Up to date on April eighth, 2022 by Bob Ciura

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

The downloadable Dividend Kings Spreadsheet Checklist beneath incorporates the next for every inventory within the index amongst different necessary investing metrics:

- Payout ratio

- Dividend yield

- Worth-to-earnings ratio

You possibly can see the complete downloadable spreadsheet of all 40 Dividend Kings (together with necessary monetary metrics similar to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

We usually rank shares primarily based on their five-year anticipated annual returns, as said within the Certain Evaluation Analysis Database.

However for traders primarily desirous about earnings, it is usually helpful to rank the Dividend Kings based on their dividend yields.

This text will rank the 20 highest-yielding Dividend Kings at the moment.

Desk of Contents

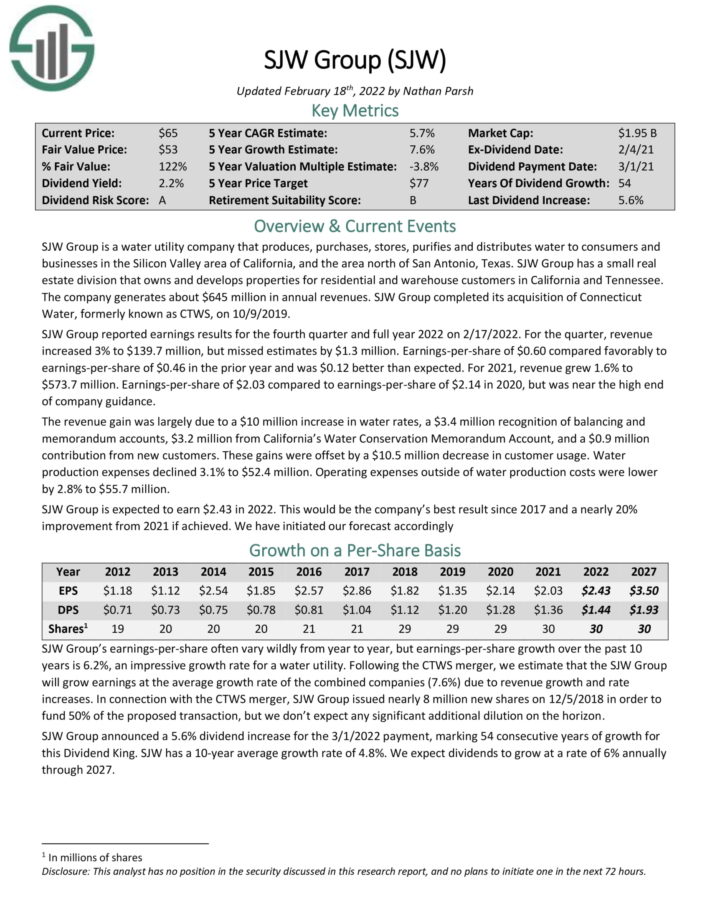

Excessive Yield Dividend King #20: SJW Group (SJW)

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, and the realm north of San Antonio, Texas. SJW Group has a small actual property division that owns and develops properties for residential and warehouse prospects in California and Tennessee. The corporate generates about $645 million in annual revenues.

Supply: Investor Presentation

SJW Group reported earnings outcomes for the fourth quarter and full yr 2022 on 2/17/2022. For the quarter, revenue elevated 3% to $139.7 million, however missed estimates by $1.3 million. Earnings-per-share of $0.60 in contrast favorably to $0.46 within the prior yr and was $0.12 higher than anticipated. For 2021, income grew 1.6% to $573.7 million. EPS of $2.03 compared to $2.14 in 2020, however was close to the excessive finish of firm steering.

Click on right here to obtain our most up-to-date Certain Evaluation report on SJW Group (preview of web page 1 of three proven beneath):

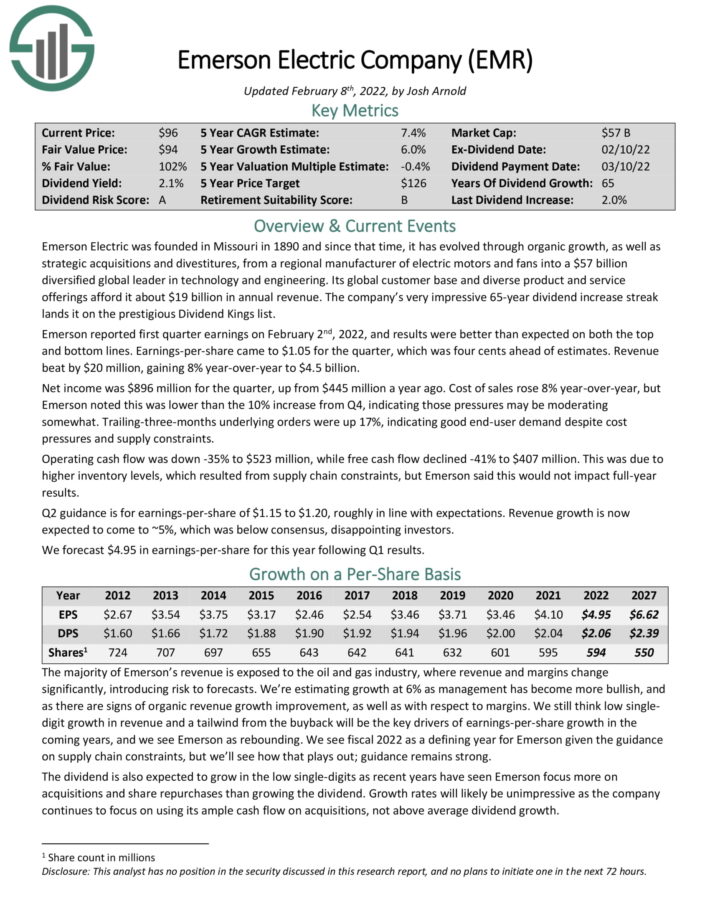

Excessive Yield Dividend King #19: Emerson Electrical Co. (EMR)

Emerson Electrical is a perfect candidate for a no-fee DRIP program, as the corporate has elevated its dividend for over 60 years in a row. Emerson Electrical was based in Missouri in 1890. At the moment, it generates $18+ billion in annual income.

Emerson is organized into two main reporting segments referred to as Automation Options and Industrial & Residential Options. Automation Options helps producers decrease vitality utilization, waste, and different prices of their processes. The Industrial & Residential Options section makes merchandise that shield meals high quality and security, in addition to increase effectivity within the manufacturing course of.

Emerson reported first quarter earnings on February 2nd, 2022, and outcomes have been higher than anticipated on each the highest and backside traces. EPS got here to $1.05 for the quarter, which was 4 cents forward of estimates. Income beat by $20 million, gaining 8% year-over-year to $4.5 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on Emerson Electrical (preview of web page 1 of three proven beneath):

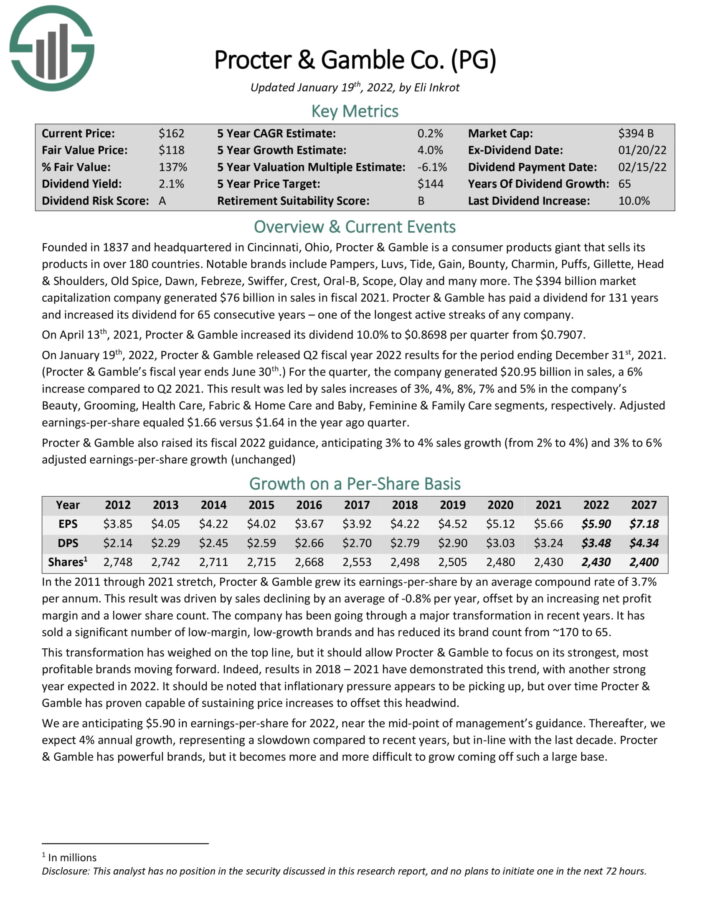

Excessive Yield Dividend King #18: Procter & Gamble Co. (PG)

Based in 1837 and headquartered in Cincinnati, Ohio, Procter & Gamble is a shopper merchandise big that sells its merchandise in over 180 nations. Notable manufacturers embody Pampers, Luvs, Tide, Achieve, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Outdated Spice, Daybreak, Febreze, Swiffer, Crest, Oral–B, Scope, Olay and plenty of extra. The firm generated $76 billion in gross sales in fiscal 2021.

Procter & Gamble has paid a dividend for 131 years and elevated its dividend for six5 consecutive years, which is one of many longest energetic streaks of any firm. On April 13th, 2021, Procter & Gamble elevated its dividend 10.0% to $0.8698 per quarter from $0.7907.

On January 19th, 2022, Procter & Gamble launched Q2 fiscal yr 2022 outcomes for the interval ending December 31st, 2021.

For the quarter, the corporate generated $20.95 billion in gross sales, a 6% enhance in comparison with Q2 2021. This end result was led by gross sales will increase of 3%, 4%, 8%, 7% and 5% in the corporate’s Magnificence, Grooming, Well being Care, Cloth & Residence Care and Child, Female & Household Care segments, respectively. Adjusted EPS equaled $1.66 versus $1.64 within the yr in the past quarter.

Procter & Gamble additionally raised its fiscal 2022 steering, anticipating 3% to 4% gross sales development (from 2% to 4%) and three% to six% adjusted earnings–per–share development.

Click on right here to obtain our most up-to-date Certain Evaluation report on PG (preview of web page 1 of three proven beneath):

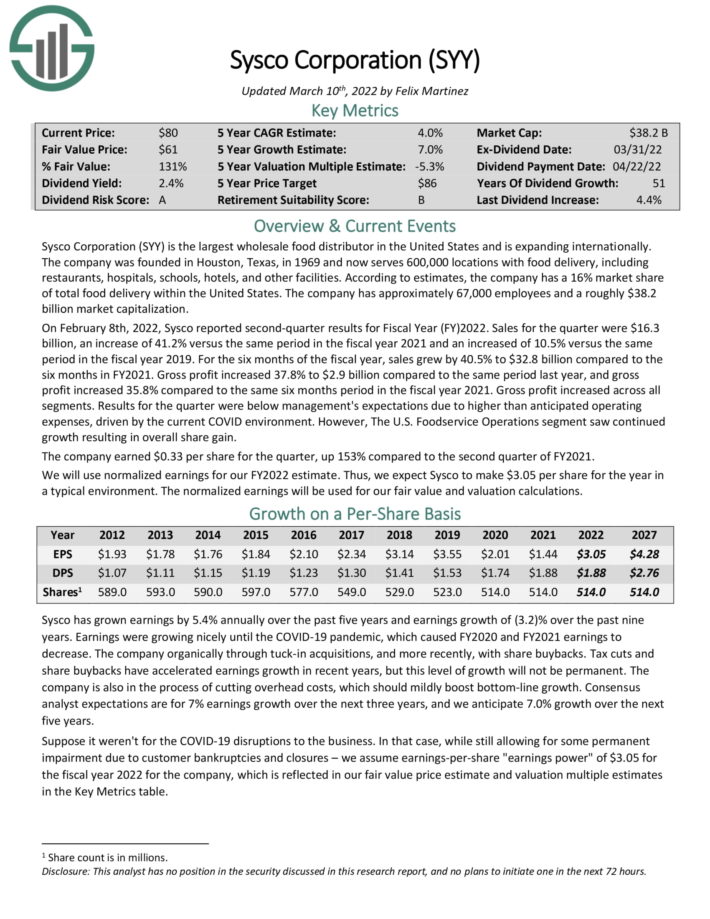

Excessive Yield Dividend King #17: Sysco Corp. (SYY)

Sysco Company is the biggest wholesale meals distributor in america and is increasing internationally. The firm was based in Houston, Texas, in 1969 and now serves 600,000 places with meals supply, together with eating places, hospitals, faculties, resorts, and different amenities.

Because of its management place within the meals distribution trade, Sysco advantages from scale.

Supply: Investor Presentation

On February 8th, 2022, Sysco reported second–quarter outcomes for Fiscal Yr (FY) 2022. Gross sales for the quarter have been $16.3 billion, a rise of 41.2% versus the identical interval in the fiscal yr 2021 and an elevated of 10.5% versus the identical interval in the fiscal yr 2019. For the six months of the fiscal yr, gross sales grew by 40.5% to $32.8 billion in comparison with the six months in FY2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sysco (preview of web page 1 of three proven beneath):

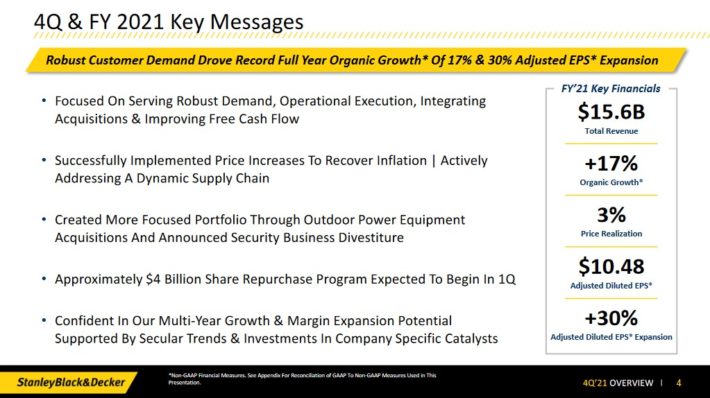

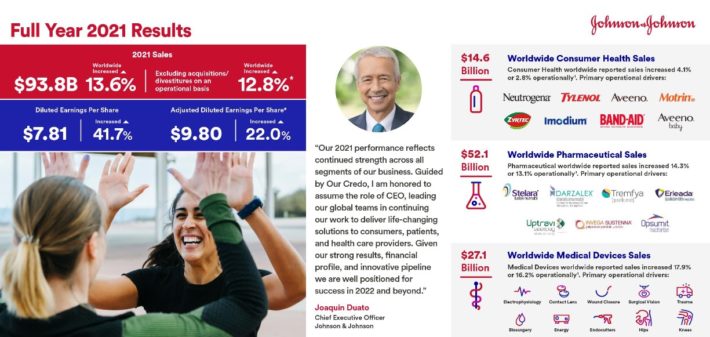

Excessive Yield Dividend King #16: Stanley Black & Decker (SWK)

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest world place in instruments and storage gross sales. Stanley Black & Decker is second in the world within the areas of economic digital safety and engineered fastening.

You possibly can see an summary of the corporate’s 2021 fourth-quarter efficiency within the picture beneath:

Supply: Investor Presentation

Income grew 17% on an natural foundation. Adjusted earnings-per-share elevated 30% year-over-year.

The inventory has a 2.2% dividend yield, and we count on 8% annual EPS development. With a ~7% annual increase from an increasing P/E a number of, complete returns are anticipated to succeed in 17.2% per yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWK (preview of web page 1 of three proven beneath):

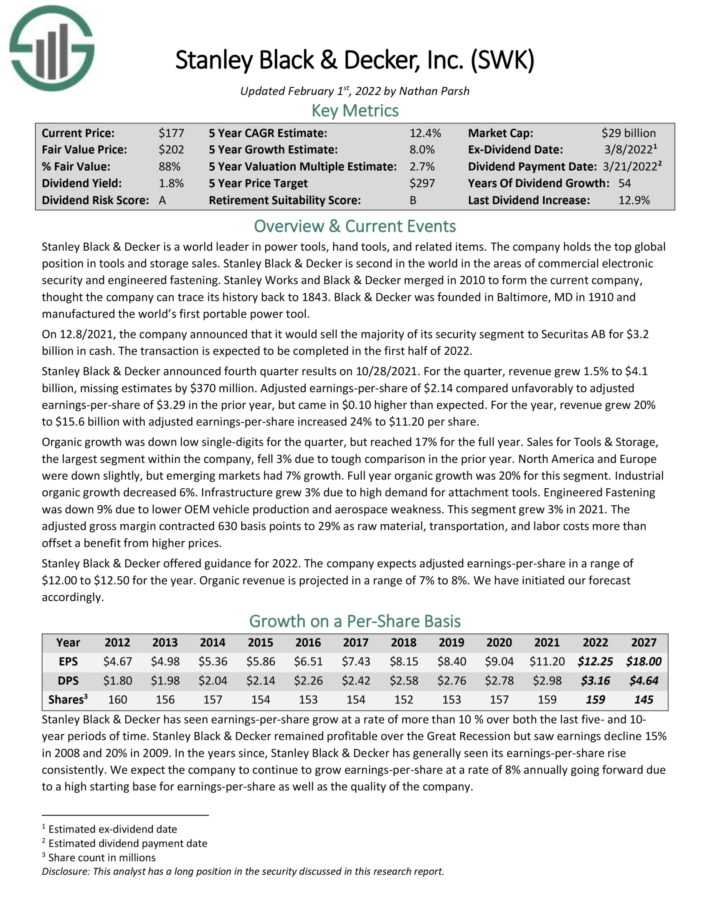

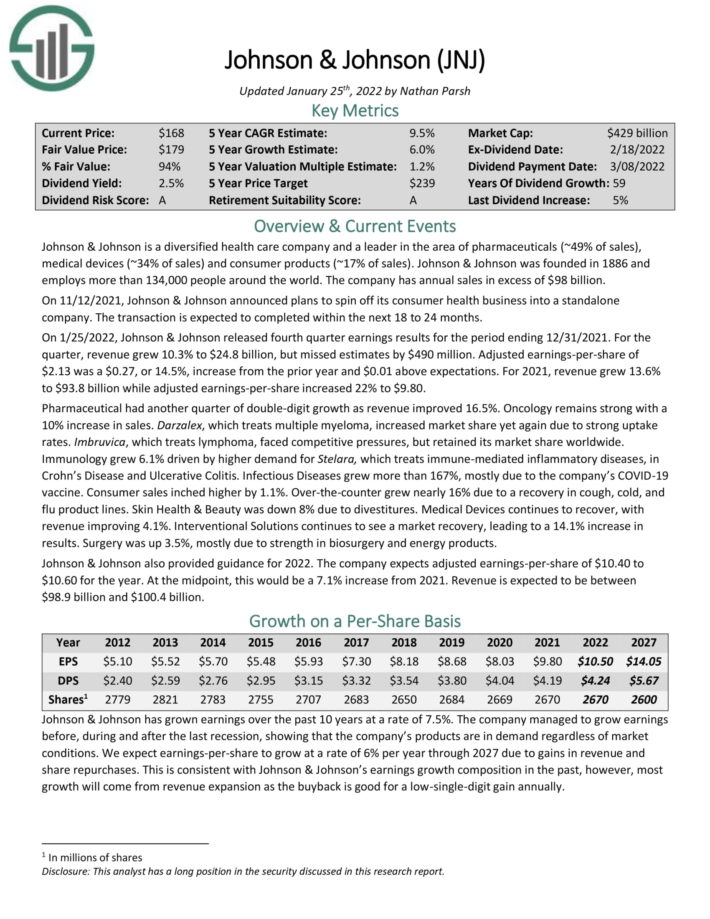

Excessive Yield Dividend King #15: Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified well being care firm and a frontrunner within the space of prescribed drugs (~49% of gross sales), medical units (~34% of gross sales) and shopper merchandise (~17% of gross sales). The corporate has annual gross sales in extra of $93 billion.

Supply: Investor Presentation

For 2021, income grew 13.6% to $93.8 billion whereas adjusted earnings–per–share elevated 22% to $9.80. Pharmaceutical had one other quarter of double–digit development as income improved 16.5%. Oncology remained robust with a 10% enhance in gross sales. Shopper gross sales inched greater by 1.1%. And Medical Units continued to get well, with

income enhancing 4.1%.

Johnson & Johnson additionally supplied steering for 2022. The corporate expects adjusted EPS of $10.40 to $10.60 for the yr. On the midpoint, this could be a 7.1% enhance from 2021. Income is anticipated to be between $98.9 billion and $100.4 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on J&J (preview of web page 1 of three proven beneath):

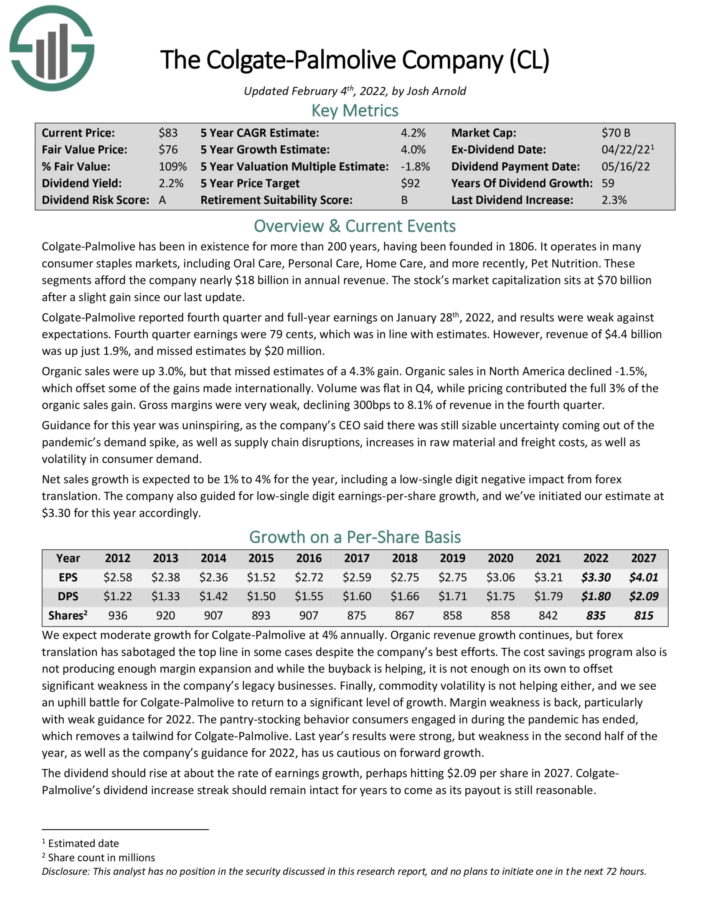

Excessive Yield Dividend King #14: Colgate-Palmolive Co. (CL)

Colgate-Palmolive has been in existence for greater than 200 years, having been based in 1806. It operates in lots of shopper staples markets, together with Oral Care, Private Care, Residence Care, and extra recently, Pet Diet. These segments afford the corporate practically $18 billion in annual income.

Colgate-Palmolive reported fourth quarter and full–yr earnings on January 28th, 2022, and outcomes have been weak towards expectations. Fourth quarter earnings have been 79 cents, which was in step with estimates. Nonetheless, income of $4.4 billion was up simply 1.9%, and missed estimates by $20 million.

Natural gross sales have been up 3.0%, however that missed estimates of a 4.3% acquire. Natural gross sales in North America declined 1.5%, which offset a few of the beneficial properties made internationally. Quantity was flat in This autumn, whereas pricing contributed the complete 3% of the natural gross sales acquire. Gross margins have been very weak, declining 300 foundation factors to eight.1% of income within the fourth quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on Colgate-Palmolive (preview of web page 1 of three proven beneath):

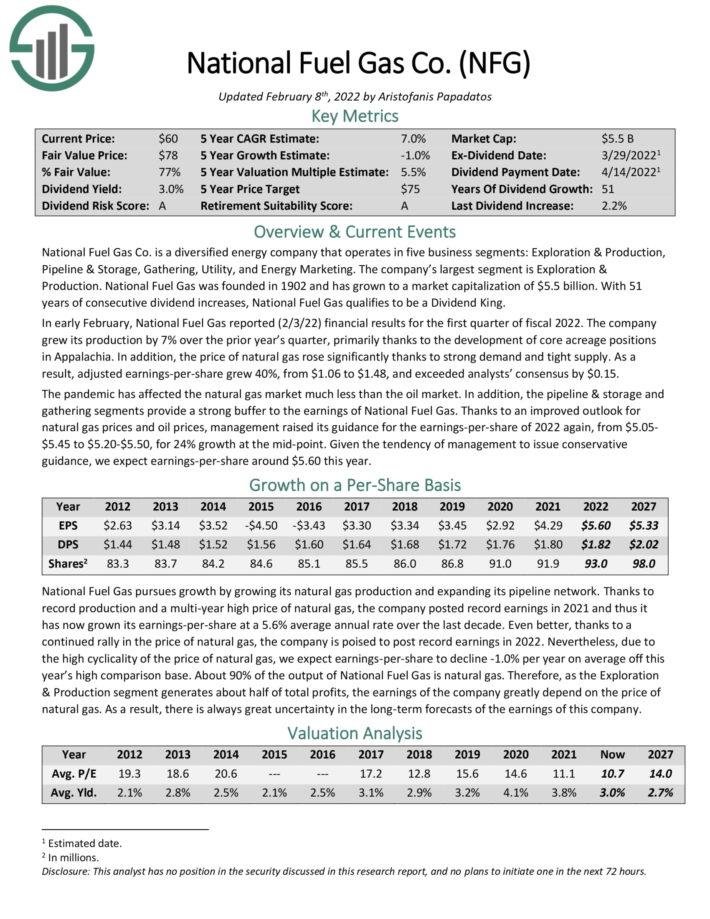

Excessive Yield Dividend King #13: Nationwide Gasoline Fuel Co. (NFG)

Nationwide Gasoline Fuel Co. is a diversified vitality firm that operates in 5 enterprise segments: Exploration & Manufacturing, Pipeline & Storage, Gathering, Utility, and Vitality Advertising and marketing. The corporate’s largest section is Exploration & Manufacturing.

In early February, National Gasoline Fuel reported (2/3/22) monetary outcomes for the first quarter of fiscal 2022. The corporate grew its manufacturing by 7% over the prior yr’s quarter, primarily thanks to the event of core acreage positions in Appalachia. As well as, the worth of pure gasoline rose considerably due to robust demand and tight provide. As a end result, adjusted EPS grew 40%, from $1.06 to $1.48.

Click on right here to obtain our most up-to-date Certain Evaluation report on NFG (preview of web page 1 of three proven beneath):

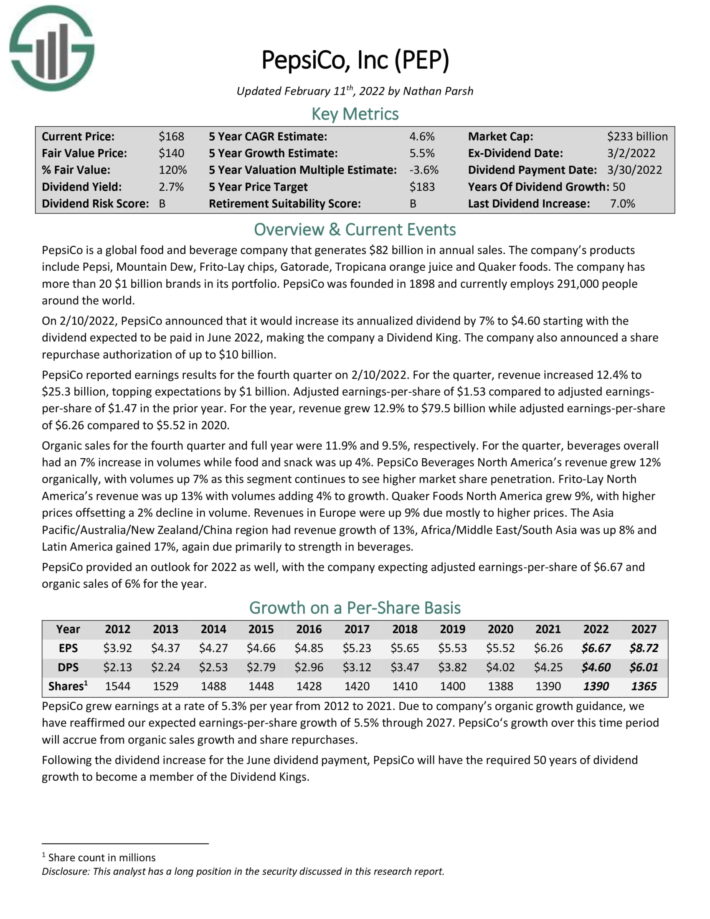

Excessive Yield Dividend King #12: PepsiCo Inc. (PEP)

PepsiCo is a worldwide meals and beverage firm that generates $82 billion in annual gross sales. The corporate’s manufacturers embody Pepsi, Mountain Dew, Frito–Lay chips, Gatorade, Tropicana orange juice and Quaker meals. The corporate has greater than 20 $1 billion manufacturers in its portfolio.

On 2/10/2022, PepsiCo introduced that it will enhance its annualized dividend by 7% to $4.60 beginning with the dividend anticipated to be paid in June 2022, making the corporate a Dividend King. The corporate additionally introduced a share repurchase authorization of as much as $10 billion.

PepsiCo reported earnings results for the fourth quarter on 2/10/2022. For the quarter, revenue elevated 12.4% to $25.3 billion, topping expectations by $1 billion. Adjusted earnings–per–share of $1.53 in comparison with adjusted EPS of $1.47 within the prior yr. For the yr, income grew 12.9% to $79.5 billion whereas adjusted EPS of $6.26 in comparison with $5.52 in 2020.

Click on right here to obtain our most up-to-date Certain Evaluation report on PepsiCo (preview of web page 1 of three proven beneath):

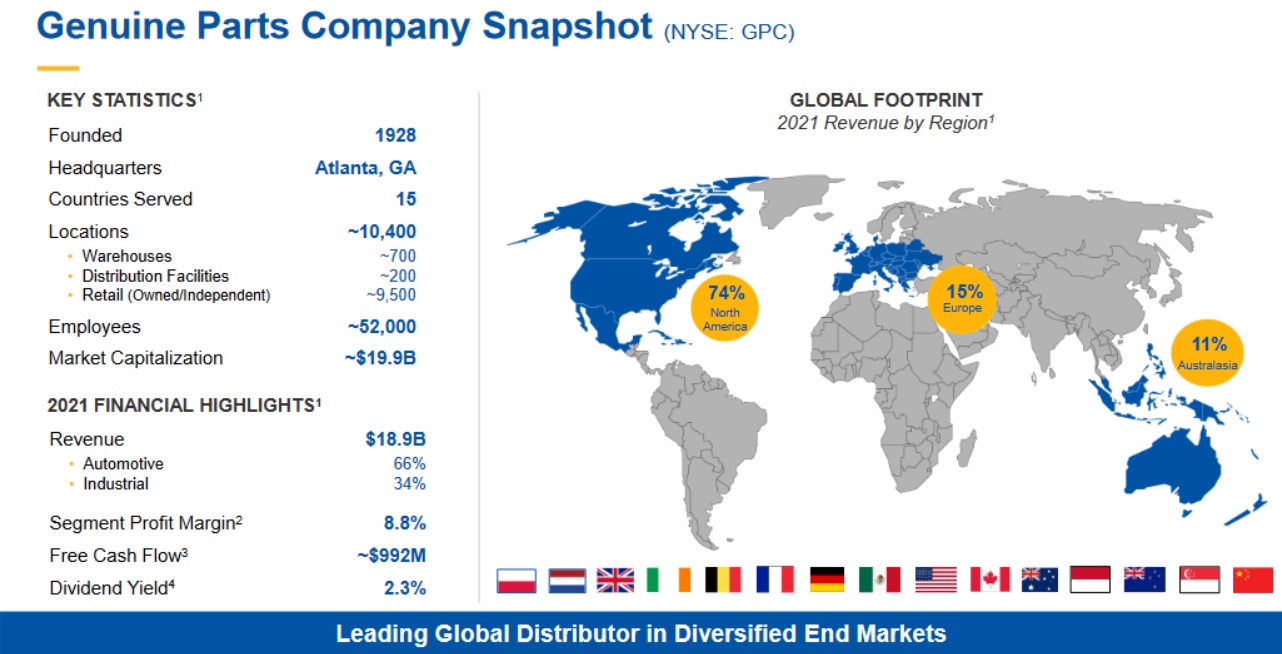

Excessive Yield Dividend King #11: Real Components Co. (GPC)

Real Components Firm was based in 1928 and since that point, it has grown right into a sprawling conglomerate that sells automotive and industrial elements, electrical supplies, and normal enterprise merchandise.

Its world span reaches all through North America, Australia, New Zealand, and Europe and is comprised of greater than 9,000 retail places.

Supply: Investor Presentation

Real Components can be a Dividend King, having raised its dividend for an unimaginable 66 consecutive years.

Real Components reported fourth quarter and full–yr earnings on February 17th, 2022. Whole income was up 13% yr–over–yr to $4.8 billion, which was $140 million forward of expectations. Gross sales beneficial properties within the fourth quarter have been attributable to an 11.3% enhance in comparable gross sales, as nicely as a 1.9% profit from acquisitions.

Earnings in This autumn got here to $1.79 per share, up sharply from $1.52 per share within the comparable interval a yr in the past on an adjusted foundation.

For the yr, gross sales have been $18.9 billion, a 14% enhance from 2020. Internet earnings on an adjusted foundation was $997 million, or $6.97 per share, up 31% from $5.27 in 2020.

Click on right here to obtain our most up-to-date Certain Evaluation report on Real Components (preview of web page 1 of three proven beneath):

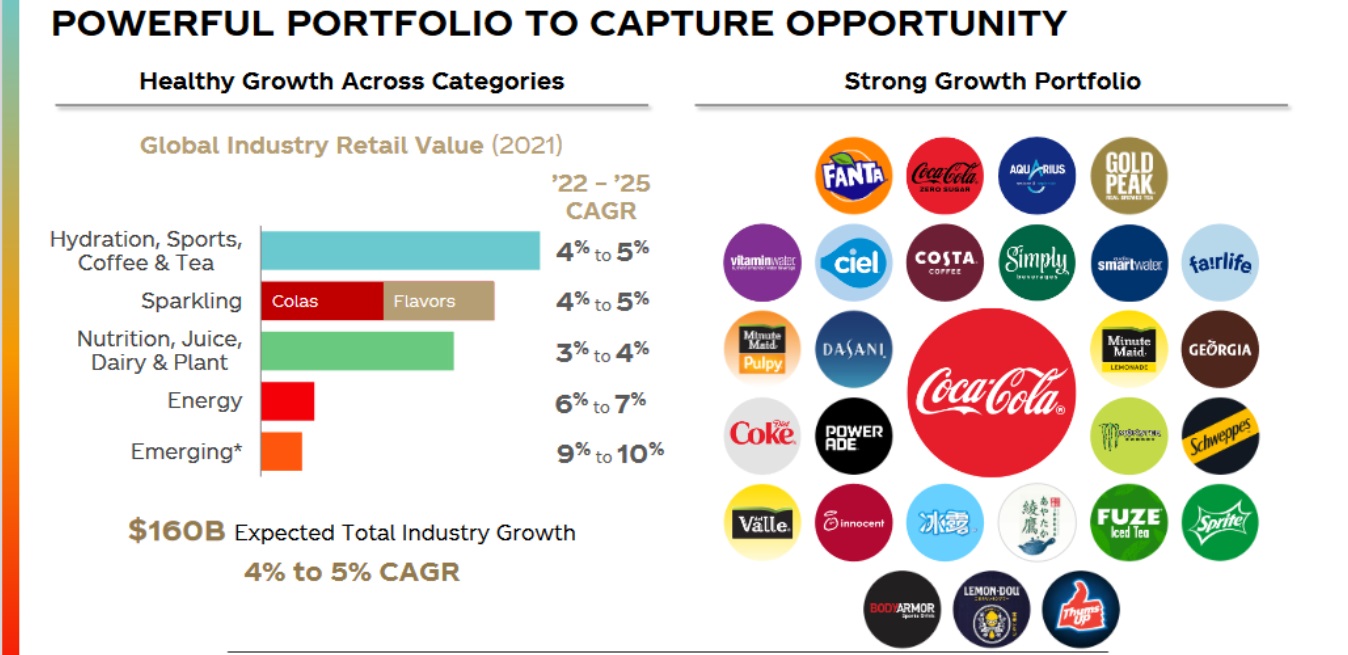

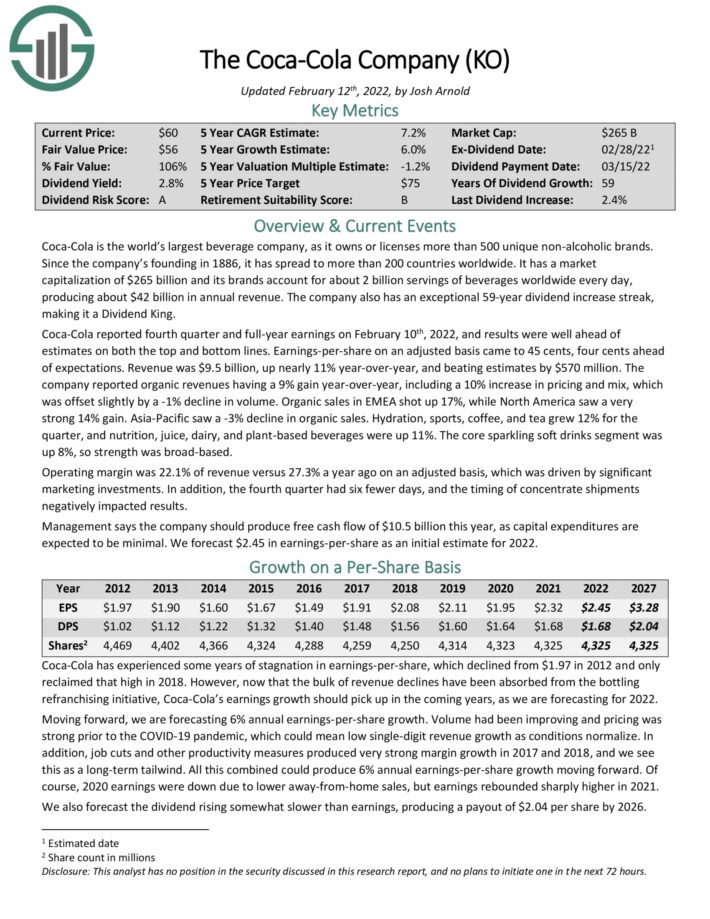

Excessive Yield Dividend King #10: The Coca-Cola Firm (KO)

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. For the reason that firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

Supply: Investor Presentation

The corporate additionally has an distinctive 59-year dividend enhance streak.

Coca-Cola reported fourth quarter and full-year earnings on February 10th, 2022, and outcomes have been nicely forward of estimates on each the highest and backside traces.

Earnings-per-share on an adjusted foundation got here to 45 cents, 4 cents forward of expectations. Income was $9.5 billion, up practically 11% year-over-year, and beating estimates by $570 million.

Natural gross sales in EMEA shot up 17%, whereas North America noticed a really robust 14% acquire. Asia-Pacific noticed a 3% decline in natural gross sales. Hydration, sports activities, espresso, and tea grew 12% for the quarter, and diet, juice, dairy, and plant-primarily based drinks have been up 11%. The core glowing comfortable drinks section was up 8%, so energy was bhighway primarily based.

Click on right here to obtain our most up-to-date Certain Evaluation report on The Coca-Cola Firm (preview of web page 1 of three proven beneath):

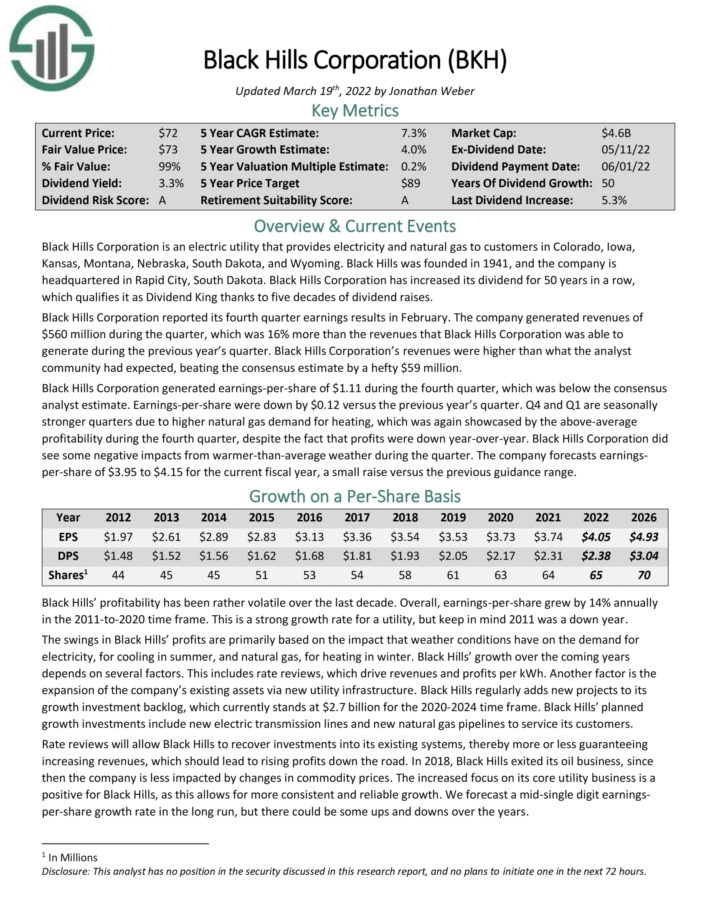

Excessive Yield Dividend King #9: Black Hills Company (BKH)

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to prospects in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Black Hills was based in 1941, and the firm is headquartered in Speedy Metropolis, South Dakota.

The corporate generated revenues of $560 million within the fourth quarter, which was 16% extra than the revenues that Black Hills Company was in a position to generate through the earlier yr’s quarter. Black Hills Company’s revenues have been greater than what the analyst group had anticipated, beating the consensus estimate by a hefty $59 million.

Black Hills Company generated EPS of $1.11 through the fourth quarter, which was beneath the consensus analyst estimate. EPS declined by $0.12 versus the earlier yr’s quarter. The corporate forecasts EPS of $3.95 to $4.15 for the present fiscal yr, which ought to simply cowl the dividend payout.

Click on right here to obtain our most up-to-date Certain Evaluation report on Black Hills (preview of web page 1 of three proven beneath):

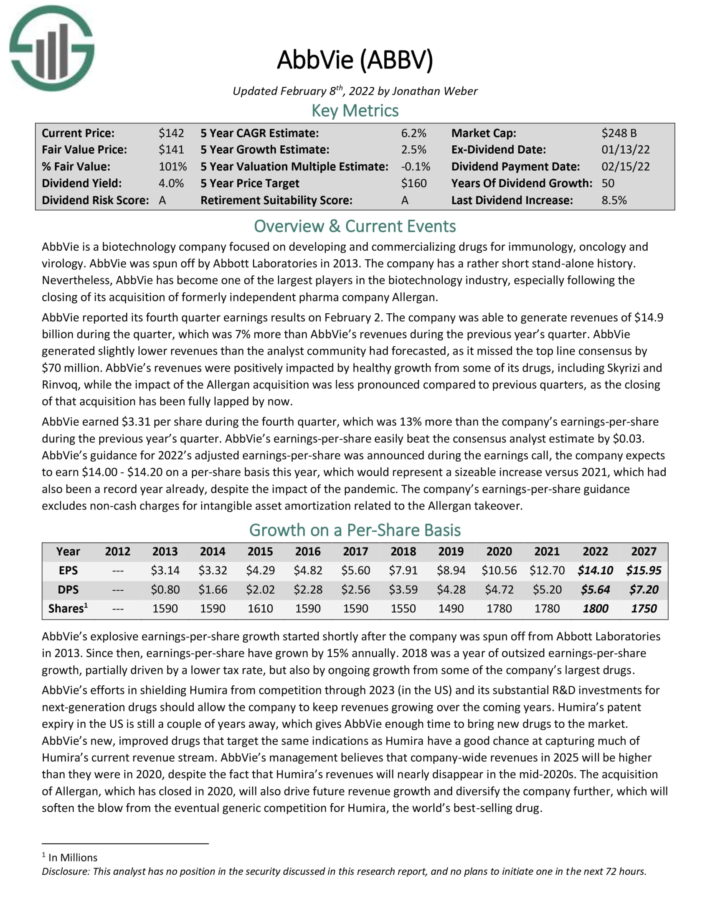

Excessive Yield Dividend King #8: AbbVie Inc. (ABBV)

AbbVie Inc. is a pharmaceutical firm spun off by Abbott Laboratories (ABT) in 2013. Its most necessary product is Humira, which is now going through biosimilar competitors in Europe, which has had a noticeable affect on the corporate. Humira will lose patent safety within the U.S. in 2023.

Even so, AbbVie stays a large within the healthcare sector, with a big and diversified product portfolio.

AbbVie reported its fourth quarter earnings outcomes on February 2. Revenues of $14.9 billion rose 7% from the earlier yr’s quarter. Revenues have been positively impacted by wholesome development from a few of its medication, together with Skyrizi and Rinvoq. AbbVie earned $3.31 per share through the fourth quarter, which was up 13% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on AbbVie (preview of web page 1 of three proven beneath):

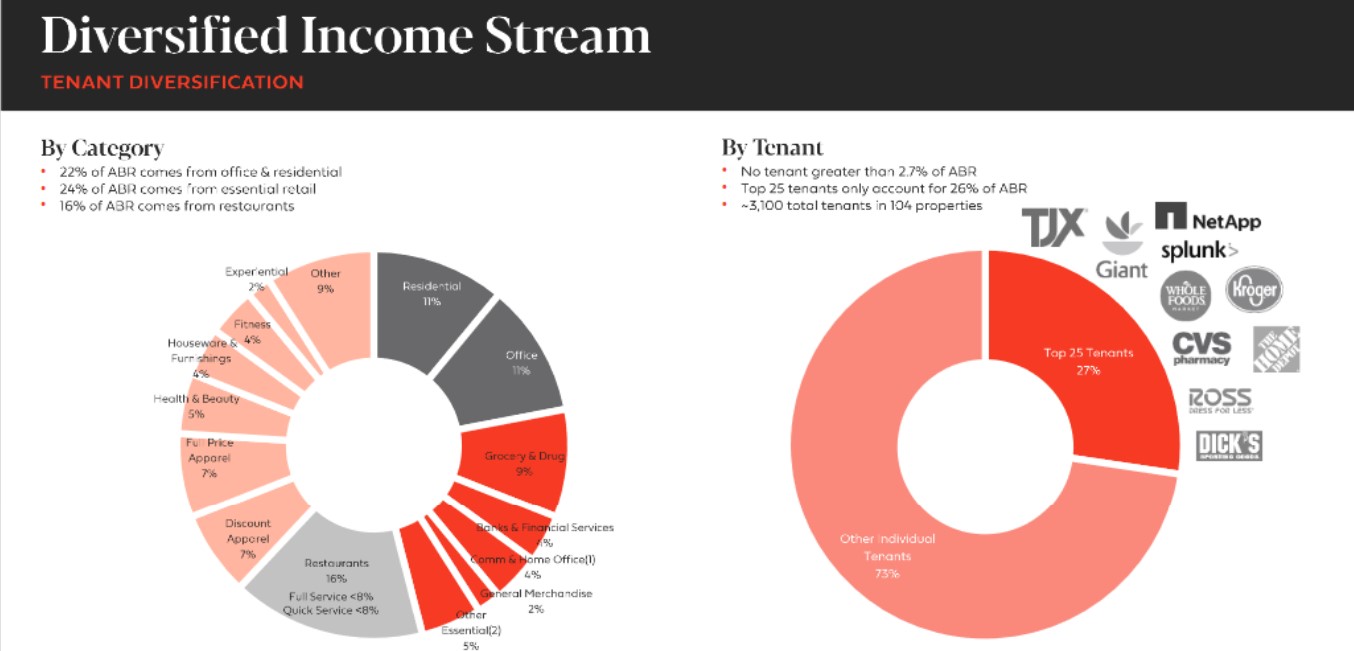

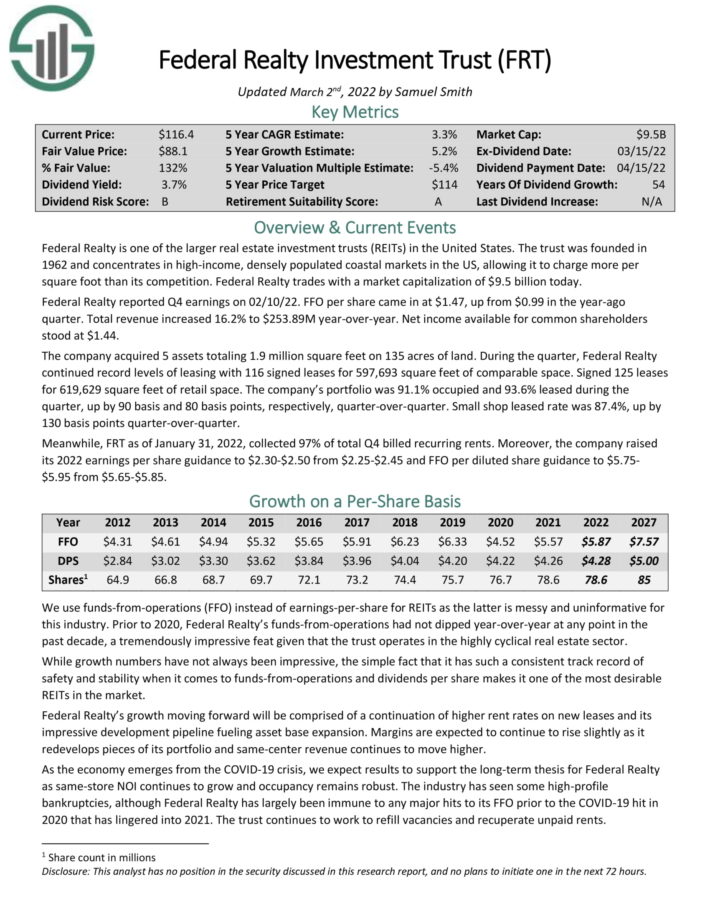

Excessive Yield Dividend King #7: Federal Realty Funding Belief (FRT)

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and lease out actual property properties. It makes use of a good portion of its rental earnings, in addition to exterior financing, to amass new properties. This helps create a “snow-ball” impact of rising earnings over time.

Federal Realty primarily owns buying facilities. Nonetheless, it additionally operates in redevelopment of multi-purpose properties together with retail, flats, and condominiums. The portfolio is extremely diversified when it comes to tenant base.

Supply: Investor Presentation

Federal Realty reported Q4 earnings on 02/10/22. FFO per share got here in at $1.47, up from $0.99 within the year-ago quarter. Whole income elevated 16.2% yr–over–yr. The corporate acquired 5 belongings totaling 1.9 million sq. toes on 135 acres of land.

The corporate’s portfolio was 91.1% occupied and 93.6% leased through the quarter. In the meantime, FRT as of January 31, 2022, collected 97% of complete Q4 billed recurring rents.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

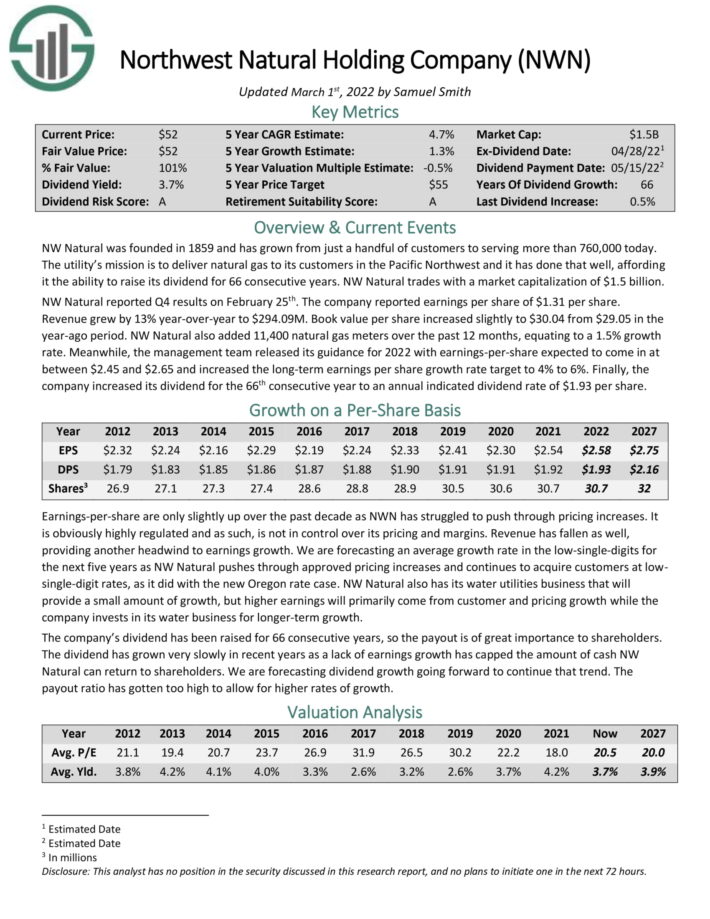

Excessive Yield Dividend King #6: Northwest Pure Holding Co. (NWN)

NW Pure was based in 1859 and has grown from only a handful of shoppers to serving greater than 760,000 at the moment. The utility’s mission is to ship pure gasoline to its prospects within the Pacific Northwest and it has completed that nicely, affording it the flexibility to boost its dividend for 66 consecutive years.

NW Pure reported This autumn outcomes on February twenty fifth. The corporate reported earnings per share of $1.31 per share. Income grew by 13% year-over-year to $294.09M. E book worth per share elevated barely to $30.04 from $29.05 within the year-ago interval. NW Pure additionally added 11,400 pure gasoline meters over the previous 12 months, equating to a 1.5% development price.

In the meantime, the administration workforce launched its steering for 2022 with EPS anticipated to return in at between $2.45 and $2.65 and elevated the long-term earnings per share development price goal to 4% to six%.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWN (preview of web page 1 of three proven beneath):

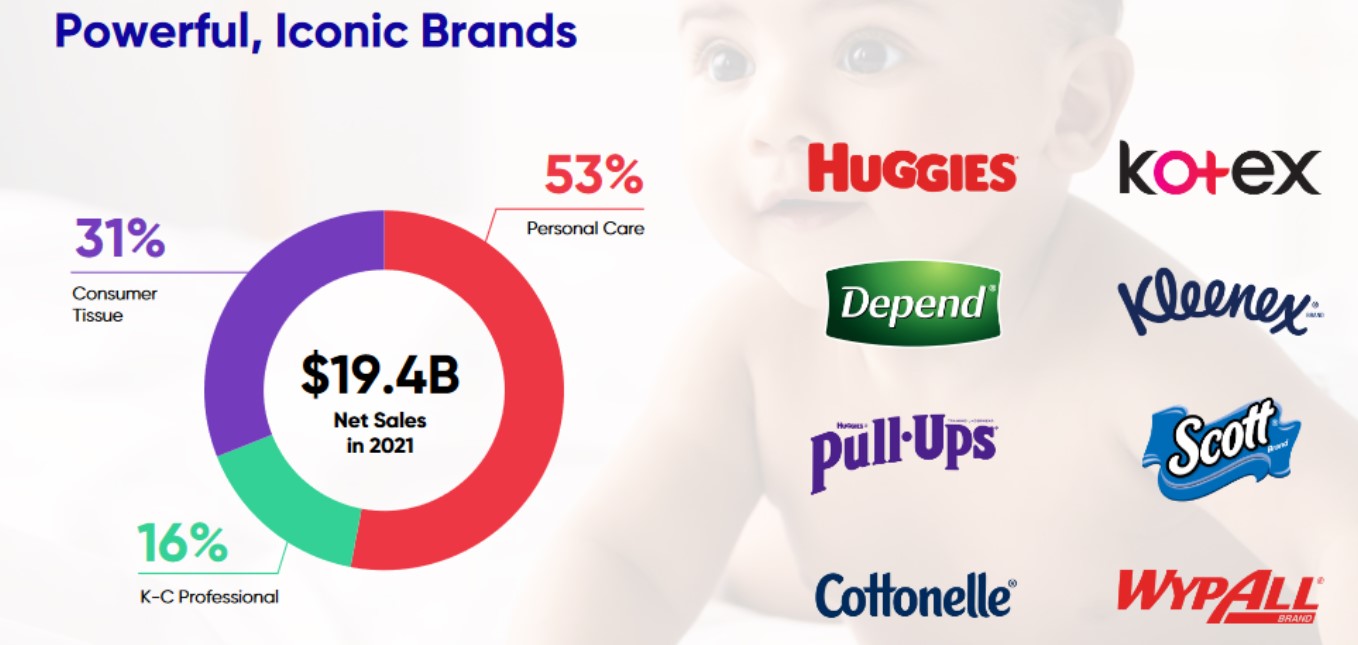

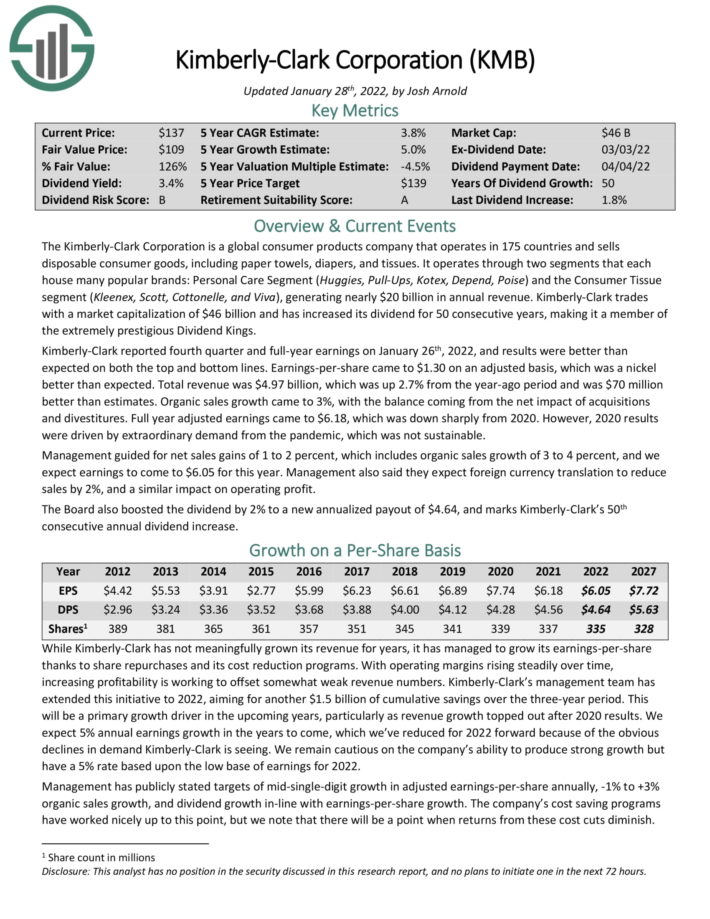

Excessive Yield Dividend King #5: Kimberly-Clark (KMB)

Kimberly-Clark is a worldwide shopper merchandise firm that operates in 175 nations and sells disposable shopper items, together with paper towels, diapers, and tissues.

It operates via two segments that every home many standard manufacturers: Private Care Section (Huggies, Pull-Ups, Kotex, Rely, Poise) and the Shopper Tissue section (Kleenex, Scott, Cottonelle, and Viva), producing practically $20 billion in annual income.

Supply: Investor Presentation

Kimberly-Clark reported fourth quarter and full–yr earnings on January 26th, 2022, and results have been higher than anticipated on each the highest and backside traces. EPS got here to $1.30 on an adjusted foundation, which was a nickel higher than anticipated.

Whole income was $4.97 billion, which was up 2.7% from the yr–in the past interval and was $70 million higher than estimates. Natural gross sales development got here to three%, with the steadiness coming from the web affect of acquisitions and divestitures.

Full yr adjusted earnings got here to $6.18, which was down sharply from 2020. Nonetheless, 2020 outcomes have been pushed by furtherextraordinary demand from the pandemic, which was not sustainable.

Click on right here to obtain our most up-to-date Certain Evaluation report on Kimberly-Clark (preview of web page 1 of three proven beneath):

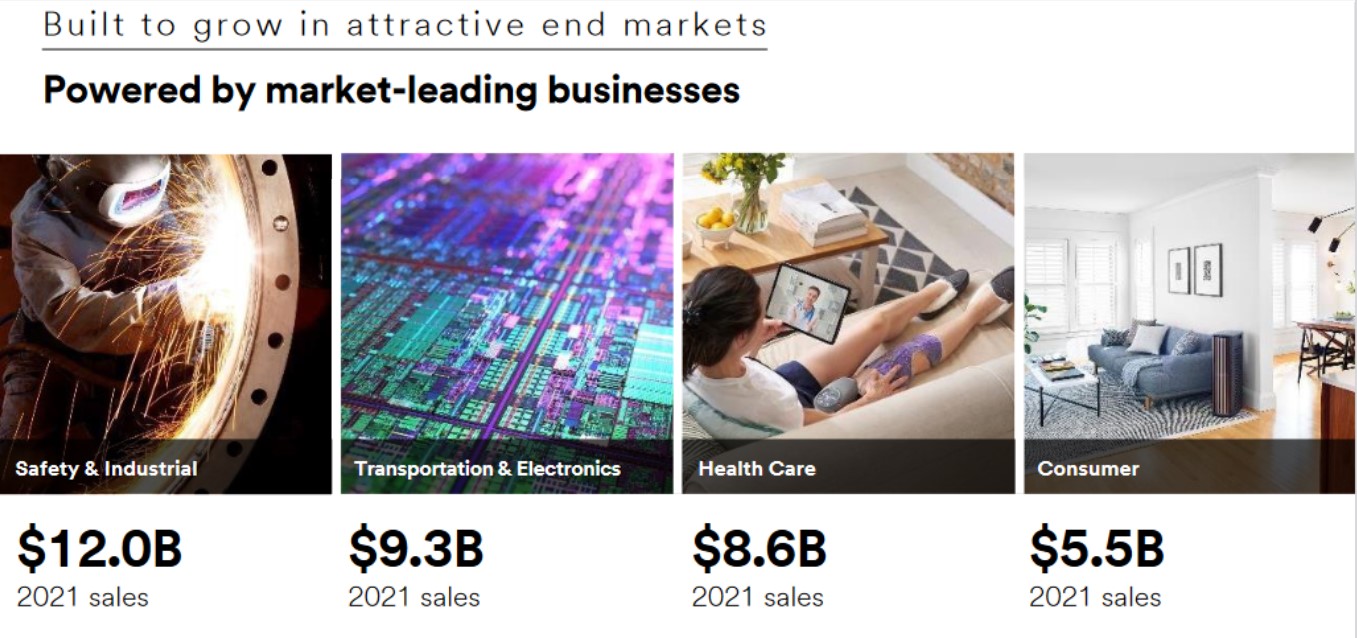

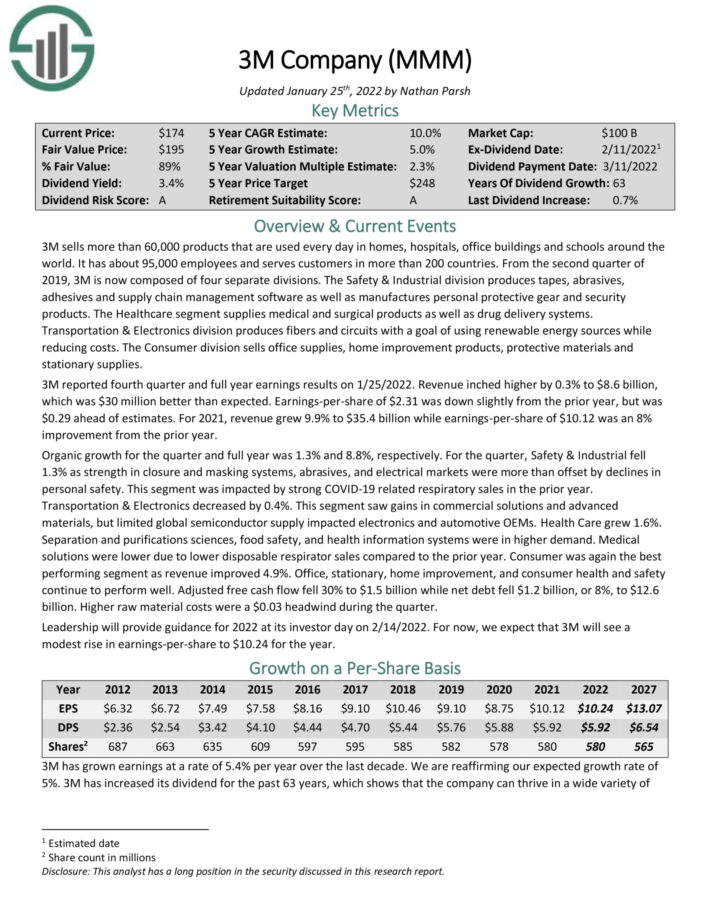

Excessive Yield Dividend King #4: 3M Firm (MMM)

3M sells greater than 60,000 merchandise which might be used daily in properties, hospitals, workplace buildings and faculties across the world. It has about 95,000 workers and serves prospects in additional than 200 nations.

Supply: Investor Presentation

3M is now composed of 4 separate divisions. The Security & Industrial division produces tapes, abrasives, adhesives and provide chain administration software program in addition to manufactures private protecting gear and safety merchandise.

The Healthcare section provides medical and surgical merchandise in addition to drug supply techniques. Transportation & Digitals division produces fibers and circuits with a purpose of utilizing renewable vitality sources whereas lowering prices. The Shopper division sells workplace provides, house enchancment merchandise, protecting supplies and stationary provides.

3M reported fourth-quarter and full yr earnings outcomes on 1/25/2022. Revenue inched greater by 0.3% to $8.6 billion, which was $30 million higher than anticipated. Earnings–per–share of $2.31 was down barely from the prior yr, however was $0.29 forward of estimates.

For 2021, income grew 9.9% to $35.4 billion whereas earnings–per–share of $10.12 was an 8% enchancment from the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M (preview of web page 1 of three proven beneath):

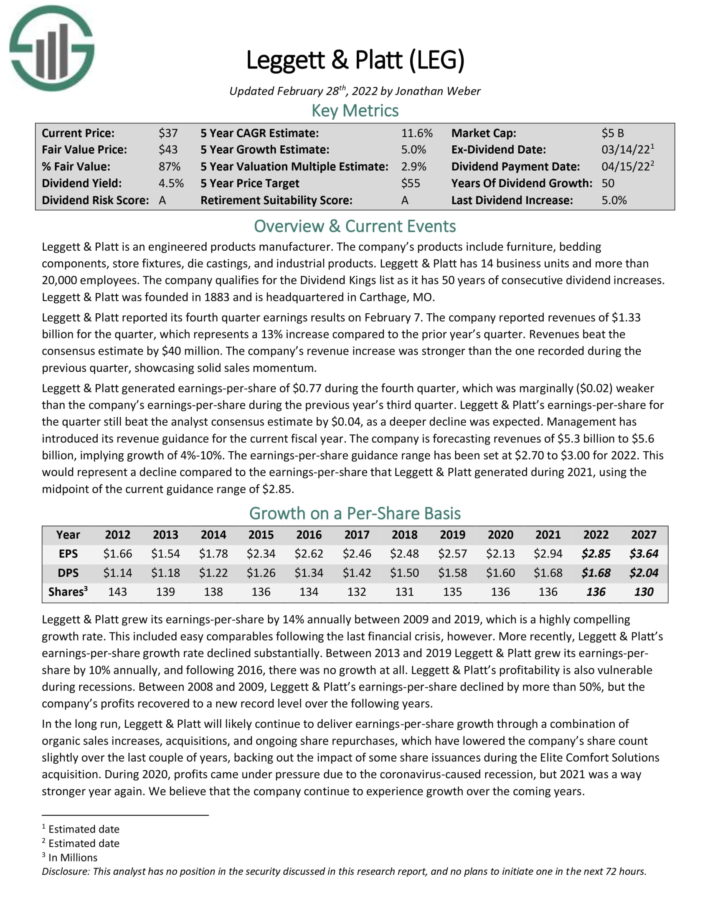

Excessive Yield Dividend King #3: Leggett & Platt (LEG)

Leggett & Platt is an engineered merchandise producer. The corporate’s merchandise embody furnishings, bedding parts, retailer fixtures, die castings, and industrial merchandise. Leggett & Platt has 14 enterprise items and greater than 20,000 workers. The corporate qualifies for the Dividend Aristocrats Index because it has 50 years of consecutive dividend will increase.

Leggett & Platt reported its fourth quarter earnings outcomes on February seventh. The corporate reported revenues of $1.33 billion for the quarter, which represents a 13% enhance in comparison with the prior yr’s quarter. EPS of $0.77 through the fourth quarter was $0.02 decrease than the earlier yr’s third quarter.

Administration has launched its income steering for the present fiscal yr. The firm is forecasting revenues of $5.3 billion to $5.6 billion, implying development of 4% to 10%. The EPS steering vary has been set at $2.70 to $3.00 for 2022.

Click on right here to obtain our most up-to-date Certain Evaluation report on Leggett & Platt (preview of web page 1 of three proven beneath):

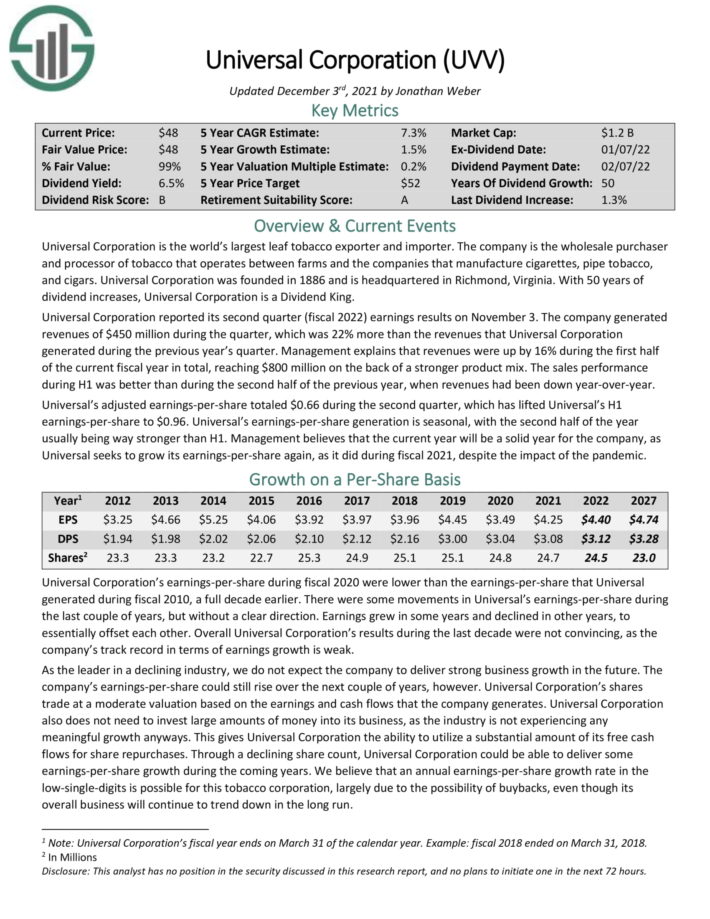

Excessive Yield Dividend King #2: Common Company (UVV)

Common Company is the world’s largest leaf tobacco exporter and importer. The corporate is the wholesale purchaser and processor of tobacco that operates between farms and the businesses that manufacture cigarettes, pipe tobacco, and cigars. Common Company was based in 1886 and is headquartered in Richmond, Virginia.

The corporate generated revenues of $450 million through the fourth quarter, which was 22% greater than the revenues that Common Company generated through the earlier yr’s quarter. Administration explains that revenues have been up by 16% through the first half of the present fiscal yr in complete, reaching $800 million on the again of a stronger product combine.

The gross sales efficiency throughout H1 was higher than through the second half of the earlier yr, when revenues had been down year-over-year. Common’s adjusted EPS totaled $0.66 through the second quarter, which has lifted Common’s H1 EPS to $0.96.

Click on right here to obtain our most up-to-date Certain Evaluation report on Common (preview of web page 1 of three proven beneath):

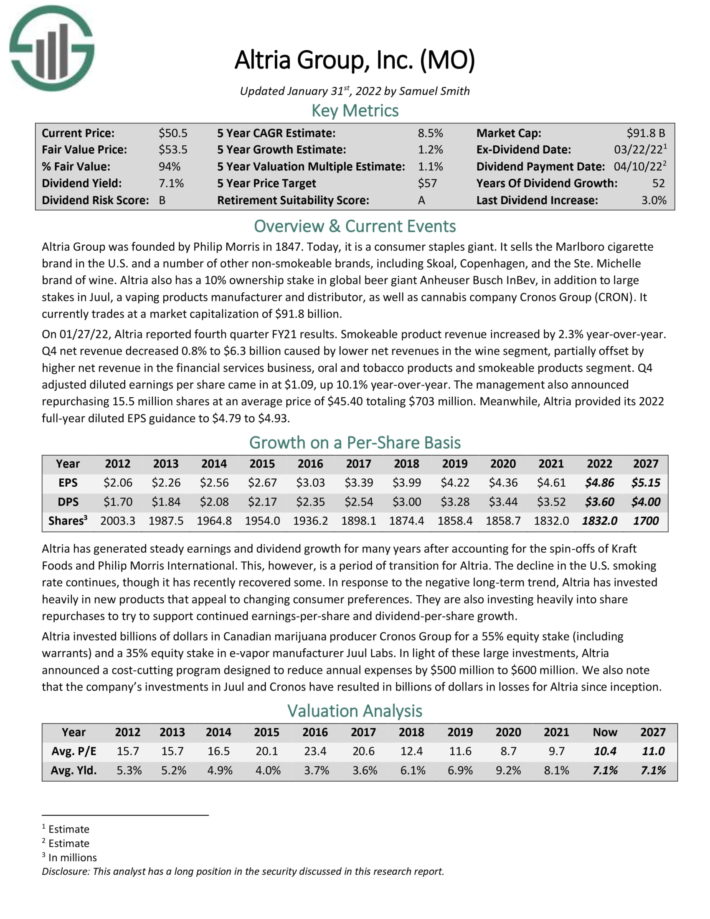

Excessive Yield Dividend King #1: Altria Group (MO)

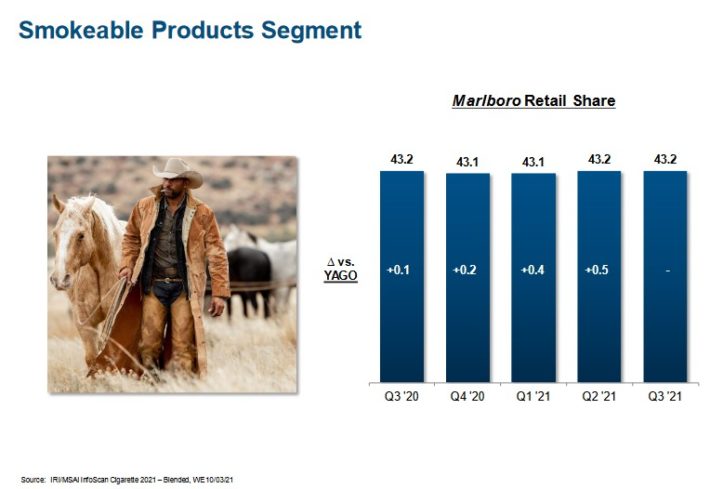

Altria Group was based by Philip Morris in 1847. At the moment, it’s a shopper staples big. It sells the Marlboro cigarette model within the U.S. and quite a lot of different non-smokeable manufacturers, together with Skoal and Copenhagen.

The flagship model continues to be Marlboro, which instructions over 40% retail market share within the U.S.

Supply: Investor Presentation

Altria additionally has a 10% possession stake in world beer big Anheuser-Busch InBev, along with giant stakes in Juul, a vaping merchandise producer and distributor, in addition to hashish firm Cronos Group (CRON).

On 01/27/22, Altria reported fourth quarter FY21 outcomes. Smokeable product income increased by 2.3% year-over-year. Net income decreased 0.8% to $6.3 billion brought on by decrease web revenues within the wine section, partially offset by excessiveer web income within the monetary companies enterprise, oral and tobacco merchandise and smokeable merchandise section. Q4 adjusted diluted earnings per share got here in at $1.09, up 10.1% year-over-year.

Altria has elevated its dividend for over 50 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria Group (preview of web page 1 of three proven beneath):

Closing Ideas

Excessive yield dividend shares have apparent enchantment to earnings traders. The S&P 500 Index yields simply ~1.4% proper now on common, making excessive yield shares much more engaging by comparability.

In fact, traders ought to at all times do their analysis earlier than shopping for particular person shares.

That stated, the 20 shares on this listing have yields a minimum of double the S&P 500 Index common, going all the best way as much as 7%. And, every of those shares has elevated their dividends for 50 consecutive years. They’re all a part of the unique Dividend Kings listing.

Because of this, earnings traders could discover these 20 dividend shares engaging.

Additional Studying

If you’re desirous about discovering high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].