AscentXmedia/E+ via Getty Images

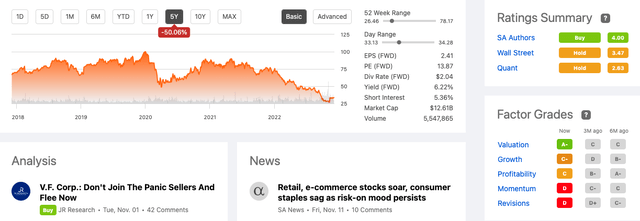

V.F. Corporation (NYSE:VFC) is an apparel company responsible for diverse lifestyle brands such as Supreme, North Face, Timberland and Vans across the globe. The stock price plummeted from an all-time high in December 2019 at $99.96 to $26.49 one month ago. Over the last five years, shareholders have made 50.06% losses investing in this company. The consumer discretionary market has and will continue to take on some significant headwinds in the face of increased global market competition, the Chinese market restrictions, and the price impact of the strong dollar on sales. Furthermore, the fear of recession looms worldwide, and customers are more cautious regarding their purchasing behavior. Is this a time to invest in a company that was riding high pre-COVID-19?

Five Year Stock Trend (SeekingAlpha.com)

If we look at VFC’s supreme dividend program, which the company has been increasing for almost 50 years, its compounding business and its low price-to-equity ratio, I think there are strong arguments to invest in VFC if you are interested in long-term gains. The level of insider trading is also a positive sign regarding the company’s self-belief in its recovery journey. Although it is currently underperforming, the strength and diversity of its brands should allow shareholders to continue seeing returns in the next few years. Historically it has been able to recover from previous difficulties and previous economic downturns. For this reason, investors may want to take a bullish stance on this company.

Long Term Growth

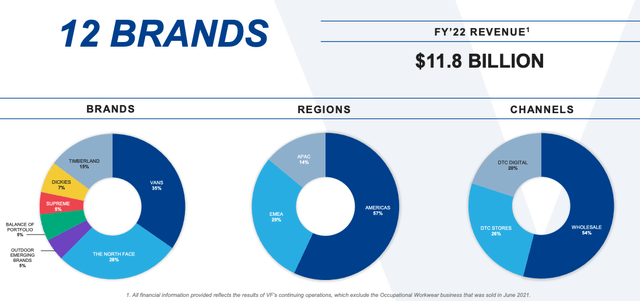

VFC is down 54.58% year to date due to several factors. Firstly, consumer discretionary stocks are not popular right now; the perception is negative due to the harsh retail environment, the global growth challenges impacted by inflation, continued supply chain issues, and the strong dollar, which has negatively impacted the ability to compete on an international online retail front. However, looking back can help us to look at the current situation and make better decisions about the future of VFC. The company is over 120 years old, dating back to 1899, when it was set up as the Reading Glove and Mitten Manufacturing Company. Today it has a market cap of $13.009 billion and has a portfolio of twelve brands across three regions sold through three diverse channels.

Company Snapshot (Investor Presentation 2022)

Although it has built itself up in a clothing industry subject to market conditions and consumer trends, VFC has been less impacted by historic recessions and consumer trends than the general industry. It has acquired and grown timeless brands less sensitive to consumer trends. Due to their younger target market, Vans and Supreme are two of the more sensitive brands, which is also shown in this year’s decreasing Van results. However, Vans, founded in 1966, has continued upward through decades of consumer changes.

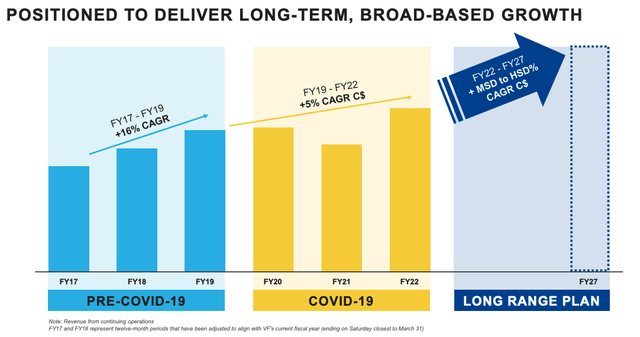

The company has historically overcome and continued to grow through difficult times. If we take the recession of 2008, we can see the following EPS trend and recovery. Earnings per share dropped from $1.39 in 2008 to $1.29, a drop of 7.2% in 2009 and 2010; the company recovered and hit new EPS highs of $1.61. Furthermore, there is still a lot of upside potential if we look at the total addressable market (“TAM”) of $600 billion.

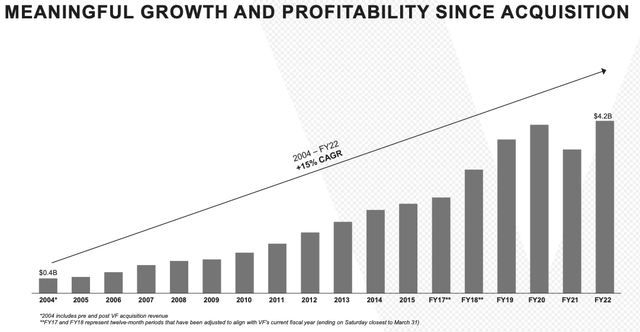

Long Term Growth (Investor Presentation 2022)

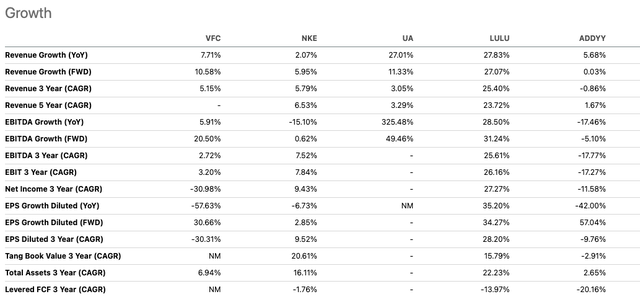

If we compare VCF’s current growth to some of its peers in the apparel market Nike, Inc. (NKE), Under Armour, Inc. (UA), Lululemon Athletica Inc. (LULU) and adidas AG (OTCQX:ADDYY), we can see that forward-looking there is a positive outlook on its revenue and EPS growth relative to its competitors. However, we see better performances for newer and much higher-valued LULU players.

Growth Comparison (SeekingAlpha.com)

49 Years of Dividend Increases

Although the stock price has fallen dramatically, investors in this company are still being generously rewarded. VFC has a consistent dividend program dating back to 49 years ago. V.F. has a remarkable 49-year streak of dividend increases, nearly twice as long as what is necessary to become a Dividend Aristocrat. The company has a long history of raising dividends but has also been an outstanding dividend growth stock. It has increased by an average of slightly over 10% over the last ten years, giving investors nearly 50 years of continuous growth and double-digit yearly gains.

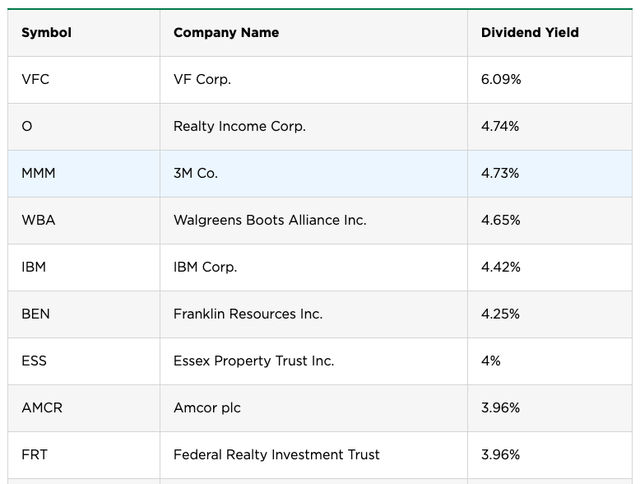

It is the number one of 64 companies classified as Dividend Aristocrats today, with a dividend yield of 6.09%. To meet the criteria, the company has to be a large-cap stock of at least $13.1 billion and raise dividends consecutively for at least twenty-five years as a public company.

Top ten dividend aristocrats ordered by current dividend yield (Nerdwallet.com)

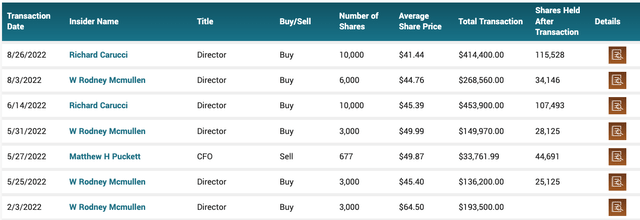

Insider Trading

Considering insider trading this year, we see several large purchases by board directors. It gives us an indication of confidence and, of course, on the other hand, a suggestion that the stock is at a bargain price. Although this should not be the only reason one invests in a stock, it is a positive indication that this company may have value in the long run.

Insider Trading 2022 (Marketbeat.com)

Valuation

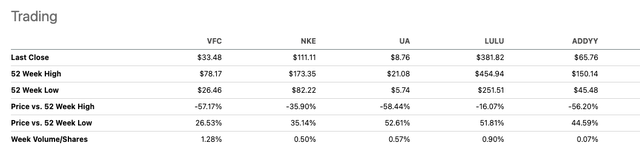

There are mixed reviews from analysts about this stock. Zack’s Rank gives it a Sell rating of 4, ranking it in the bottom 40% of its apparel and textile industry. Other analysts, such as Edward Jones and Morningstar, continue to value the stock highly and have a Hold rating on SeekingAlpha’s Quant rating system. Again, looking at some of its fellow peers, we can see that VFC is very cheap compared to most of its counterparts below.

Stock Price across Peers (SeekingAlpha.com)

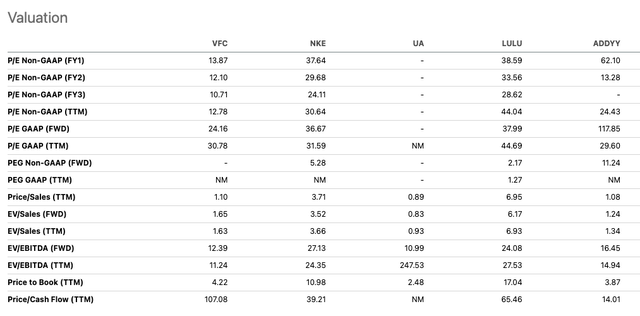

One thing that stands out if we do a peer valuation across these five companies is that VFC has a very low price-to-earnings ratio of 13.87, more than 50% less than its peers. This means that VFC is trading lower if we compare it to its fundamentals, and it may be a great moment to buy the stock before the pricing is adjusted.

Peer Valuation (SeekingAlpha.com)

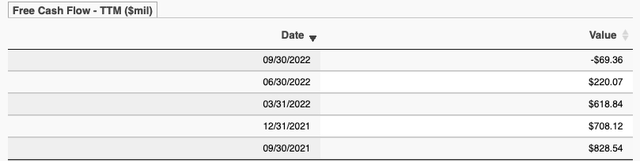

One of the ratios to be cautious of is the high price-to-cash flow ratio of 107.08. The company’s free cash flow has been reducing quarter by quarter since September 2021, as seen below, which investors should be wary of.

Free Cash Flow (Zacks.com)

Risks

We must recognize that consumer discretionary goods generally perform poorly during weaker economic markets. The market is still impacted by high energy prices and increasing inflation, all affecting the costs of essentials such as food and housing. There needs to be more certainty about how much consumers will be willing to spend on branded clothing and shoes. Although, on the other hand, the target market is a more affluent customer who may be less sensitive to the pricing.

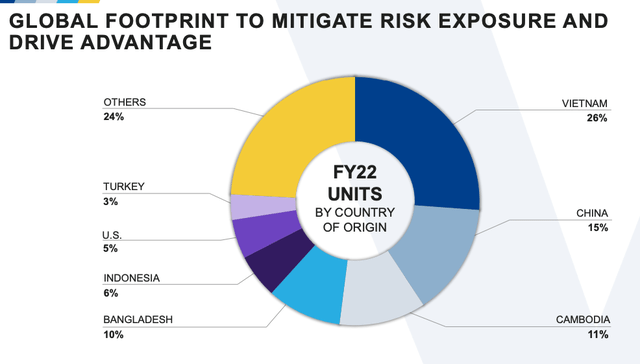

One of the critical issues has been the dependence on China to produce the products. This is not ideal for obvious reasons and has impacted the company. However, as we see in the image below, it is addressing the issue by diversifying production

Global Production (Investor Presentation)

Furthermore, Vans, one of the key brands, has been underperforming. The loss in sales has an immediate impact on the overall performance of the business as one of the key brands that the company is focused on. The market has changed, and the company is aware of and taking action to refocus, readdress the target market and install the changes from an original focus of skate, surf and snow to a street, active and outdoor culture.

Vans growth trend since acquisition (Investor Presentation 2022)

Final Thoughts

Although there are clear red flags in the short term considering the headwind that consumer discretionary stocks are facing for the future, considering what V.F. Corporation has achieved over its historical period is critical. This company has over 120 years of experience and has pushed through historically low economic markets, technological changes, and the globalization of competition. For this reason, investors may want to take a bullish stance on this really low buying opportunity.