flytosky11/iStock through Getty Pictures

PDI CEF: score improve to HOL

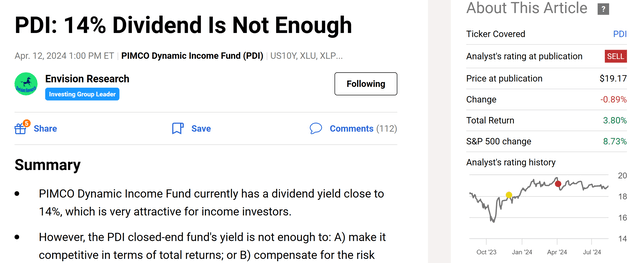

My final article on PIMCO Dynamic Earnings Fund (NYSE:PDI) advisable a SELL score for this closed-end fund, or CEF. Extra specifics of the article are supplied within the screenshot beneath. As seen, the article is entitled “PDI: 14% Dividend Is Not Sufficient” and was printed on April 12, 2024, by In search of Alpha. My promote score was based mostly on the next concerns:

PIMCO Dynamic Earnings Fund presently has a dividend yield near 14%, which could be very engaging for revenue buyers. Nonetheless, the PDI closed-end fund’s yield is just not sufficient to: A) make it aggressive by way of complete returns; or B) compensate for the danger publicity of its underlying holdings. When evaluating PDI’s complete return to different benchmarks over a fairly lengthy interval, it considerably underperforms. PDI’s giant publicity to mortgage-backed securities poses a major danger, particularly within the present circumstances with excessive charges and slim yield unfold.

In search of Alpha

Towards this background, the objective of this follow-up article is to argue for a score improve to HOLD given the shifted likelihood curve of rates of interest since my final writing. As to the detailed subsequent, such a shift has drastically diminished the danger premium of PDI relative to risk-free charges and improved its return/danger profile.

PDI CEF: fund introduction

To higher prime the next dialogue, I have to first briefly introduce the fund and its holdings. PID primarily invests in debt, as detailed by its fund description beneath (the emphases have been added by me):

The fund usually invests worldwide in a portfolio of debt obligations and different income-producing securities of any kind and credit score high quality, with various maturities and associated spinoff devices. The fund’s funding universe consists of mortgage-backed securities, funding grade, and high-yield corporates, developed and rising markets company and sovereign bonds, different income-producing securities and associated spinoff devices.

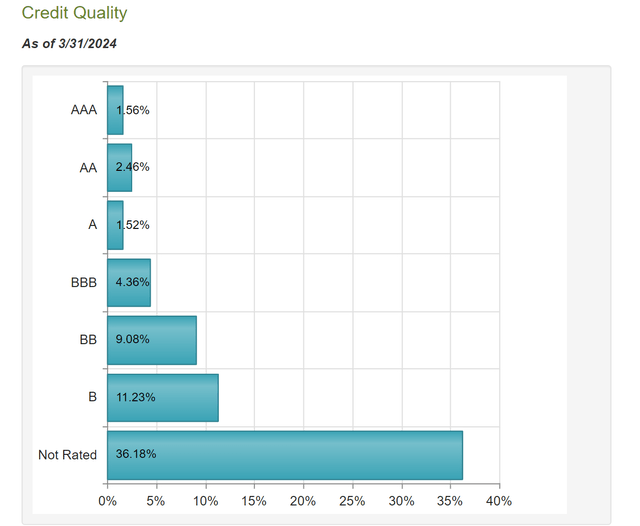

As seen, the fund focuses on high-yield money owed, and because of this, nearly all of its holdings have a credit score high quality beneath funding grades. Extra particularly, the chart beneath reveals the credit score high quality distribution of PDI CEF. As of March 31, 2024, nearly all of PDI’s holdings should not rated, accounting for greater than 36% of the fund’s portfolio. The second-largest holdings are rated B (11.23%), adopted by BB (9.08%). Holdings with credit score high quality at or above funding grades (BBB is the widespread threshold) are solely a minor portion of the portfolio. Holdings with a BBB score signify about 4.36% of the portfolio, adopted by AA (2.46%), A (1.52%), and AAA (1.56%).

Subsequent, I’ll study the return/danger profile of such a high-risk credit score profile beneath totally different rate of interest eventualities.

CEFConnect

PDI CEF: danger premium has improved

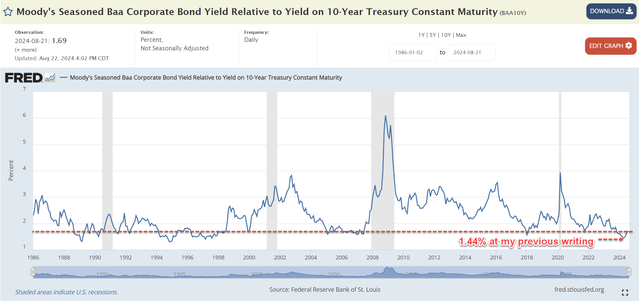

In my final article, I argued that it was among the many worst occasions to spend money on non-investment grade money owed in additional than 3 many years. This sturdy assertion was based mostly on the danger premium of non-investment grade bonds relative to risk-free treasury charges, displayed within the subsequent determine beneath. Quote:

This determine reveals the yield unfold between BAA bonds and 10-year treasury charges (US10Y) (which I exploit to signify risk-free charges). The yield unfold is presently at 1.44% solely as seen within the chart. Traditionally, the unfold has been within the vary of ~2% to three.5% more often than not. The present unfold is among the many thinnest ranges previously 3 many years.

Up to now few months since my final article, there was a cloth decline within the treasury charges. Consequently, the yield unfold between BAA bonds and 10-year treasure charges has widened noticeably to the present stage of 1.69%. Admittedly, it’s nonetheless beneath its historic common. However it’s not alarmingly skinny, as I noticed on the time of my earlier article.

Extra importantly, as to be elaborated on subsequent, the speed minimize outlook ought to additional cut back the danger premium.

FRED

Different dangers and remaining ideas

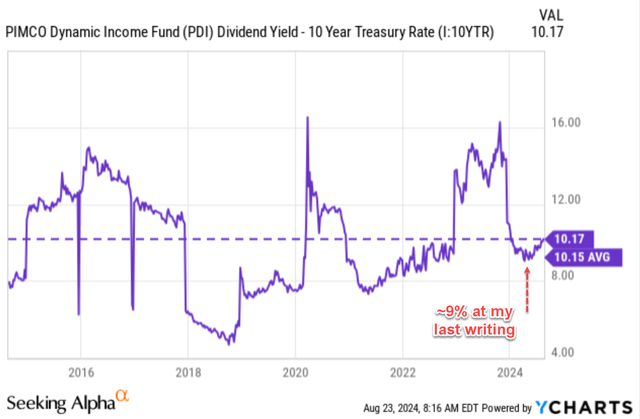

As one other reflection of PDI’s improved danger profile, the next chart reveals its dividend yield unfold relative to 10-year treasury charges. As you possibly can see from this chart, the yield unfold has been on common 10.15% in the long run. On the time of my final writing, the unfold was solely about 9%, beneath the common by margin and indicating a heightened danger premium. As of this writing, the yield unfold has widened to 10.17% to be barely thicker than the long-term common, indicating a significantly better danger profile.

In search of Alpha

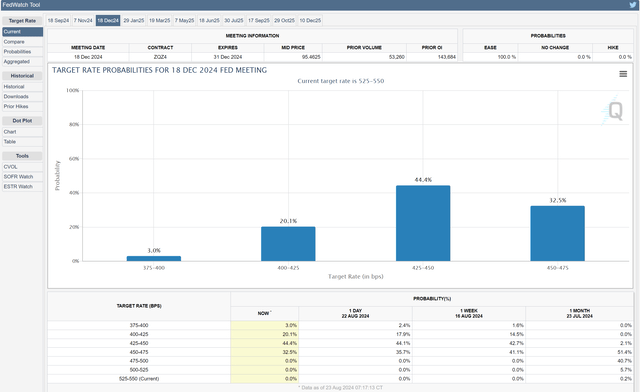

Trying forward, PDI’s danger premium turns into much more engaging given the speed minimize outlook. Extra particularly, the subsequent chart reveals the likelihood distribution of fee cuts by December 2024 based mostly on federal fund contracts monitored by the CME Group FedWatch Instrument. As seen, the present contracts recommend AT LEAST 2 curiosity cuts by December 2024. In distinction, on the time of my final writing, the market was undecided IF there could be a minimize in any respect.

With the present outlook, the yield unfold between PDI and the 10-year treasury yield would additional widen. As an illustration, assuming A) there are two cuts by 2024 totaling 0.5% and B) long-term charges drop by the identical quantity as short-term charges, the yield unfold would widen to about 10.7% beneath PDI’s present worth and payout to be comfortably above the long-term common.

CME group

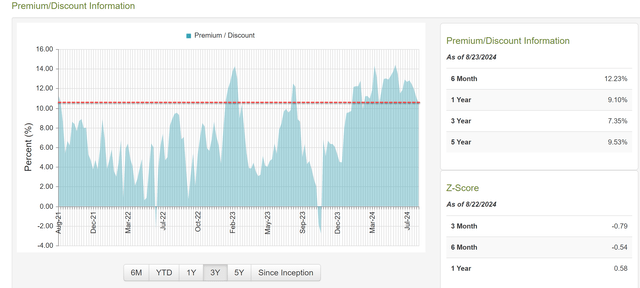

By way of draw back dangers, the fund is presently buying and selling at a considerable premium of round 12% above its internet asset worth (NAV). To higher contextualize issues, the chart beneath reveals the premium/low cost and Z-score data for PDI previously. As you possibly can see from the information proven right here, PDI’s premium/low cost has fluctuated considerably over the previous. For example, the Z-score assorted considerably relying on the timeframe you select. It’s a destructive -0.79 based mostly on the statistics from the previous month, however is a optimistic 0.58 based mostly on the statistics from the previous 1 12 months. If we widen our timeframe to the previous 3 years, the present premium is among the many highest ranges as seen.

All advised, my thesis is that the danger premium relative to treasury charges would be the dominant power within the close to future. Due to the decline of risk-free charges previously few months and the chance of a number of rate of interest cuts by 2024, I see a significantly better return/danger profile from PDI. Thus, I upgraded its score to HOLD from my earlier SELL score.

CEFConnect