Up to date on June 1st, 2022 by Josh Arnold

Cruise line operators are inclined to see immense earnings-per-share development throughout occasions of sturdy financial development and in consequence, their shares can do very properly throughout such durations. In fact, the reverse is true, and cruise line shares can develop into very dangerous throughout occasions of financial misery, or different exterior elements, resembling 2020’s COVID-19 pandemic, the consequences of which proceed right this moment.

Throughout the regular financial development of the previous decade, sure cruise line shares gained the power to return money to shareholders via speedy dividend development, making the group of shares probably engaging for earnings traders as properly.

Two of the three main cruise line operators–Royal Caribbean Cruise Traces (RCL) and Carnival Cruise Traces (CCL)–used to pay dividends to shareholders, however that every one modified when the worldwide pandemic halted the cruise trade as a complete. The episode highlighted simply how susceptible client discretionary shares will be in excessive eventualities, and no cruise traces pay dividends to shareholders right this moment.

As well as, with cruise traces nonetheless working at lowered capability, there is no such thing as a time line for these dividend funds to return. Cruise traces are as an alternative centered on conserving money to keep away from default on debt funds.

If you’re in search of a safer basket of dividend development shares, contemplate The Dividend Aristocrats. They’re an elite group of 65 shares with 25+ years of rising dividends. You may obtain an Excel spreadsheet of all 65 (with metrics that matter) by clicking the hyperlink beneath:

The previous two years have seen large volatility in travel-related shares. Valuations in travel-related shares have come down considerably as of late, however so too have earnings estimates. The trade has been hampered by COVID-19 for much longer than initially thought, and we’re cautious on the group as a complete given the immense uncertainty.

As well as, the cruise traces are nonetheless anticipated to put up losses this 12 months primarily based upon prevailing circumstances, so don’t imagine dividends will return anytime quickly.

Desk Of Contents

The desk of contents beneath supplies for straightforward navigation of the article:

On this article, we’ll check out the three main cruise line shares and rank them in response to their whole return potential. Shares are listed by five-year anticipated returns, so as of lowest to highest.

Cruise Line Inventory #3 – Royal Caribbean Cruise Traces (RCL)

Royal Caribbean Cruises was based in 1969 and since that point, has grown into 5 totally different manufacturers which have 63 cruise ships in service. The corporate gives about 1,000 totally different locations via its numerous routes for purchasers to get pleasure from.

Royal Caribbean is the second-largest cruise operator on the planet and companies six totally different continents. The corporate produced about $11 billion in annual income pre-COVID, and trades right this moment with a market capitalization of $14.8 billion. Present projections put Royal Caribbean’s income above pre-COVID ranges for 2023.

Royal Caribbean reported first quarter earnings on Could fifth, 2022, and outcomes have been very weak, however confirmed that the corporate is on the trail to restoration. Adjusted earnings-per-share got here to a lack of $4.57, which was 9 cents beneath estimates. Income was up from primarily nothing in final 12 months’s Q1 to $1.06 billion, however missed by $90 million towards expectations.

Nonetheless, the corporate famous it continues to make progress on its lengthy restoration from the COVID stoppage, and offered bullish commentary on the rest of 2022 and past.

Supply: Investor infographic

By the tip of Q1, the corporate had returned 54 of its ships to operations throughout the 5 manufacturers, which was about 90% of worldwide capability for Royal Caribbean. The primary quarter noticed about 800,000 company journey with the corporate’s manufacturers, and Q1 noticed document whole income per passenger cruise day. This can be a key income metric that measures a cruise line’s capability to spice up pricing for every visitor, so that is fairly constructive.

Royal Caribbean’s working money movement was constructive in April of 2022, marking a turning level for the corporate that has struggled because the COVID outbreak. Administration expects to be totally operational throughout 100% of the fleet by the beginning of the summer season season of 2022, which is one other key milestone on the trail to restoration.

Bookings in Q1 have been increased than the fourth quarter of 2021, and improved each week sequentially through the quarter. As well as, in comparison with the identical durations in 2019, which was pre-COVID, bookings have been “considerably increased” throughout all durations. That speaks to the power the corporate expects later this 12 months and into 2023. Based mostly on this, administration stated that it expects load elements to proceed to enhance every quarter this 12 months till they exceed 100% by the tip of 2022.

For 2023, all quarters are at present booked inside historic ranges by way of volumes, however at document pricing ranges. This won’t solely drive income increased, however will assist with margins as properly, along with money movement technology. Based mostly upon these elements, Royal Caribbean expects to function profitably within the second half of 2022.

Royal Caribbean continues to optimize its fleet, each by buying extra environment friendly ships designed to burn much less gas, in addition to encourage onboard spending, but in addition via divesting older ships. This effort will assist it obtain its environmental safety objectives, however has tangible advantages for shareholders as properly. Increased income and margins will generate increased earnings, in addition to increased money movement, all else equal.

We’re forecasting 7% earnings-per-share development for Royal Caribbean over the subsequent 5 years, primarily based off of earnings energy of $8.00 per share. Gasoline prices and foreign money publicity are widespread dangers for cruise line operators and Royal Caribbean carries these dangers.

Royal Caribbean hedges about 50% of its gas prices so volatility shall be decrease from that issue, however foreign money swings can influence outcomes positively or negatively at any given time relying upon the place the US Greenback trades. Provided that oil and gas costs stay at or close to document ranges, Royal Caribbean’s earnings are considerably uncovered.

Royal Caribbean’s price-to-earnings ratio has fallen because the COVID outbreak, together with the remainder of the trade. This has resulted within the inventory being undervalued at current, offering what we imagine is a chance for longer-term traders that may deal with the inherent danger of proudly owning a travel-related inventory at this level.

The present price-to-earnings ratio of seven.3 compares favorably to our honest worth estimate of 9 occasions earnings. That would produce a 4.4% tailwind to annual whole returns over a five-year interval, as a result of rising valuation a number of.

We notice our honest worth estimates for the cruise traces could be very low by historic requirements, owed to the extra dilution and debt the operators took on to outlive COVID. As well as, whereas the present outlook is powerful, it carries with it vital uncertainty.

Total, Royal Caribbean appears to be like poised for 11.7% whole returns, pushed by the valuation tailwind and seven% earnings development. There isn’t a dividend, and we don’t anticipate to see one for a while to come back.

Cruise Line Inventory #2 – Norwegian Cruise Line Holdings (NCLH)

Norwegian Cruise Line Holdings was based greater than 50 years in the past as a substitute for the extra structured cruises that have been supplied on different carriers. The corporate’s “freestyle” cruising has resonated properly with shoppers and right this moment, it operates 28 ships that generated virtually $7 billion in annual income previous to COVID-19. Norwegian went public in 2013, and trades with a market capitalization of $6.8 billion.

Norwegian reported first quarter earnings on Could tenth, 2022, and outcomes have been worse than expectations. Nonetheless, the corporate famous it reached a “monetary inflection level” through the quarter, that means the corporate created constructive working money movement through the quarter for the primary time because the COVID outbreak. As well as, the corporate stated pricing and quantity for future bookings stays very excessive, so the corporate is sort of optimistic on its future.

Norwegian misplaced $1.82 per share in Q1, which was 41 cents per share worse than anticipated. Income closely missed the mark, coming to $522 million, which was $238 million decrease than estimates. Nonetheless, final 12 months’s Q1 noticed primarily no income, so the restoration is underway.

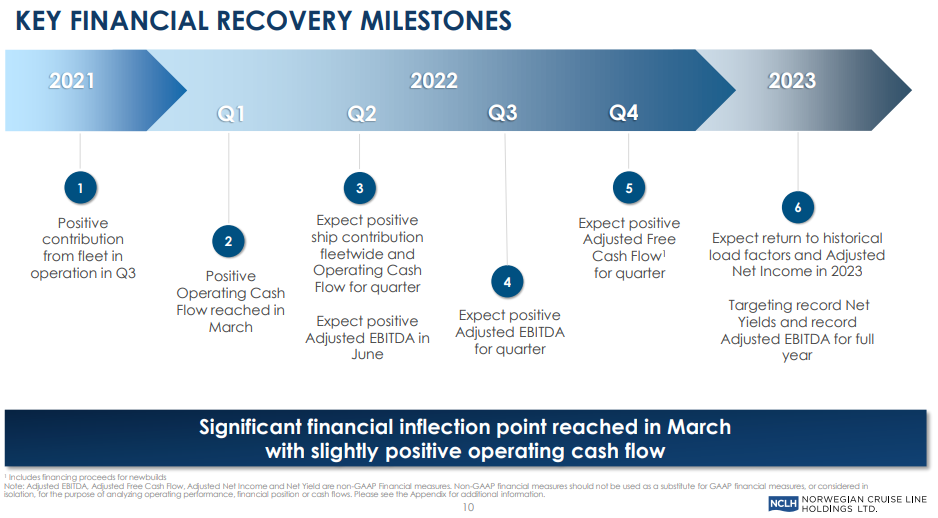

Supply: Investor presentation, web page 10

The slide above reveals the restoration Norwegian has undertaken because the starting of 2021, as administration has been centered on survival. The excellent news for shareholders is that Norwegian sees constructive adjusted EBITDA in Q2 of this 12 months, and constructive free money movement in This autumn. Additional, administration expects document occupancy and charges in 2023, which ought to produce document adjusted EBITDA for the 12 months.

We see 12% earnings-per-share development yearly over the subsequent 5 years off of our estimated earnings energy of $2.00 per share. The corporate is constructing new capability that’s extra centered on premium cabins, in addition to extra environment friendly working, each of which ought to enhance margins over pre-COVID ranges. Gasoline prices and foreign money translations are issues for Norwegian however given the sturdy reserving quantity and pricing administration is touting, we imagine the earnings outlook is sort of favorable, assuming Norwegian can function at full capability.

Norwegian trades for 8 occasions our earnings energy estimate of $2 per share, and we assess honest worth at 9 occasions earnings, driving a 2.4% potential valuation tailwind. As there is no such thing as a dividend, the valuation and earnings development mix to supply 14.7% estimated whole returns yearly.

Cruise Line Inventory #1 – Carnival Cruise Traces (CCL)

Carnival Cruise Traces was based in 1972 when it started as a small cruise ship operator. The corporate has been publicly traded since 1987, beginning what was an extended custom of utilizing shareholder capital to amass different cruise traces. Immediately, it has 9 totally different manufacturers that function virtually 90 ships, producing about $21 billion in annual income pre-COVID. The inventory trades with a market capitalization of $15.6 billion right this moment.

Carnival reported first quarter earnings on March twenty second, 2022, and outcomes have been worse than anticipated on each income and earnings. Earnings got here to a lack of $1.66 per share, 38 cents decrease than anticipated, whereas income was $1.62 billion, lacking estimates by $640 million. Like Norwegian, Carnival produced primarily no income in final 12 months’s Q1.

The corporate stated income per passenger cruise day was up 7.5% in comparison with 2019, and that 75% of the whole capability had resumed regular operations. Carnival expects constructive adjusted EBITDA through the summer season season, and a full-year loss this 12 months regardless of a revenue for Q3.

We estimate earnings energy at $2.25 per share for Carnival, however anticipate 7% development off of that degree within the years to come back. The corporate’s fleet optimization technique is seeing a extra environment friendly fleet that prices much less for gas, in addition to optimizes onboard spending. Each of those assist drive margins, and Carnival is seeing very sturdy demand for tickets each by way of quantity and pricing.

Carnival’s shares commerce for simply 6.2 occasions earnings energy, towards our honest worth estimate of 9 occasions earnings. That would drive a 7.7% tailwind from the valuation within the years to come back, and at the side of 7% projected earnings development, we see 15.2% annual returns shifting ahead.

We notice that Carnival has $29 billion in internet debt as of the tip of Q1, that means this can be very extremely leveraged. Provided that, Carnival carries with it extra danger, in addition to making it more difficult to ultimately pay a dividend to shareholders. We imagine Carnival is the furthest from having the monetary capability to return capital to shareholders, in order that’s one thing for potential consumers to remember.

Closing Ideas

The extraordinarily excessive projected charge of return for the three main cruise line shares assumes a return to normalized operations over the long-term. Future returns are additionally primarily based on their depressed valuation multiples, which might see upside if the coronavirus outbreak is contained sooner reasonably than later.

In fact, there is no such thing as a assure that this may occur within the near-term. Because of this, traders ought to anticipate continued volatility within the main cruise line shares. These cruise line shares might be sturdy investments primarily based on their discounted valuations if they’ll return to development, however traders might want to train persistence.

We suggest traders maintain a long-term view when contemplating cruise line shares. Given all of those elements, we expect Royal Caribbean is the perfect cruise line operator inventory right this moment for long-term earnings traders.

Additional Studying

The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].