[ad_1]

By Graham Summers, MBA

As I mentioned on Monday, the Great Currency Wars have begun.

Japan is about to intervene directly in their currency markets. And why wouldn’t they… Japan imports most of its energy and food… and its currency is at a 24 year LOW due to inflation (as well as differentials between its monetary policy and that of the U.S. and E.U.).

In simple terms, one of the MAJOR currencies of the world is now trading like an emerging market currency.

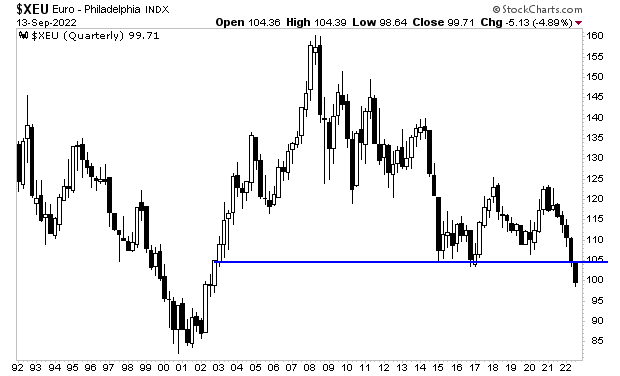

The Euro isn’t far behind either. It’s at a 20-year low. Things are so out of control there that the ECB just raised rates by the most in history: a 0.75% rate hike. This barely made a blip in the Euro’s chart as it continues to collapse.

And guess what… all these currency interventions are inevitably going to result in central banks printing more money.

After all, that’s all they can do. They can’t print oil, or workers, or any of the other things that the economy needs.

Which means… inflation is only going to get worse.

[ad_2]

Source link