[ad_1]

Revealed on April sixth, 2020 by Bob Ciura

The rise in inflation, the continuing battle between Russia and Ukraine, and the Federal Reserve’s plan to lift rates of interest, are all potential headwinds for the financial system. Because of this, it’s doable that the U.S. financial system might enter a recession in 2022.

With this in thoughts, risk-averse buyers may need to take into account positioning their portfolios in anticipation of a possible recession. A method to do that could be to purchase high-quality dividend progress shares. We imagine blue-chip shares which have market-beating dividend yields, and the power to lift their dividends every year, can outperform in a recession.

You possibly can obtain the entire checklist of all 350+ blue-chip shares (plus vital monetary metrics akin to dividend yield, P/E ratios, and payout ratios) by clicking under:

Along with the Excel spreadsheet above, this text covers our prime 20 recession-proof blue-chip inventory buys right this moment as ranked utilizing anticipated whole returns from the Certain Evaluation Analysis Database.

The next checklist represents 20 recession-proof dividend shares, ranked so as of anticipated annual returns over the subsequent 5 years.

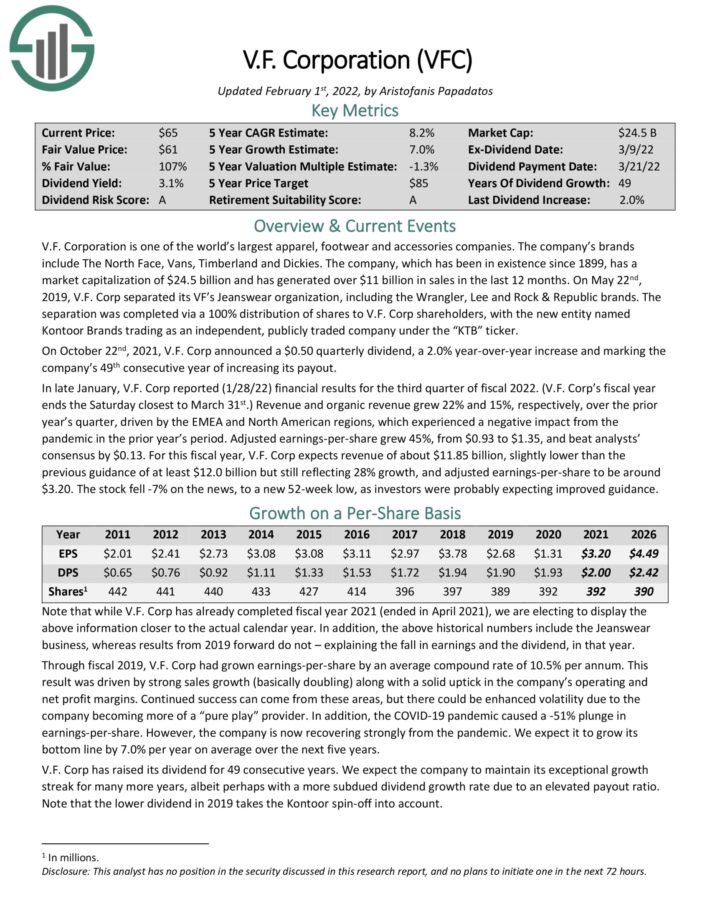

Recession-Proof Revenue Inventory #20: V.F. Corp (VFC)

- 5-year anticipated annual returns: 11.3%

V.F. Company is among the world’s largest attire, footwear and equipment corporations. The corporate’s manufacturers embrace The North Face, Vans, Timberland and Dickies. The corporate, which has been in existence since 1899, generated over $11 billion in gross sales within the final 12 months.

Supply: Investor Presentation

V.F. Corp has a aggressive benefit in the way in which of a steady of well-known, premium manufacturers that provide pricing energy. Over the past recession the corporate posted earnings-per-share of $1.39, $1.29 and $1.61 within the 2008 by means of 2010 stretch, indicating the resiliency of the enterprise. Additionally, of be aware is the corporate’s storied dividend document. The corporate has elevated its dividend for 49 years in a row, qualifying it as a Dividend Aristocrat.

Whole returns are estimated at 11.3%, because of the 3.6% dividend yield, 7% annual EPS progress, and a small increase from a rising P/E ratio.

Click on right here to obtain our most up-to-date Certain Evaluation report on V.F. Corp. (preview of web page 1 of three proven under):

Recession-Proof Revenue Inventory #19: Qualcomm Inc. (QCOM)

- 5-year anticipated annual returns: 12.0%

Qualcomm, as it’s recognized right this moment, develops and sells built-in circuits to be used in voice and knowledge communications. The chip maker receives royalty funds for its patents utilized in gadgets which might be on 3G and 4G networks.

Qualcomm reported earnings outcomes for the primary quarter of fiscal 12 months 2022 on 2/2/2022 (the corporate’s fiscal 12 months ends 9/30/2022). Income grew 29.9% to $10.7 billion, beating estimates by $270 million. Adjusted earnings-per-share of $3.23 in contrast favorably to adjusted earnings-per-share of $2.17 within the earlier 12 months.

Qualcomm not too long ago elevated its dividend by 10%, and the inventory now yields 2%. The corporate has elevated its dividend for 20 consecutive years. We count on whole returns of 12% per 12 months, pushed by the two% dividend yield, 7% anticipated EPS progress, and a 3% annual increase from an increasing valuation.

Click on right here to obtain our most up-to-date Certain Evaluation report on Qualcomm (preview of web page 1 of three proven under):

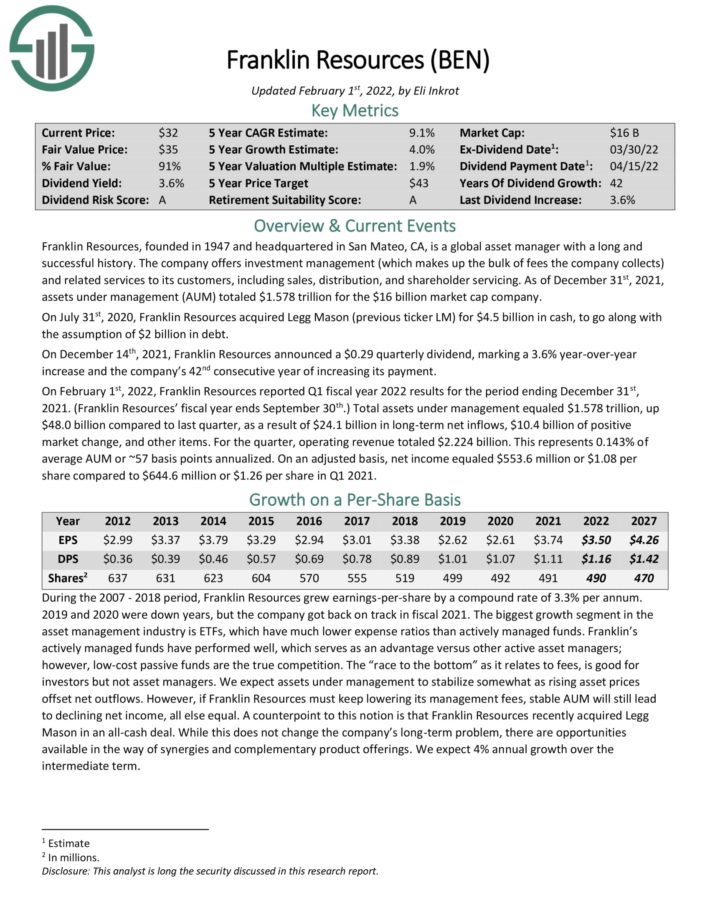

Recession-Proof Revenue Inventory #18: Franklin Assets (BEN)

- 5-year anticipated annual returns: 12.0%

Franklin Assets is a worldwide asset supervisor with an extended and profitable historical past. The corporate gives funding administration (which makes up the majority of charges the corporate collects) and associated providers to its prospects, together with gross sales, distribution, and shareholder servicing.

On December 14th, 2021, Franklin Assets introduced a $0.29 quarterly dividend, marking a 3.6% year-over-year enhance and the corporate’s forty second consecutive 12 months of accelerating its fee.

In the latest quarter, whole property below administration equaled $1.578 trillion, up $48.0 billion in comparison with final quarter, on account of $24.1 billion in long-term web inflows, $10.4 billion of optimistic market change, and different objects.

We count on annual returns of 12% per 12 months, consisting of the 4.2% dividend yield, 4% anticipated EPS progress, and a 3.8% increase from a rising P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Franklin Assets (preview of web page 1 of three proven under):

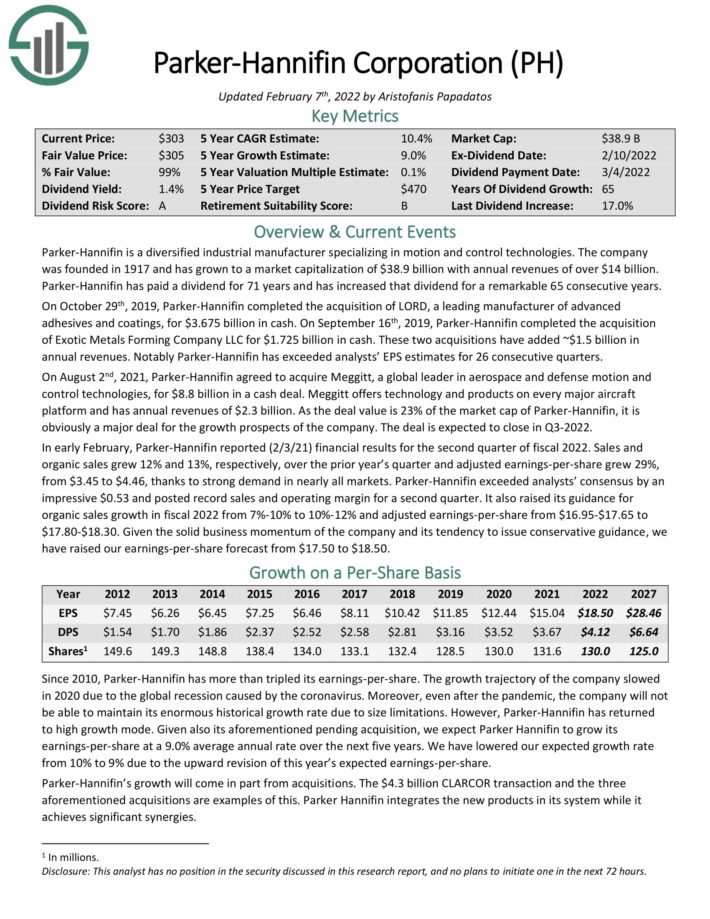

Recession-Proof Revenue Inventory #17: Parker-Hannifin (PH)

- 5-year anticipated annual returns: 12.0%

Parker-Hannifin is a diversified industrial producer specializing in movement and management applied sciences. The corporate was based in 1917 and has annual revenues of over $14 billion. Parker-Hannifin has paid a dividend for 71 years and has elevated that dividend for a exceptional 65 consecutive years.

Notably Parker-Hannifin has exceeded analysts’ EPS estimates for 26 consecutive quarters. In the latest quarter, web gross sales and natural gross sales grew 12% and 13%, respectively, over the prior 12 months’s quarter and adjusted earnings-per-share grew 29%, because of sturdy demand in practically all markets. It additionally raised its steering for natural gross sales progress in fiscal 2022 from 7%-10% to 10%-12% and adjusted earnings-per-share from $16.95-$17.65 to $17.80-$18.30.

We count on whole returns of 12% per 12 months, pushed by 9% EPS progress, the 1.5% dividend yield, and a 1.5% annual increase from a rising P/E ratio.

Click on right here to obtain our most up-to-date Certain Evaluation report on Parker-Hannifin (preview of web page 1 of three proven under):

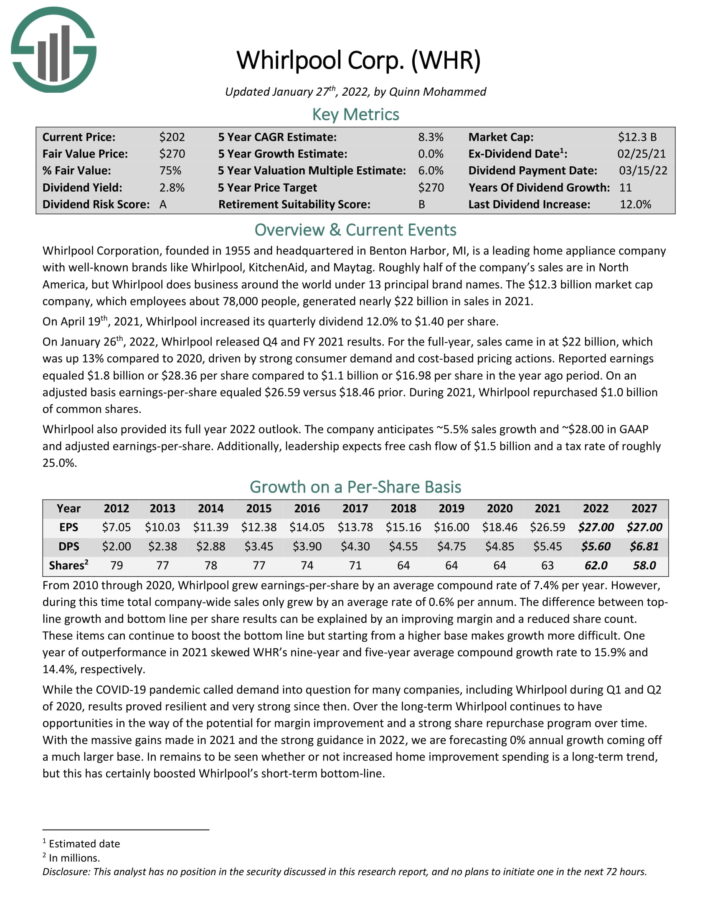

Recession-Proof Revenue Inventory #16: Whirlpool Company (WHR)

- 5-year anticipated annual returns: 12.1%

Whirlpool is a number one residence equipment firm with well-known manufacturers like Whirlpool, KitchenAid, and Maytag. Whirlpool generated practically $22 billion in gross sales in 2021.

On January twenty sixth, 2022, Whirlpool launched This autumn and FY 2021 outcomes. For the full-year, gross sales got here in at $22 billion, which was up 13% in comparison with 2020, pushed by sturdy shopper demand and cost-based pricing actions. Adjusted earnings-per-share rose 44% in 2021.

In April, Whirlpool elevated its quarterly dividend 12.0% to $1.40 per share. Shares at the moment yield 4.1%.

We count on annual returns simply above 12%, because of the excessive dividend yield, and a large 8% annual increase from a rising P/E ratio.

Click on right here to obtain our most up-to-date Certain Evaluation report on Whirlpool (preview of web page 1 of three proven under):

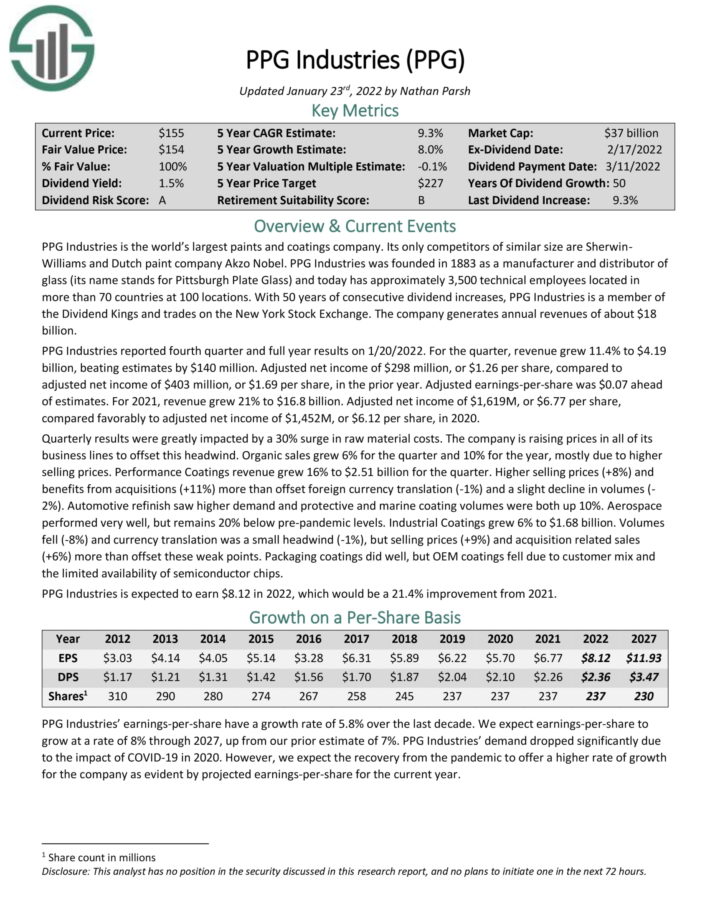

Recession-Proof Revenue Inventory #15: PPG Industries (PPG)

- 5-year anticipated annual returns: 12.5%

PPG Industries is the world’s largest paints and coatings firm. It was based in 1883 as a producer and distributor of glass. With 50 years of consecutive dividend will increase, PPG Industries is a member of the Dividend Kings. The corporate generates annual revenues of about $18 billion.

Within the 2021 fourth quarter, income grew 11.4% to $4.19 billion. Adjusted web earnings $1.26 per share, in comparison with $1.69 per share, within the prior 12 months. For 2021, income grew 21% to $16.8 billion. Adjusted web earnings $6.77 per share, in contrast favorably to $6.12 per share in 2020.

We count on 12.5% annual returns, consisting of the 1.8% dividend yield, 8% EPS progress, and a 2.7% annual increase from a rising P/E ratio.

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven under):

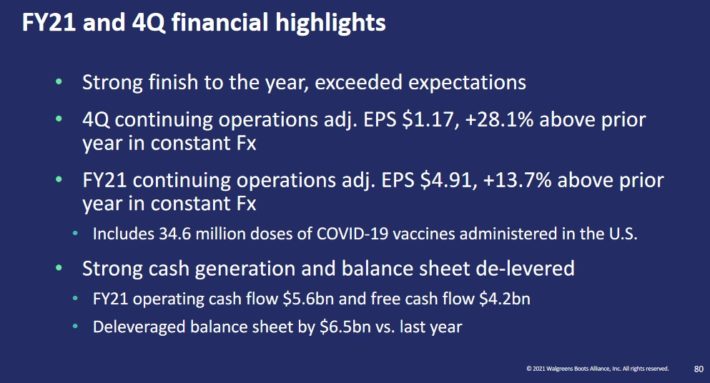

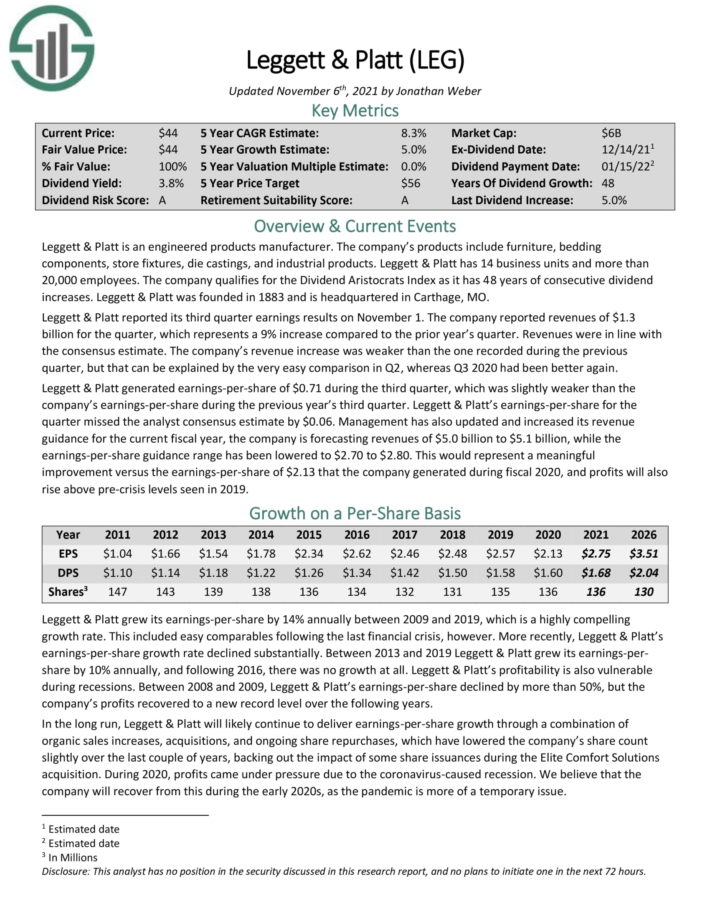

Recession-Proof Revenue Inventory #14: Walgreens Boots Alliance (WBA)

- 5-year anticipated annual returns: 12.6%

Walgreens Boots Alliance is the most important retail pharmacy in each the USA and Europe. By way of its flagship Walgreens enterprise and different enterprise ventures, the corporate employs greater than 325,000 folks and has greater than 13,000 shops.

In the latest quarter, gross sales from persevering with operations grew 7.8% over the prior 12 months’s quarter, pushed by COVID-19 vaccinations and testing. U.S. retail comparable gross sales grew 11%, which is a 20 12 months excessive progress fee. Adjusted EPS grew 53%, from $1.10 to $1.68, and exceeded analysts’ consensus by $0.34.

An summary of Walgreens’ most up-to-date quarterly efficiency might be seen within the picture under:

Supply: Investor Presentation

Walgreens inventory at the moment yields 4.4%, whereas we count on 5% annual EPS progress. With the addition of P/E growth, whole returns are estimated at 12.6% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Walgreens (preview of web page 1 of three proven under):

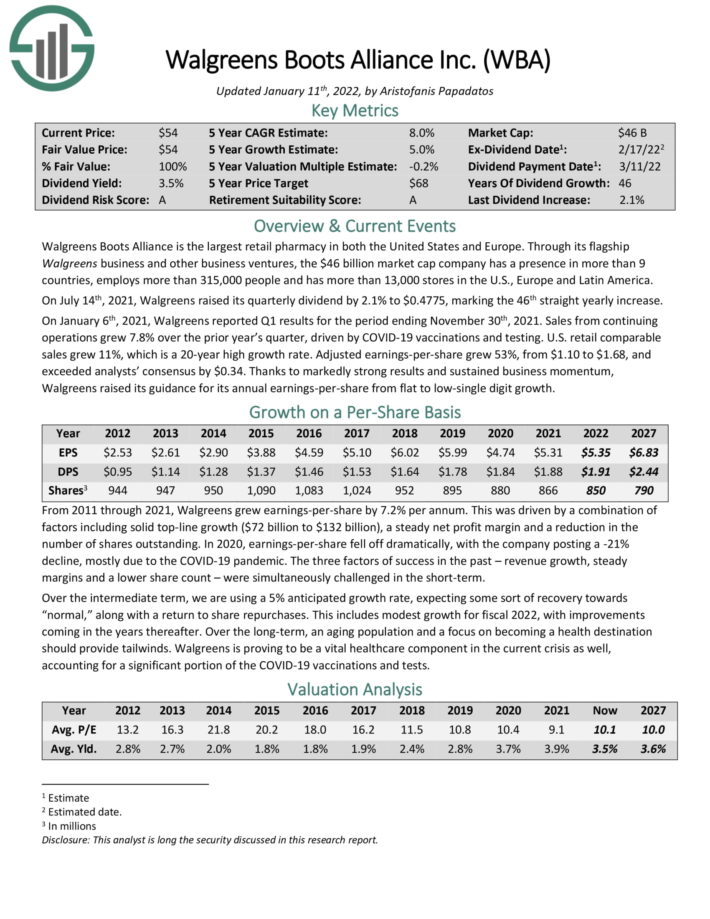

Recession-Proof Revenue Inventory #13: Leggett & Platt (LEG)

- 5-year anticipated annual returns: 12.6%

Leggett & Platt is an engineered merchandise producer. The corporate’s merchandise embrace furnishings, bedding elements, retailer fixtures, die castings, and industrial merchandise.

The corporate reported revenues of $1.33 billion for the quarter, which represents a 13% enhance in comparison with the prior 12 months’s quarter.

The corporate is forecasting revenues of $5.3 billion to $5.6 billion for 2022, implying progress of 4% to 10%. The EPS steering vary has been set at $2.70 to $3.00 for 2022.

With a P/E of 15, Leggett & Platt inventory is undervalued in opposition to our truthful worth estimate of 16. The mixture of a rising valuation a number of, 5% anticipated EPS progress, and the 4.7% dividend yield results in whole anticipated returns of 12.6% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Leggett & Platt (preview of web page 1 of three proven under):

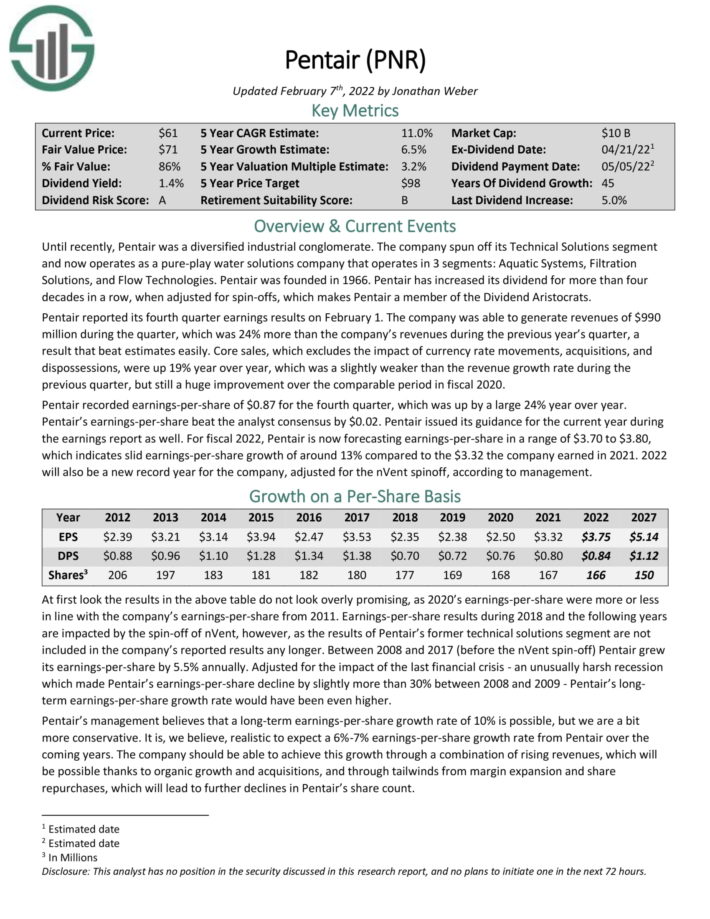

Recession-Proof Revenue Inventory #12: Bristol-Myers Squibb (BMY)

- 5-year anticipated annual returns: 12.7%

Bristol-Myers Squibb is a number one drug maker of cardiovascular and anti-cancer therapeutics. The corporate reworked itself because of the $74 billion acquisition of Celgene, a peer pharmaceutical large which derived virtually two-thirds of its income from Revlimid, which treats a number of myeloma and different cancers.

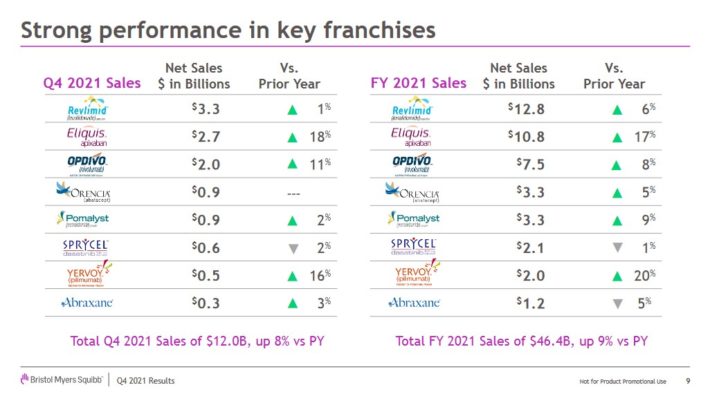

The corporate generated strong progress within the fourth quarter, and in 2021:

Supply: Investor Presentation

For the 2021 fourth quarter, income elevated 8% whereas adjusted EPS elevated 25%. For the 12 months, income grew 9% to $46.4 billion with adjusted earnings-per-share up 17%.

Shares of BMY commerce for a ahead P/E ratio under 10. Our truthful worth P/E estimate is 13-14, which is extra in-line with the pharmaceutical peer group. Lastly, BMY has a 2.9% dividend yield, resulting in whole anticipated returns of 12.7% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Bristol-Myers Squibb (preview of web page 1 of three proven under):

Recession-Proof Revenue Inventory #11: ABM Industries (ABM)

- 5-year anticipated annual returns: 12.8%

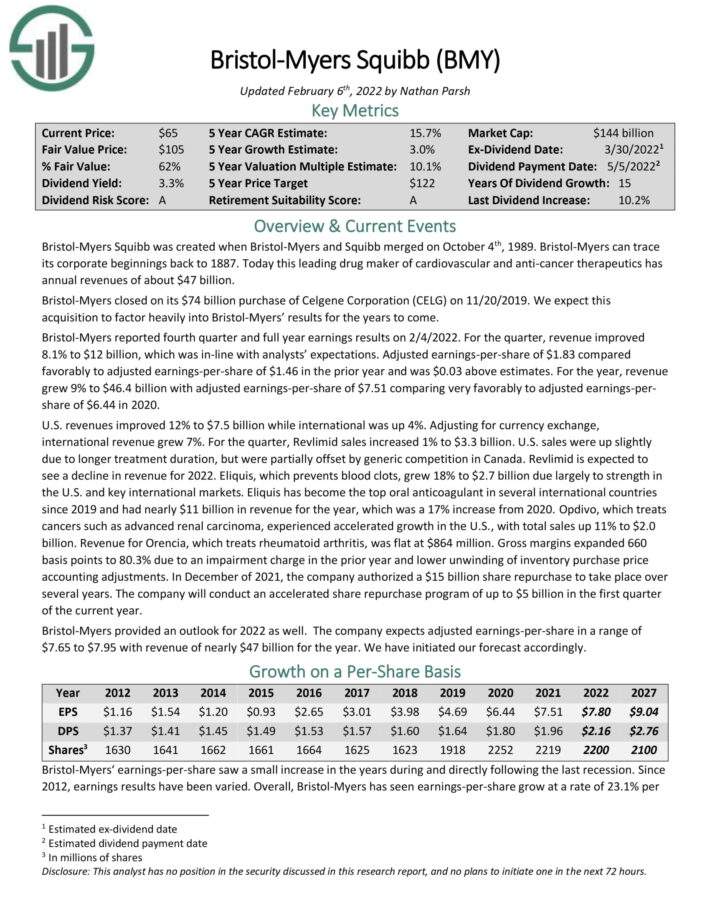

ABM Industries is a number one supplier of facility options, which incorporates janitorial, electrical & lighting, vitality options, services engineering, HVAC & mechanical, panorama & turf, and parking. The corporate has elevated its dividend for 54 consecutive years, which makes it a Dividend King.

The corporate has a formidable dividend historical past:

Supply: Investor Presentation

In the latest quarter, revenues totaled $1.9 billion up 30% versus the earlier 12 months’s quarter. Earnings truly declined 7% in comparison with the earlier 12 months’s quarter to $0.94, however this outcome beat the analyst consensus by $0.16.

ABM’s dividend payout ratio is predicted at 22% for 2022. Because of the low dividend payout ratio and its very steady, recession-resilient enterprise mannequin, ABM Industries’ dividend appears to be like very protected.

Click on right here to obtain our most up-to-date Certain Evaluation report on ABM (preview of web page 1 of three proven under):

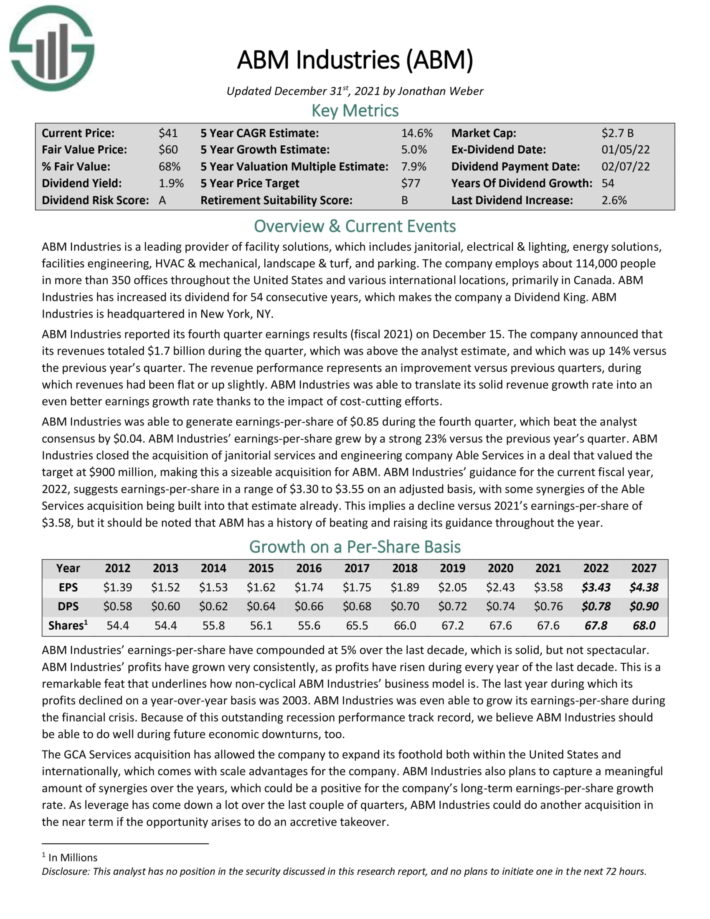

Recession-Proof Revenue Inventory #10: Pentair plc (PNR)

- 5-year anticipated annual returns: 13.3%

Pentair is a pure-play water options firm that operates in 3 segments: Aquatic Techniques, Filtration Options, and Stream Applied sciences. Pentair was based in 1966. Pentair has elevated its dividend for greater than 40 years, which makes it a member of the Dividend Aristocrats.

In the latest quarter, revenues of $990 million throughout the quarter rose 24% year-over-year. Pentair recorded earnings-per-share of $0.87 for the fourth quarter, which was up by 24% 12 months over 12 months.

Pentair issued its steering for the present 12 months, now forecasting earnings-per-share in a variety of $3.70 to $3.80. On the midpoint, this may characterize 13% progress in comparison with the $3.32 the corporate earned in 2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on Pentair (preview of web page 1 of three proven under):

Recession-Proof Revenue Inventory #9: The Andersons, Inc. (ANDE)

- 5-year anticipated annual returns: 13.3%

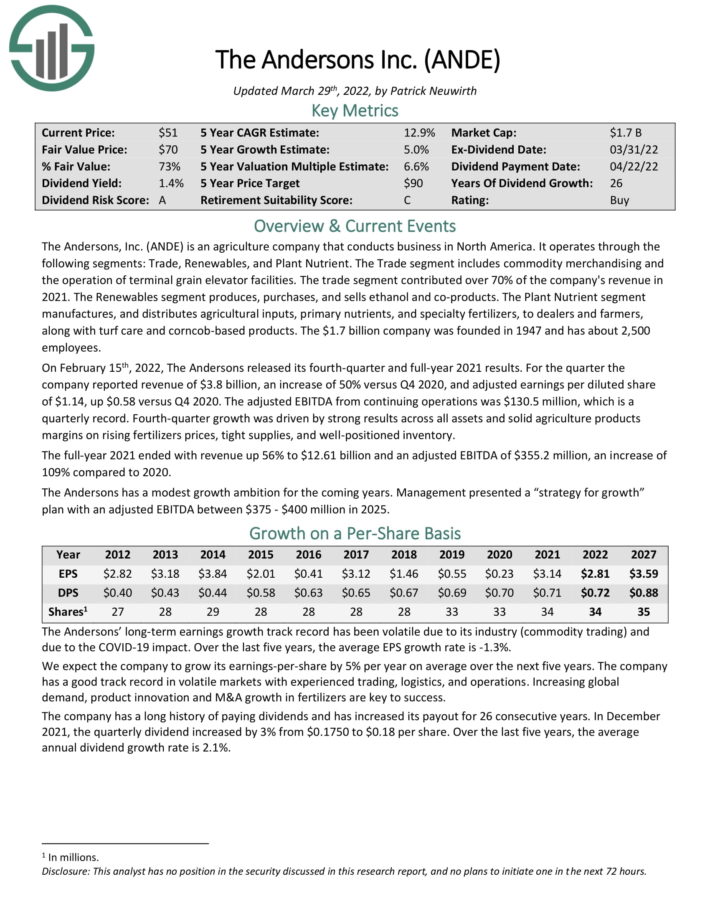

The Andersons, Inc. is an agriculture firm that conducts enterprise in North America. It operates by means of the next segments: Commerce, Renewables, and Plant Nutrient. The Commerce phase consists of commodity merchandising and the operation of terminal grain elevator services. The commerce phase contributed over 70% of the corporate’s income in 2021.

In the latest quarter, income of $3.8 billion elevated 50% versus This autumn 2020, and adjusted earnings per diluted share of $1.14, up $0.58 versus This autumn 2020. Progress was pushed by sturdy outcomes throughout all property and strong agriculture merchandise margins on rising fertilizers costs and tight provide.

The corporate has an extended historical past of paying dividends and has elevated its payout for 26 consecutive years. Shares at the moment yield 1.5%. Whole returns are estimated at 13.3% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on ANDE (preview of web page 1 of three proven under):

Recession-Proof Revenue Inventory #8: 3M Co. (MMM)

- 5-year anticipated annual returns: 13.4%

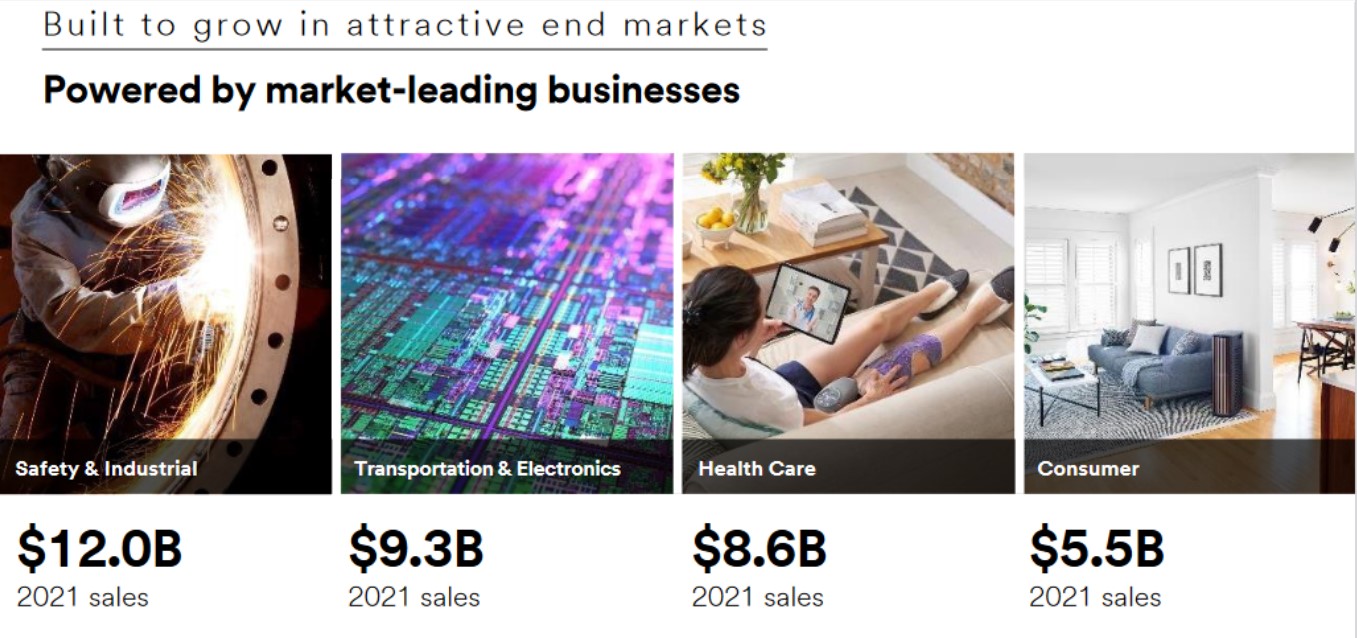

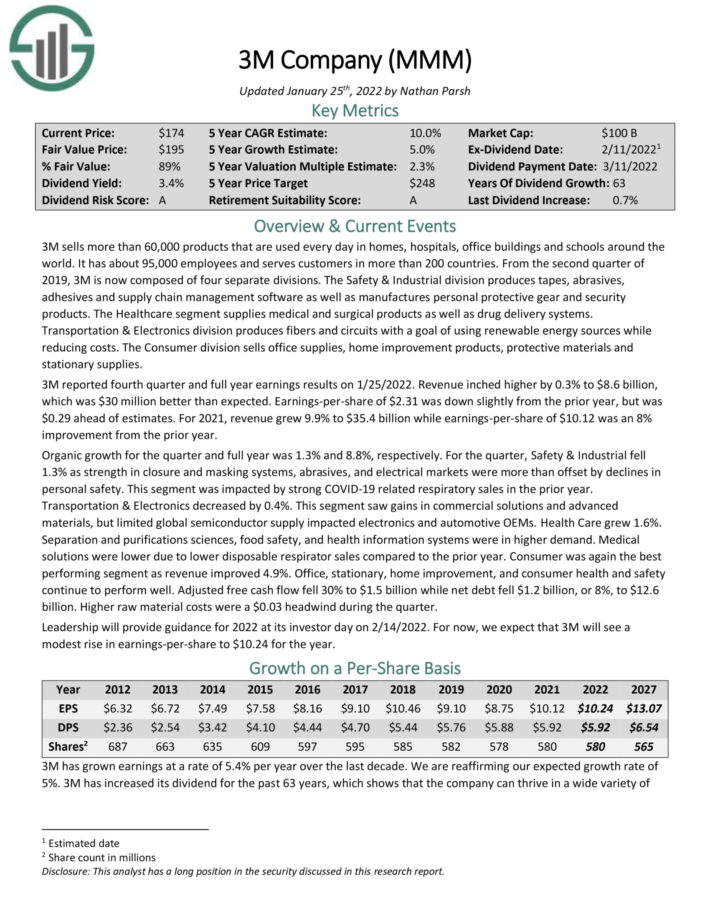

3M is an industrial conglomerate that sells greater than 60,000 merchandise. The corporate has 4 separate divisions: Security & Industrial, Healthcare, Transportation & Electronics, and Client merchandise.

Supply: Investor Presentation

Within the 2021 fourth quarter, income elevated 0.3% to $8.6 billion, which was $30 million higher than anticipated. Earnings-per-share of $2.31 was down barely from the prior 12 months however was $0.29 forward of estimates.

For 2021, income grew 9.9% to $35.4 billion whereas earnings-per-share of $10.12 was an 8% enchancment from the prior 12 months.

3M has elevated its dividend for over 60 years in a row, and the inventory yields 4%. Whole returns are anticipated to succeed in 13.5% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M (preview of web page 1 of three proven under):

Recession-Proof Revenue Inventory #7: Lowe’s Corporations (LOW)

- 5-year anticipated annual returns: 13.8%

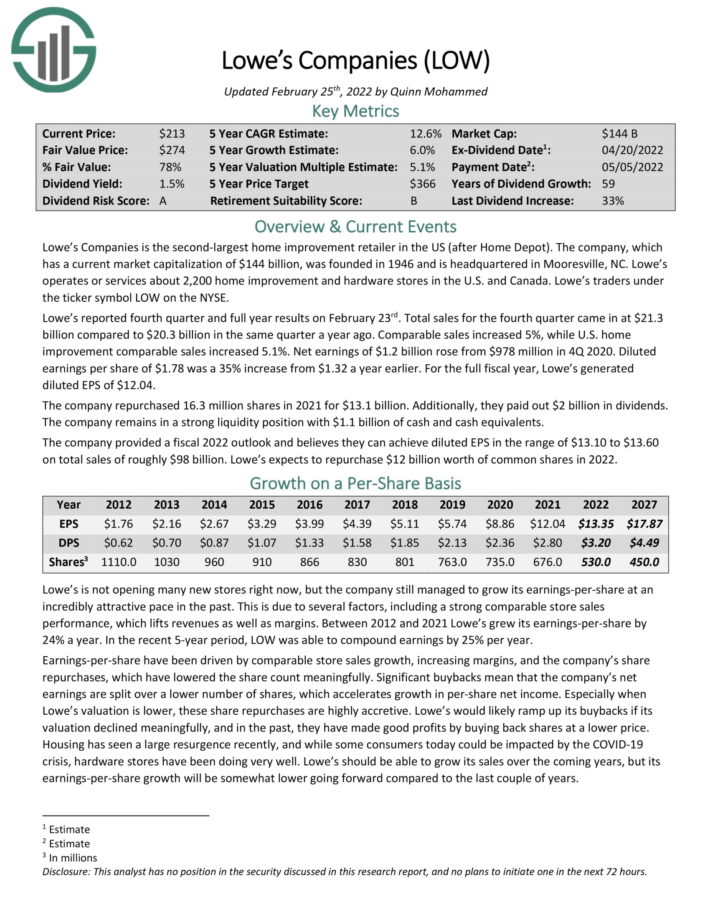

Lowe’s Corporations is the second-largest residence enchancment retailer within the US (after Dwelling Depot). Lowe’s operates or providers greater than 2,200 residence enchancment and {hardware} shops within the U.S. and Canada.

Within the 2021 fourth quarter, Lowe’s comparable gross sales elevated 5%, whereas U.S. residence enchancment comparable gross sales elevated 5.1%. Diluted earnings per share of $1.78 was a 35% enhance from $1.32 a 12 months earlier.

The corporate offered a fiscal 2022 outlook and expects diluted EPS within the vary of $13.10 to $13.60 on whole gross sales of roughly $98 billion.

Lowe’s is a Dividend King, with over 50 consecutive years of dividend will increase. Shares at the moment yield 1.6%. The mixture of a number of growth, 6% anticipated EPS progress and dividends result in whole anticipated returns of 13.8% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Lowe’s (preview of web page 1 of three proven under):

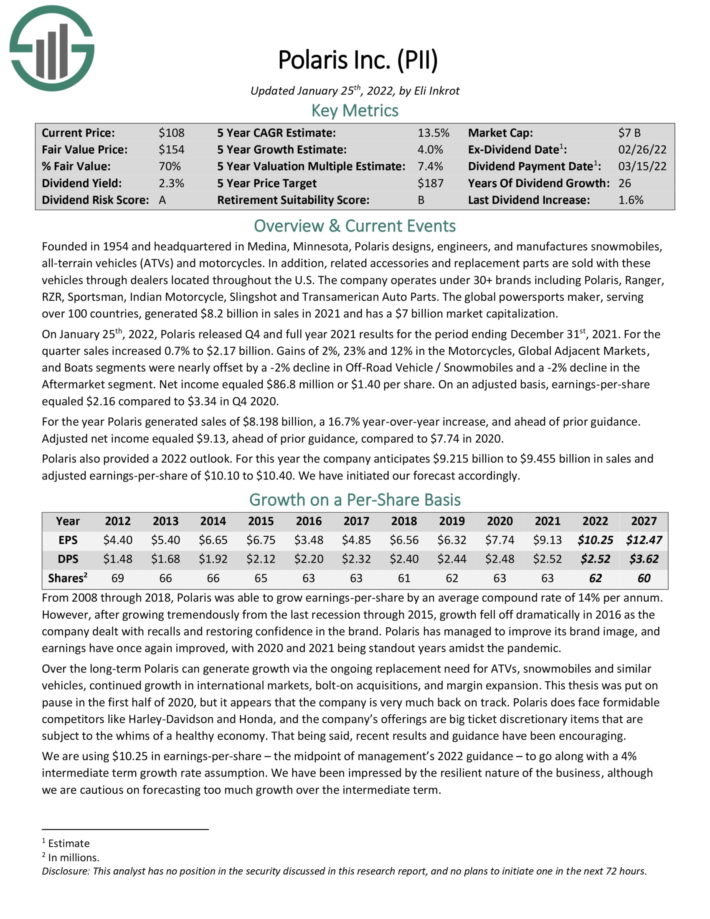

Recession-Proof Revenue Inventory #6: Polaris Inc. (PII)

- 5-year anticipated annual returns: 13.8%

Polaris designs, engineers, and manufactures snowmobiles, all-terrain automobiles (ATVs) and bikes. As well as, associated equipment and alternative elements are offered with these automobiles by means of sellers positioned all through the U.S. The corporate operates below 30+ manufacturers.

For the 2021 fourth quarter, gross sales elevated 0.7% to $2.17 billion. On an adjusted foundation, earnings-per-share equaled $2.16 in comparison with $3.34 in This autumn 2020. For the 12 months Polaris generated gross sales of $8.2 billion, a 16.7% year-over-year enhance, and forward of prior steering.

Polaris additionally offered a 2022 outlook. For this 12 months the corporate anticipates $9.215 billion to $9.455 billion in gross sales and adjusted earnings-per-share of $10.10 to $10.40.

Whole returns are anticipated to succeed in practically 14% per 12 months, pushed by 4% EPS progress, the two.4% dividend yield, and a large increase from a rising P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Polaris (preview of web page 1 of three proven under):

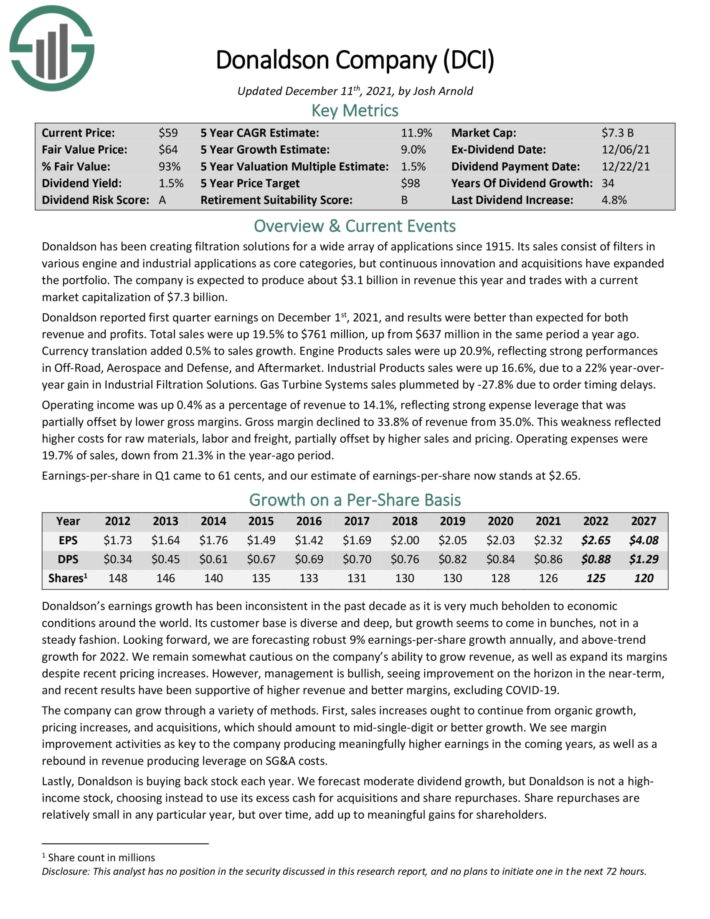

Recession-Proof Revenue Inventory #5: Donaldson Firm (DCI)

- 5-year anticipated annual returns: 13.8%

Donaldson has been creating filtration options for a wide selection of functions since 1915. Its gross sales encompass filters in numerous engine and industrial functions as core classes, however steady innovation and acquisitions have expanded the portfolio.

In the latest quarter, income elevated 18% to $803 million, and was $32 million forward of analyst estimates.

Donaldson’s payout ratio stays nicely under 40% of earnings. As talked about, Donaldson prefers to make use of most of its extra money for acquisitions and a small quantity of share repurchases, however it does increase the dividend repeatedly.

Donaldson’s recession efficiency is solidified by the aggressive benefit of greater than 100 years of expertise in its subject, in addition to a robust historical past of innovation and a large put in buyer base.

We count on annual returns of 13.8% per 12 months, pushed by 8% anticipated EPS progress, the 1.8% dividend yield, and a 4% increase from a rising P/E ratio.

Click on right here to obtain our most up-to-date Certain Evaluation report on DCI (preview of web page 1 of three proven under):

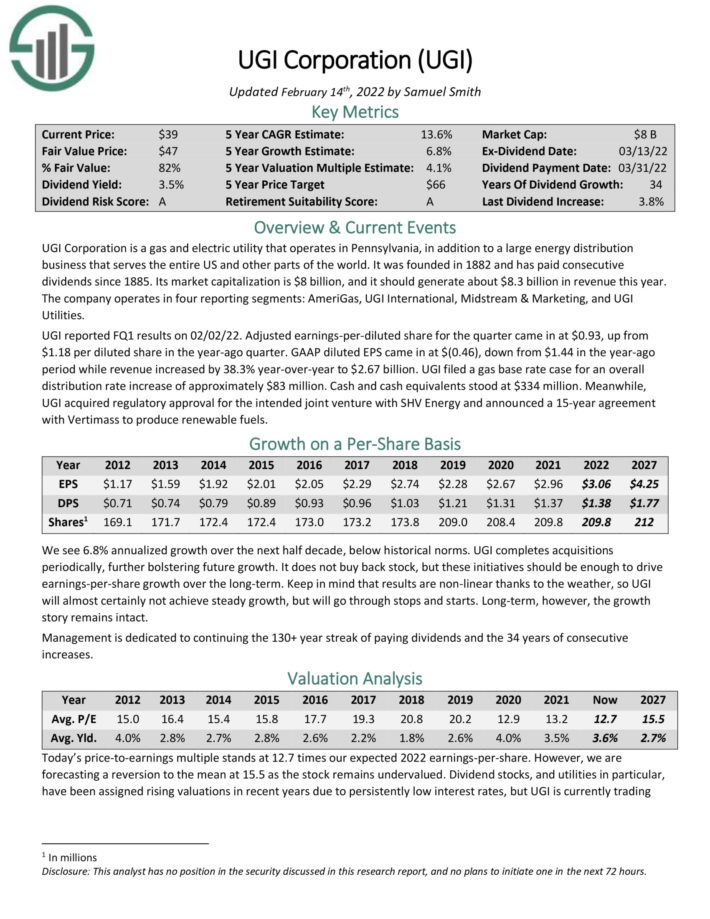

Recession-Proof Revenue Inventory #4: UGI Corp. (UGI)

- 5-year anticipated annual returns: 14.9%

UGI Company is a gasoline and electrical utility that operates in Pennsylvania, along with a big vitality distribution enterprise that serves the complete US and different elements of the world. It was based in 1882 and has paid consecutive dividends since 1885.

UGI’s essential aggressive benefit is in its extremely diversified enterprise mannequin. It has electrical and gasoline utilities, propane distribution that covers a large geographic space and numerous buyer base. UGI’s sturdy efficiency throughout the Nice Recession illustrates this.

The payout ratio is sort of cheap right this moment given the corporate weathered the COVID-19 recession nicely. We count on a sub-50% payout ratio for the foreseeable future, indicating wonderful dividend security.

We count on 14.9% annual returns over the subsequent 5 years, as a result of 6.8% EPS progress, the three.8% dividend yield, and a ~4.3% annual increase from a rising P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on UGI (preview of web page 1 of three proven under):

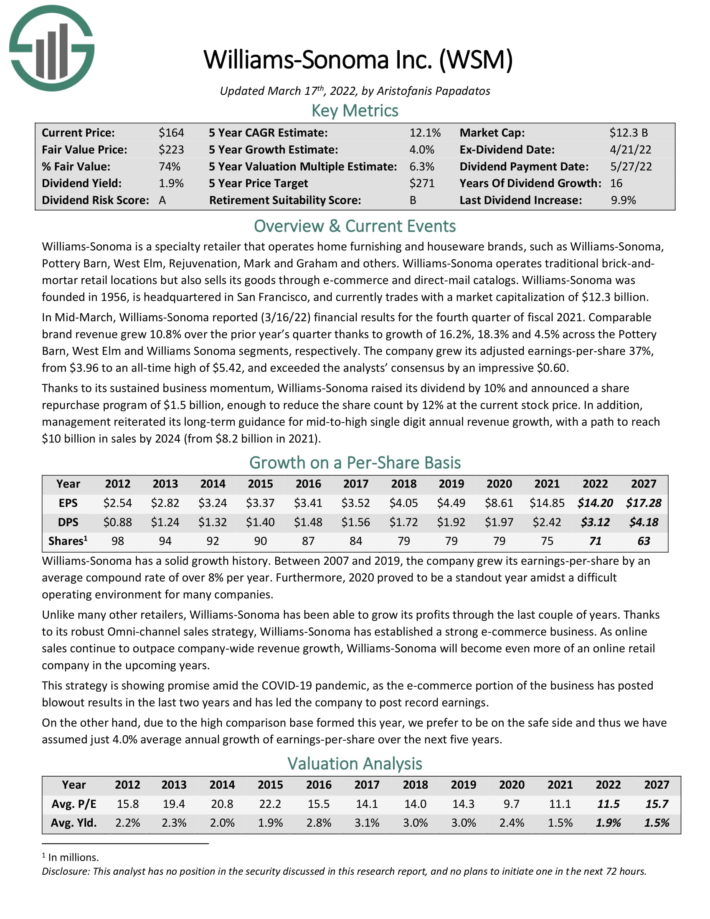

Recession-Proof Revenue Inventory #3: Williams-Sonoma (WSM)

- 5-year anticipated annual returns: 15.4%

Williams-Sonoma is a specialty retailer that operates residence furnishing and houseware manufacturers, akin to Williams-Sonoma, Pottery Barn, West Elm, Rejuvenation, Mark and Graham and others.

Supply: Investor Presentation

Within the 2021 fourth quarter, comparable model income grew 10.8% over the prior 12 months’s quarter because of progress of 16.2%, 18.3% and 4.5% throughout the Pottery Barn, West Elm and Williams Sonoma segments, respectively. The corporate grew its adjusted earnings-per-share 37%, from $3.96 to an all-time excessive of $5.42, and exceeded the analysts’ consensus by a formidable $0.60.

Due to its sustained enterprise momentum, Williams-Sonoma raised its dividend by 10%. We count on annual returns of 15.4% per 12 months, pushed by anticipated EPS progress of 4% per 12 months, the two.1% dividend yield, and a ~9.3% annual increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Williams-Sonoma (preview of web page 1 of three proven under):

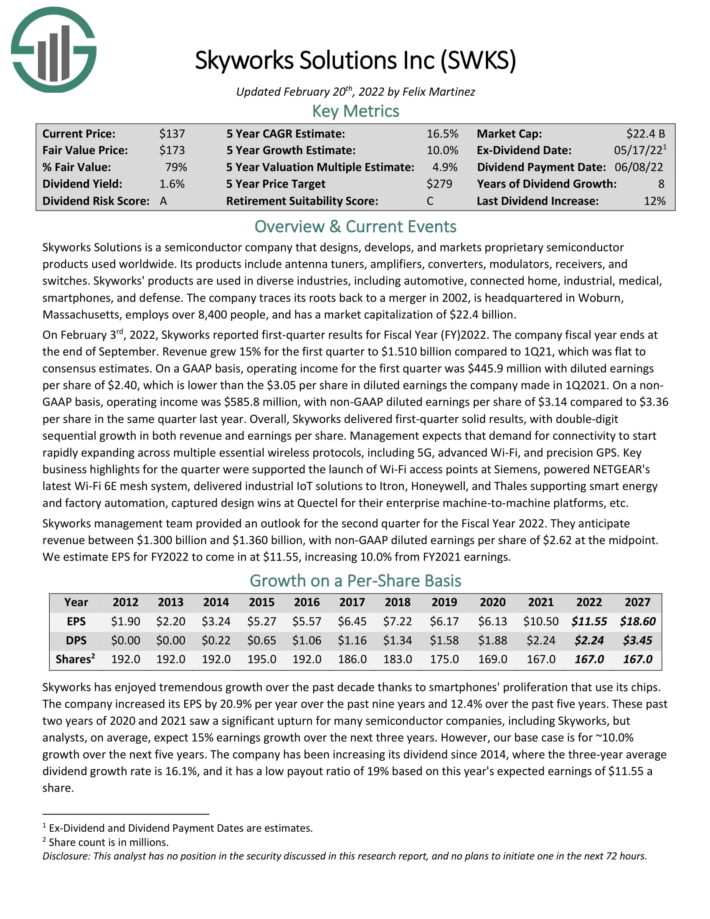

Recession-Proof Revenue Inventory #2: Skyworks Options (SWKS)

- 5-year anticipated annual returns: 17.3%

Skyworks Options is a semiconductor firm that designs, develops, and markets proprietary semiconductor merchandise used worldwide. Its merchandise embrace antenna tuners, amplifiers, converters, modulators, receivers, and switches.

In the latest quarter, income grew 15% year-over-year. Adjusted diluted earnings per share of $3.14 in comparison with $3.36 per share in the identical quarter final 12 months. General, Skyworks delivered first-quarter strong outcomes, with double-digit sequential progress in each income and earnings per share.

Skyworks has a robust stability sheet with over $1 billion in money and money equivalents and no debt. This provides the corporate large flexibility and resiliency to offset a few of its concentrated buyer base dangers and transfer ahead with its progress plans. The dividend may be very nicely coated by earnings, and we take into account it very protected. The corporate remained worthwhile throughout the earlier recession.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWKS (preview of web page 1 of three proven under):

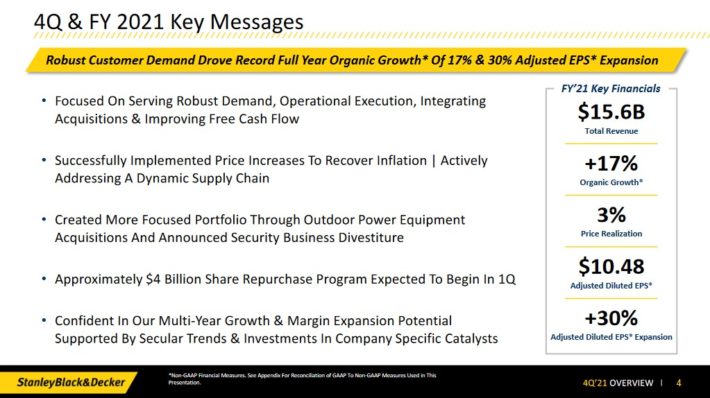

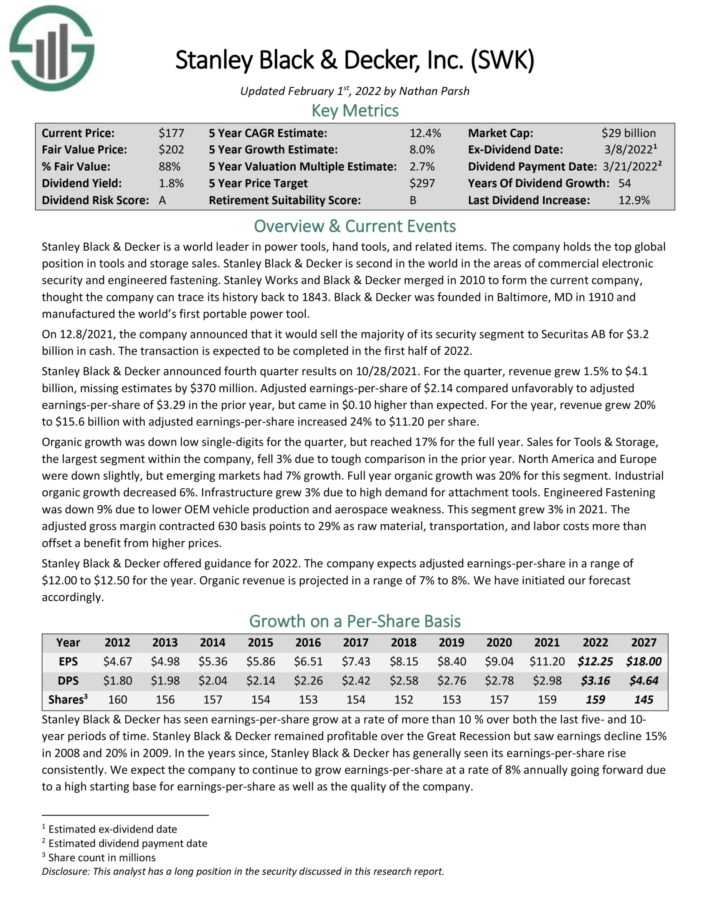

Recession-Proof Revenue Inventory #1: Stanley Black & Decker (SWK)

- 5-year anticipated annual returns: 17.6%

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated objects. The corporate holds the highest international place in instruments and storage gross sales.

Stanley Black & Decker introduced fourth quarter outcomes on 10/28/2021. You possibly can see an outline of the corporate’s 2021 fourth-quarter efficiency within the picture under:

Supply: Investor Presentation

For the quarter, income grew 1.5% to $4.1 billion, lacking estimates by $370 million. Adjusted earnings-per-share of $2.14 in contrast unfavorably to adjusted earnings-per-share of $3.29 within the prior 12 months, however got here in $0.10 increased than anticipated.

The corporate’s low payout ratio (26% projected for 2022) does make it doubtless that dividends will proceed rising even by means of a severe financial downturn. Stanley Black & Decker’s key aggressive benefit is that its merchandise are well-known and revered by prospects.

The inventory has a 2.2% dividend yield, and we count on 8% annual EPS progress. With a ~7.4% increase from an increasing P/E a number of, whole returns are anticipated to succeed in 17.6% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWK (preview of web page 1 of three proven under):

Extra Studying

The Blue Chips checklist will not be the one strategy to shortly display for shares that repeatedly pay rising dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link