Thaweesak Saengngoen

Thesis highlight

Planet Labs (NYSE:PL), trading at $5.33 at time of writing, is a stock I’d recommend buying into for the long term. The TAM and profit possibilities in this sector are enormous. Investing in PL could be lucrative if the company achieves its goals, and the rate of adoption accelerates. If PL can achieve management’s FY26 target, the company could see an upside of 100% or higher.

Company overview

PL is a public earth imaging company. What this means is that they capture the image of the whole Earth daily at high resolution. PL designs, builds, and operates a fleet of satellites to simplify how we see global change. Their mission? To use space to help life on Earth. With approximately 200 satellites, PL has over 1700 images for every point on Earth’s landmass. This makes for a rich and non-replicable historical archive for analytics and machine learning.

Investments merits

Major economic shifts in the satellite data provider industry

I think that two changes in the way the world’s economy works are driving the need for fast Earth observation data:

- The Digital transformation—the adoption of digital technologies in business,

- The Global Economic Sustainability Drive—towards equal economic growth without harming the environment.

Originally, this industry was reserved for the government and intelligence agencies. Large and massively expensive satellites were used to generate data which was both complex and expensive. What scared away potential investors were the launch costs, the long development cycle, and the single-use capability of the satellites. Recent technological innovations have lowered production and launch costs, hence attracting new players into space investment. The migration towards cloud computing to grow data platform businesses is also broadening the market base for the Earth Observation industry.

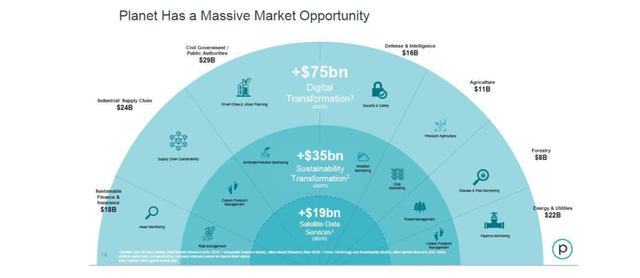

To put things into perspective, the revenue opportunity available for this industry is projected to reach $19 billion in the year 2027.

SPAC deck

The sustainability of business operations and the mitigation of the company’s impact on the environment are becoming increasingly important issues for companies everywhere. In addition, regulators have started imposing ESG goals on a small number of large corporations as a result of public pressure, and legislation to formally enforce sustainable business practices may be developed in the future. According to Bloomberg, by 2025, ESG assets will total $53 trillion as investors and stakeholders increasingly prioritize sustainability and fiduciary responsibilities change in light of this.

Digital transformation is another industry growth driver

Organizations and companies are resorting to digital transformation to be cost-efficient and scale their businesses, and these companies need cloud-native solutions to fully migrate to the digital arena. To drive these improvements, they need to maximize the use of third-party data, their own private data, and AI technologies. By providing a real-time state and trends of changes across the Earth, organizations are presented with a chance to devise data-backed growth strategies and ways to manage pending risks.

PL’s proprietary knowledge and technology well-position it to capture share

The foundation of Planet Labs is found in fast-paced aerospace technology. The technology allows maximum use of parallel innovations in AI, storage and analysis of daily, distinct Earth-changes data. PL has been powered to the forefront of digital and sustainability transformations by their rich data sets, analytic capabilities, industry-leading value extraction tools, and their constant improvements in manufacturing and managing satellites. And in order to fast track the transformation, PL has 3 deep proficiencies:

- Agile aerospace: rapid improvement of spacecraft designs.

- Proprietary big data: huge store of confidential historic data.

- PL’s own platform and analytics.

These proficiencies are being championed by PL’s founders, who had extensive experience at NASA. The secret to how PL manages the world’s largest fleet of satellites in space is an innovation that is the same as the change from mainframe to desktop computers. The innovation is aimed at building, launching, and maintaining smaller, compact, and powerful satellites. Due to the reduced size, production and maintenance costs are also kept at a low level. As a result , PL has launched more satellites compared to their nearest competitor. The higher number translates to more rapid and better data being relayed and supplied to the customers. It also gives them an advantage over competitors because they can easily address emerging market requirements and know exactly what data to collect ahead of time.

The large fleet also grows the data archive daily with unique, high-resolution, confidential data. This, coupled with AI capabilities and remote sensing science, allows automatic data processing and presentation of easy-to-understand Whole-Earth data. PL’s platform allows efficient access, discovery, and use of Earth data to build solutions at scale. The cloud-native platform receives data and analyzes it to find useful information. This information is then sent to the end user.

The platform’s user experience is continuously improved to match the mission and business value for existing and new customers. PL also believes that consistent and dependable Earth imagery data is critical for accelerating digital and sustainability transformations. Empowering industries to make data-driven decisions takes center stage in the geospatial sector transition and provides a huge market opportunity for digital and sustainability transformations. These transformations and satellite data services are estimated to be valued at over $120 billion by the year 2027 (source: PL’1 S-1).

High barriers to entry

With approximately 200 operational satellites in space, PL positions themselves as pioneers among commercial geospatial companies. They already have a comprehensive platform for data processing, delivery, and image integration to enable customers to obtain value from the satellite data. Some of the “barriers” that PL has are:

- A record-sized fleet in history,

- A higher operational efficiency,

- Extensive historical data sets,

- Reduced data processing and storage costs

- Proven execution.

I believe that these advantages place PL in a better position to capture the market and improve on innovation.

Valuation

Price target

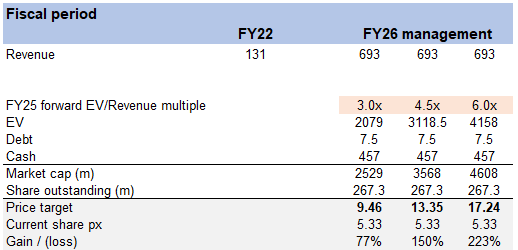

With a current share price of $5.33, my model suggests a range of $9.5 to $17 for the stock’s eventual price. Here, we consider three alternative valuation models (3, 4.5, and 6x forward revenue multiple in FY25).

There is a huge TAM and variety of possible outcomes, which is why this method of valuation is used. As I was saying before, it’s a massive market. In FY26, the industry as a whole may have matured, or PL may still be expanding at a rate of more than 100%. My use of these multiples figures is based on the wide trading range experienced by PL in the past. I know it’s not the gold standard, but it’s all we have right now to use as a yardstick.

Own estimates

Risks

Adoption is still an unknown

Public imaging of the Earth is a new market previously held by government and intelligence agencies, and the entrance of commercial organizations like PL is an emerging trend. As expected in new markets, growth can be instant, delayed or non-existent.

Competitive industry

PL operates in a highly competitive market, and I anticipate that the level of competition will only increase over time. PL’s offerings go up against those of a wide variety of private and public entities that also provide satellite and aerial imagery and related products and services. It’s possible that PL’s rivals will be able to offer similar services to customers for the same or a lower price due to greater access to resources (such as money, skilled labor, and other materials).

Conclusion

To sum up, I think PL’s upside is worth a lot more than it is now if it can meet management’s FY26 guidance, and even at a mid-single digit multiple, it still has more than 100% upside. If you buy PL, you’re betting on its proprietary technology to transform the space observatory industry; I think it has what it takes to do that. Keeping a high rate of successful execution would be good for the stock price because it would give investors more faith that management’s predictions are accurate.