Anna Moneymaker/Getty Images News

Every EV charging station stock going public in the last year via a SPAC has been a disaster. Tritium DCFC Limited (NASDAQ:DCFC) has been no exception with the stock dipping all the way down to $2 with the company unable to generate a gross margin on booming sales. My investment thesis is Neutral on the stock due to the lack of gross margins in a competitive charging station sector offset by Tritium already trading down at $2.

No Margin

The Australian based firm completed their SPAC deal to go public on the Nasdaq back in January. The company faces the same problems as the other EV charging station stocks that have been on the public markets going back to prior years.

Tritium last reported results for the June quarter with the company just reporting annual results. Revenues were only $86 million for FY22 and the gross margin was -0.4%.

The company faced a whole host of problems in the quarter pressuring margins. Tritium had problems getting parts for charging stations, hiring employees for the new Tennessee plant and shipping costs surged while a lot of the contracts were priced 12 months ago when inflation costs weren’t so problematic.

Tritium forecasts a long-term margin in the mid-30% range. The company is more focused on selling the charging station hardware for the fast-charging segment while competitors are generally more focused on other business models built off the charging station, questioning how much the company can charge in the future.

The new Tennessee facility allows Tritium to more than double capacity this year to 11K DCFC unit capacity. The company expects to have annual capacity surge to 35K by the end of 2023.

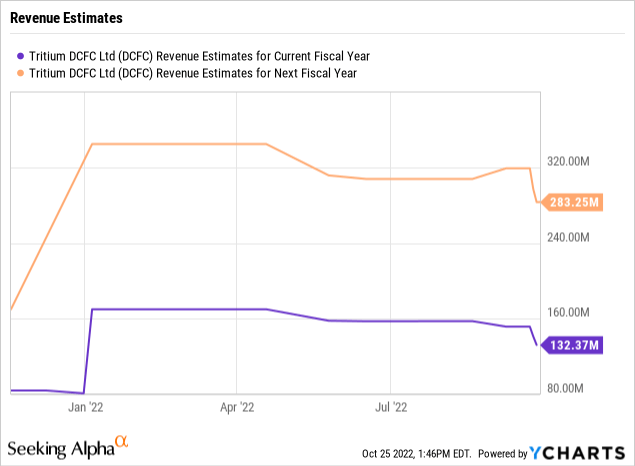

Tritium has a strong customer base with BP ordering 1,000 chargers and Shell having a large contract with the company. The charging station company just started FY23 and analysts forecast revenues reaching $132 million this year and jumping to $283 million next year.

Already Missing Targets

The SPAC deal had forecasted revenues of $359 million in 2023 and a massive $603 million in 2024. Not surprising to see the revenue targets missed, but the big question is where the upside exists for the business.

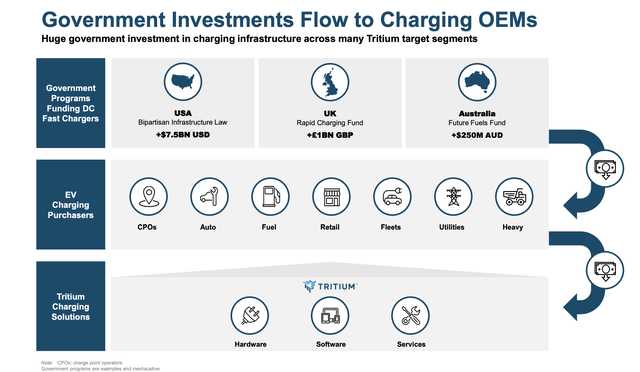

Tritium will see a huge surge in demand for charging stations hardware, but ultimately the hardware demand will peak. The governments around the world are definitely assigning money to build EV charging infrastructure, but one still has to question whether the charging stations actually benefit from tax credits and incentives, or if all of the savings are only passed along to the corporations or government entities buying the charging stations.

Source: Tritium FY22 presentation

The most compelling part of the story is that Tritium isn’t wildly spending on building a massive operation. The company only forecast an operating expense base of $46 million to start this fiscal year.

The DC fast charging station specialist only needs to achieve basic 25% gross margins on $200 million in annual revenues to reach breakeven. The company started the year with a backlog of $149 million after a year with sales orders of $203 million in FY22 ending June 30.

The big question is where the business goes over time without much a focus on services right now. Tritium did generate $4 million in services for the last FY and the company forecasts a release of new products ranging from software to expanded service coverage to grow revenues beyond pure hardware sales.

The company only had a cash balance of $71 million with debt already up at $88 million. The SPAC deal saw massive 35 million shares redeemed leaving Tritium far below the expected net cash raise of $300 million requiring the recent debt and equity facilities to increase the access to capital.

At $2, the stock only has a listed market cap of $360 million. Tritium definitely has the ability for a big rally on any quarterly print where gross margins are tilted toward 20%.

The company has a period of a few years where exceptional growth could lead to a profitable trade. Ultimately though, Tritium is only an EV charging station manufacturer in a competitive space with competitors practically giving away chargers to obtain subscriptions and display digital ads.

Takeaway

The key investor takeaway is that Tritium has been a disaster since going public with a large percentage of shareholders redeeming shares. The stock could see a sizable rally in a period where revenue growth is matched with some solid gross margins. Any meaningful transition to software and services could make for a long-term investment, but for now Tritium doesn’t have the financials or cash to warrant the risk.