[ad_1]

It’s laborious to study this idea for the primary time. However uninterrupted compound curiosity can flip small accounts into life-changing quantities. With a easy plan and sufficient time, anybody can turn into rich.

With the reason and examples under, you’ll see how compound curiosity works. And why it’s greatest to go away uninterrupted. However not solely that, you’ll get some perception from a number of the world’s best thinkers and buyers. By following their lead, you’ll be able to enhance your returns…

What Is Uninterrupted Compound Curiosity?

The ability of compound curiosity comes from reinvesting. Or extra so, merely staying invested. Let’s take a fast take a look at this desk that reveals how curiosity compounds…

| 12 months | Begin | Curiosity | Finish |

| 1 | $100 | $10 | $110 |

| 2 | $110 | $11 | $121 |

| 3 | $121 | $12.10 | $133.10 |

This reveals how $100 grows at 10% annually. Within the first 12 months, you begin with $100 and obtain $10 in curiosity ($100 x 10%). That then provides you $110 to start out with in 12 months two…

Then a ten% return on $110 provides you $11 in curiosity within the second 12 months. Every year, this continues and the curiosity grows. That’s assuming you let the uninterrupted compound curiosity proceed to be just right for you. Some folks take it out early and this lowers long-term returns.

It doesn’t quantity to large numbers within the short-term, however the additional out in time you go, the bigger it turns into. Right here’s the identical instance that reveals years 30, 40 and 50…

| 12 months | Begin | Curiosity | Finish |

| 30 | $1,586 | $159 | $1,745 |

| 40 | $4,114 | $411 | $4,526 |

| 50 | $10,672 | $1,067 | $11,739 |

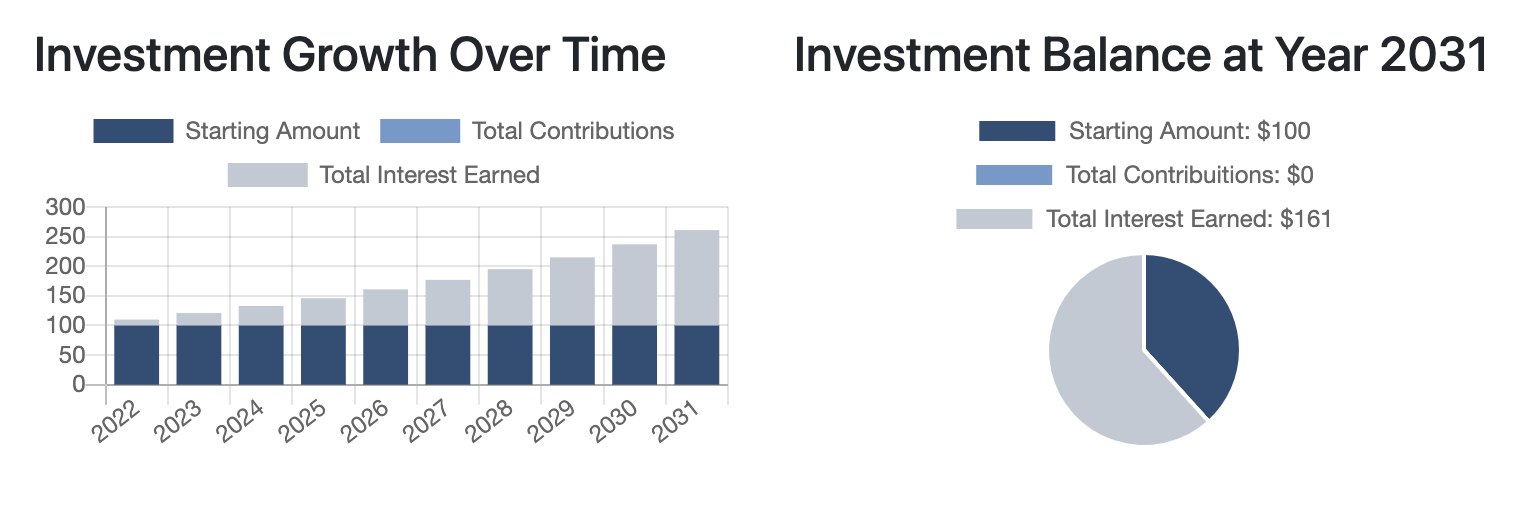

These are some strong returns! Be at liberty to take a look at this free dividend calculator and right here’s an funding calculator as properly. You may strive a number of examples to see how your funding accounts can develop. For instance, right here’s a screenshot of this similar funding instance out to 10 years…

Greatest Compound Curiosity Quotes

The world’s greatest buyers know the facility of compound curiosity. To start out, right here’s a quote from Warren Buffett…

My life has been a product of compound curiosity.

If Warren Buffett stopped investing when he was 50 years outdated, not many individuals would know his title at this time. That’s as a result of 99% of his wealth got here after his fiftieth birthday. Because of the facility of compounding, his later years in life are seeing a lot increased returns. This isn’t as a result of annual proportion returns are increased. As an alternative, it’s the change in complete {dollars} as his portfolio grows.

And right here’s some knowledge from Charlie Munger…

The primary rule of compounding is to by no means interrupt it unnecessarily.

If you happen to can comply with this easy rule, you’ll be able to develop you portfolio to new highs. And going one step additional, compound curiosity isn’t simply restricted to investing. This final quote is usually attributed to Albert Einstein…

Compound curiosity is the eighth surprise of the world. He who understands it, earns it… he who doesn’t… pays it.

We are inclined to suppose linearly however many issues in our world transfer exponentially. However I digress, let’s take a look at one final necessary piece to compounding…

Discovering the Greatest Uninterrupted Returns

With the quotes and examples above, you see the facility of uninterrupted compound curiosity over a few years. Though, one problem is discovering the most effective investments…

There are lots of property to select from. For instance, you’ve gotten commodities, actual property, cryptos, shares and plenty of extra. Though, over the long-term, simply one in every of these property tends to outperform the others…

Shares have returned roughly 8-12% yearly. There’s loads of volatility in any given 12 months, or perhaps a few years. However long-term, these common annual returns beat out different property.

On prime of that, you should buy the most effective shares with zero transaction charges at this time and don’t need to put in any further work. Actual property, then again, comes with hefty charges, upkeep, insurance coverage, taxes, and so forth. And for one more comparability, commodities like gold don’t produce any ongoing worth comparable to dividends. Gold is barely price what the subsequent individual is prepared to pay for it.

After all, every asset class has some distinctive advantages and it may be good to diversify. Though, most of the world’s greatest buyers give attention to shares and play the long-game. As you’ve now seen, uninterrupted compound curiosity is an attractive factor.

If you happen to’re searching for a number of the greatest funding alternatives, try these free funding newsletters. They’re full of perception from investing consultants. And as at all times, it’s good to proceed exploring many funding concepts. Through the years, you’ll join extra dots and it may possibly result in even higher returns.

Brian Kehm double majored in finance and accounting at Iowa State College. After graduating, he went to work for a cryptocurrency firm in Beijing. Upon returning to the U.S., he began working with monetary publishers and in addition handed the CFA exams. When Brian isn’t researching and sharing concepts on-line, you’ll be able to normally discover him mountain climbing or exploring the good open air.

[ad_2]

Source link