Of their seminal paper, Modigliani and Miller (1958) established that, within the absence of frictions and transaction prices, a agency’s capital construction is irrelevant. Since then, economists have developed varied theories describing frictions and transaction prices that drive the selection of company financing selections, together with taxes, chapter prices, company issues, and informational asymmetries. All these elements can differentially have an effect on debt and fairness financing and subsequently affect a agency’s optimum capital construction.

An essential supply of distortions in monetary markets is political financial system (Lambert et al. 2021). For instance, Faccio et al. (2006) have proven that politically linked corporations are considerably extra more likely to be bailed out than comparable non-connected corporations. Markets perceive this and will subsequently be extra prepared to offer (cheaper) credit score to such corporations. Certainly, that is what a latest research by Bussolo et al. (2021) finds: regardless of being much less productive, politically linked corporations borrow greater than comparable non-connected corporations.

The last word type of political connections is state possession. If governments usually tend to bail out state-owned corporations than privately owned ones, then the previous ought to make better use of debt. Nonetheless, governments might not solely present (implicit or specific) bailout ensures, they might additionally use state-owned enterprises for political functions. For instance, particularly in nations with weaker establishments, state-owned enterprises could also be (ab)used to maximise voting for incumbent events and politicians fairly than to maximise shareholder worth and the power to repay loans (e.g. Bircan and Saka 2019). Politicisation of state-owned enterprises’ enterprise selections is towards collectors’ pursuits and might subsequently end in a better value of credit score.

Which of those countervailing forces dominates is an empirical query. The present literature principally helps the primary argument. For instance, Dewenter and Malatesta (2001) take into account the five hundred largest non-US corporations and present that state-owned enterprises are leveraged extra. Additionally they present that leverage falls after privatisation. In an analogous vein, Boubakri and Cosset (1998, 79 giant corporations), D’Souza and Megginson (1999, 85 giant corporations), and Megginson et al. (1994, 61 giant corporations) discover that, after privatisation, corporations scale back their debt ratios. Boubakri and Saffar (2019, 453 giant corporations) additionally discover a optimistic correlation between state possession and leverage.

These present research all analyse information from giant and principally listed corporations. In a latest paper (De Haas et al. 2022), we take into account a much wider dataset that covers 4 million corporations from 89 nations. The overwhelming majority of those corporations are small or medium sized; only a few of them are listed. Our information come from splicing varied historic variations of Bureau Van Dijk’s Orbis dataset. They span twenty years (2000-2019) and embody 20 million annual observations (thus 5 observations per agency on common).

The great nature of this new dataset permits us to match state-owned and personal corporations whereas controlling not just for standard firm-level determinants of leverage (corresponding to measurement, profitability, asset tangibility, and the non-debt tax defend) but additionally for sector-country-year mounted results. We discover that, on common, state possession is negatively correlated with leverage, outlined as a agency’s debt-to-total belongings (Villar-Burke 2013). In different phrases, for the overwhelming majority of corporations, the unfavorable impression of state possession greater than offsets any advantages corporations might derive (when it comes to borrowing capability) from the state as a shareholder. This impact is rising within the diploma of state possession however is important even when the state solely has a small possession stake. The magnitude of the impact is substantial: throughout the similar country-sector-year, corporations with any state possession, on common, have a 5 proportion level decrease debt/belongings ratio. That is about one-quarter of the median leverage of 19% in our pattern.

This sturdy unfavorable relationship between state possession and company leverage doubtless displays the company governance dangers of state possession. Collectors might concern the state’s intervention in corporations’ operations, and so they might subsequently be much less prepared to lend to such corporations. Certainly, we discover the unfavorable results of state possession on leverage are a lot stronger in nations with a weaker rule of regulation, management of corruption, safety of buyers, and insolvency procedures. These outcomes are per the view that state possession is very pricey in nations with weaker political and authorized establishments.

The unfavorable relationship between state possession and company leverage holds throughout many of the firm-size distribution – with the essential exception of the (beforehand studied) very largest corporations. In keeping with the sooner literature on this matter, we present that (solely) among the many largest corporations in our pattern (these with greater than $3 billion of belongings), state possession is related to larger company leverage (see Determine 1). In different phrases, solely the biggest corporations in a rustic profit from (partial) state possession by way of bailout ensures and cheaper credit score. The market appears to imagine that these ensures are most credible for ‘nationwide champions’ that the state will doubtless deal with in a privileged method.

Determine 1 The impact of state possession on agency leverage by agency measurement

Notes: This determine studies common marginal results of state possession on agency leverage with 95% confidence intervals.

Supply: De Haas et al. (2022).

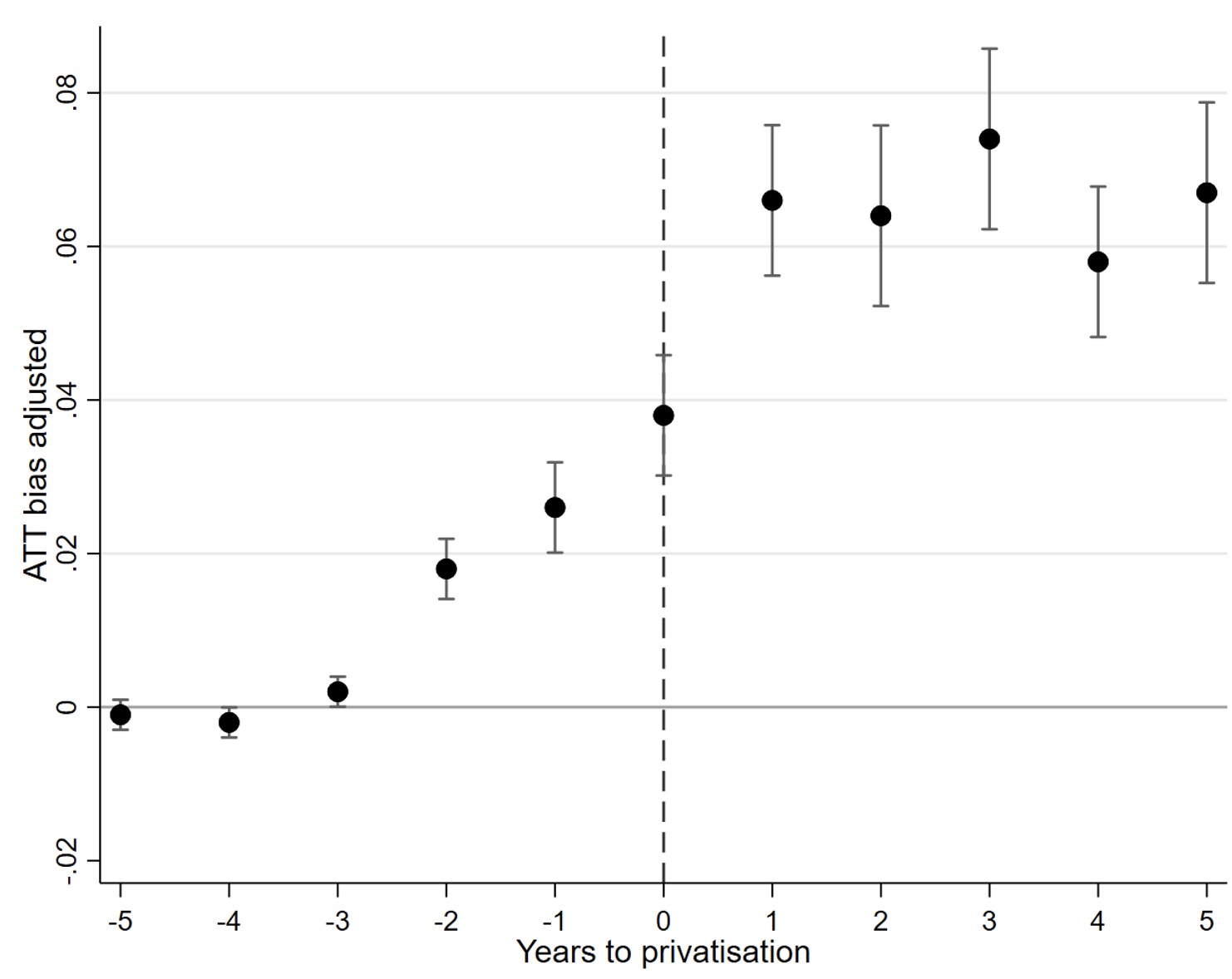

We complement our cross-firm outcomes with a within-firm evaluation primarily based on panel information for enterprises that had been privatised. We examine the change in capital construction over time in these corporations to the change in leverage amongst observationally comparable however non-privatised state-owned enterprises. The outcomes are similar to these from the cross-firm evaluation, each qualitatively and quantitatively. We discover that corporations sometimes enhance their leverage by about 5 proportion factors (27% of the pattern imply) within the 5 years after privatisation and relative to comparable (matched) non-privatised corporations (see Determine 2). Curiously, leverage begins to go up two years earlier than the precise privatisation – doubtless reflecting that privatisations take time to implement and that credit score markets worth within the results of future privatisations prematurely.

Determine 2 Privatisation and agency leverage: Occasion research

Notes: This determine offers a graphic illustration of a mean remedy on the handled (ATT) evaluation. The dots correspond to annual ATT estimates together with a bias-adjustment time period. The whiskers characterize 95% confidence intervals.

Supply: De Haas et al. (2022).

Our outcomes may also be seen in gentle of a latest literature (Bento and Restuccia 2018) that underlines the substantial misallocation of capital and labour throughout corporations – even inside narrowly outlined industrial sectors and throughout the similar nation. State possession might be an essential supply of such allocative inefficiency and the ensuing drag on whole issue productiveness. Our outcomes spotlight one mechanism by way of which state possession can introduce distortions and useful resource misallocation: it interferes with the power of all however the largest corporations to entry credit score.

References

Bento, P and D Restuccia (2018), “Misallocation is a key determinant of common institution measurement and combination productiveness throughout wealthy and creating nations”, VoxEU.org, 22 October.

Bircan, C and O Saka (2019), “Lending cycles and actual outcomes: Prices of political misalignment”, VoxEU.org, 10 Might.

Borisova, G, V Fotak, Okay Holland and W L Megginson (2015), “Authorities Possession and the Price of Debt: Proof from Authorities Investments in Publicly Traded Corporations”, Journal of Monetary Economics 118(1): 168-191.

Boubakri, N and J-C Cosset (1998), “The Monetary and Working Efficiency of Newly Privatized Corporations: Proof from Growing Nations”, Journal of Finance 53(3): 1081-1110.

Boubraki, N and W Saffar (2019), “State Possession and Debt Selection: Proof from Privatization”, Journal of Monetary and Quantitative Evaluation 54(3): 1313-1346.

Bussolo, M, F de Nicola, U Panizza and R Varghese (2022), “Politically linked corporations and privileged entry to credit score: Proof from Central and Jap Europe”, European Journal of Political Economic system 71: 102073.

De Haas, R, S Guriev and A Stepanov (2022), “State Possession and Company Leverage Across the World”, CEPR Dialogue Paper 17300.

Dewenter, Okay L and P H Malatesta (2001), “State-owned and Privately Owned Corporations: An Empirical Evaluation of Profitability, Leverage, and Labor Depth”, American Financial Evaluate 91(1): 320-334.

D’Souza, J and W L Megginson (1999), “The Monetary and Working Efficiency of Privatized Corporations throughout the Nineties”, Journal of Finance 54(4): 1397-1438.

Faccio, M, R Masulis and J McConnell (2006), “Political Connections and Company Bailouts”, Journal of Finance 61(6): 2597-2635.

Lambert, T, E Perotti and M Rola-Janicka (2021), “Political financial system in finance”, VoxEU.org, 6 July.

Megginson, W L, R C Nash and M Van Randenborgh (1994), “The Monetary and Working Efficiency of Newly Privatized Corporations: An Worldwide Empirical Evaluation”, Journal of Finance 49(2): 403-452.

Modigliani, F and M Miller (1958), “The Price of Capital, Company Finance and the Principle of Funding”, American Financial Evaluate 48(3): 261–297.

Villar-Burke, J (2013), “Assessing leverage within the monetary sector by way of movement information”, VoxEU.org, 14 November.