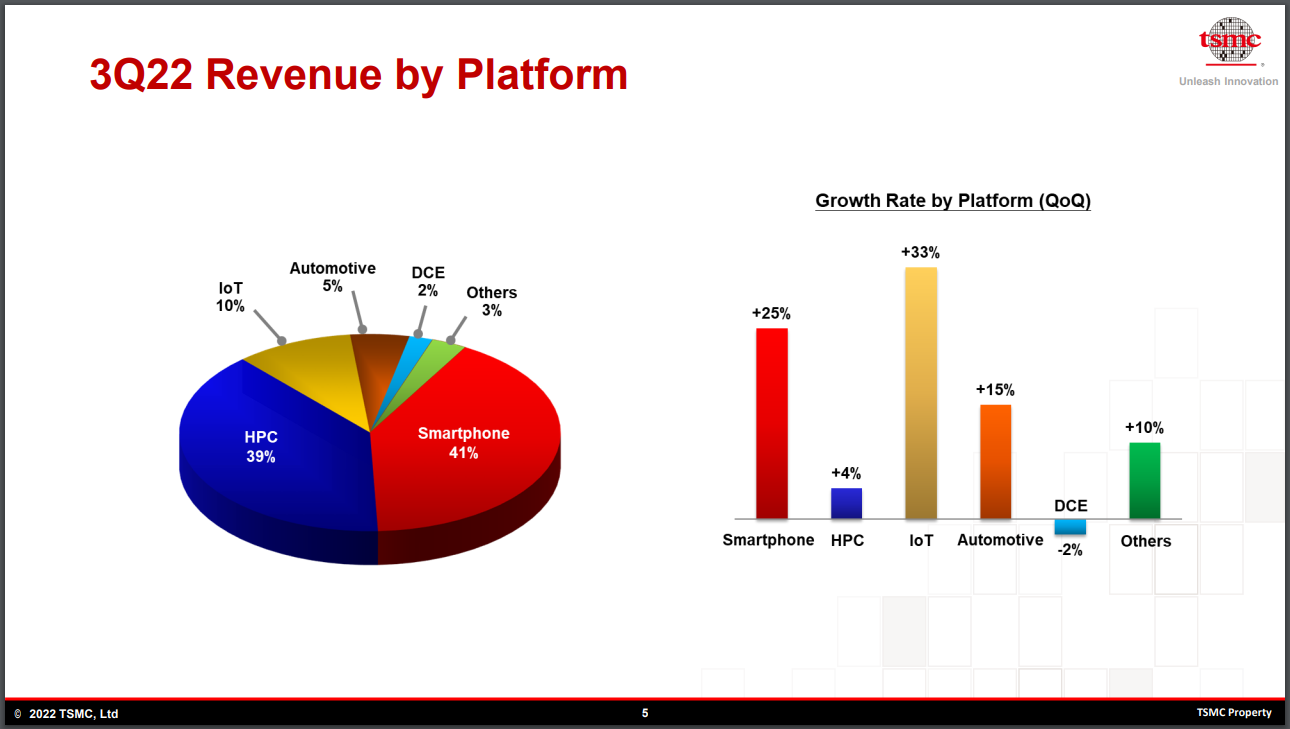

Source: Investor Presentation

We expect earnings-per-share growth over the next five years to materialize primarily due to the accelerated deployment of 5G and the growing adoption of 7-nanometer solutions in High-Performance Computing.

The company’s involvement in the Internet of Things (IoT) and Automotive solutions could catalyze outsized earnings. And the company’s smartphone revenue provides a solid base of earnings.

One significant but speculative risk to keep in mind is the geopolitical relations between China and Taiwan. This stock would likely suffer severe losses if China were to invade Taiwan.

Still, we project that the company can continue to grow earnings per share by about 9.0% annually through 2027.

Competitive Advantages & Recession Performance

Taiwan Semiconductor has a solid balance sheet. Since the company generates strong free cash flows to fund its business, Taiwan Semiconductor has no debt. Only a few companies out of the whole market have no debt, which is a strong advantage.

Still, the company’s results are tightly linked to the smartphone market. However, much of the smartphone growth has already come to pass, so it is unknown how much more smartphone sales can increase from the current level.

As a result, the stock is likely to underperform in a recession, as smartphone sales could plunge in such an event. To illustrate this, despite the all-time high earnings of the company amid strong demand for its chips in smartphones, vehicles, and high-performance computing, the stock has plunged -38% this year due to fears of an upcoming recession and a decrease in global demand for chips.

However, in the recent recession resulting from the pandemic, the company managed to grow its sales and earnings thanks to strong growth in 5G smartphones and product launches in high-performance computing.

Taiwan Semiconductor has raised its dividend for seven consecutive years so far. And the current dividend is well-covered by earnings. Based on expected fiscal 2022 earnings, TSM has a payout ratio of just under 31%. We expect the company to significantly grow its dividend thanks to its healthy payout ratio and rising earnings.

Valuation & Expected Returns

Shares of Taiwan Semiconductor Manufacturing have traded for an average price-to-earnings multiple of 17.0 over the last ten years. Shares are now trading below this average, indicating that shares could be undervalued at the current 13.7 times earnings.

Our fair value estimate for Taiwan Semiconductor Manufacturing stock is 17.0 times earnings. If this proves correct, the stock will benefit from a 4.4% annualized return gain through 2027.

Shares of Taiwan Semiconductor currently yield 2.2%, lower than the ten-year average yield of 2.9%. Also, investors should be aware that a 21% withholding tax from the Taiwanese government reduces the after-tax yield. On a dividend yield basis, Taiwan Semiconductor shares seem to be trading above fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 15.5% per year over the next five years. This makes Taiwan Semiconductor Manufacturing a buy.

Final Thoughts

Taiwan Semiconductor is the world’s largest dedicated foundry for semiconductor components. The company makes a vital component in many technology products.

The stock has suffered a 38% year-to-date loss due to fears of a recession and lower global demand for chips as customers may hold back on spending.

However, this stock price plunge has landed Taiwan Semiconductor in a favorable valuation position, leading us to estimate outsized returns.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].