From Goldmoney Insights:

Tragic although the scenario in Ukraine has turn out to be, the actual struggle which began out as monetary in character a while in the past has now turn out to be each monetary and about commodities. Putin made an enormous mistake invading Ukraine however the West’s response by in search of to isolate Russia and its commodity exports from the worldwide market is a good higher one.

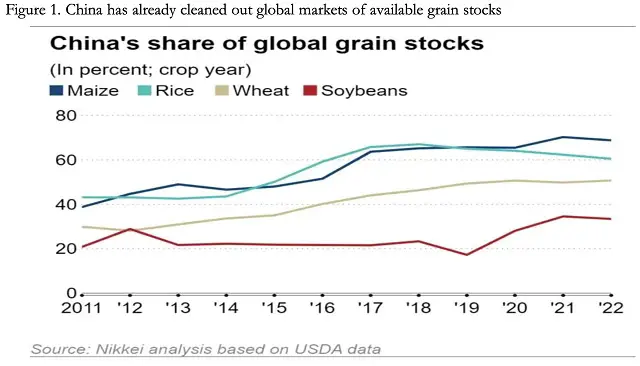

Moreover, with Ukraine being Europe’s breadbasket and a serious exporter of fertiliser, this summer time will deliver acute meals shortages, worsened by China having already collected the majority of the world’s grains for its personal inhabitants. Inflation measured by shopper costs has solely simply commenced an accelerated rise.

As a result of they low cost falling buying energy for currencies, rising rates of interest, and collapsing bond costs at the moment are inevitable. Being loaded up with bonds and monetary belongings as collateral, the results for the worldwide banking system are so vital that it’s just about unattainable to see the way it can survive. And if the banking system faces collapse, being unbacked by something aside from quickly disappearing religion in them fiat currencies will fail as effectively.

Unexpected monetary and financial penalties

Again within the Nineteen Sixties, Harold Wilson as an embattled British Prime Minister declared {that a} week is a very long time in politics. At present, we are able to additionally remark it’s a very long time in commodity markets, inventory markets, geopolitics, and nearly anything we care to think about. The rapidity of change will not be captured in simply seven calendar days, however in latest weeks we’ve seen the preliminary pricking of the fiat forex bubble and all that floats with it.

That is turning out to be an excessive monetary occasion. The background to it’s unwinding of financial distortions. By means of a mixture of forex and credit score growth and market suppression, the distinction between state-controlled pricing and market actuality has by no means been higher. Zero and detrimental rates of interest, deeply detrimental actual bond yields, and a deliberate coverage of synthetic wealth creation by fostering a monetary asset bubble to divert consideration from a deepening financial disaster in recent times have all contributed to the hole between bullish expectations and market actuality.

At present, nearly nobody thinks that our blessèd central banks and their governments can fail, not to mention lose management over markets. And in case you stroll like a Keynesian, discuss like a Keynesian you’re a Keynesian. Everybody does — even the gait of mathematical monetarists is indistinguishable from them of their help of inflationism. And Keynesians imagine within the state idea of all the things, despising markets and now fearing their actuality.

This week sees rising considerations that American-led makes an attempt to kick Putin’s ass comes with penalties. Put to at least one aspect the destruction wreaked on the Ukrainian individuals as the 2 main navy nations wage yet one more proxy struggle. This one is in Europe’s breadbasket, driving wheat costs over 50% increased to this point this 12 months. Having laid waste over successive Arab nations since Saddam Hussein invaded Kuwait in 1990, the individuals who have survived American-led wars within the Center East and North Africa and never emigrated as refugees at the moment are going to face hunger.

Fuelled by the growth of forex and credit score, it isn’t simply wheat costs that are hovering. Different foodstuffs are as effectively. And we study by way of numerous sources that the Chinese language have been prescient sufficient to stockpile huge portions of grains and different comestible supplies to guard their residents from a summer time meals disaster. Twenty per cent of the world’s inhabitants has secured greater than half the globe’s maize and different grains (Nikkei Asia, 23 December – see Determine 1). And that was two months earlier than Putin ordered the invasion of Ukraine, which has made the place over world meals provides even worse. And China’s dominant place in maize will hit sub-Saharan Africa particularly exhausting, whereas world shortages of rice will hit Southern and East Asian nations.

All we want now’s crop failures. Talking of which, fertiliser shortages, exacerbated by the Ukraine struggle and excessive fuel costs, are sure to have an effect on world meals manufacturing adversely for this 12 months’s harvest. And effectively finished to our elected Leaders for imposing sanctions on Russian exports of fertiliser, which added to China’s conservation of its provides will guarantee our poor, and everybody else’s poor, face hovering meals costs and even hunger in 2022.

But, few appear conscious of this creating disaster. Whereas Ukraine is an apparent issue driving up meals and vitality costs, the foundation trigger has been and can proceed to be financial insurance policies driving the main currencies. Historical past is affected by examples of forex debasement resulting in a meals disaster and civil unrest: the Emperor Diocletian’s edict controlling costs in 301AD; coin debasement resulting in hovering meals costs in 1124AD on the time of England’s Henry I; the collapse of John Legislation’s livre in 1720 France, to call however just a few.

From the greenback because the reserve forex, to euros, yen, kilos, and the remaining, all of them have been debased in what was once known as the civilised world. And an understanding of cash and the empirical proof each level to a consequential meals disaster this summer time.

Learn the remainder of this (for much longer) article right here.

402 views