PM Images

The market continues to rally in 2024 as the S&P 500 is up 7.42%, and the Nasdaq has climbed 7.15% YTD. While the bears think the Nasdaq above 16,000 and the S&P above 5,000 are unsustainable, we could very well be in the early innings of a multi-year bull cycle. Corporate earnings continue to be strong, and the largest companies in the market, including Microsoft (MSFT) and Alphabet (GOOGL), are forecasting strong earnings growth for years to come. We are also on the verge of a Fed pivot as Fed Chair Powell testified on March 7th that the U.S. Central Bank was not far from gaining the confidence it needs from inflation data to begin cutting rates. It looks like shares of PDO bottomed toward the end of 2023 when Fed Chair Powell pivoted and started discussing the possibility of rate cuts in 2024. The current setup is strong for fixed income, and when the Fed pivot occurs, I think that PDO is likely to increase. I think now is a good time to lock in the double-digit yield as PDO’s distribution yield could finish the year in the mid to high single digits. As an income investor, I am excited about the opportunity in fixed income because many assets have been under pressure during the rising rate environment, and establishing a base at the current levels could generate capital appreciation in the future while locking in a yield on cost of 11.74% for the monthly distribution.

Seeking Alpha

Following up on my previous article about PDO

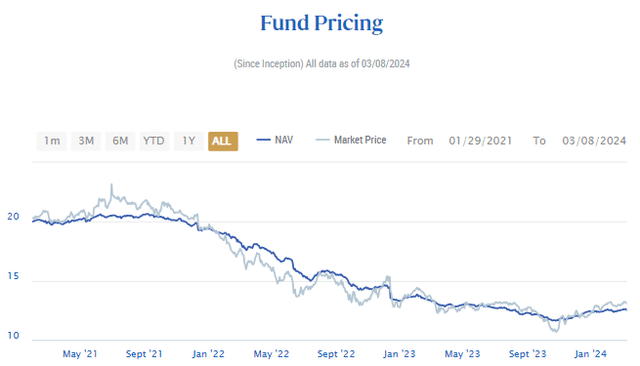

I previously wrote an article about PDO (can be read here) on October 16th, 2023. At that point, fixed income fell off a cliff, and shares of PDO continued to decline. The article was released on October 16th as shares were bottoming, and since then, PDO has increased by 16.49% compared to the S&P 500, which gained 17.99%. When the distributions are taken into consideration, PDO has a total return of 22.58% since October 16th, 2023. In that article, I discussed how the macroeconomic environment was negatively impacting PDO and why I felt the fear in the fixed-income markets was overblown. Now that we have significantly more economic data and a Fed pivot looks imminent, I wanted to provide an update and discuss why I am still bullish on PDO after the recent appreciation in share value.

Seeking Alpha

Risks to investing in PDO

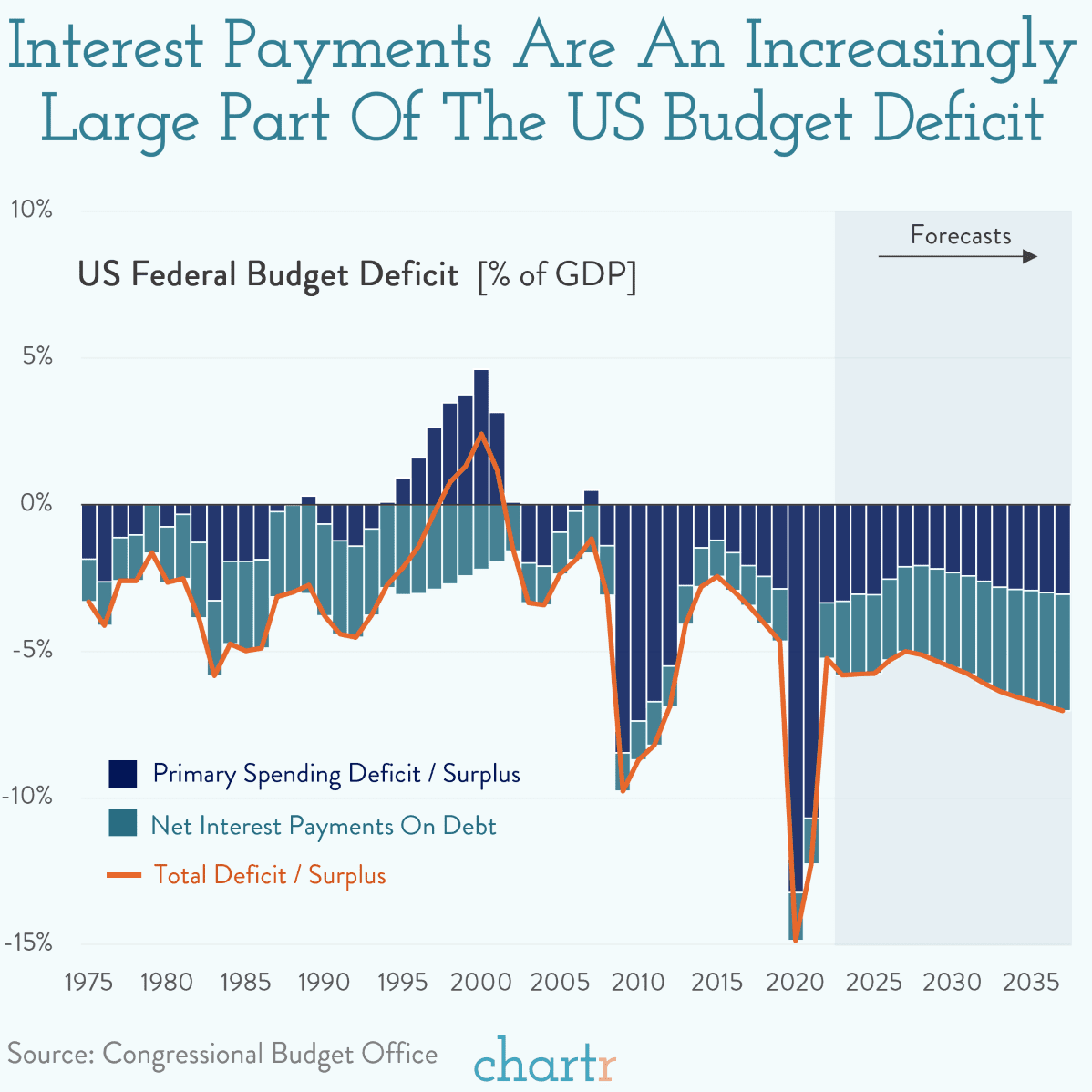

At one point in 2023, shares of PDO had lost more than half their value since inception. A rising rate environment can be catastrophic to fixed income, and we witnessed many funds that specialize in the fixed income markets deteriorate throughout 2022 and 2023. Fixed-income investments are debt obligations from government, corporations, or other entities that make fixed-interest payments on the borrowed capital at specific durations over the agreement’s lifespan. During rising rate environments, existing fixed-income investments can become less attractive as there are new debt originations with higher yields. Therefore, the existing debt values with lower yields can only command a percentage of their face value because there is less of a market for a 3% yield on a $1,000 bond when newly issued $1,000 bonds come with a 5% coupon. PDO and other funds like it experienced their underlying assets depreciating as debt was issued at higher rates.

While it looks like shares of PDO have bottomed, the risk is trying to time the Fed and how the global markets react. Just because Chair Powell says that the Fed is closer to a pivot doesn’t mean one will occur. There is always a chance that inflation climbs higher prior to the summer or after the Fed pivots, and inflation reverses course to the upside. This could cause the Fed to stay higher for longer or even take rates higher if the data warrants such a drastic move. In these scenarios, the fixed-income markets could probably come under significant pressure, and the global credit markets would be thrown into chaos as fears of defaults would increase. The fund managers at PDO can’t control the macroeconomic environment or what the Fed does, and if a Fed pivot doesn’t occur in the near future, we could see shares of PDO retrace and retest their previous lows.

Why I am bullish on PDO and think now is a good time to lock in the 11.74% yield

I think fixed income is going to make a comeback in 2024 and 2025. PDO focuses on multiple fixed-income sectors in the global credit markets. Its investment mix is alluring to me because some corporate debt, mortgage-related debt, government-issued debt, and floating rate debt products are trading at less than face value. Due to the Fed Funds Rate being 525 – 550 bps, older debt with lower fixed interest rates have become less appealing, so they trade at a discount so the yield can match the market. PDO has many corporate bonds and non-agency mortgage-backed securities that currently have high yields and lengthy maturity dates. Looking through the Excel file for PDO’s holdings found on PIMCO’s website, there are MBS products from JP Morgan Chase Commercial Mortgage Securities Trust that have a 9.33% yield with a maturity date of 3/15/2036 and many corporate bonds with fixed rates that exceed 8%.

The Fed Watch Tool from CME Group indicates that there is only an 8.5% chance that rates will remain where they are by the July FOMC meeting. President Biden recently predicted that the Fed would move to cut rates sooner rather than later while Chair Powell testified on the hill and indicated that the central bank is in a closer position to cutting interest rates. I think the most likely scenario is that the Fed pivot occurs at either the May or June meeting. If this happens and we enter an ongoing rate-cutting environment, it will be very bullish for the fixed-income markets. Newly issued debt will come with lower fixed rates as time goes on, and instead of investors racing to buy up new debt, they will likely race to purchase debt that has been trading at discounted rates to lock in higher yields before they trade at par values again. PDO has always traded close to its net asset value (NAV), and I am beginning to believe that the bottom has been established. I think there is a strong opportunity for PDO’s underlying assets to appreciate in value as the Fed cuts rates going into the election cycle, which would drive PDO’s NAV and share price to rise.

PIMCO

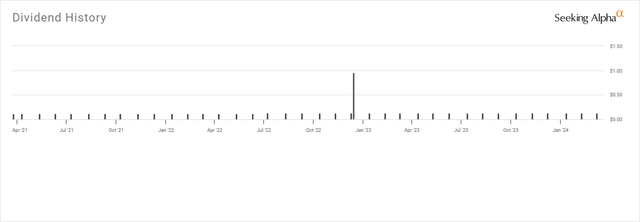

Adding PDO now would also allow investors to lock in a double-digit yield. Unlike some of PIMCO’s other funds, PDO hasn’t reduced the distribution, in fact it’s grown. PDO is a younger fund which was started in 2021. During 2022, PDO increases the monthly distribution from $0.1184 to $0.1279. Investors received an 8.02% increase in the monthly distribution and was also issued a large special distribution of $0.96.

Adding shares of PDO now allows investors to lock in an 11.74% yield on cost as PDO pays an annualized distribution of $1.53. In order to generate at least 1 additional share per month by reinvesting the distribution at the current price, investors would need to lock in the 11.74% yield on 102.19 shares. Over time, the power of compounding interest from reinvesting in the distributions will increase. I think that during the upcoming rate-cutting environment, PDO could also be in a position to provide investors with another increase to the current distribution.

Seeking Alpha

Conclusion

I am bullish on shares of PDO because I think the fixed-income markets will catch a bid in the second half of 2024. As rates start to decline, existing fixed-income assets should start to appreciate in value and continue to appreciate throughout the cycle. PDO is in a position where the NAV looks to have bottomed out, and investors can lock in a double-digit yield while waiting for the rate environment to pivot. There could also be an influx of capital coming in from the sidelines to the fixed-income market as the risk-free rate of return declines and fixed income becomes more attractive. I plan on adding more PDO to my portfolio as I am looking to capitalize on this investment thesis in the future.