Bitstamp‘s newest Crypto Pulse survey confirmed that the overwhelming majority of cryptocurrency traders imagine that crypto will see mainstream adoption inside the subsequent decade.

The information comes from a survey of over 28,000 respondents from 23 completely different international locations, together with 5,450 senior institutional funding technique decision-makers and greater than 23,000 retail traders.

Regardless of the huge variations between the respondents, the overwhelming majority appear to agree that the crypto market is but to see its heyday.

Crypto is certain to overhaul conventional funding autos, traders agree

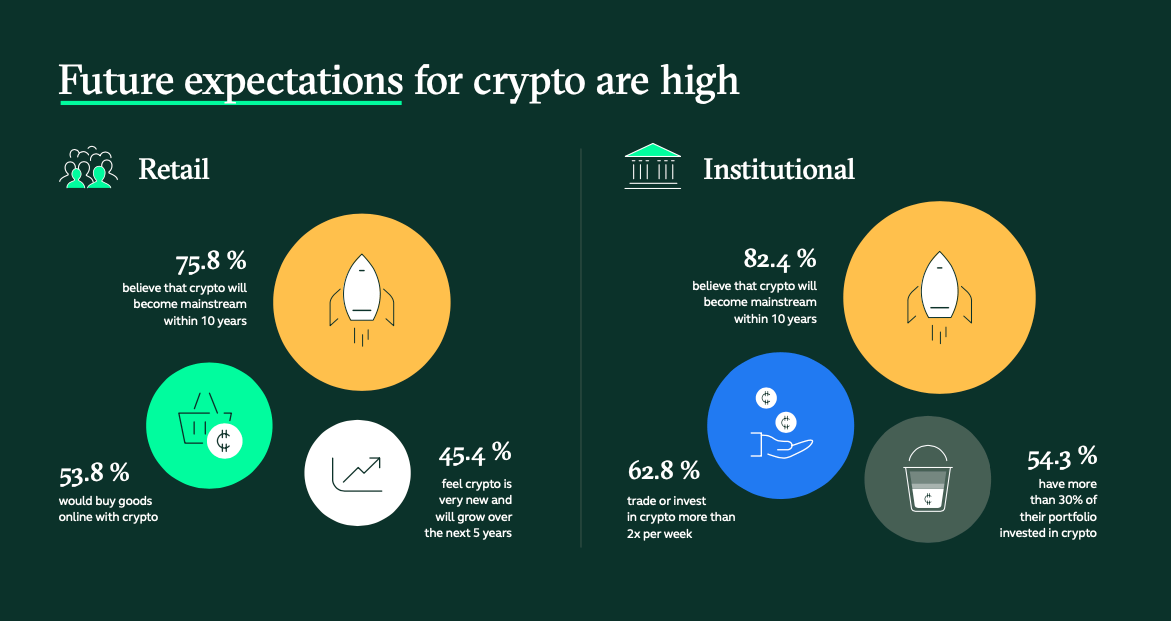

In line with Bitstamp‘s intensive survey, 88% of institutional traders and 75% of retail traders imagine that cryptocurrencies will see mainstream adoption inside a decade. An extra 80% of institutional traders mentioned that cryptocurrencies are set to overhaul conventional funding autos resembling shares and bonds.

Having such numerous institutional traders notice the potential of cryptocurrencies paints a bullish image for the way forward for the crypto trade.

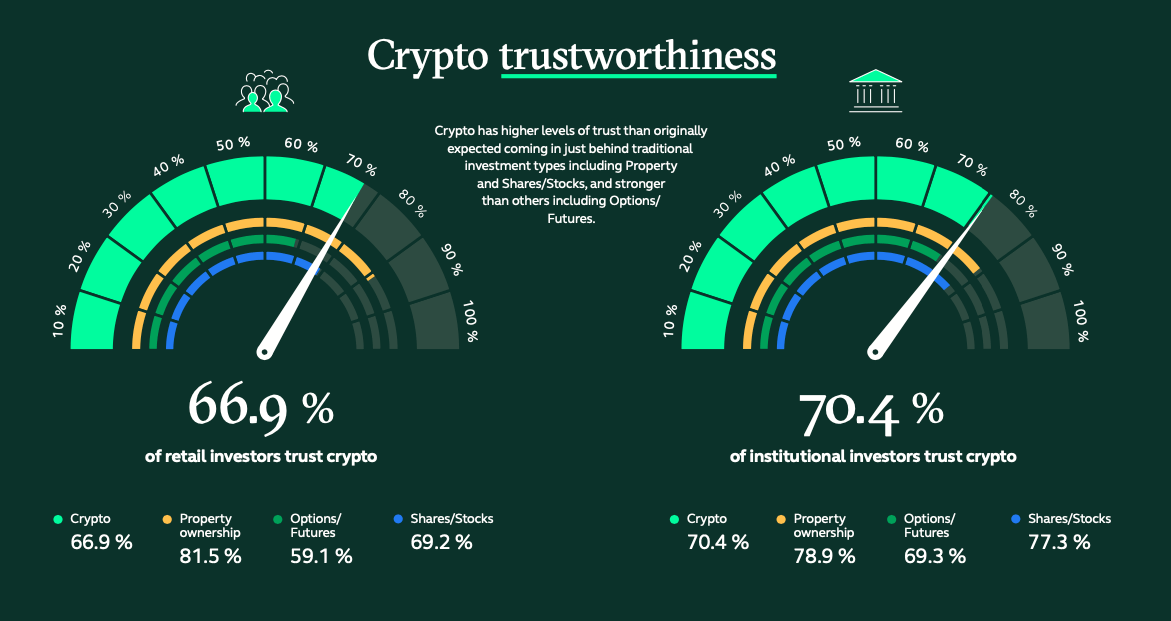

Retail traders, nonetheless, have been much less satisfied that cryptocurrencies would overtake conventional investments, with solely 54% agreeing. Retail traders additionally had much less belief in cryptocurrencies as an asset class—whereas 71% of funding professionals said they trusted crypto, solely 65% of retail traders agreed with the assertion.

Institutional traders have been additionally extra prone to suggest cryptocurrencies as an funding technique to their clients and corporations.

Julian Sawyer, the CEO of Bitstamp, advised CryptoSlate that the adoption of cryptocurrencies and different digital belongings was advancing at an unprecedented fee, which was evident within the survey’s findings.

“In the previous few years, cryptocurrencies have moved from the outskirts of the monetary ecosystem to search out themselves entrance and heart of mainstream investing, with most of the largest buying and selling venues on this planet now catering to each retail and institutional crypto wants,” he defined.

The rising recognition cryptocurrencies are seeing within the institutional world doesn’t imply that the asset class is universally supported. As a relative toddler in comparison with conventional belongings, cryptocurrencies are trusted lower than property possession, shares, and shares.

One other main barrier to crypto funding is an absence of belief in regulation. In line with the survey, almost half of retail traders and greater than a 3rd of institutional traders see cryptocurrencies as “unregulated.” Bitstamp mentioned that this demonstrates a urgent want for stronger regulation, which can enhance investor belief in crypto.

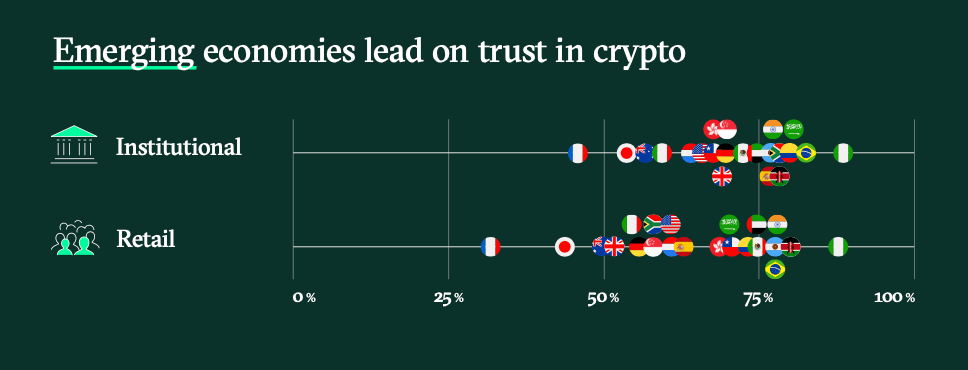

Then again, Bitstamp’s survey discovered that there’s no lack of belief in cryptocurrencies within the growing world. Belief at a worldwide degree in cryptocurrencies is primarily pushed by growing international locations the place the general belief within the conventional monetary system is low. In rising economies, 79% of respondents mentioned that cryptocurrencies have been extra reliable than the standard monetary system. It is a notable enhance from the 69% of respondents coming from developed monetary markets.

“We’ve seen curiosity propel within the years for the reason that pandemic, and crypto is now a part of the broader dialog in international macro-economic issues. Our survey exhibits one thing we have now advocated over a very long time: speaking about survival of digital belongings is firmly over — the query is now about evolution,” Sawyer advised CryptoSlate.