UK client confidence has fallen to its lowest degree since information started almost 50 years in the past as surging inflation hits households’ funds and the broader financial system.

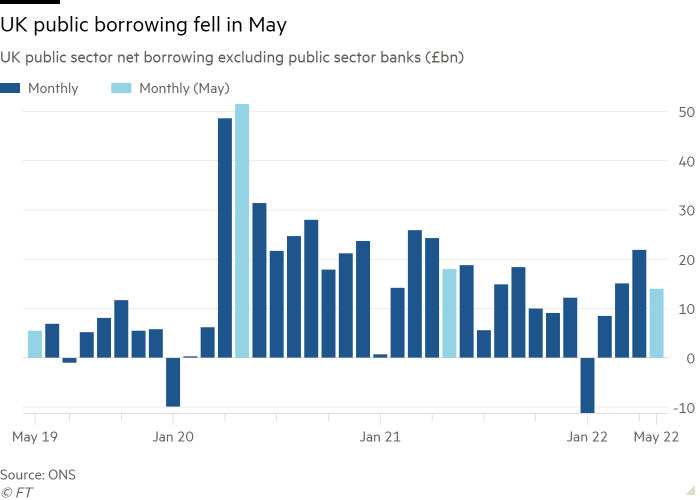

The information, printed by analysis firm GfK, got here a day after official figures revealed that curiosity funds on UK authorities debt hit one in every of their highest ever ranges final month as climbing inflation restricted an anticipated fall in public sector borrowing.

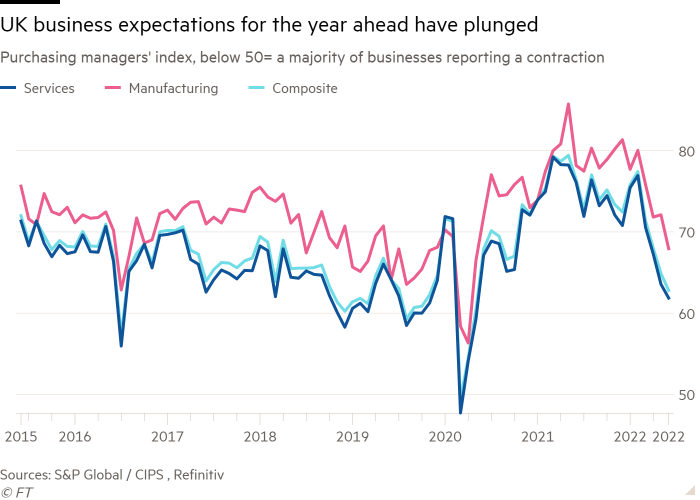

The sharp rise within the client value index, which in Could reached a 30-year excessive of 9.1 per cent, additionally led enterprise sentiment to fall to the bottom degree seen in two years, in response to separate figures from the S&P World/CIPS UK buying managers’ survey, additionally launched on Thursday.

The UK client confidence index, an indicator of individuals’s perceptions of their private monetary scenario and common financial situations, decreased one level to -41 in June, the bottom since information started in 1974.

Joe Staton, consumer technique director at GfK, stated the autumn mirrored costs rising quicker than wages and the prospect of strikes and spiralling inflation inflicting a summer time of discontent.

“The patron temper is at the moment darker than within the early phases of the Covid pandemic, the results of the 2016 Brexit referendum, and even the shock of the 2008 international monetary disaster, and now there’s speak of a looming recession,” he added.

The index, based mostly on interviews carried out within the first half of June, confirmed a very giant drop in expectations concerning private funds as quickly rising costs squeeze what customers can purchase. A studying beneath 30 is traditionally related to the financial system getting into a recession.

Hovering inflation additionally forged a shadow over the general public funds and enterprise sentiment.

Curiosity prices on authorities debt rose to £7.6bn in Could, up 70 per cent from final yr and better than the £5.1bn forecast by the unbiased fiscal watchdog, following a 40-year excessive tempo in retail value inflation to which many debt funds are linked.

The Workplace for Nationwide Statistics stated the debt curiosity funds have been the third-highest made by the federal government in any single month and the best made in any Could on document.

Inflation will increase authorities borrowing prices as a result of gilts linked to the retail value index make up 25 per cent of UK sovereign debt.

Public sector web borrowing nonetheless declined in Could — however by lower than anticipated — as inflation additionally aided authorities funds by bringing in larger tax revenues.

Borrowing in Could was £14bn, down £4bn from the identical month final yr, in response to ONS knowledge. However Could’s borrowing was larger than the £12bn forecast by economists polled by Reuters and nicely above the £10.3bn anticipated by the Workplace for Price range Accountability watchdog.

The robust labour market and reopening of the financial system boosted authorities earnings too. In Could, authorities receipts rose by £5.7bn, together with a £3.4bn annual enhance in tax receipts.

Samuel Tombs, economist at Pantheon Macroeconomics, famous that authorities receipts undershot the OBR forecasts, notably for consumption tax revenues. This will likely recommend “that the financial system is underperforming the OBR’s expectations”, he stated.

Borrowing for April was additionally revised up. Which means that the general public funds for the present fiscal yr “have gotten off to a disappointing begin”, stated Martin Beck, chief financial adviser to the EY Merchandise Membership.

Chancellor Rishi Sunak stated: “Rising inflation and rising debt curiosity prices pose a problem for the general public funds, as they do for household budgets.”

The upper curiosity funds have been additionally partially offset by the top of most Covid-19 authorities assist schemes.

Michal Stelmach, senior economist at KPMG UK, stated “the tempo of deficit discount is ready to sluggish over the approaching months” on account of the federal government’s £15bn assist package deal introduced final month to assist households with rising vitality payments and due to weaker financial development.

June’s buying managers’ indices added proof of the UK financial system heading to a brand new downturn as inflation weighed on client spending intentions and enterprise expectations.

The interim composite PMI index, a barometer of the change in non-public sector exercise relative to the earlier month, was unchanged from the 15-month low seen within the earlier month at 53.1.

Nonetheless, the forward-looking index of enterprise expectations registered the most important month-to-month decline for the reason that begin of the pandemic. The brand new order index additionally dropped to 50.8 in June from 53.8 in Could, signalling the weakest charge of development in additional than a yr

Chris Williamson, chief enterprise economist at S&P World Market Intelligence, stated “enterprise confidence has now slumped to a degree which has prior to now usually signalled an imminent recession”.