[ad_1]

FilippoBacci

Investment Thesis

Stitch Fix (NASDAQ:SFIX) reported the last quarter of its fiscal 2022, with fiscal Q4 2022 missing revenue estimates. Meanwhile, its guidance for fiscal Q1 2023 doesn’t inspire much confidence for investors.

It’s easy to recognize the surface appeal of this investment. After all, the stock has already fallen so much that there’s only ”value left”. Yet, I don’t believe there’s enough here to warrant an investor to buy this dip.

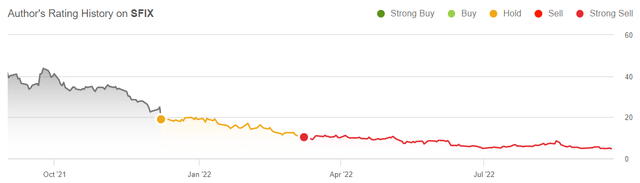

That being said, I do now upgrade my bearish call to a hold. Why?

Author’s work

While I don’t believe that Stitch Fix will return to plus $8.xx when I went bearish on this name, the fact remains that nearly 50% of its market cap is today made of cash.

So I take my ”hypothetical” returns and close out my bearish call here and upgrade SFIX to a hold.

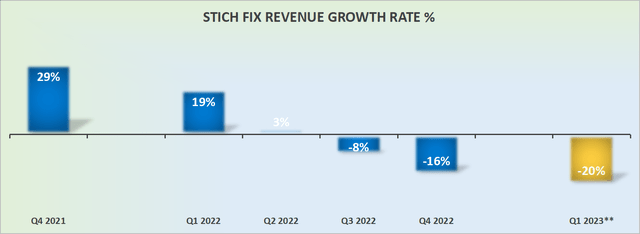

Revenue Growth Rates Expected to Slide

SFIX revenue growth rates

Stitch Fix stated during the call that the first half of fiscal 2023 will be challenging for the company.

It’s important to note that lower active clients in FY ’22 will have an impact on revenue, particularly in the first half of the fiscal year. With this in mind, we expect total revenue to be between $1.76 billion and $1.86 billion for full year FY ’23.

The high-end of Stitch Fix’s fiscal 2023 guidance points to $1.9 billion, a substantial shortfall from analysts’ expectations of $2.2 billion.

What’s Next for Stitch Fix?

Ultimately, it’s difficult for a business to thrive when it needs to rely on increasing revenues per client for the business to remain viable.

SFIX Q4 2022

As you can see above, active clients were down 9% y/y, a trend that has seen active clients come down throughout fiscal 2022.

For their part, Stitch Fix recognizes that these results are suboptimal and the business is embarking on cost savings, which will be reflected in its improving bottom profitability.

Path to Profitability Can’t Come Soon Enough

The good news for bulls is that Stitch Fix has $230 million of cash and equivalents and no debt. That’s clearly something to consider and I believe that’s part of the reason why the stock didn’t sell off more significantly on the back of its Q4 2022 results, after hours.

Indeed its cash balance is coming close to 50% of its market cap is made up of cash.

On the other hand, further confounding matters is that Stitch Fix reported $9 million of positive free cash flow for fiscal 2022, a substantial improvement from a negative $51 million in the prior year.

However, we should be mindful that the biggest driver of its free cash flow has been an extension of its accounts payables. In essence, that’s a ”short-term loan” from its trading partners. Cash that will soon become outgoing.

Needless to say that the recently appointed CEO Elizabeth Spaulding is aware of what’s needed and stated on the call,

We will manage the business towards a goal of being adjusted EBITDA and free cash flow positive sometime in FY ’23.

While in the same breath acknowledging that fiscal 2023 will see a negative $25 million of EBITDA. That’s a negative 1% EBITDA margin for the year ahead. A figure that’s consistent with the negative 1% EBITDA reported in fiscal 2022.

SFIX Stock Valuation – Less Than 0.5x Sales

Stitch Fix is priced at approximately 0.3x sales. That clearly appears like a very low valuation. But the problem here is that it doesn’t matter how low its P/Sales multiple gets if the business can’t convince investors of its path to profitability.

Indeed, as I already noted in the past, Stitch Fix has under this management team several times downwards revised its guidance as fiscal 2022 progressed.

Thus, I simply struggle to muster up enough belief to put any weight behind Stitch Fix’s most recent guidance.

The Bottom Line

Stitch Fix is not the type of stock that one should look to catch the falling knife on. Particularly in a bear market.

The situation can be summarized as this. If there are fewer investors left to buy this dip, by extension, there’s going to be a lot of selling pressure.

That means that there’s a serious risk that these shares will continue to slide. Indeed, it makes no difference what price the investor originally bought at. What matters here is where the business is headed. And I don’t conclude that there’s enough in this bull case to get new investors interested in the stock.

[ad_2]

Source link