[ad_1]

olm26250/iStock by way of Getty Photographs

Introduction

Goldman Sachs (NYSE:GS) is a kind of shares that has continued to elude my portfolio, as every time it neared fascinating territory, there was at all times one thing larger on my precedence checklist, however having seen the inventory development downwards together with the overall promote it was time to present it an in-depth look. Goldman was due for a very good pullback; its market cap having ridden the extraordinarily sturdy monetary efficiency it delivered throughout FY2021. On this take a look at Goldman, I conclude that the present share worth presents a good entry level, however one should even be thoughtful of the present financial cycle, the place a possible recession could have unfavorable impacts for banks together with Goldman.

Goldman’s Enterprise

Most of us perceive the workings of a conventional retail financial institution. Clients make deposits, and the financial institution leverages these deposits by way of lending, the tip. There’s after all extra to it, however that’s mainly how such a company works. An funding financial institution is a distinct piece of equipment and I imagine it’s value understanding that in a bit extra element, which is the aim of this part.

Goldman Sachs is greater than 150 years previous and is as we speak primarily an funding financial institution. If I had been to make one word in regard to current historical past, then it will be that Goldman was an impartial securities agency, which modified within the wake of the monetary disaster, the place each Goldman and Morgan Stanley (MS), the 2 remaining U.S. funding banks, grew to become conventional financial institution holding firms in an effort to acquire entry to authorities emergency funding upon approval by the Fed, which means they fall beneath Fed regulation versus SEC as of late. This has after all impacted Goldman as an organization since then and up till as we speak. Anyway, an funding financial institution in a nutshell, is a company who assist shoppers, each institutional and retail, to take dangers. They’re the mediator who makes issues occur so to say. This will take kind in plenty of methods, however to maintain it excessive stage, it may well take kind within the following methods.

- The funding financial institution can assume danger by itself steadiness sheet, e.g., by underwriting an IPO, being a counterpart in a securities transaction equivalent to assuming danger on behalf of their shopper or in any other case.

- The funding financial institution can match danger by transferring danger between events, e.g., associated to commodities equivalent to oil, corn, soy bean and many others. the place a given get together desires to guard itself towards a drop in a given commodity whereas one other get together desires to guard itself towards an increase in that very same commodity. The funding financial institution then sits between these events and presents the infrastructure, creating {the marketplace} so to say.

- The funding financial institution can supply dangers, e.g., by providing structured merchandise equivalent to derivatives for shoppers who wish to tackle a sure danger publicity.

As such, what Goldman Sachs specialised in is kind of totally different from conventional wholesale, business and retail banking which regularly is quite a bit much less advanced. Taking business banking for instance, nonetheless, it’s common for among the choices aimed toward massive commercials to incorporate both of the three above, however relying on measurement and complexity, it could possibly be dealt with by the shopper’s incumbent financial institution or by a specialist like Goldman.

Having briefly touched upon the actual fact, that an organization like Goldman makes danger taking potential for its shoppers, it’s little shock that FY2021 become a file yr for Goldman each by way of income and web earnings, as 2021 was characterised as a yr the place world danger urge for food was large – with 2021 being a file yr for IPOs not least as a result of SPACs, the tech craze (dare I say bubble?), new funding merchandise, and many others. This additionally signifies that Goldman is to be thought of a cyclical enterprise, which can also be evident by the truth that FY2022 income is anticipated to be effectively beneath that of 2021, however roughly 10% above that of 2020 with the next years offering low development according to normal GDP expectations, or roughly so. In different phrases, when the economic system is booming and corporations are aggressive inside M&A, IPOs and comparable, enterprise is booming for funding banks equivalent to Goldman.

Goldman operates via 4 totally different divisions, being.

- World Markets: Providing gross sales and buying and selling for equities, fastened earnings, and many others. whereas making up roughly 35%-40% of Goldman’s complete income seen over a time frame. Goldman drives earnings by way of its perform as a market maker, incomes from the unfold between connecting purchaser and vendor. Moreover, Goldman secures earnings associated to financing, margin lending in brokerage in addition to totally different types of lending.

- Funding Banking: Goldman’s M&A and advisory arm additionally providing fairness and debt underwriting, making up roughly 20%-25% of Goldman’s complete income seen over a time frame. A extremely worthwhile a part of Goldman’s enterprise as Goldman drives earnings by way of taking a reduce of total transaction volumes in relation to IPO and debt choices. Relying on the scale of a given deal, it may be within the matter of some proportion factors for IPOs whereas being a matter of foundation factors for debt choices. M&A earnings sits someplace between amassing roughly half a proportion level, once more relying on measurement of a given deal. Goldman has a very sturdy market place inside its funding banking division seen from a worldwide perspective.

Earlier than going via the remaining two divisions, it’s value mentioning that the two above are the extra cyclical components of Goldman’s enterprise, which is counterweighted a bit by the final two divisions. Goldman counts its shoppers’ property beneath supervision within the trillions of {dollars}, whereas being considerably of a extra secure enterprise construct round administration charges making it simpler to estimate income and earnings over prolonged durations of time, because it doesn’t rely on the enterprise cycle to the identical extent as, as an example, IPOs and M&A advisory.

- Asset Administration: The identify offers it away, the division the place Goldman manages someplace between $2 and $3 trillion on behalf of shoppers. Within the funding world, we regularly hear the time period “property beneath administration”, however within the case of Goldman, we speak about “property beneath supervision” which is an umbrella time period protecting AUM but in addition the truth that Goldman presents advisory companies with out being the precise supervisor of these property, therefore the time period property beneath supervision. This division makes up roughly 20%-25% of Goldman’s complete income seen over a time frame, and the earnings come by way of administration charges probably within the vary of twenty to thirty foundation factors contemplating measurement of pockets, and many others., with given shoppers. That is additionally a division the place Goldman historically, and this isn’t uncommon for funding banks, has leveraged its steadiness sheet and inhouse competencies to hold out offers for its personal profitability. This a part of the asset administration enterprise can also be the place fluctuations can seem, as Goldman can accumulate each positive aspects and losses from quarter to quarter. Nevertheless, this in-house enterprise isn’t a strategic precedence for Goldman, which means this a part of the enterprise will carry a decrease footprint over time.

- Shopper & Wealth Administration: Each the smallest and in addition most up-to-date division, I take into account it a consequence of Goldman having turn into a extra conventional financial institution, at the least by way of its beforehand talked about financial institution holding license, with administration seeing the chance inside such a division. Earlier than it sounds too principal avenue, it ought to be talked about that this division amongst different issues operates a excessive web value, an ultra-high web value personal banking and wealth administration providing. This division secures roughly 10%-15% of Goldman’s complete income and drives earnings by way of payment constructions.

When it comes to aggressive panorama, I’d summarise in a method that Goldman has grown bigger during the last decade whereas consolidating its place. From my perspective, Goldman sits on the centre of the worldwide monetary system and the necessity for company recommendation isn’t going wherever. Large has been getting greater relating to M&A, equities, fastened earnings and so value, additionally translating right into a rising income for Goldman. With a rising quantity of excessive net-worth people globally, Goldman ought to have alternative to develop its enterprise over time, maybe additionally strengthened by a rising client & wealth administration division.

Large is typically a danger for banking, particularly when considering again to 2007-2008 on the peak of the monetary disaster. Can we find yourself in one other world monetary meltdown at some point? Positive, we will, however can anyone single particular person predict a black swan occasion? No, I don’t imagine so. We are able to all make references to Dr. Michael Burry who predicted the meltdown, however forgive me, may even he predict a disaster two instances in a row? Anyway, the purpose being that regulators have pulled a whole lot of levers to safe ample quantities of liquidity in case of a troublesome market occasion that may’t be foreseen. As such, massive banks have on a large scale turn into much less uncovered to probably going belly-up as we noticed greater than a decade in the past.

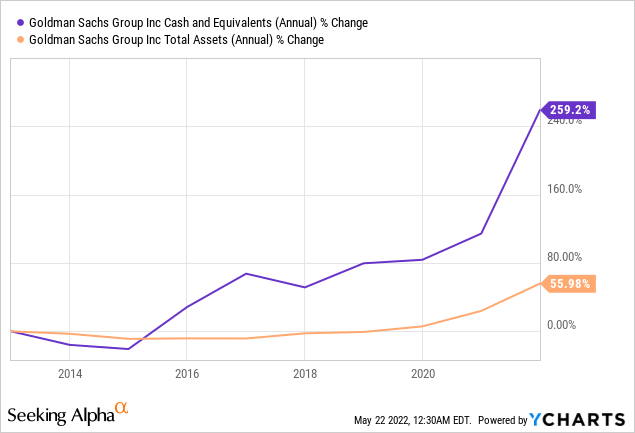

I imagine a good solution to showcase that is to match the event between Goldman’s steadiness sheet, which has grown to greater than $1.5 trillion by FY2021 after which the expansion in money and equivalents on the steadiness sheet which stood at above $260 billion by finish of FY2021. Each will be seen beneath in a percentage-based illustration.

Goldman’s Financials

When observing Goldman’s financials, it’s value going a bit again in time to This fall-2021 simply to grasp how beneficial the market has been for Goldman up till now.

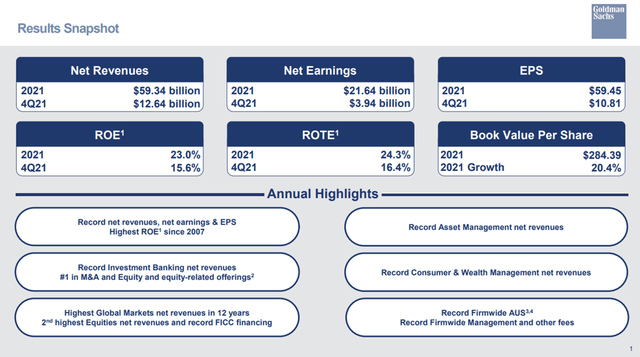

Goldman Sachs Traders Centre

The FY-2021 efficiency was revealed January 18th 2022, and if we take a look at the annual highlights, the phrase “file” seems in 5 out of six spotlight bins. As such, Goldman additionally secured its finest return on fairness since 2007, in different phrases, cash was pouring in. Goldman ended the yr with a web earnings of $21.6 billion up from $9.4 billion the yr earlier than, with the online earnings of $10.4 billion in 2018 being the perfect yr within the current decade. That was, till the FY2021 which in all methods was a really sturdy yr for Goldman.

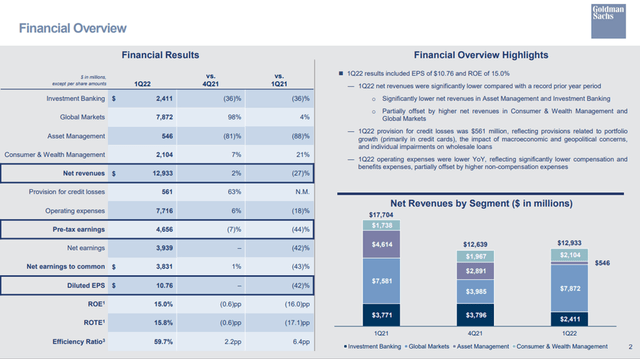

If we then transfer to current day, Q1-2022, we see a distinct image as YoY income was down 27%. Going into the Q1-2022 earnings, Goldman was naturally not anticipated to ship the identical astonishing efficiency because the yr prior, not least due to fairness market volatility and decreased M&A exercise, however by the straightforward proven fact that it’s harder for patrons and sellers to agree on an acceptable worth in an setting with important inflation and tightening rates of interest. The rate of interest setting naturally gives some carry to efficiency, however extra so within the path of your bread-and-butter retail banks.

Goldman Sachs Traders Centre

Having mentioned, regardless of being down by 27% YoY when measured on income, Goldman truly beat consensus income expectations by $1.17 billion being up 2% from This fall-2021. Equally, Goldman beat expectations for its earnings per share with $1.78 above expectations, a considerable beat. The annualised return on fairness was 15%, hitting the midpoint of Goldman’s personal mid-term expectations of delivering 14%-16%, with FY2021 ROE coming in at 23%, once more underlining how immaculate FY2021 was. Lastly, Goldman additionally delivered an effectivity ratio beneath 60%, which is the edge I want to see banks keep beneath.

The one disappointing division was asset administration, with chief monetary officer Denis Coleman saying the next in the course of the earnings name.

“Shifting to Asset Administration on web page six, first quarter revenues had been $546 million, materially decrease than the primary quarter of final yr as a result of market headwinds in fairness investments and lending and debt investments. Administration and different charges totaled $772 million, up 4% sequentially.

Web revenues for fairness investments had been unfavorable $360 our private and non-private portfolios, we skilled substantial losses tied to Russia-related positions, all of which have been written right down to 0. Extra broadly, we skilled further headwinds as a result of total market setting.

All in, we skilled roughly $620 million of web losses in our public portfolio, offset by roughly $255 million in web positive aspects throughout our personal portfolio, largely as a result of event-driven objects, together with asset gross sales and financing rounds.

We harvested $1 billion of on-balance sheet fairness investments within the first quarter. We stay absolutely dedicated to decreasing this portfolio over time and have line of sight on one other $1 billion of incremental personal asset gross sales comparable to roughly $750 million of capital discount.”

Chief Monetary Officer, Denis Coleman

All in all, Q1-2022 proved to be a very good quarter pushed by sturdy outcomes inside world markets and client wealth. If we stay up for the approaching quarters, Goldman will in all probability must depend on the diversification inside its portfolio, as we will count on IPO and M&A exercise to be low so long as the present market volatility and world uncertainty persists. As such, Goldman is anticipated to safe income of $11.95 billion for Q2-2022, which might be 22% beneath Q2-2021, which I already identified as being a really sturdy yr. Now we have to look in the direction of 2023 earlier than Goldman is as soon as once more anticipated to have the ability to beat its year-on-year comparability income sensible. Nevertheless, banks are cyclical, so fluctuations aren’t uncommon.

For FY2022, Goldman is anticipated to gather a web earnings of roughly $13.5 billion, slowly trending upwards in the direction of FY2024 the place present expectations are a web earnings of $14.4 billion. Estimating financial institution earnings even a few years into the long run is fickle enterprise, nonetheless, having beforehand identified of a web earnings of $10.4 again billion in 2018 was the perfect within the current decade outdoors of FY2021, indicating that Goldman is anticipated to proceed delivering earnings development over time.

Valuation

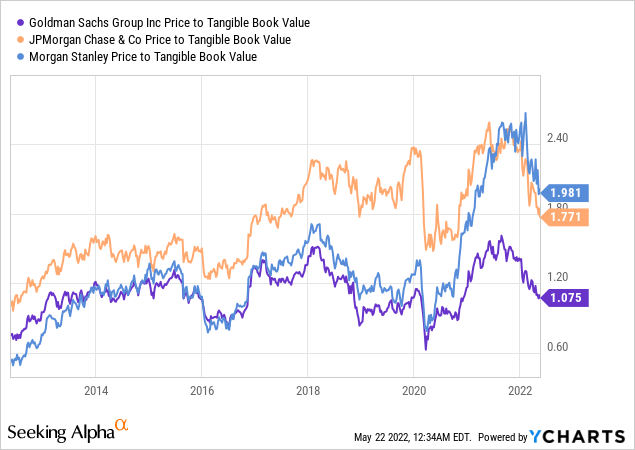

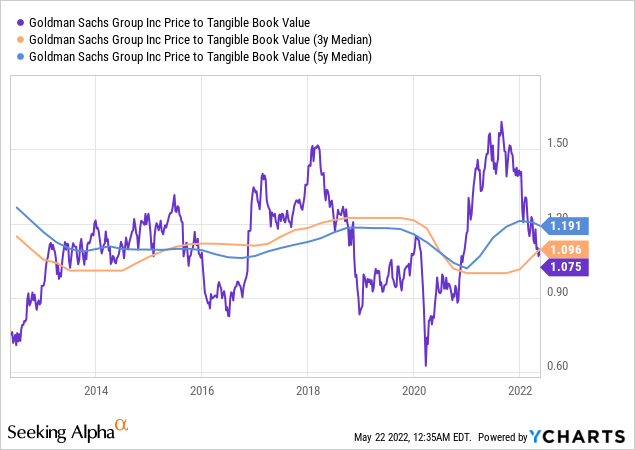

After we take a look at financial institution shares, we at all times must understand that particularly earnings can fluctuate, which makes the standard P/E multiples mute. As an alternative, I take a look at worth to ebook or worth to tangible-book-value. P/TBV is advantageous because it solely contains property equivalent to property, money in addition to the loans in its portfolio, which is in distinction to P/B that additionally contains intangible property equivalent to patents, model identify and goodwill. Stripping away these property, we focus solely on the tangible property which drive a financial institution’s earnings.

We want one thing to match Goldman to, and I’ve determined to incorporate Morgan Stanley and JPMorgan Chase (JPM) and only for the sake of it, if we did evaluate the three on ahead P/E, Goldman stands at 8.1, Morgan Stanley at 10.5 and JPMorgan Chase at 10.5. As I discussed, P/E isn’t my most popular device to gauge the valuation of a financial institution and particularly not in a time the place we face an unsure financial setting, nonetheless, these valuations wouldn’t instantly recommend overpricing territory. We must always nonetheless simply understand that earnings of banks can collapse throughout a recession, one thing we aren’t certain is looming within the horizon as this very lengthy bull market might come to its finish.

Above, you’ll discover the P/TBV comparability for the three aforementioned banks, and at a primary look, Goldman seems to be the extra enticing. Morgan Stanley and JPMorgan Chase are, after all, totally different establishments, with a distinct steadiness sheet and focus, but in addition appreciable titans inside funding banking, and usually a worth to tangible-book-value round 1 doesn’t scare me for a high-quality monetary establishment like Goldman. In Europe, we’ve gotten used to with the ability to choose up banks for beneath 1 in ebook worth, which means we get hold of their property at a reduction, however that has not been the custom for American banks as there hasn’t been the identical instability within the banking sector as we’ve seen in Europe in the course of the 2010s. Paying above 1 for P/B, and we pay a premium, and given the volatility of banks, I don’t personally like having to pay effectively above 1.0, however Goldman hovering round 1.0 is enticing in my eyes.

If we zoom in on Goldman, we see the present P/TBV is on level with each the 3y and 5y median.

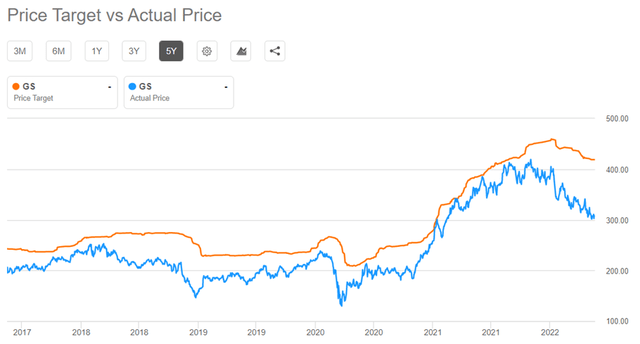

Observing the consensus Wall Road worth goal for Goldman, it has been down trending a bit for the reason that starting of 2022 the place it stood at just under $460 per share along side the altering outlook for a few of Goldman’s core companies as already talked about, which means the consensus goal as we speak stands at $418 per share. Ought to the financial situations proceed to worsen, that concentrate on could possibly be lowered fairly a bit, pushing the inventory worth downwards, which as we speak stands at round $306 per share. Nevertheless, it doesn’t take a lot for Goldman to dip beneath P/TBV 1.0, and will it go beneath 0.9, Goldman would begin to turn into a really apparent purchase compared to its historic valuation. Nevertheless, even right here, at P/TBV 1.0, Goldman seems to be a good purchase.

Searching for Alpha

What justifies an increasing worth goal is of course the truth that Goldman has managed to raise its web earnings seen over the previous decade, whereas additionally on course to realize a web earnings above that of FY2020 with the stellar FY2021 thought of an outlier. Additional, that Goldman is anticipated to proceed to keep up and increase this subsequent step of its web earnings staircase. Once more, I simply must level out that there’s a danger tied to that outlook altering on the short-term in reference to the worldwide financial outlook, the place we simply don’t have readability. As laid out earlier, Goldman has a robust place in its area of interest, and it has strengthened that place within the final decade, and as such I count on that Goldman certainly can preserve these revenue ranges over the mid- to long-term.

How Can An Investor Strategy The Alternative?

We are able to’t deny the truth that we don’t know if we’re staring into a big storm by way of the financial outlook. Many economies are sustaining their GDP outlook for 2022, however we’re seeing client sentiment dropping, with retailers like Goal (TGT) and Walmart (WMT) disappointing massively as customers are beginning to swap to extra financial choices. A scenario the place financial sentiment worsens is rarely advantageous for banks, be it a retailer or funding financial institution.

In my very own portfolio, I’ve an allocation for financials, and I already maintain Royal Financial institution of Canada (RY), a financial-do-it-all firm catering to shoppers throughout retail, company, funding and so forth. I used to be lucky to choose it up in the course of the market turmoil associated to Covid-19, and Goldman proper now isn’t a steal because it was again in the identical interval, as additionally evident by its P/TBV at 0.6 throughout that crash. Subsequently, combining the present market uncertainty and the truth that Goldman is enticing at this level, I might probably dollar-cost-average my method into the inventory by initiating a place, after which construct it all through the subsequent 6-12 months as we get extra readability on the financial outlook globally.

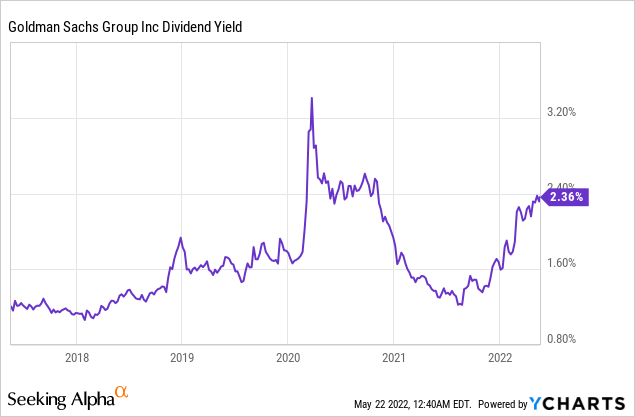

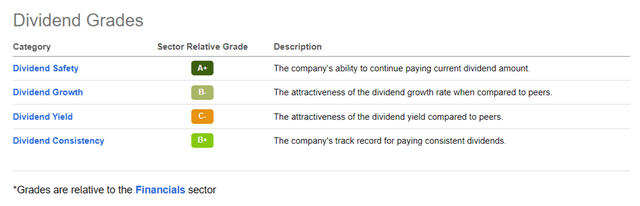

Moreover, selecting up Goldman now would traditionally be fascinating when contemplating the present dividend yield, coming in at 2.6% in a ahead perspective, effectively above the historic common. Nevertheless, beware, dividends are sometimes slashed throughout recessions, and Goldman solely holds a 5-year rising dividend streak as of as we speak. To that story goes that the present dividend is effectively lined, additionally receiving a reasonably sturdy total rating for its dividend in comparison with friends. Nevertheless, if the dividend is the primary focal point, it ought to be famous that Goldman is persistently traded with a decrease dividend than as an example Morgan Stanley, JPMorgan Chase and different banks as additionally evident from the dividend grading device.

Searching for Alpha

Conclusion

Goldman trades 27.6% off its most up-to-date excessive and is down 22.4% YTD which has resulted within the inventory having turn into fascinating. Goldman had a surprising FY2021 inflicting the valuation to bloat and whereas FY2021 is to not be replicated as danger urge for food peaked in world markets, Goldman nonetheless delivered a robust Q1-2022 and is on monitor to a different passable yr, having to date delivered by itself key metrics together with return on fairness and effectivity ratio. The inventory is presently buying and selling at worth to tangible-book-value simply above 1, which is just under the 3-year and 5-year median and beneath that of friends Morgan Stanley and JPMorgan Chase. Sitting on the centre of the worldwide monetary system with a robust market place inside its key segments, there’s little to recommend Goldman received’t be churning out sturdy income over the long-term. When it comes to the financial cycle, it’s unsure if the worldwide volatility YTD will choose up with continued sturdy inflation and rising rates of interest, which dampens curiosity for among the actions driving income for Goldman and its friends. This means that potential traders might take into account dollar-cost-averaging if they’re to provoke a place, as to mitigate the doubtless worsening market situations for funding banks basically within the yr to come back. Taking the unsure market situations into consideration, Goldman must development additional downwards for it to be thought of a robust purchase. Ought to Goldman attain worth to tangible-book-value 0.9, it will traditionally point out a robust alternative to go lengthy the inventory.

[ad_2]

Source link