Intensify the constructive, they are saying. And why not, as we cruise into Monday with shares pointing larger amid hopes for relieving U.S. tariffs on China.

Granted, optimism is a tall order as of late, with the U.S. economic system slowing, COVID not carried out but (let’s hope monkeypox passes quick) and Russian boots nonetheless on the bottom in Ukraine. Because the S&P 500 index

SPX

teeters perilously near a bear market, buyers stay understandably torn between shopping for the dip and promoting the rip.

That doesn’t imply some aren’t giving requires the underside a shot.

Final week, we heard from technician Tom DeMark, who, after calling the COVID backside in 2020, predicted a “surprising rally” was headed our method as inflationary drivers —-energy and commodities —- begin to peak.

In that upbeat vein is our name of the day from the Caught within the Center weblog’s Mr Blonde, who says oversold situations are “leaving markets weak to some excellent news.”

“A exact catalyst shouldn’t be at all times simple to establish, however Mr. Blonde sees inflation momentum passing its worst, fee markets calming as essentially the most hawkish Fed situations are being eliminated,” writes Mr Blonde.

He expects a reduction rally to play out over the subsequent 4 to 6 weeks, and on his danger scale (1 to 10 — the worst), it’s a transfer from 2 to 4 for him. “It displays the view main fairness indices can rally 10% to 12% and nonetheless be in a transparent downtrend, so the chance/reward has shifted considerably.”

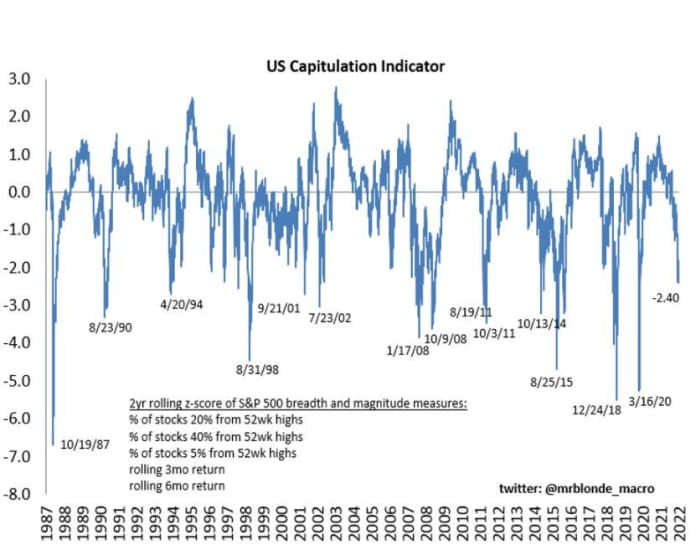

Mr Blonde’s graph under summarizes 2-year rolling S&P 500 drawdowns, with 20% pullbacks not solely not unprecedented, but additionally attainable outdoors of massive financial downturns. In his view, fairness markets have already met minimal standards for a cyclical bear market, pricing in round 80% odds of a “regular” recession.

@mrblonde_macro

“Backside line, significant harm already carried out and being extra bearish in the present day than 6 months in the past might be inappropriate even when the correction has additional to go,” he mentioned.

Elsewhere, he factors to the Nasdaq Composite

COMP,

ripe for reduction because it’s fallen 20% over 7 straight weeks, has retraced 50% of its rally from the lows of March 2020, and its ahead valuation has reverted to the pre-COVID common, amongst different components.

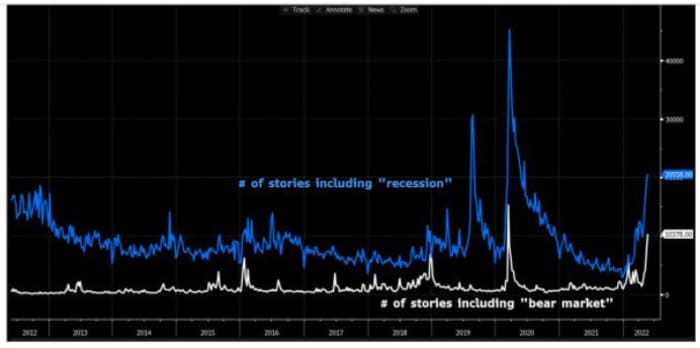

@mrblonde_macro

Then there’s the abundance of “growling bear markets” tales within the media — a easy reflection of market sentiment. Whereas reluctant to depend on any sentiment indicators, he notes that during the last 30 years, equally bearish attitudes have led to larger inventory costs 4 to 6 weeks later.

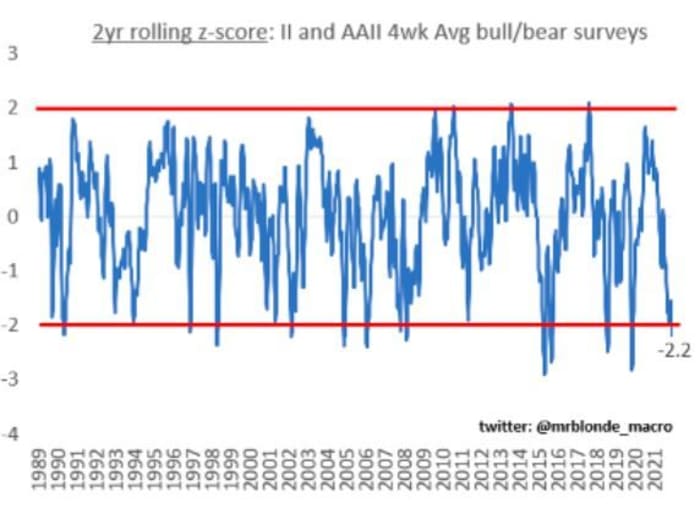

His sentiment measure provides in surveys from Traders Intelligence and the American Affiliation of Particular person Traders, normalized over rolling two-year durations. And certain there are false-positive dangers right here , however “30-year historic chance of upper costs in 4-6 week are laborious to battle,” he says.

@mrblonde_macro

Extra proof {that a} turning level is forward: a current Financial institution of America fund managers survey exhibiting managers with the very best money balances in 20 years, plus current capitulation amongst retailer merchants. Citing Goldman Sachs, Mr Blonde mentioned they seem to have offered 50% of what they purchased in 2020-2021.

But deep capitulation eludes, he says, noting that his personal most popular measure nonetheless has not breached a damaging 2.5%. Standing in the best way are still-standing vitality, utilities, insurance coverage and staples, although the final sector simply began promoting final week.

@mrblonde_macro

General, Mr Blonde believes that we’re most likely passing the worst of inflation momentum, “and if the market begins to consider this it will probably take away the extra hawkish situations and act as a constructive growth.” Not making it simple is the truth that the Fed has “put all its coverage chips on essentially the most lagging indicator of all of them,” inflation.

Learn the complete put up right here.

The thrill

Beijing has prolonged stay-home orders for staff and college students, and ordered extra mass testing as COVID instances leap.

On his Asia tour, President Joe Biden mentioned a U.S. recession was not inevitable, and mentioned America would defend Taiwan in case of China aggression. Elsewhere, Russia has been urgent its offensive in jap Ukraine.

U.S. officers are voicing warning over a monkeypox outbreak, with one U.S. case and several other in Europe, with specialists pointing to intercourse at two raves in Spain and Belgium,

After a two-year absence, the World Financial Discussion board in Davos, Switzerland is again, with loads of pressing points for the uber-rich to attempt to kind. Addressing the crowed (just about after all), Ukraine President Vlodomir Zelenskyy was urging ‘most’ sanctions on Russia over the brutal invasion of his nation.

Atlanta Fed President Raphael Bostic and Kansas Metropolis Fed President Esther George will each converse at occasions Monday. The U.S. knowledge calendar is empty, however the week will convey us the minutes of the most recent Fed assembly on Wednesday and its favourite inflation gauge on Friday.

The markets

Uncredited

Inventory futures

YM00

ES00

NQ00

are pushing larger, together with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y,

and oil costs

CL00

are additionally up. And with danger urge for food larger, the greenback

DXY

is down throughout the board. Cryptocurrencies are stabilizing, and stablecoin Luna has gotten a lift as buyers have been burning their cash.

The tickers

Random reads

A lackluster opening for the brand new Downton Abbey film could also be proof older girls are nonetheless cautious put up COVID.

How a pair and their 19 canine escaped a war-torn Ukraine metropolis.

Must Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will likely be despatched out at about 7:30 a.m. Japanese.

Need extra for the day forward? Join The Barron’s Day by day, a morning briefing for buyers, together with unique commentary from Barron’s and MarketWatch writers.