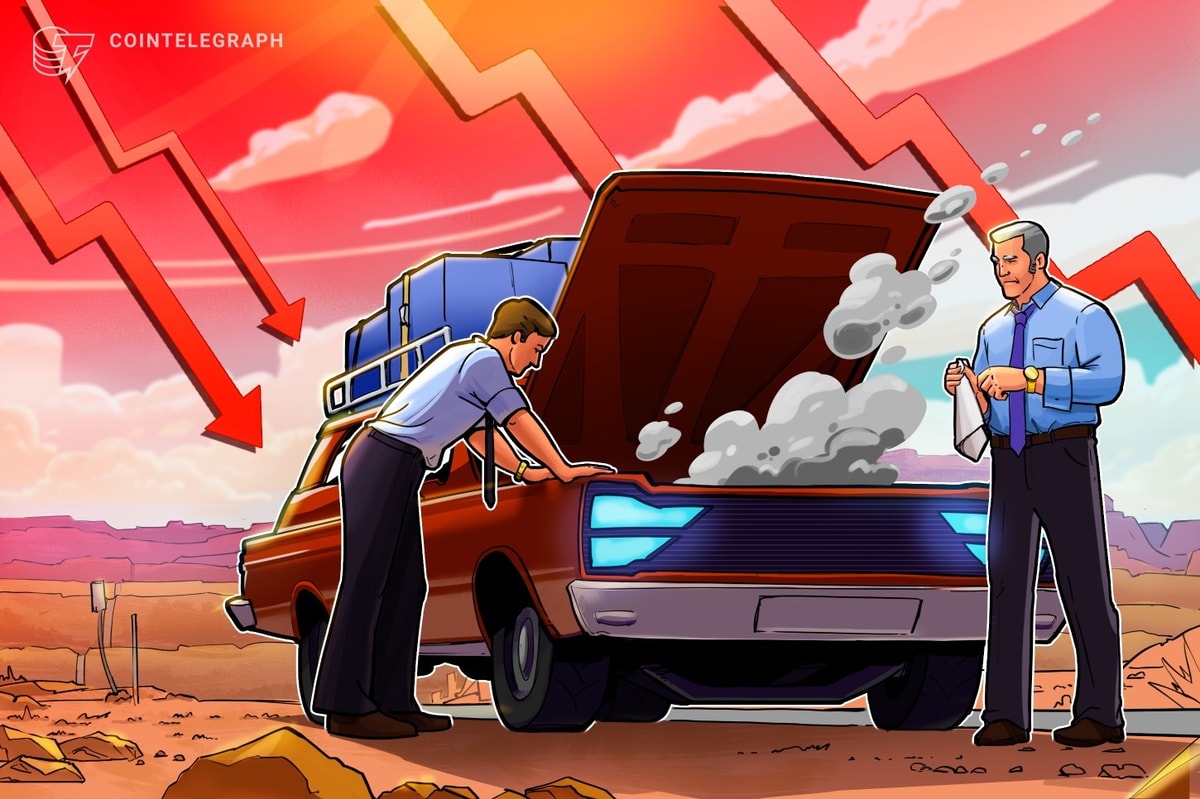

The legendary musician Prince exhorted us to “Party Like It’s 1999,” but today, as a small-cap stock investor, I’d flip the calendar one year ahead, to 2000.

That’s because by March 2000, the NASDAQ had peaked at 5048 and by April had plunged by almost 35%. The following 18 months were no party either. Many former high-flying tech stocks, including Pets.com and Priceline, lost all or nearly all their value. Even stalwarts like Intel, Cisco, and Oracle experienced major drawdowns. In fact, trillions of dollars vaporized during this infamous period that became known as the dot-com bubble.

But for some investors, the aftermath of the dot-com bubble was one of the best times to deploy capital ever. It was the all-too-rare opportunity to acquire meaningful positions in quality companies for which the market simply had no appetite.

I believe that quality small caps are in a similar position today.

These days, small caps are unloved, unwanted, and uninvited to the party. And there has been a party — a big one hosted by a handful of mega-cap tech stocks, particularly those perceived as bellwethers of all things artificial intelligence (AI)-related.

The parallels between AI mania and the dot-com era are hard to ignore. Back in 1999, any company that touted its internet bona fides was a market darling. Spoiler alert: It did not end well. Nevertheless, it was an excellent time for selective stock picking, and there are familiar echoes in today’s Canadian small-cap technology stocks.

What’s Happening Now — Why the Big Discount?

In life, as in investing, everything happens for a reason, or several reasons. And that holds true for the absolute and relative low valuations for small-cap stocks.

1. Big pools of capital are increasingly going private.

Pension funds and other large institutional investors are looking to generate alpha. In the past, they would allocate a portion of their investments to small-cap public companies to achieve that. Today, these investors are shifting their portfolios away from public markets and into private markets. When only a handful of stocks are driving most of the gains, asset managers have a hard time achieving outperformance. Hence, the diversification benefits of private equity and its alpha potential look appealing. For example, Yale University’s endowment fund has nearly 40% in private equity and venture capital funds today compared with only 5% in 1990. As demand for small-cap stocks declines, so do their valuations.

2. Investors are chasing performance.

We have all heard of the Magnificent Seven, the mega-cap tech stocks that have driven recent equity returns: Nvidia, Microsoft, Amazon, Apple, Alphabet, Tesla, and Meta. To put things in perspective, Apple is worth more than all the smaller US companies contained in the entire Russell 2000. Investors have been chasing large-cap returns, and the five-year track record of the NASDAQ is excellent. That was true back in January 2000 as well.

3. There’s the macro and the micro.

At the macro level, the small-cap market turned over in 2021 and has faced the headwinds for almost 2.5 years now. Rising interest rates were priced into small-cap valuations, and with different debt dynamics from their larger peers, smaller companies generally sell off first ahead of a potential recession. Smaller companies, especially those in earlier growth stages, tend to carry more debt, and that debt tends to have a shorter average maturity — 5.7 years vs. 8.2 years — which puts them at greater risk in tighter monetary environments. Smaller companies also have fewer sources of financing to rely on.

What Are the Upside Catalysts?

Against this backdrop, where are the opportunities in small-cap stocks? Smaller companies tend to lead the way ahead of a recovery. When monetary policy becomes more dovish, perhaps as early as the first quarter of 2024, small-cap equities should respond strongly. As performance leadership continues to narrow, institutional funds, among other investors, will begin to look elsewhere, and quality small caps are one place where they will likely deploy capital.

Because small caps tend to be less liquid, a spike in demand can potentially generate significant surges in share prices and a re-rating. Mean regression dictates that, at some point, small-cap valuations will return to their long-term average.

The M&A market is another source of potential upside for small caps. Today, willing sellers are hard to find. Many quality companies came to market at high valuations, and management teams have psychologically anchored to those higher multiples. But in time, their shareholders and board members will accept the new reality and realize that acquisition may be the best path to continued growth.

The small-cap premium historically implies that small-cap stocks outperform their large-cap counterparts over the long term. For example, from 2000 to 2005, after the telecom boom and bust, the S&P 600 outperformed the S&P 500 by 12% per year on average. We’re in a period with a compressing multiple in small caps compared with large caps.

As of September 2023, the forward P/E of the S&P 600 is 13.8. The last two times the S&P 600 had a forward P/E in this range was during the global financial crisis (GFC) and at the start of the global pandemic. On both those occasions, those investors who deployed capital to small caps were well rewarded. There could be a similar opportunity today.

If you liked this post, don’t forget to subscribe to Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / jjwithers

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.