Last week, Bitcoin rode the bullish wave it got on last fall and broke above the coveted $52,000 level. Bitcoin regaining almost all of its losses since the collapse of FTX is a significant milestone for the industry that has been struggling to get out of a bear market for the better part of the past year.

Bitcoin’s upward momentum has been followed by an increase in the aggregated market cap of major stablecoins, most notably USDT, USDC, BUSD, and DAI. The four stablecoin giants saw their aggregate market cap grow from $131.232 billion to $132.472 billion between Feb. 13 and Feb. 18, showing a growing demand.

Stablecoins are a bridge between fiat currencies and the crypto market, making up the majority of crypto trading pairs and, therefore, the majority of market liquidity. The increase in market cap reflects a higher adoption rate of stablecoins and reaffirms them as a preferred medium for interacting with cryptocurrencies.

Zooming out shows a 3.475% increase in the supply of the top four stablecoins over the past 30 days. This increase in supply can result from multiple factors, but it’s most likely a market-wide push to move assets (be it fiat or crypto) into stablecoins to prepare for trading. This suggests that the market is anticipating activity in the coming weeks and preparing for quicker entry or exit from Bitcoin.

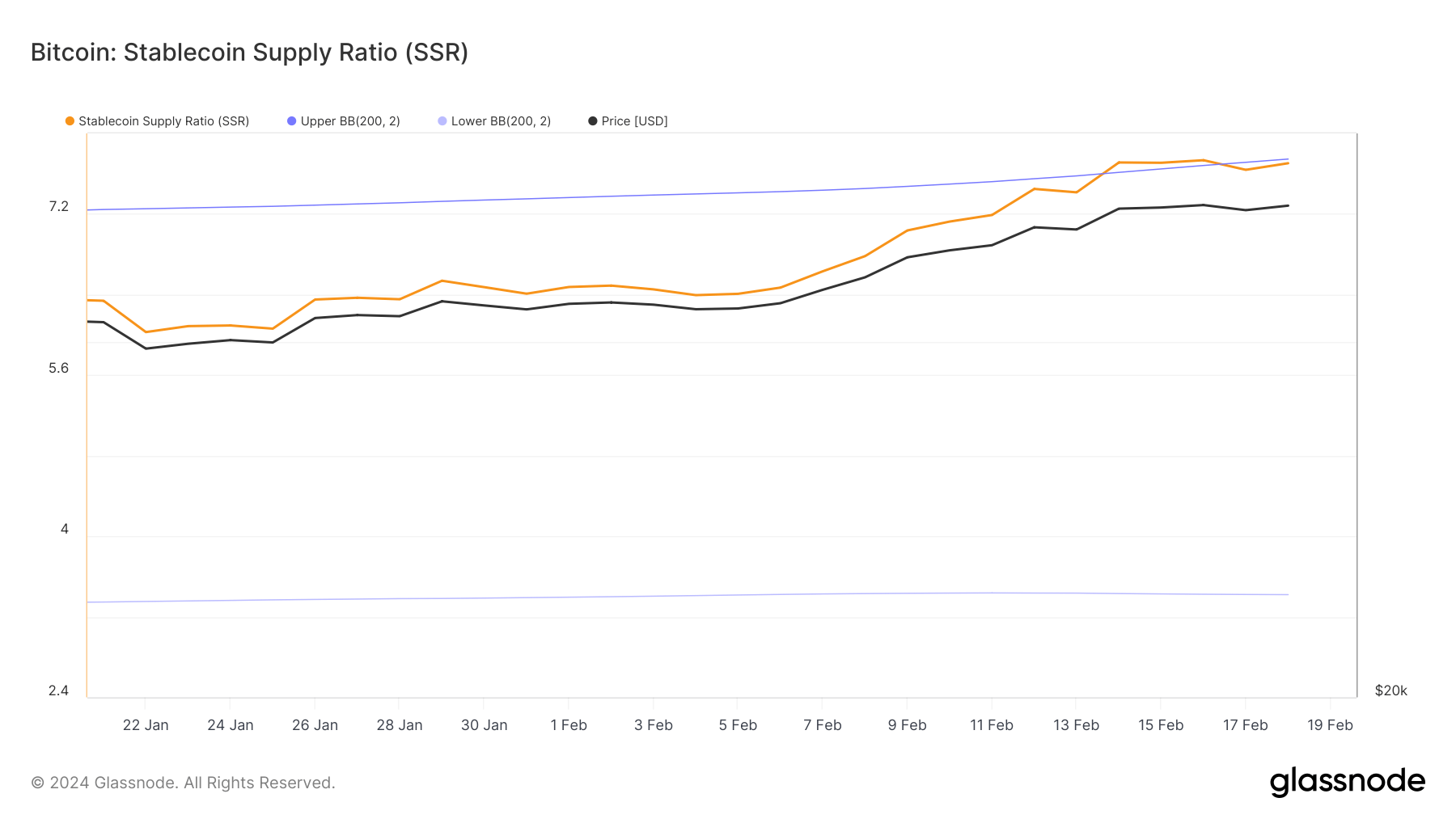

This is further supported by a notable stablecoin supply ratio (SSR) increase. The SSR is a critical metric that measures the supply of stablecoins relative to Bitcoin’s market cap, showing how deep market liquidity is and the market’s potential buying power. A higher SSR indicates that there are more stablecoins relative to Bitcoin, so the potential buying power could drive Bitcoin’s price up if the stablecoin supply were to be exchanged into Bitcoin.

The SSR being above the upper Bollinger band from Feb. 14 to Feb. 16 signals an unusual increase in potential buying power, possibly indicating that investors were preparing to move into Bitcoin or other cryptocurrencies, which is consistent with the observed price increase in Bitcoin during this period.

The increase in Bitcoin’s price, alongside a growing market cap and supply of major stablecoins, suggests an influx of capital into the market. For stablecoins, the observed trends highlight their critical role in the ecosystem, acting not only as safe havens during times of volatility but also as essential tools for capital deployment into Bitcoin.

Last week’s trends show just how connected the stablecoin market is to Bitcoin and how movements in the supply and market cap of stablecoins can serve as indicators of forthcoming market activity.