[ad_1]

Marijn Bolhuis, Judd N. L. Cramer, Lawrence H. Summers 28 March 2022

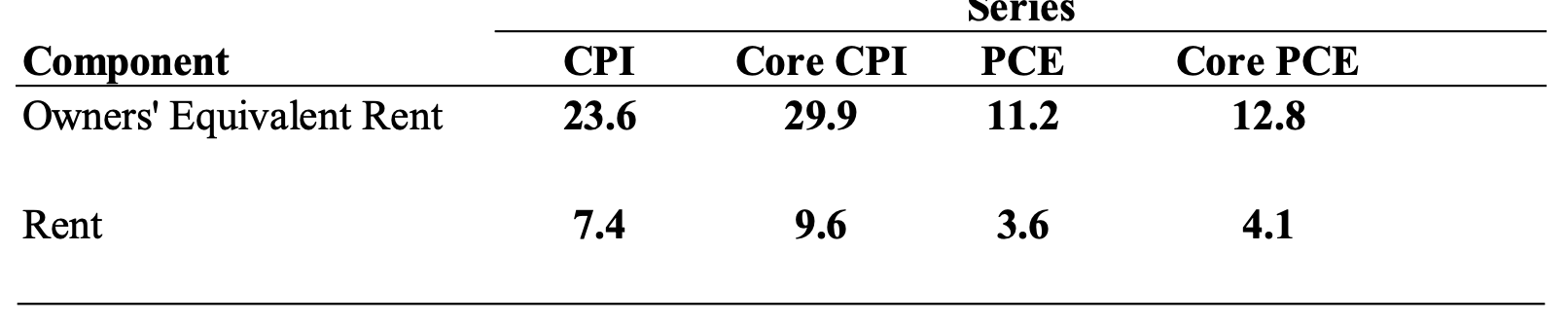

A couple of primary statistics counsel the significance of residential providers to the general inflation course of. The 2 largest parts of residential providers – house owners’ equal lease of residence (OER) and lease of major residence – mix to vary from about 15% of the Private Consumption Expenditure Worth (PCE) Index to virtually 40% of the Client Worth Index (CPI) core measure, which strips away risky vitality and meals costs (Desk 1).1 This represents roughly half of the providers element of the CPI.

Desk 1 Variations in weight shares in housing PCE vs CPI (%)

Sources: Bureau of Labor Statistics, Bureau of Financial Evaluation, authors’ calculations

Notes: PCE weights will change with new releases and revisions.

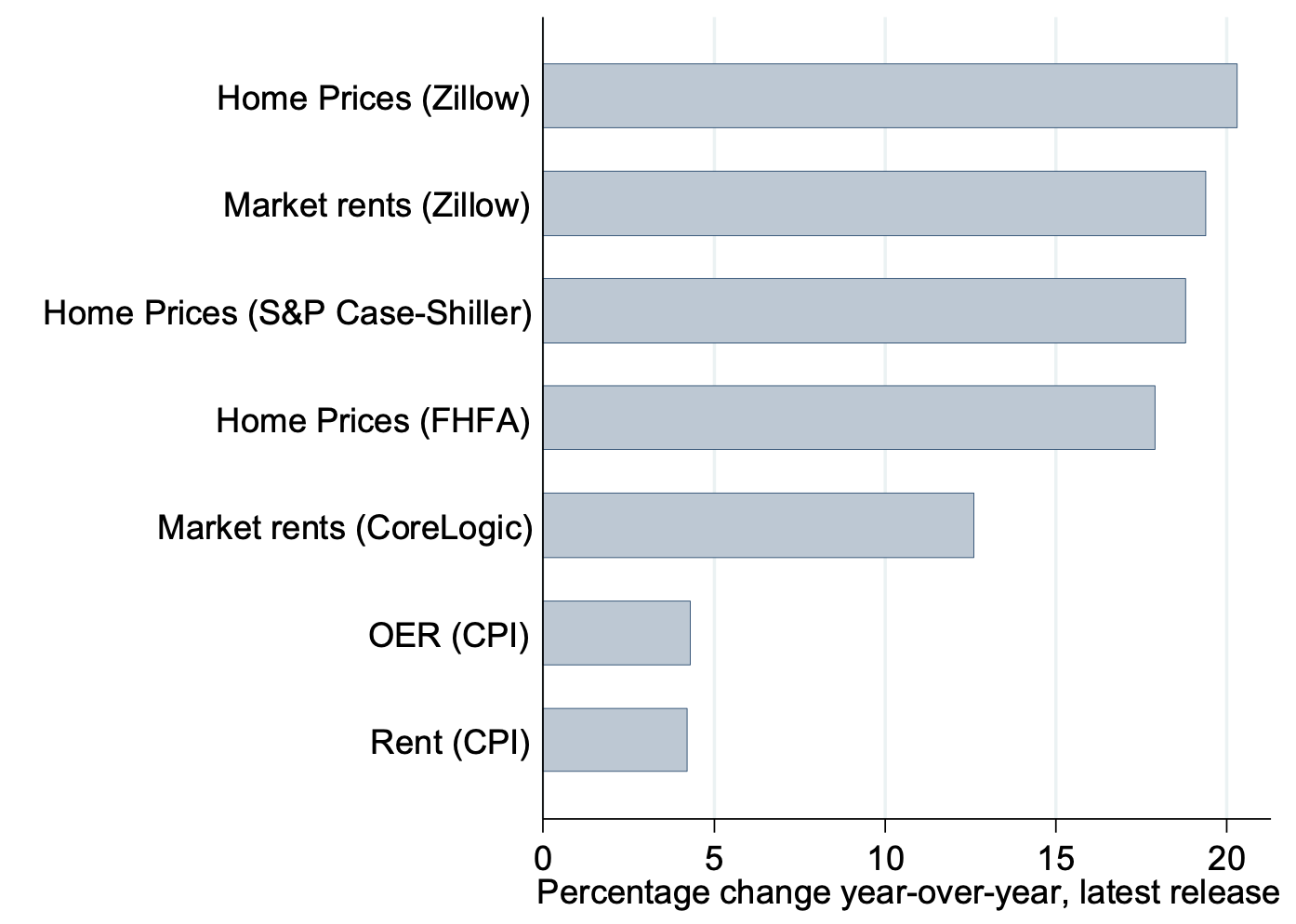

Measured residential providers inflation was solely 4.3% within the twelve months ending in February 2022 for OER, and 4.2% for the much less vital rental housing element over the identical interval. These figures characterize a latest improve, however nonetheless appear virtually incommensurate with non-public sector estimates of the present change in the price of dwelling for owners and renters. Over the identical interval, house costs have jumped by 20.3% in keeping with Zillow. The Zillow Noticed Lease Index has elevated 19.4%, and the CoreLogic Single-Household Lease Index, prone to be a very good main indicator for OER, had risen by 12.6% within the twelve months ending January 2022 (Determine 1).2

Determine 1 Progress in measures of housing prices, newest releases

Sources: Zillow Dwelling Worth Index, S&P CoreLogic Case-Shiller Dwelling Worth Index, FHFA Home Worth Index, CoreLogic Single-Household Lease Index, Zillow Noticed Lease Index, CPI Proprietor’s Equal Lease of Residences, CPI Lease of Major Residence.

Notes: Determine plots newest information launch of collection, expressed in share change relative to 12 months earlier. This determine displays up to date numbers for the reason that publication of Bolhuis et al. (2022). S&P Case-Shiller, shorthand for S&P CoreLogic Case-Shiller, is from December 2021, FHFA from This autumn 2021, CoreLogic from January 2022. Different collection from February 2022.

The explanation for this obvious disconnect is that the majority owners and renters didn’t transfer in 2021. They thus didn’t should pay the spot worth for shelter because it rose quickly. As an alternative, many needed to pay the speed that they signed for earlier within the 12 months or the speed they signed for years earlier that had been modified barely by their landlord or financial institution. These costs ought to are inclined to converge to the market worth, however the lag time could also be vital and the convergence incomplete.

Whereas earlier than we would not have been capable of forecast the trajectory of measured governmental rental inflation precisely, the arrival of real-time huge information on rental asking costs from companies like Zillow and machine studying methods permit us to foretell modifications extra precisely. In a latest paper (Bolhuis et al. 2022), we offer tough estimates for the housing element of inflation within the close to time period.3

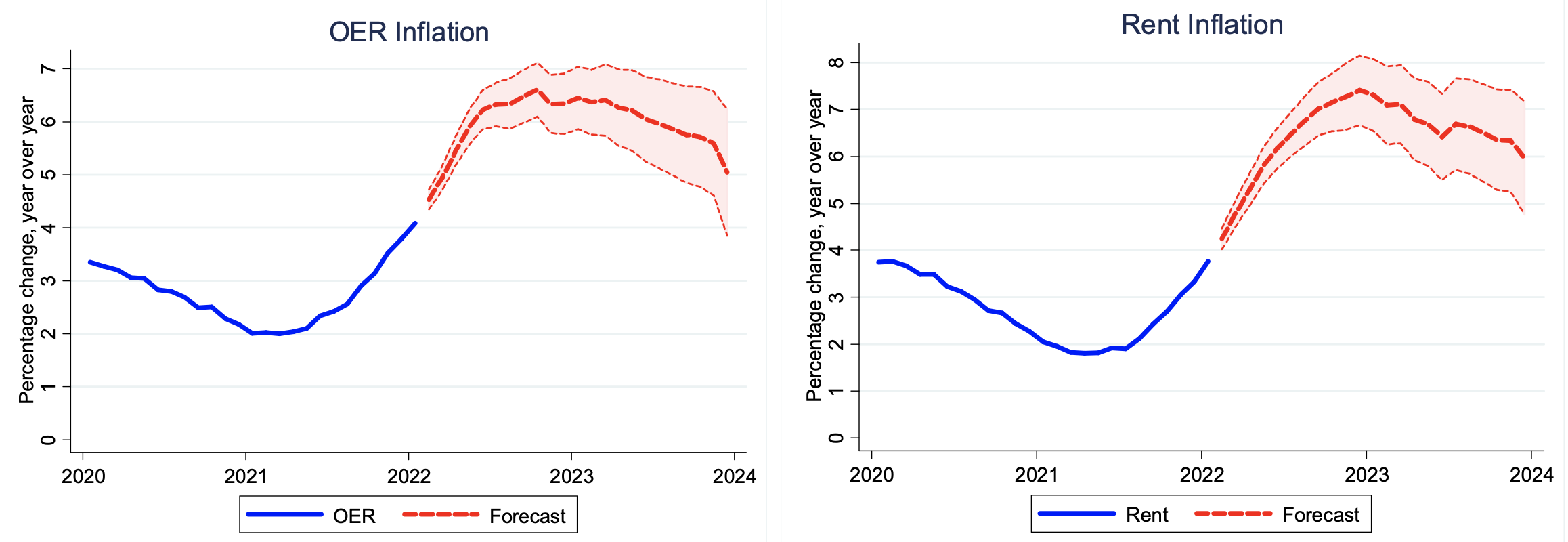

Forecasting housing inflation

Extrapolating from previous relationships utilizing a machine-learning forecasting technique, we estimate that housing inflation is prone to transfer to between 6.5% and seven% in the direction of the top of 2022 (Determine 2). This could imply housing will make a major contribution to total inflation in 2022, starting from about one share level for the PCE to 2.6 share factors for core CPI, relying on the load housing is given. Our estimates indicate housing’s contribution to total inflation can be between 0.4 and 1.1 share factors increased in 2022 in comparison with 2021, relying on the selection of index. We imagine that our estimates are comparatively sturdy on account of their stability irrespective of knowledge collection decisions or forecasting methods.

Determine 2 Projected OER and lease

Sources: Bureau of Labor Statistics. Personal sector lease information from CoreLogic Single-Household Lease Index. Dwelling costs from Zillow Dwelling Worth Index. Authors’ calculations.

Notes: Forecast mannequin is an elastic internet utilizing 24 months of lags within the year-over-year progress charges of the dependent variable and 24 months of lags within the year-over-year progress fee of the Zillow Dwelling Worth Index and the CoreLogic Single-Household Lease Index. Dotted strains are 95% confidence intervals based mostly on in-sample forecast errors.

In our paper, we assess the general influence on core and headline inflation beneath two eventualities. We present that even when the remainder of the CPI basket returns to the goal of two%, we mission that housing will push up core CPI to shut to 4% in December 2022. We additionally estimate that even when the value of used automobiles relative to the general CPI returns to pre-pandemic ranges, this might not offset the extra residential providers inflation that we mission in 2022.

Together with main indicators of housing provide, the mannequin initiatives 8% for the weighted inflation fee of OER and lease within the CPI in December 2022. This improve in our forecasts displays the muted provide response relative to what would have been predicted given historic relationships and the fast run-up in housing costs for the reason that begin of the pandemic. Our fashions counsel that the expansion in new provide will reasonable in 2022, protecting the availability of recent houses on the market under the height of the earlier cycle.

Conclusion

Within the period of Covid, extrapolating from historic relationships comes with substantial uncertainty. That is very true for residential providers, as working from house, modifications in family formation, and provide bottlenecks have affected each side of the housing and rental markets. We take this chance to record a couple of different caveats that would serve to bias our forecasts.

Particularly for persevering with tenants, there are various state and native legal guidelines that cap lease will increase.4 Whereas these restrictions don’t all the time bind in all jurisdictions, they may attenuate our outcomes as landlords might not be capable of regulate to the spot worth as rapidly as they’ve prior to now. Newly proposed and current legal guidelines on lease management and eviction moratoria would additionally make our estimates for 2022 too excessive. Moreover, whereas we don’t assume that bottlenecks have been the only real purpose for value will increase, their easing might result in a robust provide response. If there are nonlinearities within the response of development to costs – as costs have risen at file charges – then costs might decline sooner than the information on which our forecasting fashions are educated. Alternatively, if bottlenecks proceed properly into 2022, our estimates could be biased downwards as the shortage of recent provide might exacerbate robust rental worth progress. In the identical route, robust housing pricing progress might worth potential new homebuyers out of the housing market and hold them within the rental market. This might serve to strengthen the rental market past our estimates and result in increased measured residential providers inflation than we mission. Taking a step again, our mannequin itself is calibrated on previous readings for personal sector house and rental will increase that aren’t as giant as they’re presently. Persevering with unprecedented worth rises might additionally make our extrapolation extra error inclined in both route.

Regardless of these caveats, utilizing a wide range of methods and datasets, we estimate housing’s contribution to 2022 providers inflation and total inflation as being vital. The way in which that housing inflation is measured – as the common worth progress throughout all housing occupants, not as the common worth improve one searching for housing right now would pay relative to an precedent days – ensures that previous developments within the housing market will end in a rise in recorded housing inflation in 2022. Our findings counsel that if previous relationships maintain into 2022, housing inflation is prone to transfer to between 6.5% and seven% and make a major contribution to total inflation in 2022, starting from one to almost three share factors. Though our projections counsel that residential inflation will peak in late 2022, we count on it to stay elevated in 2023.

Authors’ notice: The views expressed herein are these of the authors and don’t essentially replicate the views of the, IMF, its Government Board, or IMF administration.

References

Bernstein, J, E Tedeschi, and S Robinson (2021), “Housing costs and inflation”, Council of Financial Advisers weblog submit.

Boesel, M, S Chen, and F E Nothaft (2021), “Housing preferences throughout the pandemic: impact on house worth, lease, and inflation measurement”, Enterprise Economics.

Bolhuis, M A, J N L Cramer, and L H Summers (2022), “The Coming Rise in Residential Inflation”, NBER Working Paper 29795.

Brescia, E (2021), “Housing poised to be robust driver of inflation”, Fannie Mae Housing Insights.

Dolmas, J, and X Zhou (2021), “Surging Home Costs Anticipated to Propel Lease Will increase, Push Up Inflation”, Federal Reserve Financial institution of Dallas weblog submit.

Glaeser, E L and J Gyourko (2009), “Arbitrage in Housing Markets”, in E L Glaeser and J M Quigley (eds), Housing markets and the economic system: threat, regulation, and coverage: essays in honor of Karl E. Case.

Endnotes

1 For extra info on how the indices differ and a latest dialogue of comparable points, see work by the Council of Financial Advisers (Bernstein et al. 2021).

2 Glaeser and Gyourko (2009) present that the rental inventory and owner-occupied inventory of housing differ considerably, with single-family houses extra prevalent amongst owner-occupied items. Boesel et al. (2021) present the utility of the CoreLogic Single-Household Lease Index and the way it higher captured housing dynamics early within the pandemic.

3 Brescia (2021) and Dolmas and Zhou (2021) forecast lease and OER inflation utilizing historic information on house costs. Our evaluation exhibits that, whereas house costs have a tendency to steer official shelter inflation, non-public sector lease information are a extra sturdy predictor of shelter inflation within the close to time period.

4 See Been et al. (2019) for a latest dialogue of the previous, current, and potential futures of lease laws.

[ad_2]

Source link