[ad_1]

Bitcoin has been hinting at decrease ranges throughout in the present day’s buying and selling session. The benchmark crypto was rejected at round $48,000 and has been unable to reclaim its earlier highs.

Associated Studying | Galaxy Digital’s Jason City What Will Drive Ethereum To Flip Bitcoin

On the time of writing, Bitcoin trades at $43,100 with a 1% and 5% loss within the final 24 hours and seven days, respectively.

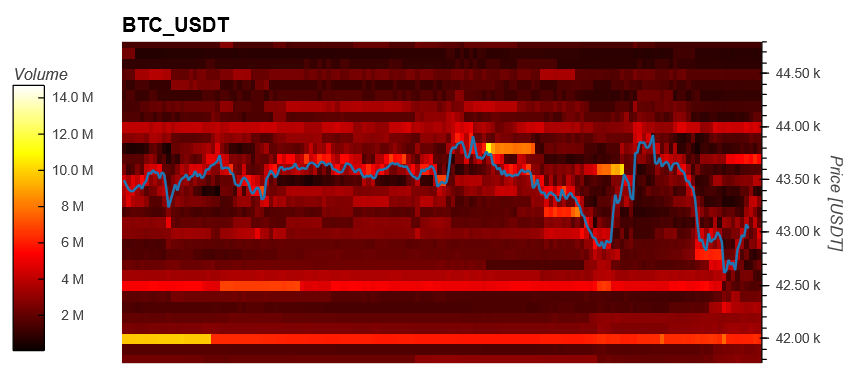

Knowledge from Materials Indicators information little help for BTC’s value because it strikes in a good vary between $42,500 and $43,500. The benchmark crypto has been shedding bid orders that would take in future draw back value motion.

Because the chart under exhibits, BTC had round $10 million in bids orders that had been pulled because the crypto trended to the draw back. This liquidity appears to have been distributed between $42,000, $41,500, and $41,000 which may stand because the final line of protection in opposition to a recent assault from the bears.

The chart additionally exhibits how an entity locations strategic asks orders when BTC’s value tried to reclaim its earlier ranges. This occurred as traders with asks orders of round $100,000 push BTC’s value again all the way down to the low $40,000.

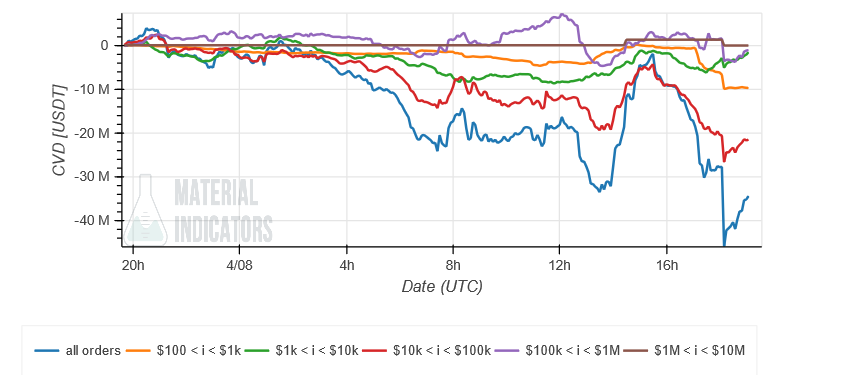

The largest sellers of this present value motion appear to be retail traders and traders with asks orders of round $10,000 (yellow and crimson within the chart under). Solely traders with bid orders of round $1,000 (inexperienced within the chart) appear to have been exhibiting curiosity in shopping for into BTC’s value.

The above counsel a possible giant entity making an attempt to push BTC’s value all the way down to accumulate BTC at optimum ranges. The distribution of liquidity first concentrated at $42,000 after which distributed between these ranges and $40,000 appears to help this thesis.

BTC whales typically make use of this technique to entice retail and acquire liquidity to take their positions. Small traders appear to have taken within the bait.

Bitcoin Whales Play Thoughts Video games

Analyst Ali Martinez confirmed an elevated within the variety of lengthy positions taken on crypto Binance trade. The Lengthy/Brief Ratio stands at 70% for Lengthy merchants and 29% for the other facet of the commerce.

Associated Studying | Extra Correction Quickly? Bitcoin Whale Ratio Stays Elevated

The analyst commented the next on the potential implications for BTC’s value:

Bitcoin may very well be making ready for a liquidation cascade! 70.69% of all buying and selling accounts on Binance Futures are presently net-long on $BTC, which can end in a long-squeeze. BTC may go all the way down to $42,000-$41,000 to gather liquidity.

[ad_2]

Source link