Revealed on March twelfth, 2025 by Bob Ciura

The objective of rational traders is to maximize complete return beneath a given set of constraints.

Most traders are searching for outperformance when shopping for shares. Some of the common measures of funding outperformance is alpha.

Put merely, alpha is a monetary metric that compares the efficiency of a given funding, with an appropriate index for that funding.

We created an inventory of 100 excessive alpha shares which have outperformed the S&P 500 Index.

You possibly can obtain a spreadsheet of the 100 excessive alpha shares (together with necessary monetary metrics like price-to-earnings ratios and dividend yields) by clicking on the hyperlink under under:

This text will clarify alpha in better element, illustrate the idea with an instance, and record the highest 10 excessive alpha shares within the Positive Evaluation Analysis Database proper now.

Desk of Contents

You should use the hyperlinks under to immediately leap to a person part of the article:

What Is Alpha?

As beforehand talked about, Alpha compares the efficiency of a given funding, with an appropriate index for that funding.

Usually, the index utilized for comparability is the S&P 500 Index, arguably probably the most well-known inventory market index on this planet.

If a inventory has an alpha worth of 1.0, it means the safety in query outperformed the chosen index by 1% over no matter timeframe is used for comparability.

Against this, a unfavourable alpha means the inventory underperformed the index.

For instance, an alpha of -1 means the inventory underperformed the index by 1% per 12 months over the desired time interval.

Alpha is one in every of a number of efficiency measures which might be generally used to guage an funding safety or portfolio. One other frequent efficiency measure is Beta, which measures a inventory’s volatility in contrast with an index.

Associated: Low Beta Shares Checklist

Alpha and beta are each used to calculate the capital asset pricing mannequin, in any other case often known as CAPM, which calculates the required return of an funding to compensate for the extent of threat concerned.

Anticipated returns are additionally necessary for valuation evaluation. The components for anticipated complete return of a inventory is under:

Anticipated complete return = change in earnings-per-share x change within the price-to-earnings ratio

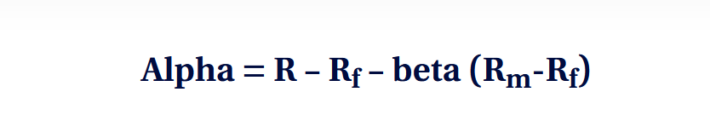

With this, traders can calculate alpha as follows:

The variables are outlined as:

- R = Portfolio return

- Rf = Threat-free charge

- βi = Beta of the funding

- Rm = Anticipated return of market

Moreover, subtracting the danger free charge from the anticipated return of the market is also called the market threat premium.

Our evaluation makes use of a 4.3% threat free charge (present 10-year Treasury charge) and a 5.5% market threat premium.

For instance, assume a portfolio generated a complete return of 20% in a given time interval, with a Beta worth of 1.1. On this situation, alpha could be calculated as follows:

- Alpha = (0.20-0.043) – 1.1(0.055)

=.0965 or 9.65%

Due to this fact, the alpha on this instance could be 9.65%.

The High 10 Excessive Alpha Shares

The next 10 shares have the very best alpha within the Positive Evaluation Analysis Database. Shares are listed by alpha worth, from lowest to highest.

Excessive Alpha Inventory #10: Autoliv Inc. (ALV)

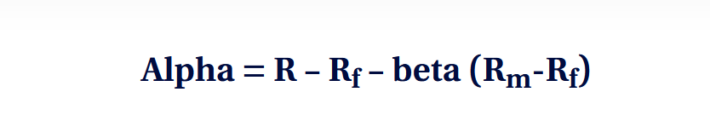

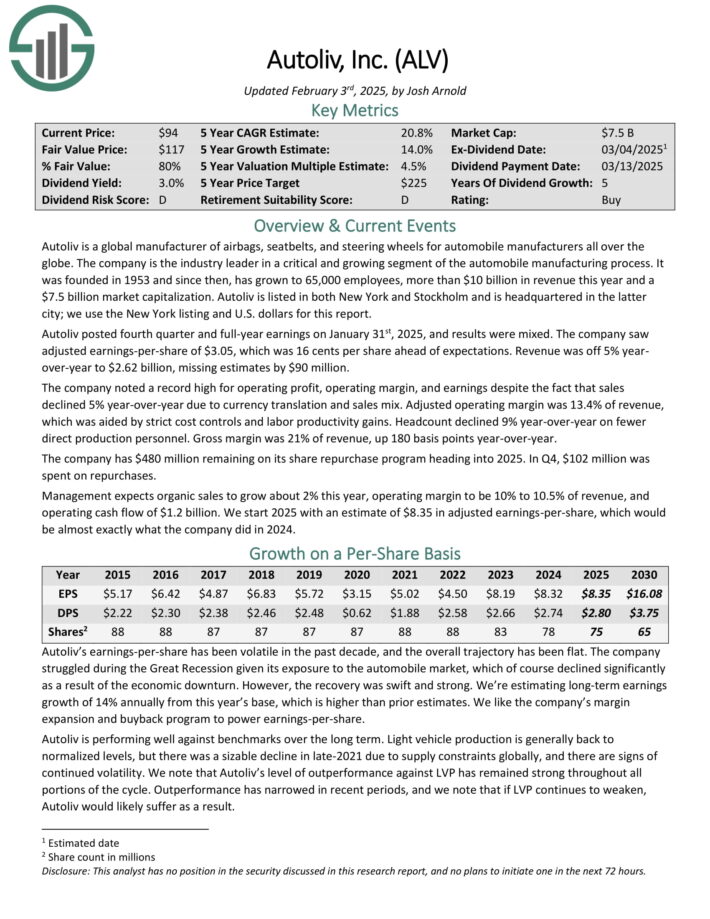

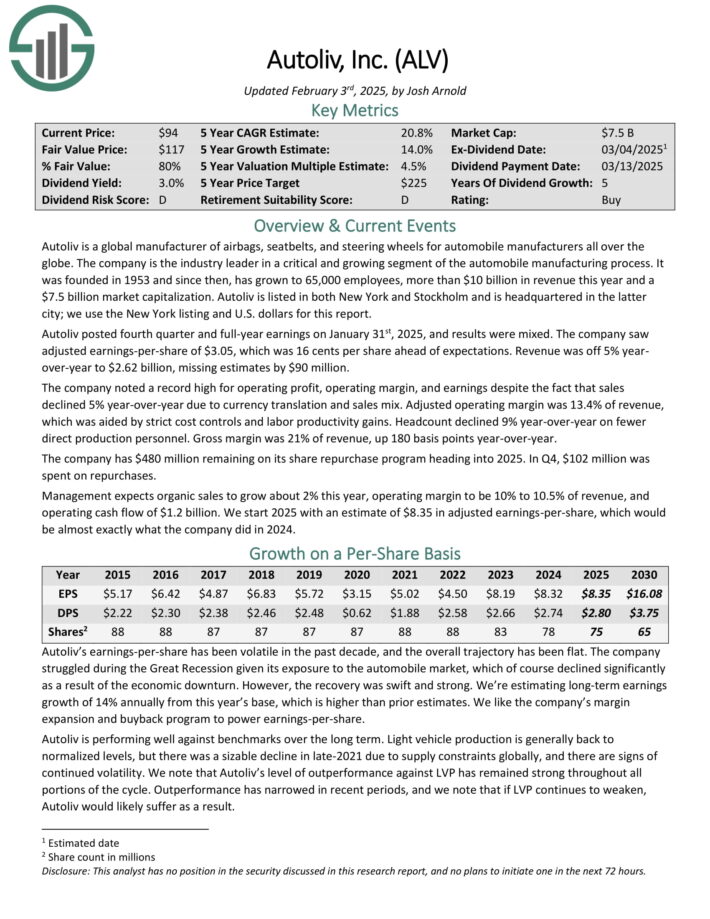

Autoliv is a world producer of airbags, seatbelts, and steering wheels for car producers all around the globe. The corporate is the business chief in a important and rising phase of the auto manufacturing course of.

Autoliv posted fourth quarter and full-year earnings on January thirty first, 2025, and outcomes have been combined. The corporate noticed adjusted earnings-per-share of $3.05, which was 16 cents per share forward of expectations. Income was off 5% year-over-year to $2.62 billion, lacking estimates by $90 million.

The corporate famous a document excessive for working revenue, working margin, and earnings although gross sales declined 5% year-over-year as a result of foreign money translation and gross sales combine.

Adjusted working margin was 13.4% of income, which was aided by strict price controls and labor productiveness positive factors. Headcount declined 9% year-over-year on fewer direct manufacturing personnel. Gross margin was 21% of income, up 180 foundation factors year-over-year.

The corporate has $480 million remaining on its share repurchase program heading into 2025. In This autumn, $102 million was spent on repurchases.

Click on right here to obtain our most up-to-date Positive Evaluation report on ALV (preview of web page 1 of three proven under):

Excessive Alpha Inventory #9: Carters Inc. (CRI)

Carter’s, Inc. is the most important branded retailer of attire solely for infants and younger youngsters in North America. It was based in 1865 by William Carter. The corporate owns the Carter’s and OshKosh B’gosh manufacturers, two of probably the most recognized manufacturers within the youngsters’s attire area.

Carter’s acquired competitor OshKosh B’gosh for $312 million in 2005. Now, these manufacturers are offered in main department shops, nationwide chains, and specialty retailers domestically and internationally.

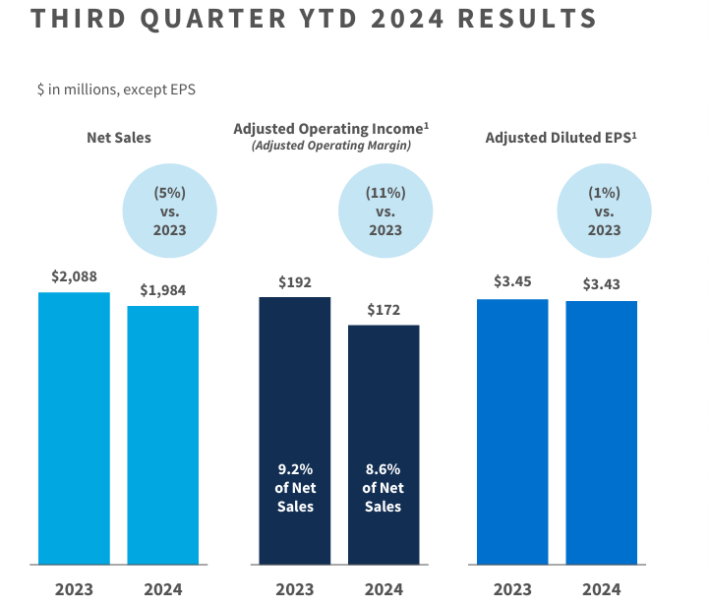

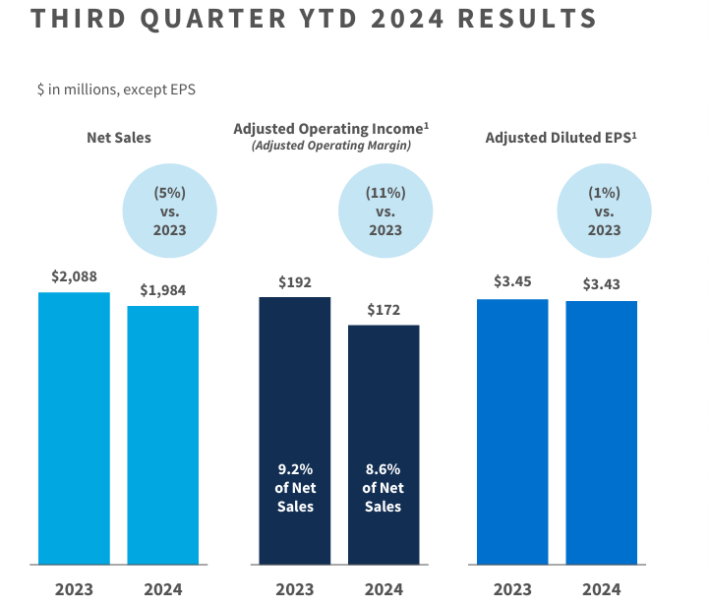

On October twenty sixth, 2024, the corporate reported third-quarter outcomes for Fiscal 12 months (FY)2024. The corporate reported a decline in third-quarter fiscal 2024 outcomes, with web gross sales down 4.2% to $758 million in comparison with the earlier 12 months’s $792 million.

Supply: Investor Presentation

The corporate’s working margin decreased to 10.2% from 11.8%, attributed to increased investments in pricing and advertising and marketing, regardless of a decrease price of products.

Earnings per diluted share (EPS) dropped to $1.62 from $1.78, reflecting softer demand in key segments.

Click on right here to obtain our most up-to-date Positive Evaluation report on CRI (preview of web page 1 of three proven under):

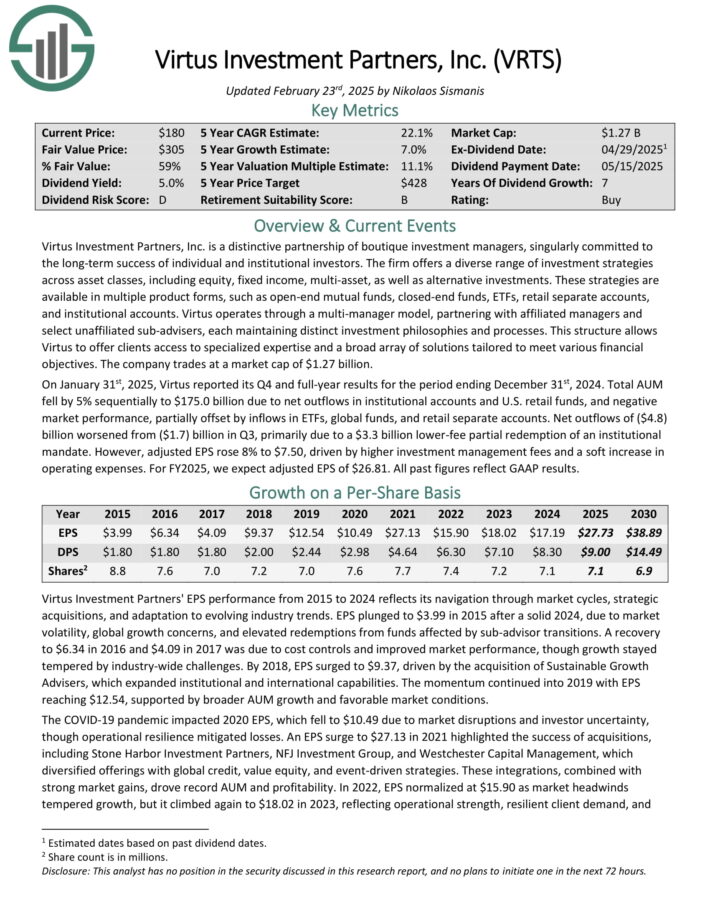

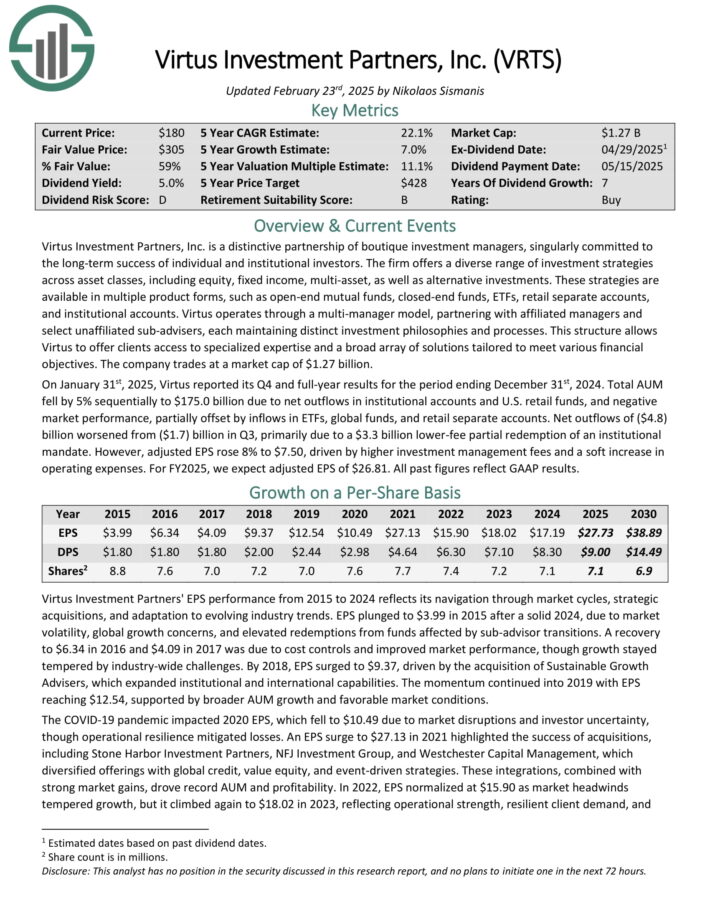

Excessive Alpha Inventory #8: Virtus Funding Companions Inc. (VRTS)

Virtus Funding Companions, Inc. is a particular partnership of boutique funding managers, singularly dedicated to the long-term success of particular person and institutional traders.

The agency affords a various vary of funding methods throughout asset lessons, together with fairness, mounted earnings, multi-asset, in addition to different investments.

These methods can be found in a number of product types, resembling open-end mutual funds, closed-end funds, ETFs, retail separate accounts, and institutional accounts.

Virtus operates by means of a multi-manager mannequin, partnering with affiliated managers and choose unaffiliated sub-advisers, every sustaining distinct funding philosophies and processes.

This construction permits Virtus to supply purchasers entry to specialised experience and a broad array of options tailor-made to fulfill numerous monetary targets.

On January thirty first, 2025, Virtus reported its This autumn and full-year outcomes for the interval ending December thirty first, 2024. Whole AUM fell by 5% sequentially to $175.0 billion as a result of web outflows in institutional accounts and U.S. retail funds, and unfavourable market efficiency, partially offset by inflows in ETFs, world funds, and retail separate accounts.

Web outflows of ($4.8) billion worsened from ($1.7) billion in Q3, primarily as a result of a $3.3 billion lower-fee partial redemption of an institutional mandate.

Nonetheless, adjusted EPS rose 8% to $7.50, pushed by increased funding administration charges and a smooth improve in working bills. For FY2025, we anticipate adjusted EPS of $26.81.

Click on right here to obtain our most up-to-date Positive Evaluation report on VRTS (preview of web page 1 of three proven under):

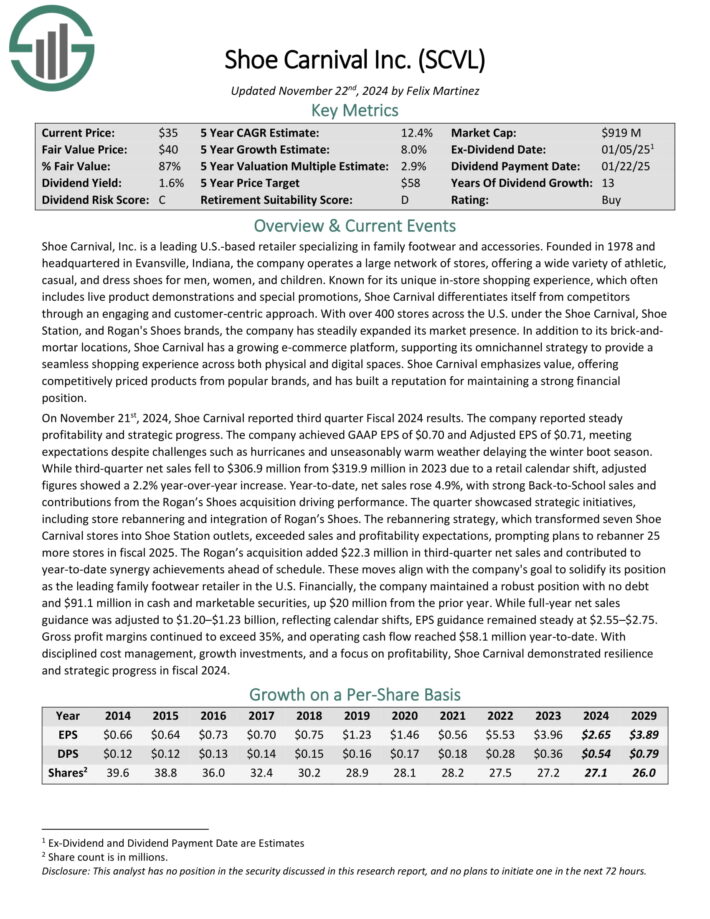

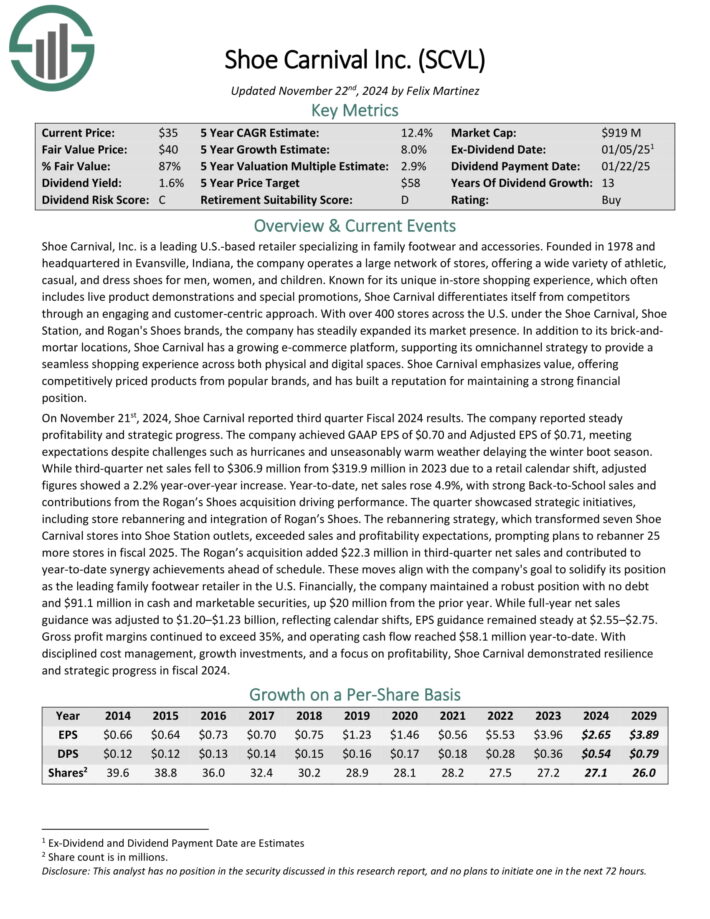

Excessive Alpha Inventory #7: Shoe Carnival Inc. (SCVL)

Shoe Carnival, Inc. is a number one U.S.-based retailer specializing in household footwear and equipment. The corporate operates a big community of shops, providing all kinds of athletic, informal, and gown footwear for males, girls, and kids.

With over 400 shops throughout the U.S. beneath the Shoe Carnival, Shoe Station, and Rogan’s Sneakers manufacturers, the corporate has steadily expanded its market presence.

Along with its brick-and mortar places, Shoe Carnival has a rising e-commerce platform, supporting its omnichannel technique.

On November twenty first, 2024, Shoe Carnival reported third quarter Fiscal 2024 outcomes. The corporate reported GAAP EPS of $0.70 and Adjusted EPS of $0.71, assembly expectations.

Whereas third-quarter web gross sales fell to $306.9 million from $319.9 million in 2023 as a result of a retail calendar shift, adjusted figures confirmed a 2.2% year-over-year improve.

12 months-to-date, web gross sales rose 4.9%, with robust Again-to-Faculty gross sales and contributions from the Rogan’s Sneakers acquisition driving efficiency.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCVL (preview of web page 1 of three proven under):

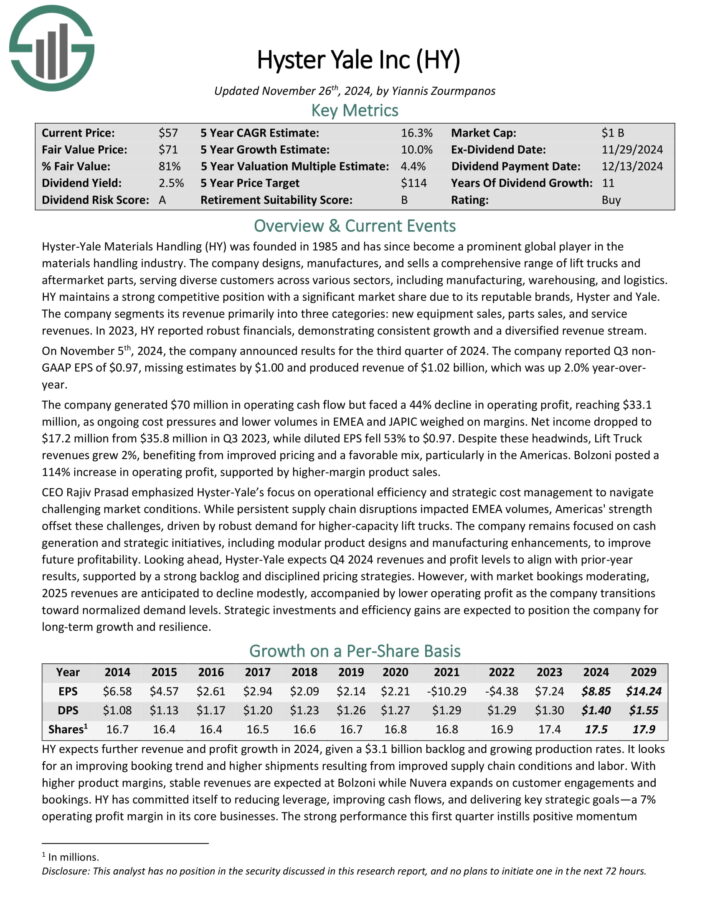

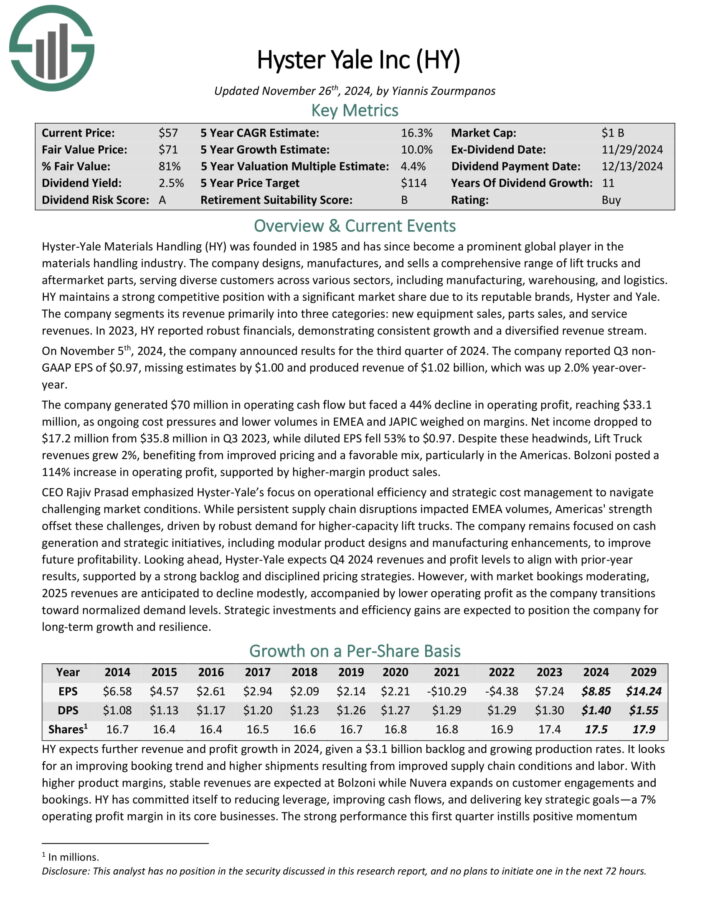

Excessive Alpha Inventory #6: Hyster Yale Inc. (HY)

Hyster-Yale Supplies Dealing with operates within the supplies dealing with business. The corporate designs, manufactures, and sells a complete vary of carry vans and aftermarket components, serving numerous clients throughout numerous sectors, together with manufacturing, warehousing, and logistics.

HY maintains a powerful aggressive place with a major market share as a result of its respected manufacturers, Hyster and Yale. The corporate segments its income primarily into three classes: new gear gross sales, components gross sales, and repair revenues. In 2023, HY reported sturdy financials, demonstrating constant progress and a diversified income stream.

On November fifth, 2024, the corporate introduced outcomes for the third quarter of 2024. The corporate reported Q3 non GAAP EPS of $0.97, lacking estimates by $1.00 and produced income of $1.02 billion, which was up 2.0% year-over 12 months.

The corporate generated $70 million in working money circulation however confronted a 44% decline in working revenue, reaching $33.1 million, as ongoing price pressures and decrease volumes in EMEA and JAPIC weighed on margins. Web earnings dropped to $17.2 million from $35.8 million in Q3 2023, whereas diluted EPS fell 53% to $0.97.

Click on right here to obtain our most up-to-date Positive Evaluation report on HY (preview of web page 1 of three proven under):

Excessive Alpha Inventory #5: ASML Holding NV (ASML)

ASML Holding is among the largest producers of chip-making gear on this planet. The corporate’s clients embrace all kinds of industries, and ASML is current in 16 nations with about 31,000 workers.

ASML has a present market capitalization of ~$275 billion and produces greater than $30 billion in annual income.

ASML posted fourth quarter and full-year outcomes on January twenty ninth, 2025, and outcomes have been robust as soon as once more. The corporate famous income was 28% increased year-on-year to $9.6 billion, and beat estimates by greater than $200 million.

Earnings-per-share got here to $7.10, which beat estimates by 12 cents. Quarterly web reserving have been $7.4 billion, of which $3.1 billion was EUV.

China accounted for complete web system gross sales of 27%, whereas the US was nonetheless the most important phase at 28%. It’s unclear as of but how export controls might play a component on this going ahead.

For this 12 months, steering was initiated with a really big selection of ~$31 billion to ~$36 billion in gross sales, with gross margins anticipated to be 51% to 53% of income. Q1 gross margins are anticipated to be 52% to 53%, implying the opportunity of deterioration for the remaining three quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on ASML (preview of web page 1 of three proven under):

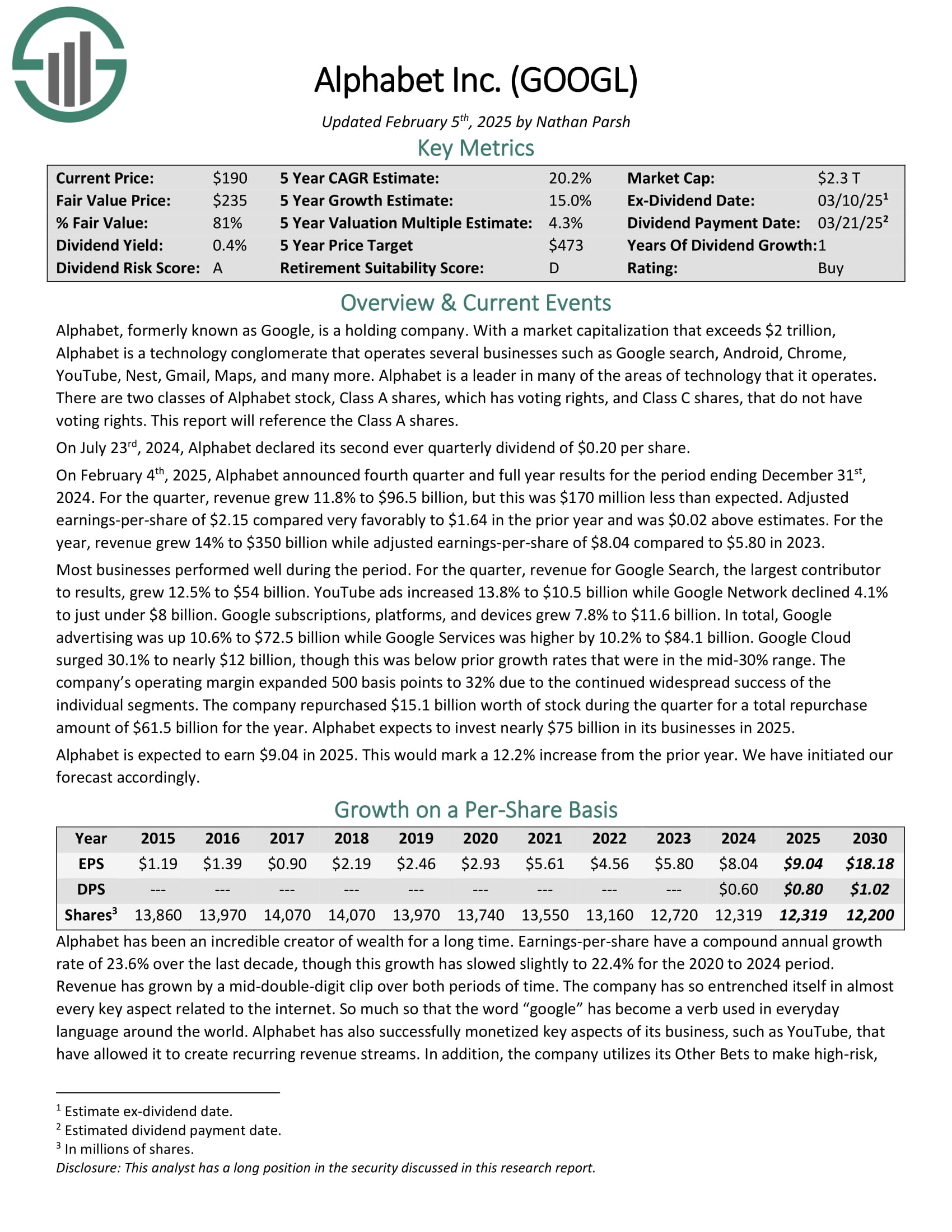

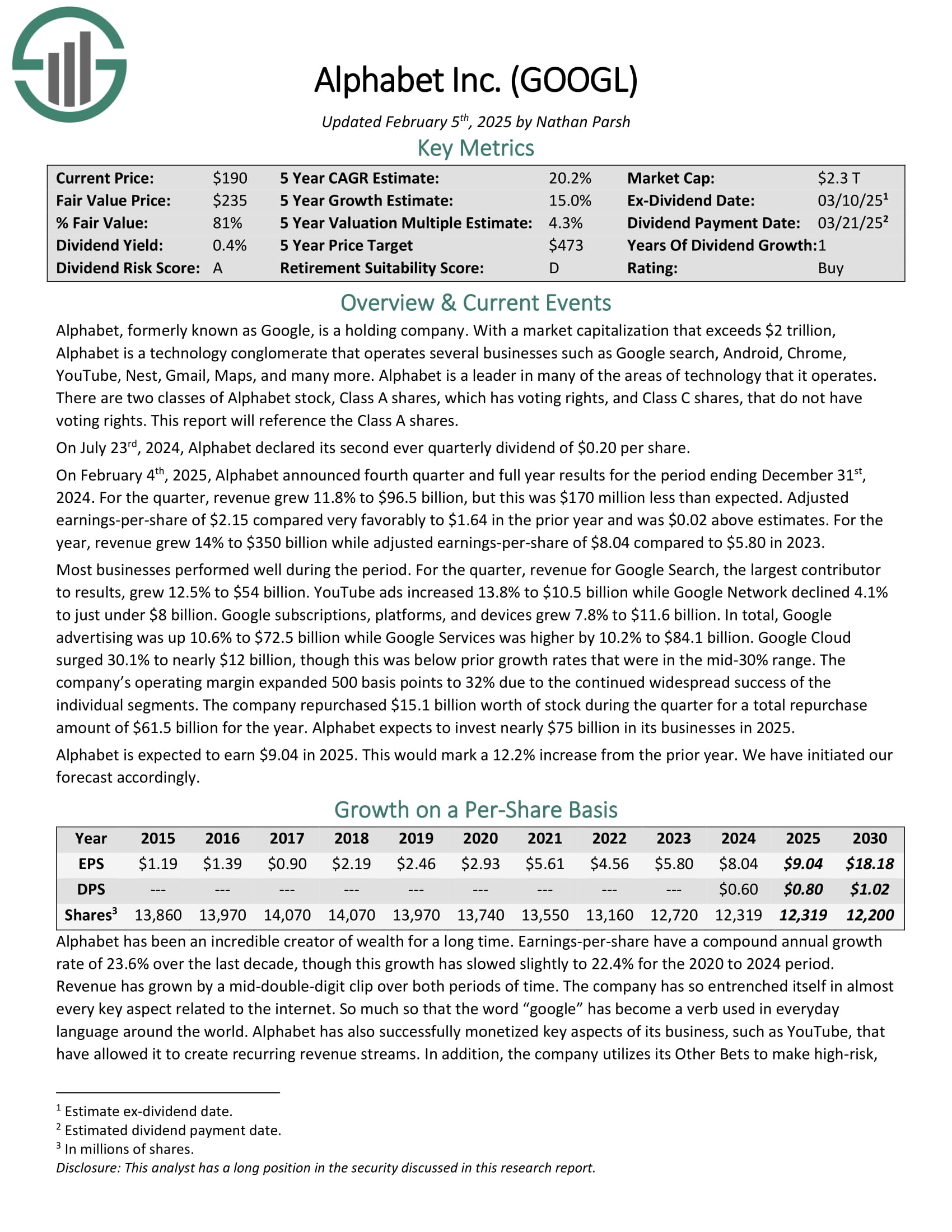

Excessive Alpha Inventory #4: Alphabet Inc. (GOOG)(GOOGL)

Alphabet is a expertise conglomerate that operates a number of companies resembling Google search, Android, Chrome, YouTube, Nest, Gmail, Maps, and plenty of extra. Alphabet is a pacesetter in lots of the areas of expertise that it operates.

On February 4th, 2025, Alphabet introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024. For the quarter, income grew 11.8% to $96.5 billion, however this was $170 million lower than anticipated.

Adjusted earnings-per-share of $2.15 in contrast very favorably to $1.64 within the prior 12 months and was $0.02 above estimates. For the 12 months, income grew 14% to $350 billion whereas adjusted earnings-per-share of $8.04 in comparison with $5.80 in 2023.

Most companies carried out properly in the course of the interval. For the quarter, income for Google Search, the most important contributor to outcomes, grew 12.5% to $54 billion. YouTube adverts elevated 13.8% to $10.5 billion whereas Google Community declined 4.1% to only beneath $8 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on GOOGL (preview of web page 1 of three proven under):

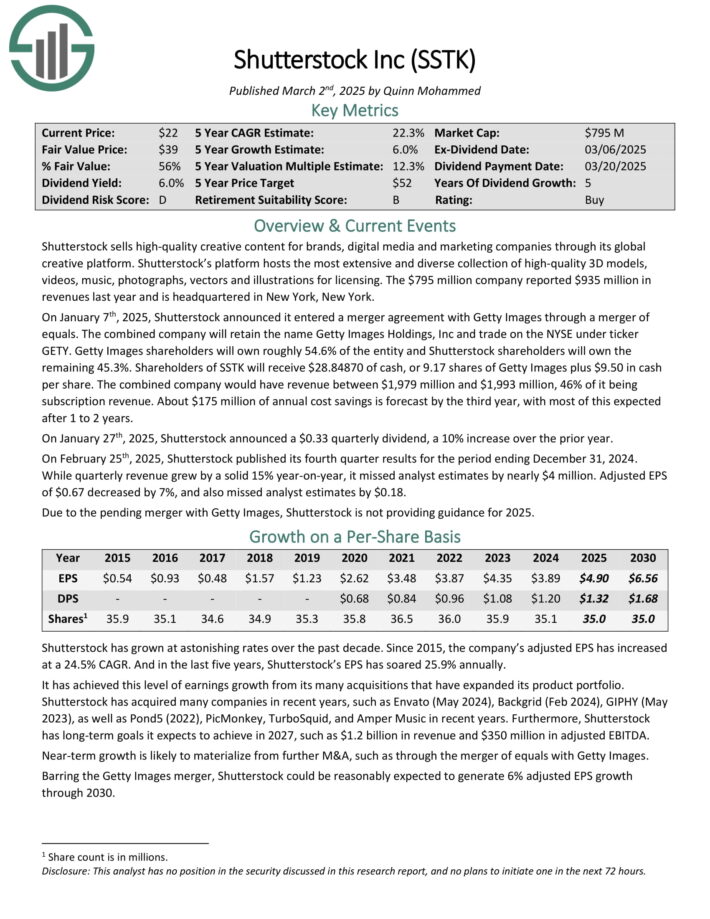

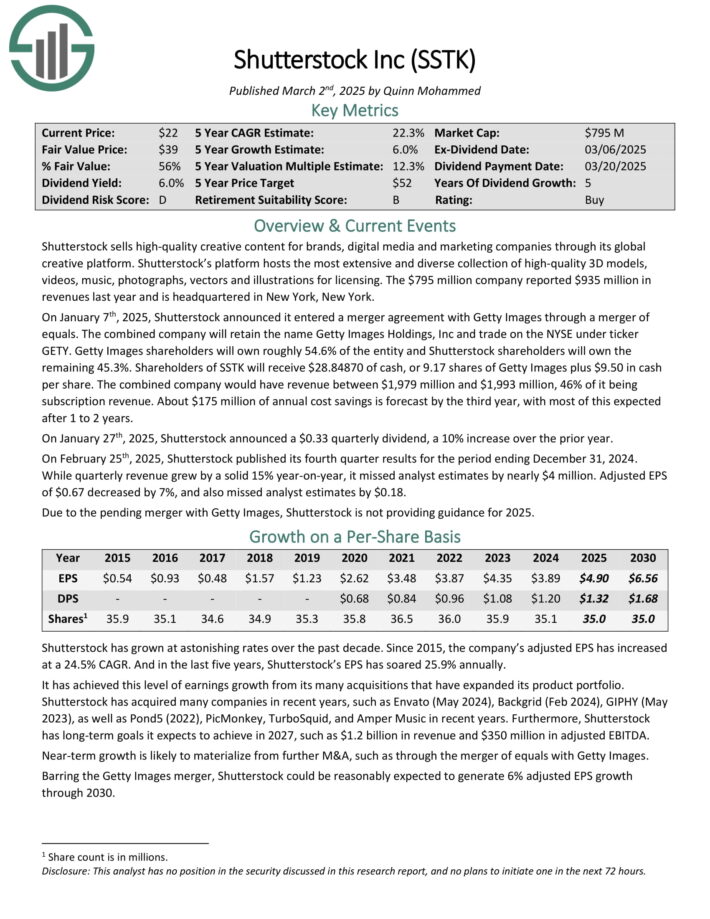

Excessive Alpha Inventory #3: Shutterstock, Inc. (SSTK)

Shutterstock sells high-quality inventive content material for manufacturers, digital media and advertising and marketing corporations by means of its world inventive platform.

Its platform hosts probably the most intensive and numerous assortment of high-quality 3D fashions, movies, music, pictures, vectors and illustrations for licensing. The corporate reported $935 million in revenues final 12 months.

On January seventh, 2025, Shutterstock introduced it entered a merger settlement with Getty Photos by means of a merger of equals. The mixed firm will retain the title Getty Photos Holdings, Inc and commerce on the NYSE beneath ticker GETY.

Getty Photos shareholders will personal roughly 54.6% of the entity and Shutterstock shareholders will personal the remaining 45.3%. Shareholders of SSTK will obtain $28.84870 of money, or 9.17 shares of Getty Photos plus $9.50 in money per share.

The mixed firm would have income between $1,979 million and $1,993 million, 46% of it being subscription income. About $175 million of annual price financial savings is forecast by the third 12 months, with most of this anticipated after 1 to 2 years.

On January twenty seventh, 2025, Shutterstock introduced a $0.33 quarterly dividend, a ten% improve over the prior 12 months.

On February twenty fifth, 2025, Shutterstock printed its fourth quarter outcomes for the interval ending December 31, 2024. Whereas quarterly income grew by a stable 15% year-on-year, it missed analyst estimates by practically $4 million.

Adjusted EPS of $0.67 decreased by 7%, and likewise missed analyst estimates by $0.18.

Click on right here to obtain our most up-to-date Positive Evaluation report on SSTK (preview of web page 1 of three proven under):

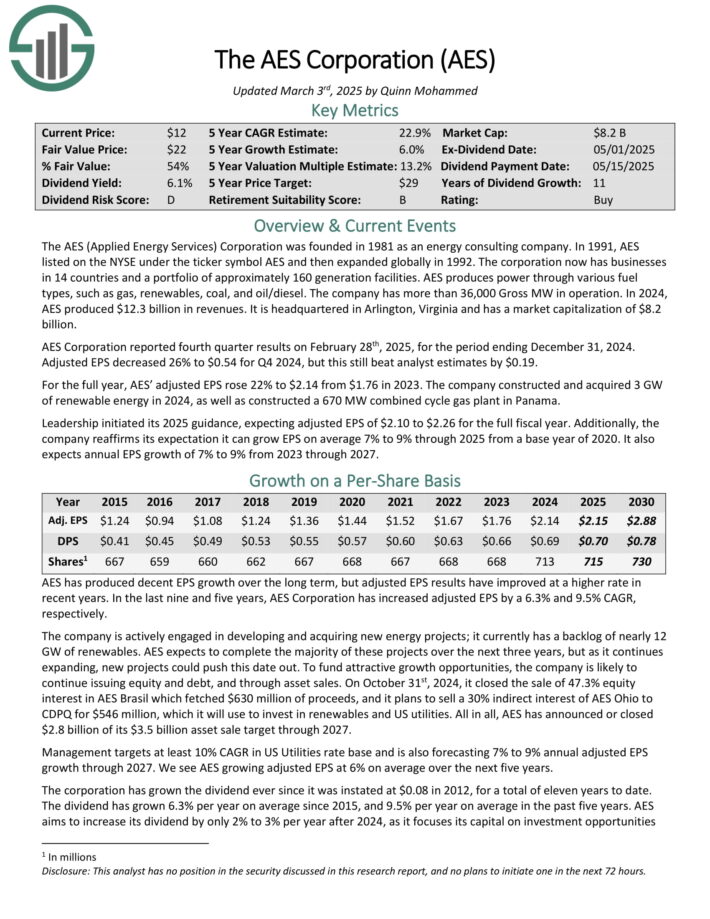

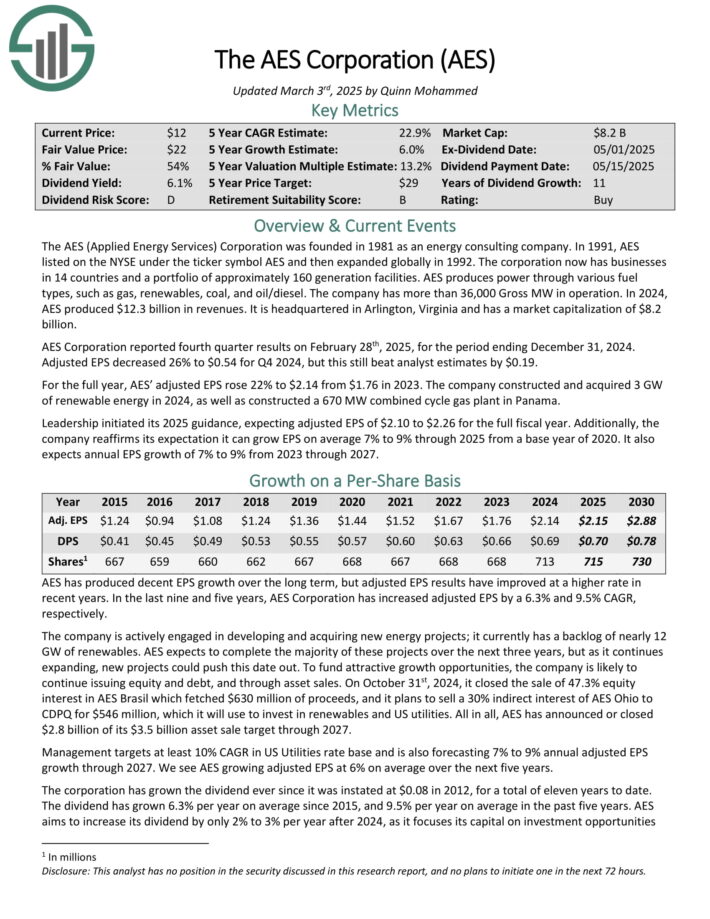

Excessive Alpha Inventory #2: AES Corp. (AES)

The AES (Utilized Vitality Providers) Company was based in 1981 as an vitality consulting firm. The company now has companies in 14 nations and a portfolio of roughly 160 era services.

AES produces energy by means of numerous gas varieties, resembling fuel, renewables, coal, and oil/diesel. The corporate has greater than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported fourth quarter outcomes on February twenty eighth, 2025, for the interval ending December 31, 2024. Adjusted EPS decreased 26% to $0.54 for This autumn 2024, however this nonetheless beat analyst estimates by $0.19.

For the complete 12 months, AES’ adjusted EPS rose 22% to $2.14 from $1.76 in 2023. The corporate constructed and bought 3 GW of renewable vitality in 2024, in addition to constructed a 670 MW mixed cycle fuel plant in Panama.

Management initiated its 2025 steering, anticipating adjusted EPS of $2.10 to $2.26 for the complete fiscal 12 months. Moreover, the corporate reaffirms its expectation it could develop EPS on common 7% to 9% by means of 2025 from a base 12 months of 2020. It additionally expects annual EPS progress of seven% to 9% from 2023 by means of 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven under):

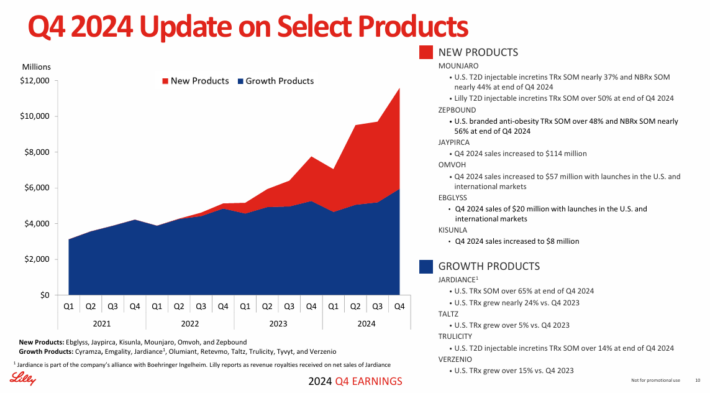

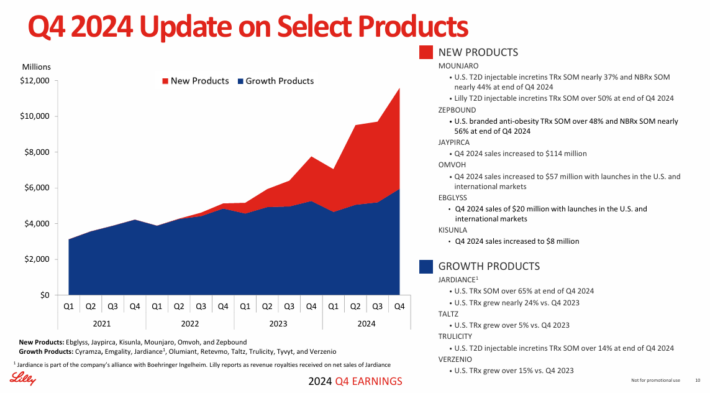

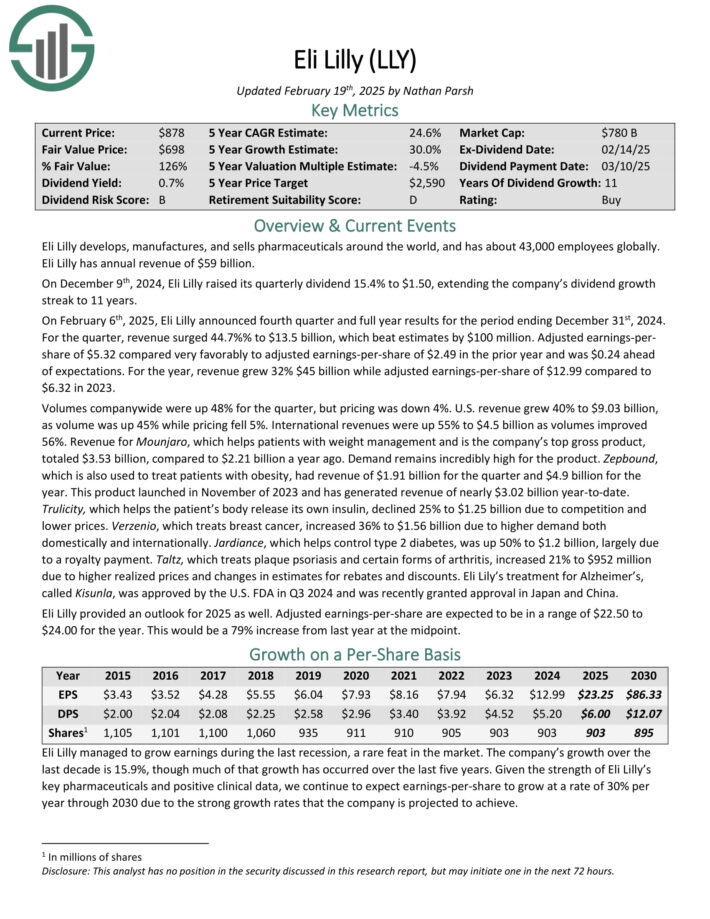

Excessive Alpha Inventory #1: Eli Lilly & Co. (LLY)

Eli Lilly develops, manufactures, and sells prescribed drugs all over the world, and has about 43,000 workers globally. Eli Lilly has annual income of $59 billion.

On December ninth, 2024, Eli Lilly raised its quarterly dividend 15.4% to $1.50, extending the corporate’s dividend progress streak to 11 years.

On February sixth, 2025, Eli Lilly introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024. For the quarter, income surged 44.7%% to $13.5 billion, which beat estimates by $100 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $5.32 in contrast very favorably to adjusted earnings-per-share of $2.49 within the prior 12 months and was $0.24 forward of expectations.

For the 12 months, income grew 32% $45 billion whereas adjusted earnings-per-share of $12.99 in comparison with $6.32 in 2023. Volumes company-wide have been up 48% for the quarter, however pricing was down 4%.

U.S. income grew 40% to $9.03 billion, as quantity was up 45% whereas pricing fell 5%. Worldwide revenues have been up 55% to $4.5 billion as volumes improved 56%.

Income for Mounjaro, which helps sufferers with weight administration and is the corporate’s prime gross product, totaled $3.53 billion, in comparison with $2.21 billion a 12 months in the past.

Demand stays extremely excessive for the product. Zepbound, which can be used to deal with sufferers with weight problems, had income of $1.91 billion for the quarter and $4.9 billion for the 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on LLY (preview of web page 1 of three proven under):

Additional Studying

In case you are concerned with discovering high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].