[ad_1]

by Charles Hugh-Smith

All this decay is so incremental that no one thinks it doable that it might ever accumulate right into a threat that threatens all the system.

The humorous factor about threat is the danger that everybody sees isn’t the danger that blows up the system. The mere undeniable fact that everyone seems to be listening to the danger tends to defang it as everybody rushes to hedge or scale back the danger.

It’s the danger that accumulates underneath everybody’s radar that takes down the system. There are a number of dynamics driving this paradox however for now let’s have a look at the paradox of optimization.

The paradox of optimization is that to optimize effectivity and output (i.e. revenue) resilience should be sacrificed. This leaves the system weak to break down when the system veers past the parameters set in stone by optimization.

Resilience is the results of quite a lot of costly-to-maintain options. For instance, redundancy: to optimize the provision chain, do away with the upper price suppliers and rely totally on the lowest-cost provider. This sole-source optimization works nice till the sole-source provider encounters a spot of hassle, or one of many sole-source provider’s element producer encounters a spot of hassle. By the point all the provide chain has collapsed, it’s too late to reconfigure a manufacturing facility or improve the manufacturing of marginal suppliers.

The traditional instance of optimization and redundancy is a spacecraft. Oops, the oxygen valve simply blew out. Set up the substitute valve earlier than all of us expire. Oops, the spare valve was eradicated within the push to scale back weight.

Optimization assumes every thing will work inside very tight parameters. Sustaining redundancy, backups and adaptableness is dear and so so long as every thing is working properly then all these bills considered as pointless are minimize to scale back prices and improve earnings.

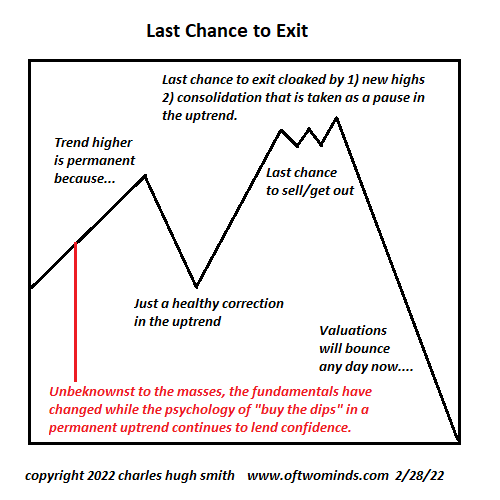

The identical might be mentioned of hedges. If the market solely goes up, what’s the purpose of sustaining expensive hedges in opposition to a crash that may by no means occur?

The longer optimized methods work as meant, the higher the arrogance within the system. Since nothing has ever failed earlier than, members begin taking liberties on the margins of the system, letting high quality slip as a result of high quality management, coaching, and so forth. are all expensive in time, cash and energy. Since every thing is working so properly, why hassle being fanatic about high quality and threat mitigation?

This confidence feeds complacency and hubris. Because the O-rings have by no means failed, go forward and launch. In our confidence and hubris, we cease listening to the boundaries of the optimized parameters: sure, the system works, however provided that all of the parameters maintain.

Whereas the gang basks in complacency and hubris, threat seeps into the system in ways in which few are listening to. Each optimized system invitations taking liberties as a result of pushing the boundaries doesn’t appear to have any draw back. Take into account subprime mortgages for instance: lowering the down cost required of house patrons didn’t break the system, so why not scale back it to zero? See, every thing’s nonetheless working.

Because the system is so clearly sturdy, let’s dispense with verifying earnings of mortgage candidates and settle for no matter they declare. And for the reason that system remains to be working properly with these tweaks, threat is clearly low so let’s price all these mortgage swimming pools as low-risk. And for the reason that urge for food for low-risk securities is so excessive, let’s bundle as many of those as we are able to and promote them to pension funds, and so forth.

Since everybody is just listening to what’s inside the optimized parameters, the danger piling up exterior the parameters goes unnoticed. The truth that the system hasn’t blown up but induces a hubristic confidence bordering on quasi-religious religion that the system can soak up all types of sloppiness, fraud and run to failure dynamics and carry on ticking.

This substitution of religion for rigor goes unnoticed. These few who’re watching the construct up of threat the place nobody else is wanting are dismissed as perma-bears, Cassandras, and so forth. What’s handed off as rigorous (dot-plots, anybody? very tasty!) isn’t truly rigorous as a result of what’s being paid consideration to is all well-known and properly tracked.

What breaks methods is just not well-understood. As soon as we begin speaking about non-linearity, part shifts and incoherence then we’re in summary la-la land. And so the human default is to position quasi-religious religion within the sturdiness of no matter system has been optimized for particular situations. When these situations erode or change, no one notices as a result of the system remains to be functioning.

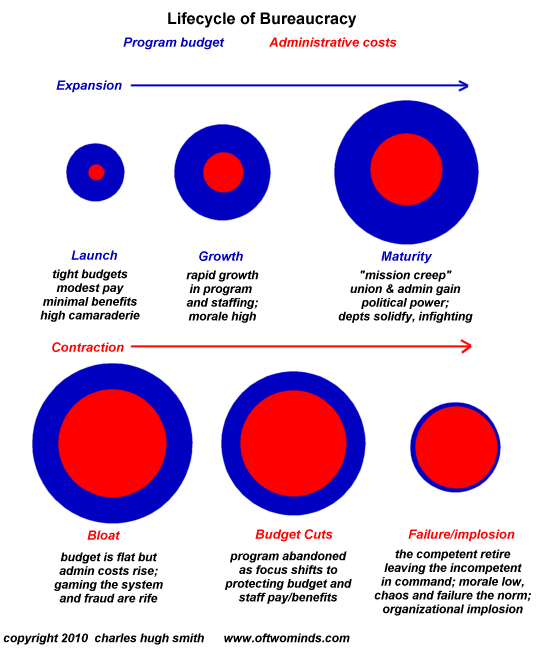

As soon as an optimized system is taken into account so sturdy as to be everlasting, then members begin larding on mission creep and the corruption of self-enrichment. No person will discover if time beyond regulation is fudged, expense accounts padded, studies crammed with copy-and-paste jargon, and so forth.

All this decay is so incremental that no one thinks it doable that it might ever accumulate right into a threat that threatens all the system. Because the system is optimized for particular situations and the feedbacks of resilience are considered as pointless bills (or given quick shrift as a result of they’re considered as mere routine), the system veers exterior its optimization parameters and begins orbiting the black gap of decoherence.

Programs that spiral into decoherence by no means emerge. The chance piled up exterior of what everybody has been skilled to concentrate to, and so everybody who reckoned the system was steady and sturdy is unprepared for each its unraveling and the velocity of that unraveling.

Optimizing a system for particular outputs generates threat exterior the attain of no matter shreds of resilience are left after years or many years of decay, corruption, self-service and mission creep. Coherence with out resilience is phantasm.

Solely the few listening to the buildup of threat exterior what everybody else sees and is aware of see the final likelihood to exit. Everybody else continues enjoying with the iceberg’s scattered ice chunks on deck as a result of everybody is aware of the ship is unsinkable as a result of the danger has been mitigated with waterproof bulkheads. Solely the few listening to the small print perceive the ship will sink.

Quasi-religious religion within the Federal Reserve is just not an alternative to the rigor of listening to what no one else is listening to.

[ad_2]

Source link