[ad_1]

BsWei

High yielding stocks have a special place for some portfolios, especially retirees, as 3-4% yields may not be enough for an inflationary environment even if they have 10-12% annual dividend growth. It’s no wonder that some investors may want to get “their marshmallow” now, to help fund everyday living expenses. This brings me to Ladder Capital (NYSE:LADR), which presents on such option with a yield nearing 10%. This article highlights why income investors should give LADR a hard look.

Why LADR?

Ladder Capital is an internally-managed commercial mortgage REIT that’s focused on generating senior secured loans collateralized by high-quality properties in the middle-market. Since inception, LADR has made $45 billion of investments, including $30 billion of loans originated. At present, its portfolio carries $5.8 billion of assets across CRE loans, securities, and equity.

What differentiates LADR from peers is its high insider ownership, helping to ensuring a stronger alignment of interest between management and shareholders. Management and directors own more than 10% of the company, amounting to an over $150 million equity investment and over 2 times higher than public peers. Moreover, employees are compensated based on profits with a significant portion in stock.

LADR’s business has shown no signs of slowing down, as it originated $4.0 billion of new first mortgage loans in the first half of the year, helping to bring its percentage of post-COVID loans to 80%. It’s also well-positioned for rising rates as 90% of its balance sheet loans are floating rate, which are positively correlated to rising interest rates.

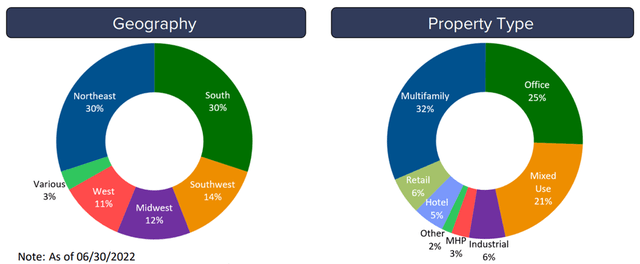

LADR’s investment portfolio is also conservatively managed, with 98% of its loan portfolio being first mortgages, which means that LADR is first in line to be paid in the event of a borrower default. Since inception in 2008, LADR has seen less than 0.1% in cumulative losses on investments. This is achieved in part by ensuring borrowers have significant equity in the underlying properties, with a weighted average loan-to-value ratio of 67%. LADR’s office exposure of 25% resembles that of peer Starwood Property Trust (STWD) and sits lower than Blackstone Mortgage Trust’s (BXMT) 41%.

LADR Portfolio Mix (Investor Presentation)

While office exposure represents a near-term risk, due to work-from-home trends, LADR doesn’t face long-term risks in the manner of the building landlords. That’s because LADR’s loans carry a weighted-average duration of just 1.5% years. Moreover, management is pivoting away from office, as 77% of its second-quarter originations were from the growing segments of multi-family and manufactured housing segments.

Meanwhile, LADR maintains reasonably low leverage with a debt to equity ratio of 1.8x and a BB+ credit rating. It also carries a long-term debt to capital ratio of 69%, sitting below the 72% of Starwood Property Trust and 80% of Blackstone Mortgage Trust. Furthermore, LADR has no bond maturities until 2025, which could help it avoid the current high interest rate environment that we are in.

The recent dip in LADR’s share price from the $11 – $12 range to $9.68 has pushed the dividend yield a high 9.5%. Importantly the dividend is well-covered by a 68% payout ratio, based on Q2 Distributable EPS of $0.34.

I find LADR to be undervalued at present, with a price to book value of just 0.82x, sitting at the low end of its valuation range over the past 3 years outside of the 2020-timeframe. As shown below, LADR’s price to book ratio sits below that of peers STWD and BXMT. Analysts have a consensus Strong Buy rating on the stock and S&P Capital IQ has an average price target of $13.30, translating to potentially strong double-digit annual returns, especially when including the dividend.

LADR Price to Book (Seeking Alpha)

Investor Takeaway

LADR is a well-run commercial mortgage REIT that’s focused on generating senior secured loans collateralized by high-quality properties in the middle-market. It has very high insider ownership resulting in close alignment of interest with shareholders. It also has a strong track record and a conservatively put together investment portfolio. LADR’s cheap valuation and well-protected dividend make it a sound buy for high income investors.

[ad_2]

Source link