Olivier Le Moal

When Does The Trade Desk Report Earnings?

The Trade Desk (NASDAQ:TTD) will report Q2 2023 earnings on Wednesday, Aug. 9, after the market close.

In this article, we’ll look forward to those earnings: What to expect and pay attention to?

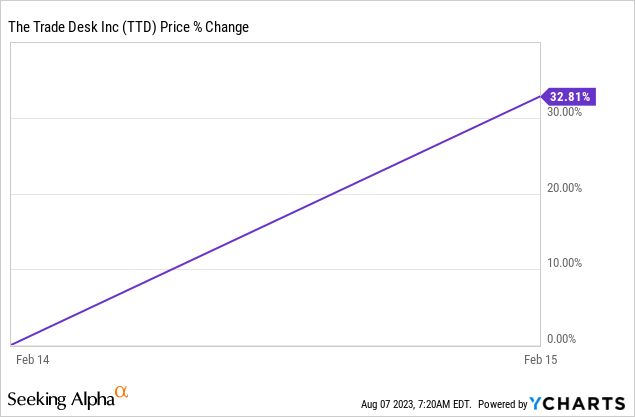

But before that, I want to show you how TTD’s stock did after some previous earnings releases. This is the reaction to the Q4 and FY 2022 results, for example.

As you can see, the stock was up almost a third of its market cap on a single day.

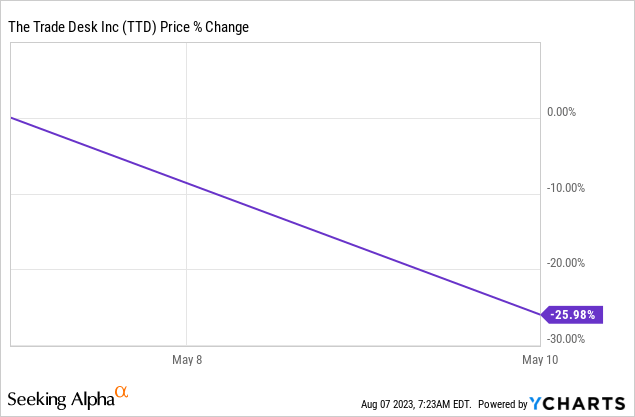

After Q1 2023, the market reaction was moderate, but it’s not the first time The Trade Desk had a big move after earnings. After the company announced its Q1 2021 earnings, the stock dropped by 25%.

I wrote an article back then that this was a great opportunity to get into the stock or to add to your position. The stock is up 55% since then, compared to 7% for the S&P 500.

This also means another big stock price move is always possible after The Trade Desk has announced its earnings. Forewarned is forearmed, right?

What To Expect From The Trade Desk’s Q2 Earnings?

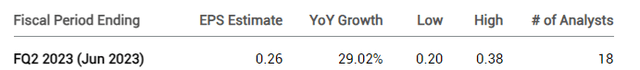

If we look at the expectations, this is the consensus we see for (non-GAAP) earnings per share, based on the estimates of 18 analysts.

Seeking Alpha Premium

As you can see, the consensus is $0.26 but there is a big variation between the estimates, going from $0.20 to $0.38.

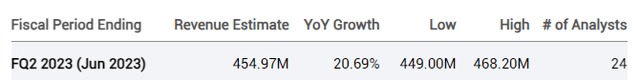

If we look at revenue, 24 analysts tried to predict The Trade Desk’s Q2 revenue. The consensus stands at $455 million, representing 20.7% growth year-over-year.

Seeking Alpha Premium

Here, the range of the estimates is narrow, at just a $19.2 million difference between the highest and the lowest guesses. That represents a 4.2% difference from the consensus.

Is The Trade Desk Expected To Beat Q2 Earnings Estimates?

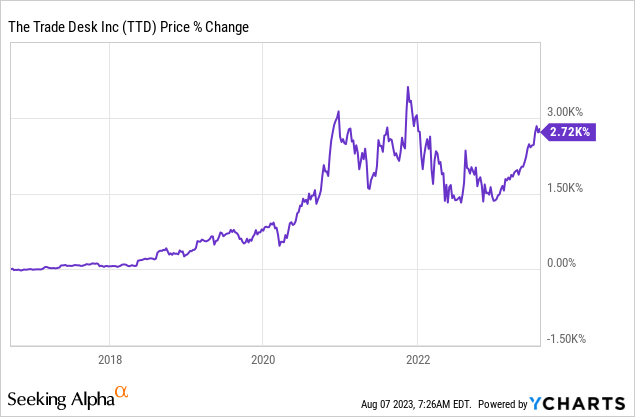

The Trade Desk is an outstanding performer and you can see that in the stock price performance since the IPO in 2016:

If you invested in the IPO of The Trade Desk, you would be up 2,720%. Of course, you can also see the big volatility of the stock, which is typical for high-growth stocks.

One of the reasons is the company’s great track record on earnings. In 2019, I wrote an article stating that The Trade Desk ridicules the Wall Street Shuffle. I quote from that article to explain what I mean:

We all know the game of Wall Street and often companies and analysts set low barriers to allow companies to beat the expectations. So often EPS are beaten by $0.01 or $0.02. Privately I call this the Wall Street Shuffle, after the 10CC hit of 1974.

But by always beating the consensus, sometimes by huge margins, The Trade Desk ridicules this game a bit. Some analysts also don’t like that the company doesn’t give a range for guidance but an “at least” formula.

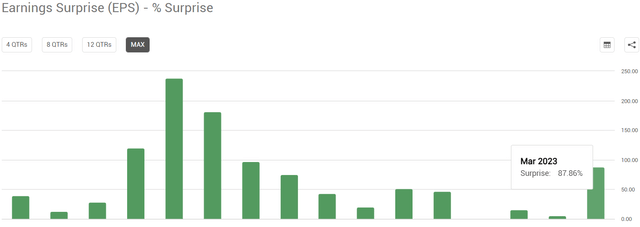

Seeking Alpha Premium

I made sure that the EPS beat in the last quarter can be seen. With 88%, it was an impressive one but if you look at The Trade Desk’s earnings beats, it’s not even in the top three of the last four years.

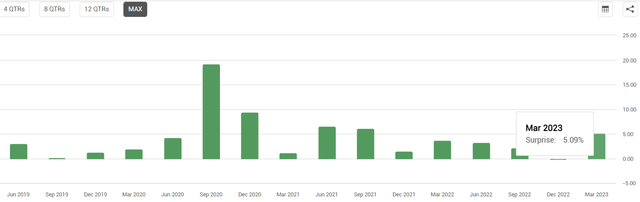

Revenue beats are, of course, never that big from a percentage point of view. But here, too, The Trade Desk has an outstanding track record.

Seeking Alpha Premium

As you can see, the earnings surprise for The Trade Desk in the previous quarter was 5%. Just like for the earnings, the company has a great track record of beating revenue estimates.

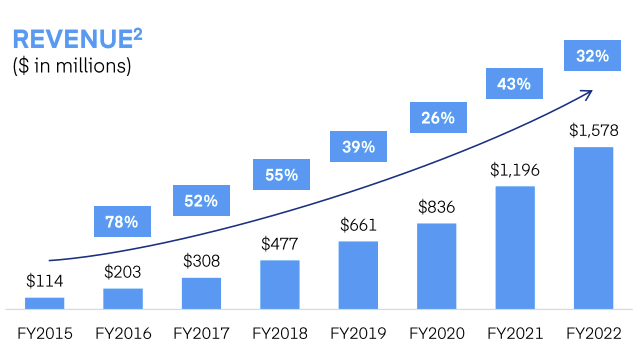

If you look at revenue growth since 2015, you see an impressive track record, not just because of the magnitude of the revenue growth, but also because of the consistency.

The Trade Desk’s Q1 2023 earnings presentation

This track record means there is a big chance The Trade Desk beats again on both EPS and revenue. We’ll have to wait to know by how much, of course, and the stock price reaction can also depend on this. A small beat may be perceived as negative, considering the stock price return The Trade Desk has seen this year. More about that later in this article.

What is the long-term outlook for Trade Desk?

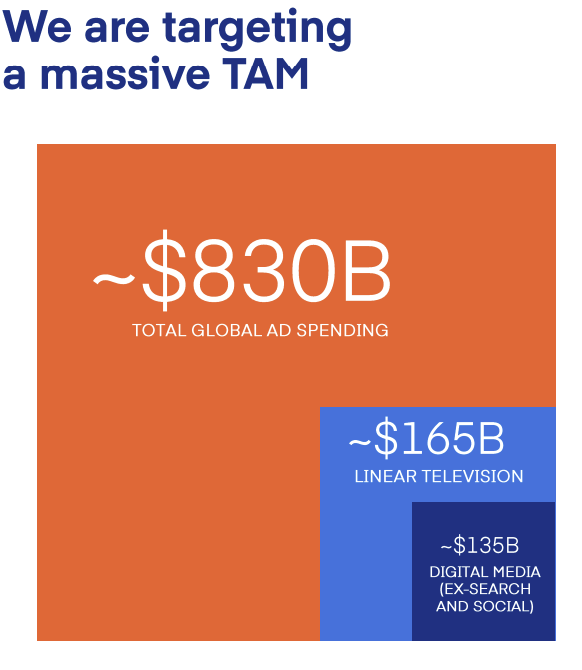

The Trade Desk operates in a huge total addressable market.

The Trade Desk, Q1 2023 earnings presentation

Two fundamental shifts are going on in the ad market, both of which favor The Trade Desk.

The first is the shift from impressions to value. As advertisers can access more data for their campaigns across multiple channels, they will start prioritizing value over just the price. While they will still consider the cost of buying ad space, they will focus more on whether the ads delivered the desired outcome for the price paid. The Trade Desk’s founder and CEO Jeff Green even goes as far as calling this correcting a historical mistake. Impressions should never have been a measuring stick; conversion should have and should be.

Until now, inventory was low in CTV, because most streaming was subscription based. Think of Netflix (NFLX). That meant high CPIs (cost per mille, so how much 1,000 impressions cost an advertiser). With Netflix and other streamers adding an ad-based model, the low inventory can no longer be based on scarcity. That’s why content creators are more willing to add measurability.

That enhances brand value, and therefore CPIs don’t have to drop. With the additional value, brands are happy to pay these higher CPIs because more targeted ads and more flexibility in terms of spending give them a better return on investment.

We let Jeff Green explain the second shift in his own words from the Q4 2022 earnings call. The second shift is a consequence of the first one:

in the pursuit of value, advertisers decisioning will shift from inventory to audience. Instead of focusing on buying a certain show or a certain piece of inventory, advertisers will put much more priority on audience precision regardless of channel, because data enables them to do that. This is especially important as the industry moves from a once-a-year upfront to an always-on forward market.

The words “regardless of the channel” are essential because The Trade Desk can offer any channel an advertiser wants.

During the same Q4 earnings call, Green made a prediction, which he does on a regular basis:

I also predict that more walled gardens will begin to take down some of their barriers. They will see that incremental demand and higher CPMs that companies like The Trade Desk can generate with a focus on advertiser goals, data and the open Internet.

In the Q&A section, Green even went further and predicted that change would already show up in 2023.

I do believe you will see announcements in 2023 suggesting more and more walls coming down.

Like many times before, Green proved to be an accurate predictor again. Roku (ROKU), which also used the walled garden model to a large extent, has already started working with third-party DSPs, like The Trade Desk. On its Q2 earnings call, Roku’s management said it is “ramping up our work with third-party DSPs to capture incremental demand while not reducing existing revenue streams.”

But this is just the start, according to Green. From the Q1 2023 earnings call:

I do not believe the walled garden strategy is a good long-term strategy for anyone. That includes even the biggest, the Googles and Facebooks and Baidus, Alibabas and Tencents of the world. But it’s especially bad for the smaller walled gardens.

This means the long-term potential for The Trade Desk is still huge, if Jeff Green is right. Having followed him for years, I haven’t seen any instance in which he predicted something that was not proven to be correct.

The Netflix Lesson

The power of The Trade Desk can be seen from the path that Netflix followed. The company signed an exclusive deal with Microsoft (MSFT) for its ad inventory from the ad-powered tier. In the Q1 2023 earnings call, this is what Jeff Green said (my bold):

As we’ve discussed previously, biddable marketplaces are inevitable for media companies to maximize demand and compete in the CTV content arms race. This only becomes more true as the streaming wars intensify each year. By the way, this also makes integration with The Trade Desk somewhat inevitable for all major streaming platforms as they scale because they need as much demand as possible to their platforms.

I shared with others that this was meant as a message for Netflix. And what happened? Netflix renegotiated its deal with Microsoft to be allowed to also work with other partners, such as The Trade Desk. Netflix had trouble filling the ad slots. It could keep more of the advertising revenue from Microsoft, but the volume and probably the quality was just much lower.

At the same time, Netflix said that its ad-tier subscribers already were more valuable than their subscription-based tiers. Valuable can mean several things, but Netflix meant it dollar-based. This is another testament to how powerful advertisement-based models are, even if they are more cyclical. Some of the biggest juggernauts like Alphabet (GOOGL) (GOOG) and Meta (META) were built on this model. Amazon (AMZN) and Apple (AAPL) have also discovered the high margins of ads more and more recently.

Is The Trade Desk A Buy, Sell Or Hold Now?

I think the previous part of this article makes it clear that I’m still very bullish on the long-term potential of The Trade Desk as an investment. I picked the stock at $19.5 in May of 2019 and it’s one of my top positions. I also intend to hold the stock for much longer, probably another 15 to 20 years, as that is my investing horizon. From that perspective, I think The Trade Desk is still a clear buy.

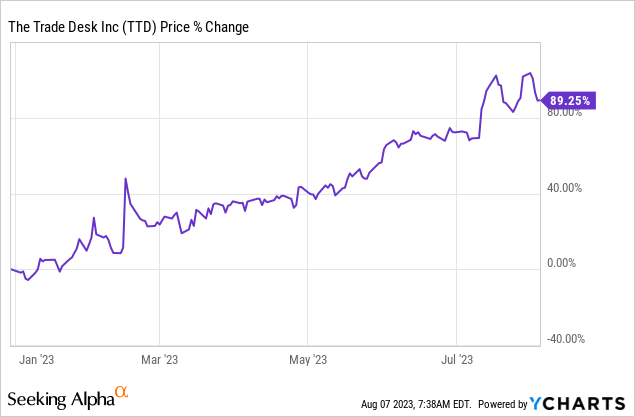

At the same time, I haven’t added to my position in the last few months, even though I invest money into the stock market every two weeks. The Stock is up 90% this year.

That means that anything but fantastic earnings could mean a substantial drop in the stock price.

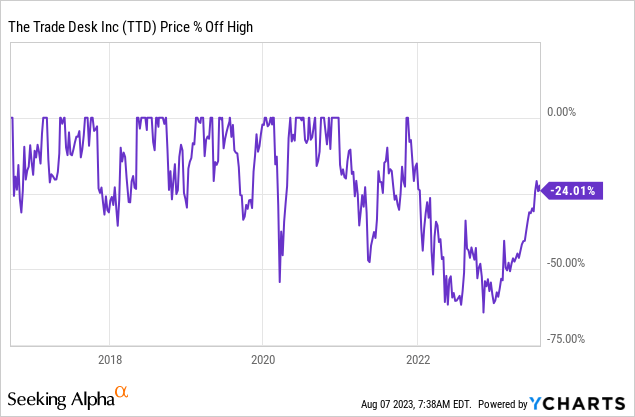

Unlike many other growth stocks, The Trade Desk is not down 50% or more from its all-time highs, but it still trades a quarter under its 2021 peak.

One of the great benefits of investing for the long term is that I can’t lose with The Trade Desk. If the stock jumps on earnings, my investment becomes worth more. If it drops, I will be happy that I can add to my position at a lower price than the current one.

But for interested potential buyers sensitive to price fluctuations, I would encourage them to exercise some patience until the stock price drops a bit or maybe only start a tiny position to monitor the stock price.

In the meantime, keep growing!