Alex Wong/Getty Images News

If more of us valued food and cheer and song above hoarded gold, it would be a merrier world.”― J.R.R. Tolkien.

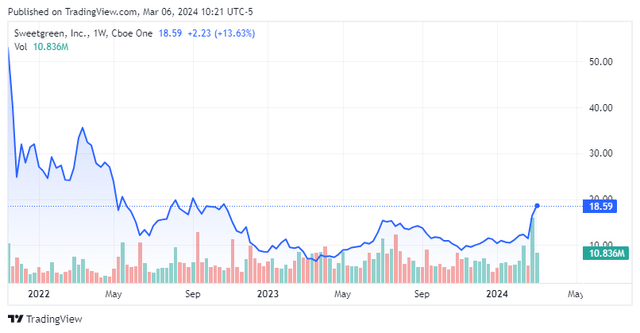

Today, we put restaurant operator Sweetgreen, Inc. (NYSE:SG) in the spotlight. The shares have been on a nice roll recently, after being deep in “Busted IPO” territory since soon after the company came public late in 2021.

Sweetgreen posted solid fourth quarter results at the end of February. Can the rally in the stock continue as we get further into 2024? An analysis follows below.

Seeking Alpha

Company Overview:

Sweetgreen is headquartered in Los Angeles. The company operates fast food restaurants serving healthy foods at scale across the United States. Orders can also be placed via its website and mobile app. Digital sales account for nearly 60% of overall sales, a rarity in the restaurant industry. At the end of 2023, the company had 225 restaurants in 18 states. The stock currently trades near $18.50 a share and sports an approximate market capitalization of $2.05 billion.

Sweetgreen is quite innovative within its industry. The company launched its first “Infinite Kitchen” in the spring of 2023. This automated system relies on robotics and greatly cuts staffing costs. A good story on the launch and how this system works is found here. Given how much inflation has risen in the restaurant industry in the past few years and huge minimum wage hikes for fast food workers in states like California, this could evolve to a significant competitive advantage.

The company opened its second Infinite Kitchen in Huntington Beach towards the end of 2023. In addition to cost savings, average ticket prices have been 10% higher than its median store. Labor expenses amounted to 29% of total revenues for Sweetgreen in the fourth quarter of 2023.

Fourth Quarter Results:

Sweetgreen posted its Q4 numbers on February 29th. The company delivered a GAAP loss of 24 cents a share, three pennies above expectations. The net loss of $27.4 million for the quarter was down significantly from the net loss of $49.3 million in Q4 2022. Losses improved thanks largely to a $12 million improvement in restaurant profit and a $6.4 million decrease in stock-based compensation. Only one new store was opened in the fourth quarter compared to 10 new shops in the same period in the prior year. For the entire year, Sweetgreen opened 35 new restaurants compared to 36 in FY2022.

Revenues rose 29% on a year-over-year basis to $153 million, which was slightly over the consensus. It was the 11th consecutive quarter of over 20% revenue growth. Same store sales growth of six percent was considerably above the four percent expected by the analyst community.

Management provided initial guidance for FY2023. Leadership sees 23 to 27 new store openings in 2024 and same store sales growth of between three to five percent. Seven of these new restaurants will launch with the Infinite Kitchen concept. Three to four existing stores will be renovated to include this system in 2024 as well. Overall revenues for FY2024 are expected to be in the range of $655 million to $670 million, which would represent year-over-year sales growth of 13.5% at the midpoint of the range. Revenue growth in FY2023 clocked in 24% over FY2022.

Analyst Commentary And Balance Sheet:

Despite solid Q4 numbers, the analyst community remains mixed on the company’s current prospects. Since fourth quarter results came out, five analyst firms including RBC Capital and JPMorgan have reissued/assigned Buy/Outperform ratings on the stock. Price targets proffered range from $17 to $20 a share. Citigroup ($16 price target), TD Cowen ($15 price target) and Morgan Stanley ($11 price target) have maintained Hold/Sell ratings on the equity.

Over 17% of the outstanding float is currently held short and nearly three percent of the equity is held by insiders (as of 2/15). Several insiders were consistent sellers of the shares throughout 2023. So far in 2024, insiders have sold just over $2 million worth of equity collectively. Sweetgreen exited its fiscal 2023 year with approximately $257 million of cash and marketable securities on its balance sheet against no long-term debt according to the 10-K filed for the fiscal 2023 year.

Verdict:

Sweetgreen, Inc. posted losses of 94 cents a share on revenues of $584 million in FY2023. The current analyst firm consensus sees losses falling to 54 cents a share in FY2024 on sales of $663 million. The project losses of 44 cents a share in FY2025 on sales growth in the mid-teens.

Sweetgreen is an intriguing concept within the staid restaurant industry. The company seems to be making considerable progress on the cost front and the “Infinite Kitchen” concept might eventually be an emerging new trend for the industry struggling with personnel costs. The company also has a solid balance sheet.

That said, the stock is up some 65% year to date and bumping up against the most optimistic of analyst firm price targets. While management expects Adjusted EBITDA to turn positive in FY2024, the company seems several years away from actual profitability. Therefore, this seems a story to bear watching, but the stock is not quite investable at current trading levels.

I cook with wine, sometimes I even add it to the food.”― W.C. Fields.