Key Takeaways

- Solana and Avalanche have risen by roughly 20% up to now 36 hours.

- SOL wants to remain above $42 to advance to $52.

- AVAX might set off an upswing to $28 if it breaks $24.

Share this text

Solana and Avalanche are gaining bullish momentum after slicing by essential resistance areas.

Solana and Avalanche Overcome Resistance

Solana and Avalanche seem well-positioned for positive factors because the broader cryptocurrency market enjoys new tailwinds.

Solana’s SOL token has risen by practically 20% over the previous 36 hours. It soared from a low of $38.60 to submit a brand new month-to-month excessive of $46.10. The sudden upswing has allowed Solana to beat an important space of resistance, probably resulting in increased highs.

Solana sliced by the center trendline of a parallel channel that had developed on its four-hour chart. Buying and selling historical past reveals that each time SOL has breached this barrier since June 20, it has superior towards the channel’s higher boundary. Now, related value motion might push the asset to $49 and even $52.

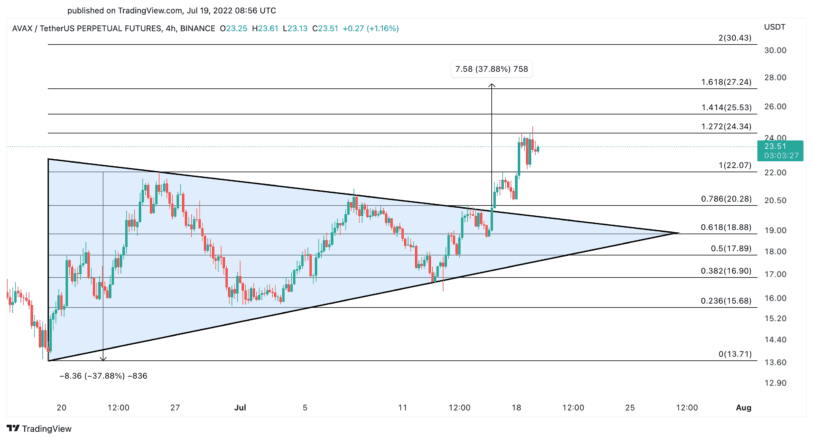

Avalanche has additionally seen a wave of bullish momentum over the previous 36 hours, surging from a low of $20.60 to a excessive of $24.80. The upward impulse was triggered after AVAX broke out of a symmetrical triangle that had developed on its four-hour chart. With two corrections occurring after the breakout, it seems that the token has collected sufficient liquidity to advance additional.

The peak of the triangle’s Y-axis means that Avalanche has entered a 38% uptrend towards $28. A sustained four-hour candlestick shut above the $24.30 resistance degree might additional validate the bullish thesis.

Though the chances seem to favor the bulls, the assist ranges are essential because of the ongoing uncertainty throughout crypto and international monetary markets.

If Solana fails to maintain the channel’s center trendline at $42 as assist, the optimistic outlook could also be invalidated. A four-hour candlestick shut beneath this very important degree might set off a spike in profit-taking that sends SOL to $38.50 or $35.20. Equally, Avalanche must keep away from dipping beneath $22 because the downswing might provoke a retracement to $20.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.

For extra key market tendencies, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.