Do job displacements compound personal prices (i.e. earnings losses) with productivity-enhancing reallocation? The previous facet has been documented in an unlimited literature. Since Jacobson et al. (1993) and Farber (1993), analysis has constantly proven that displaced staff endure long-run earnings losses (see Bertheau et al. 2022 for current cross-country proof). The latter facet is nevertheless known as into query by current advances within the job displacement literature.

On the one hand, it’s an outdated concept that low productiveness corporations (should) shrink whereas excessive productiveness corporations (can) develop (Schumpeter 1942, Foster et al., 2001). In that view, declining industries and struggling companies are the inevitable penalties of a altering economic system, and displacements are only a particular kind of reallocation of things. As a result of reallocation seems as a course of on the core of productiveness progress (Hsieh and Klenow 2009, Foster et al. 2016), displacement can thus be considered as socially productive.

Alternatively, the newest advances within the job displacement literature doc that staff are reallocated towards lower-wage corporations. Current papers certainly spotlight the function of variations between origin (i.e. firing) and vacation spot (i.e. hiring) corporations to elucidate the long-run decline in wage fee that’s generally noticed upon displacement (Gulyas and Pytka 2019, Lachowska et al. 2020, Moore and Scott-Clayton 2019, Schmieder et al. 2020, Fackler et al. 2021, Bertheau et al. 2022). Specifically, these research present that displaced staff reallocate to corporations with decrease wage premium – the place premia are measured à la Abowd et al. (1999).

That is shocking as a result of an ever-growing literature paperwork that productiveness and wages are correlated within the cross part of corporations (Berlingieri et al. 2018, Card et al. 2016). If displaced staff go down the wage ladder, does this suggest that additionally they reallocate towards decrease productiveness corporations? Or does this suggest that losses in agency premium are pushed by reemployment at high-productivity but low-labour-share corporations (Autor et al. 2020, Aghion et al. 2022)? Whether or not earnings losses replicate a reallocation to corporations producing much less surplus per employee or a decline in staff’ negotiation energy is a vital query. Not solely does it matter for our understanding of labour reallocation within the wake of downsizing occasions, however it is usually telling concerning the function of corporations within the labour market and might due to this fact assist derive more practical insurance policies.

In a current paper (Brandily et al. 2022), we shed new mild on these questions by finding out the method of reallocation that follows job displacement. Counting on wealthy administrative knowledge from France, we research collectively the wage coverage and productive efficiency of the corporations wherein displaced staff are re-employed.

The function of corporations in shaping the price of job displacement in France

We depend on an administrative definition of financial layoffs whereby corporations should justify going through financial difficulties. This allows us to minimise the chance of finding out people who voluntarily left their agency and whose employment trajectory is extremely endogenous, whereas counting on a bigger set of involuntary labour market separations than within the literature counting on mass layoffs (outlined as episodes of enormous employment contraction – usually in extra of 30% of the preliminary workforce).

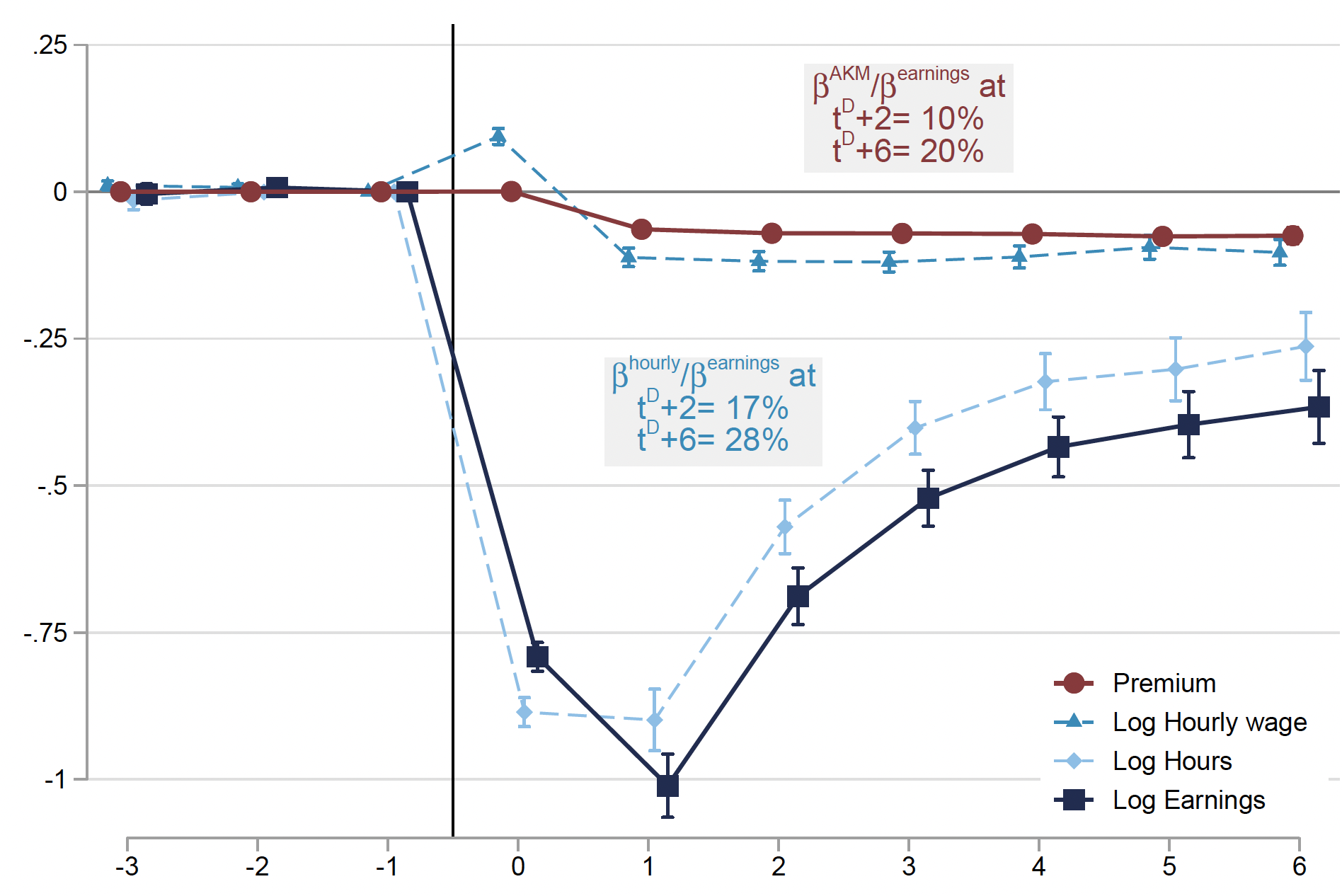

Utilizing this pattern of staff laid-off for financial causes, we first discover proof of enormous and protracted earnings losses, that quantity to a couple of third of pre-displacement earnings six years post-displacement. Determine 1 traces out the typical distinction (between displaced and management staff) earlier than and after the job displacement occasion. It additional decomposes this distinction by way of hours, hourly wage and agency premium. In the long term, losses in hourly wage fee present no signal of restoration. These persistent losses in hourly wage are defined to a really massive extent (80.5%) by loss in agency wage premium. This discovering provides to an energetic literature assessing the significance of misplaced wage premium in shaping the price of displacement in different international locations. Lachowska et al. (2020) and Schmieder et al. (2020) got here to totally different conclusions on this matter, thereby prompting additional analysis (Gulyas and Pytka 2019, Moore and Scott-Clayton 2019, Fackler et al. 2021, Bertheau et al. 2022).

Determine 1 Decomposition of the price of job displacement

Total, this primary evaluation exhibits that in our setting losses in agency premium are a significant driver of decline in hourly wage within the wake of job displacement, and that reallocation to low-wage corporations seems quantitatively extra vital than various explanations (resembling employer-employee match results or human capital depreciation as emphasised by Lachowska et al. 2020).

Productiveness and wage premium

As defined earlier than, these findings might be in step with two views. Within the first view, displaced staff are reallocated towards decrease productiveness corporations. Certainly, we all know from the literature that wage premium and productiveness are positively associated throughout corporations (Card et al. 2013), a function we additionally observe in our estimation pattern (Determine 2). The opposite chance is that losses in agency premium are as an alternative pushed by reemployment at high-productivity but low-labour-share corporations.

Determine 2 Agency-specific wage premium and productiveness

Leveraging detailed administrative agency knowledge, we present that the reallocation of staff to decrease wage premium corporations doesn’t replicate a reallocation in direction of low productiveness corporations. As a substitute, vacation spot corporations are usually extra productive however pay decrease premium (Determine 3). Extra exactly, we discover that displaced staff reallocate on common towards corporations which might be 15% extra productive than the counterfactual staff’ (Determine 3a),1 and that they face a discount within the agency wage-premium (Determine 3b). Consequently, displaced staff are reallocated to corporations that additionally function a decrease labour share of value-added than the counterfactual (-15.5% 5 years after displacement; see Determine 3c).

Determine 3 Productiveness and labour share of present employers

Collective bargaining in vacation spot corporations

We view the sample documented above as suggestive of a decline in bargaining energy versus difficulties to entry jobs in productive corporations. That’s, losses in premium appear to replicate a decline in staff’ negotiation energy; the place we outline loss in negotiation energy as being re-employed by corporations with unfavourable wage coverage given (versus due to) their productiveness.

To help this concept, we construct authentic firm-level indicators capturing the state of labour relations in every employer. The usage of firm-level knowledge (versus sector-level proxies for collective bargaining) is essential as a result of we present that the results are pushed by within-sector dynamics quite than reallocation throughout sectors with systematic variations. In Determine 4, we offer proof that displaced staff are reallocated to employers which might be much less more likely to efficiently conclude firm-level collective wage agreements (previous to staff’ displacement occasion) and the place staff have a decrease participation fee throughout skilled elections – arguably reflecting a decrease diploma of group of the workforce.

Determine 4 High quality of labour relations: Agency-level measures

Conclusion

Our findings have a number of implications. By way of modelling of the labour market, they spotlight that wage and productiveness ladders (Moscarini and Postel-Vinay 2018) are usually not all the time collinear – staff can fall from one whereas climbing the opposite. By way of coverage, confirming that job displacements are productivity-enhancing reallocations means that, quite than slowing down the method of reallocation, it could be helpful to discover methods of mitigating the personal value they impose on staff, as an example by way of wage insurance coverage. Alternatively, coverage might as an alternative deal with enhancing staff bargaining energy in vacation spot corporations.

These vacation spot corporations are capable of constrain labour compensation even though they generate massive surplus-per-worker. Understanding whether or not this capability derives from market energy (on the labour or the product market) and in flip what the determinants of this market energy are stay vital questions which we go away for future analysis.

References

Abowd, J M, F Kramarz, and D N Margolis (1999), “Excessive wage staff and excessive wage corporations”, Econometrica 67(2): 251–333.

Aghion, P, A Bergeaud, T Boppart, P J Klenow, and H Li (2022), “A principle of falling progress and rising rents”, Nationwide Bureau of Financial Analysis and Stanford mimeo.

Autor, D, D Dorn, L F Katz, C Patterson, and J Van Reenen (2020), “The autumn of the labor share and the rise of famous person corporations,” The Quarterly Journal of Economics 135 (2): 645–709.

Berlingieri, G, S Calligaris, and C Criscuolo (2018), “The productiveness wage premium: It’s productiveness, not dimension, that issues in a service economic system”, VoxEU.org, 19 September.

Bertheau, A, E M Acabbi, C Barcelo, A Gulyas, S Lombardi, and R Saggio (2022), “The unequal value of job loss throughout international locations”, VoxEU.org, 11 March.

Brandily, P, C Hémet, and C Malgouyres (2022), “Understanding the reallocation of displaced staff to corporations”, CEPR Dialogue Paper 17071.

Card, D, A R Cardoso, and P Kline (2016), “Bargaining, sorting, and the gender wage hole: Quantifying the influence of corporations on the relative pay of girls”, The Quarterly Journal of Economics 131(2): 633–686.

Fackler, D, S Mueller, and J Stegmaier (2021), “Explaining wage losses after job displacement: Employer dimension and misplaced agency wage premiums”, Journal of the European Financial Affiliation 19 (5): 2695–2736.

Farber, H S (1993), “The incidence and prices of job loss: 1982-91”, Brookings Papers on Financial Exercise 24 (1 Microeconomics): 73–132.

Foster, L, C Grim, and J Haltiwanger (2016), “Reallocation within the nice recession: Cleaning or not?,” Journal of Labor Economics 34(S1): S293–S331.

Gulyas, A and Ok Pytka (2019), “Understanding the sources of earnings losses after job displacement: A machine-learning method”, CRC-TR-224 Dialogue Paper Collection, College of Bonn and College of Mannheim, Germany.

Hsieh, C-T and P J Klenow (2009), “Misallocation and manufacturing TFP in China and India”, The Quarterly Journal of Economics 124(4): 1403–1448.

Jacobson, L S, R J LaLonde, and D G Sullivan (1993), “Earnings losses of displaced staff”, The American Financial Overview 83(4): 685–709.

Lachowska, M, A Mas, and S A Woodbury (2020), “Sources of displaced staff’ long-term earnings losses”, The American Financial Overview, October, 110(10): 3231–66.

Moore, Brendan and Judith Scott-Clayton(2019), “The agency’s function in displaced staff’ earnings losses”, Technical Report, Nationwide Bureau of Financial Analysis.

Moscarini, G and F Postel-Vinay (2018), “The cyclical job ladder”, Annual Overview of Economics 10: 165–188.

Schmieder, J, T von Wachter, and J Heining, “The prices of job displacement over the enterprise cycle and its sources: Proof from Germany”, Working Papers February 2020.

Schumpeter, J A (1942), Capitalism, socialism, and democracy, New York: Harper.

Endnotes

1 Observe that firm-level productiveness is measured over the 2001-2004 (pre-displacement) interval and is held mounted, in order that the coefficients solely replicate the displacement-induced reallocation of staff towards corporations with totally different preliminary productiveness.