eToro‘s CEO Yoni Assia, Bitstamp‘s CGO Barbara Daliri, Utrust‘s CEO Sanja Kon and Finoa’s COO Michaela Fleischer joined Tech.eu‘s Fintech occasion and mentioned the current and the way forward for crypto.

Throughout his Q&A session, Yoni Assia talked concerning the causes behind crypto’s volatility and adoption, in addition to his expectations from the crypto area by 2030.

Following Assia, Daliri, Fleischer and Kon mentioned how far the dimensions of adoption may go, who’s answerable for the market volatility and what issues might be solved by schooling on crypto.

Crypto’s current

Two questions had been mentioned underneath crypto’s current: why excessive volatility exists, and what does the excessive adoption price inform us?

Volatility

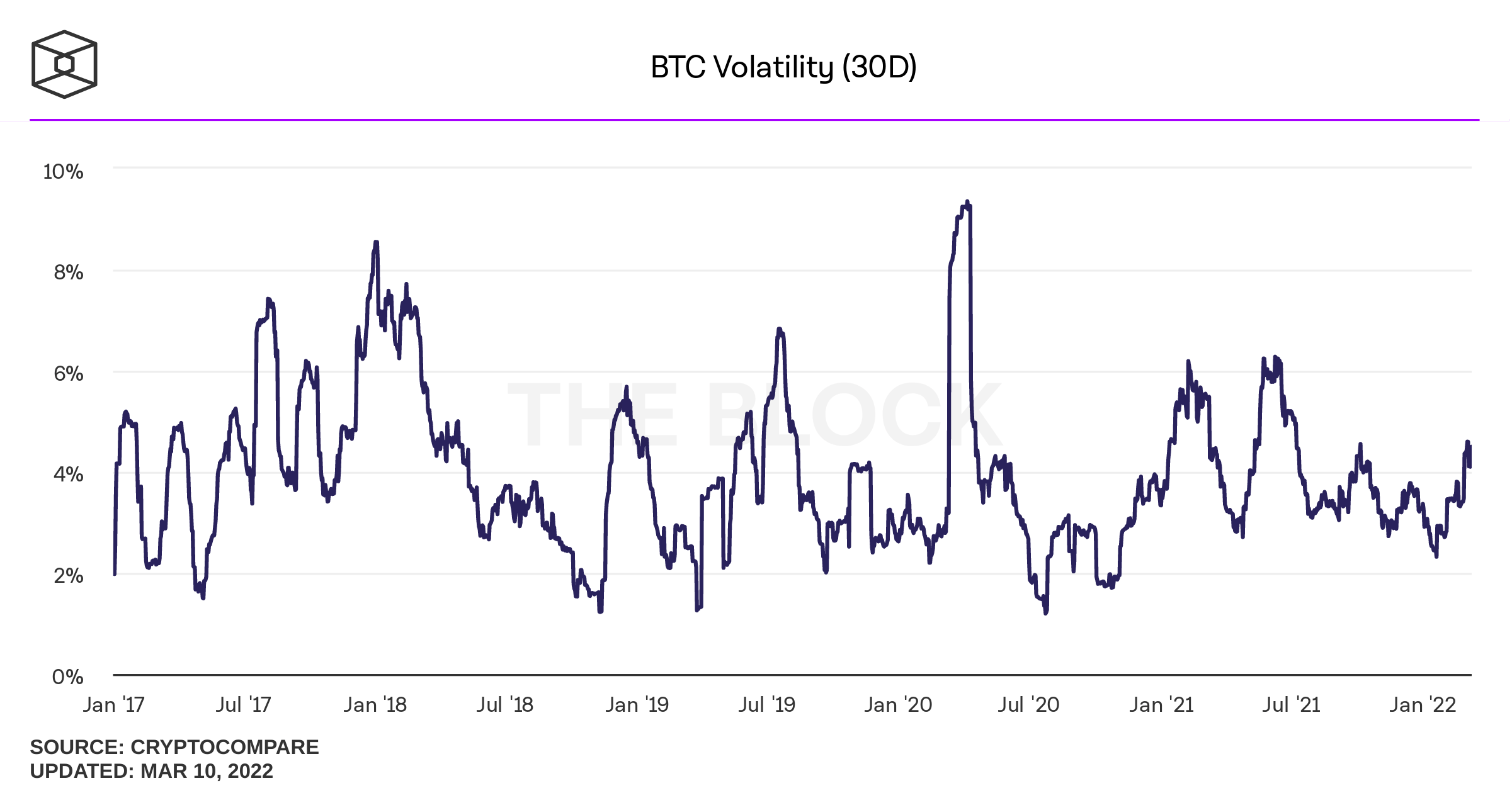

The above chart exhibits the 30-day shifting common volatility index for Bitcoin, the place volatility is outlined as the usual deviation of every day income returns.

The latest all-time low Bitcoin volatility was recorded in July 2020. Since then, volatility solely continued to extend. Spikes recorded in December 2021 and early January 2022 had been comparatively calmer compared to Bitcoin’s historical past. Nonetheless, sanctions towards Russia led to a volatility surge.

Worth volatility had at all times been an issue for all crypto belongings, particularly Bitcoin. Sudden actions inside an hourly window have grow to be the norm, and in keeping with famend crypto executives, volatility isn’t about to relax any time quickly.

eToro CEO Yoni Assia argues that top market volatility happens because of an unbalance between “common” homeowners and institutional traders. Based on him, crypto costs are affected by the next:

“First, real contributions of normal customers from all generations. Second, institutional traders, that are drawn to the market as a result of they’re intrigued by the excessive stage of uncertainty.”

He additional elaborated:

“When second actors see a rise out there worry, they instantly sell-out and create additional instability. These two aren’t on the proper stability, which is why we expertise volatility nonetheless. Volatility will live on till they discover the suitable stability.”

Following Assia’s session, Barbara Daliri and Michaela Fleischer approached market volatility from an even bigger perspective.

Daliri talked about that volatility is an inevitable a part of all monetary methods and it shouldn’t be discouraging for the traders. An identical strategy has been said by well-known investor Anthony Pompliano as properly.

Fleischer agreed with Daliri and additional added:

“Crypto is a really younger market. New actors of all sizes take part on daily basis, and never all are properly educated. All of them contribute to volatility.”

Each Fleischer and Daliri highlighted that the crypto market is far more secure compared to its early years and it’ll solely develop much less and fewer risky in time.

Adoption

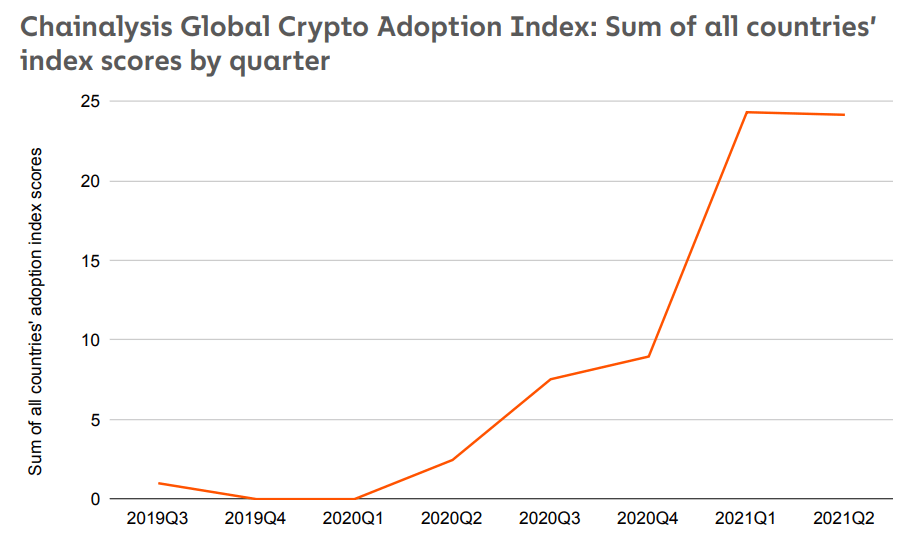

Based on Chainalysis‘ 2021 Geography of Cryptocurrency Report, crypto adoption skyrocketed within the final twelve months.

The above chart exhibits international adoption at 2.5 on the finish of 2022 Q2 and 24 on the finish of 2021 Q1, indicating an 881% development over lower than a yr. General adoption, from starting to right now exhibits greater than 2300% development since 2019.

The Chainalysis analysis revealed that the explanation behind elevated adoption differed world wide. Rising markets turned in direction of cryptocurrencies to protect their financial savings towards foreign money devaluation, difficulty transfers and perform enterprise transactions. Alternatively, North American, Jap Asian and Western European markets grew by means of institutional investments.

Yoni Assia, Sanja Kon and Barbara Daliri’s feedback on rising adoption additionally confirmed parallelism to Chainalysis’ report.

Assia talked about the elevated adoption amongst particular person customers and argued that it elevated because of two elements: possession and hedging capabilities. He argued that the shortage of Bitcoin allowed it to behave like gold, which is a main inflation hedge. Since fiat-based investments misplaced nice worth because of COVID, people turned to hunt aid in crypto.

Assia famous:

“Cash isn’t essentially secure heaven and folks now realized they wanted to learn to make investments their cash. Bitcoin is a hedge towards the governments’ inflation as a result of its shortage transforms it right into a type of digital gold.”

He additionally argued that with crypto people may each personal their very own cash, and reap the benefits of the assorted funding alternatives. He added:

“Remainder of the weather of crypto, like sensible contracts and NFTs, carry their very own worth into the market. Every represents a special sort of funding alternative, fully totally different from the capital markets and fully owned by the asset holders. That’s why we see a real adoption from all generations.”

Kon primarily centered on adoption round enterprise transactions. She talked about that when Utrust was launched, all their retailers accepted funds in crypto provided that it was instantly exchanged for fiat currencies. Now, increasingly more retailers have gotten accustomed to accepting crypto as cost with out exchanging it. She stated:

“As we speak, greater than 50% of our retailers, even small ones are accepting Bitcoin or stablecoins as cost, and are retaining them that means. These numbers inform us that retailers are inclined to grasp crypto as a legitimate asset.”

Daliri, then again, drew consideration to the rising variety of industrial gamers. She argued that massive actors had been entering into the crypto area all world wide, and their involvement elevated crypto’s credibility. She added that with the assistance of the rules, adoption throughout establishments would improve much more.

Crypto’s future

When it got here to crypto’s future, Barbara Daliri and Sanja Kon talked concerning the significance of schooling whereas Yoni Assia shared his daring predictions.

Training

One of many essential issues all executives agreed on was the significance of schooling for the newcomers. Daliri and Kon argued that lack of schooling harmed the market by inflicting volatility and the person by inflicting extreme losses. As well as, these damages additionally negatively affected public opinion on crypto.

Whereas discussing present volatility, Daliri said:

“Instructing newcomers concerning the mechanics of the market is significant to therapeutic volatility. With correct coaching, we may stop massive gamers to stop. We are able to additionally educate everybody easy methods to defend themselves towards volatility to stop losses, which ultimately creates volatility itself.”

Kon agreed with Daliri and added that schooling might be an accelerator for the adoption and that the rules can improve schooling. She stated:

“Each retailers and prospects who take care of crypto need reassurance. We are able to present it by constructing belief and educating them. Lack of schooling is without doubt one of the core boundaries to adoption. As rules consolidate, they need to assist with schooling ranges as properly.”

Yoni Assia’s predictions

Throughout his Q&A session, Assia talked about that the change we noticed was solely the tip of the iceberg. He argued that the crypto group was rising by the day and that individuals weren’t solely collaborating however had been figuring out with it. He added that the subsequent 10 years will show how crypto goes to have an effect on our lives on an even bigger scale.

He said:

“As folks transfer in direction of an inevitable digital financial system, we’ll see groundbreaking modifications within the subsequent 10 years. We will certainly have an embedded pockets in each browser by 2030. That is inevitable. Crypto as an asset will advance sufficient to make this a necessity.”

He additionally talked about his confidence in NFTs and stated:

“All crypto-related capabilities are unbelievable. However NFTs are essentially the most distinctive issues created to this point. They’re extremely sturdy funding choices. Additionally they have distinctive capabilities which might be utilized in profound methods. Sooner or later, NFTs will grow to be a major a part of our lives, past investments.”

Assia concluded his phrases by agreeing with Kon and stated eToro’s main concern is to shine up their consumer expertise and contribute to their schooling in an effort to additional improve adoption.

Get your every day recap of Bitcoin, DeFi, NFT and Web3 information from CryptoSlate

It is free and you’ll unsubscribe anytime.

Get an Edge on the Crypto Market 👇

Turn into a member of CryptoSlate Edge and entry our unique Discord group, extra unique content material and evaluation.

On-chain evaluation

Worth snapshots

Extra context

Be part of now for $19/month Discover all advantages