da-kuk

Back in April, I wrote that while Palo Alto (NASDAQ:PANW) has a big opportunity to grow its SASE business and that the company has done a good job of moving beyond its traditional firewall business that I thought the stock looked close to fairly valued. The market clearly disagreed with the latter part, sending the stock up over 40% since my article, easily outpacing the under 7% return of the S&P 500. Let’s catch up on the name.

Company Profile

As a reminder, PANW is a cybersecurity firm that sell both products and subscriptions and support in the areas of network security, secure access service edge, cloud security, and end point security.

On the product side, the company in known for its firewall appliances & software. Its Panorama centralized security management solution, meanwhile, controls all its firewall applications on a client’s network. It can be implemented as either a physical or virtual appliance. The company also deploys virtual system upgrades that act as extensions to its virtual system capacity that comes with its physical appliances.

On the subscription side, the company provides a number of cloud-delivered security services solutions. These solutions are sold as options to its firewall appliances and software and include things such as Threat Prevention, Advanced Threat Prevention, WildFire, Advanced URL Filtering, DNS Security, and other solution. It also offers cloud security, secure access service edge, and security operations solutions that are sold on a per-user, per-endpoint, or capacity-based basis.

Steady Riser

While PANW’s stock got a modest lift the session following a solid fiscal Q3 report, the increase in the stock price has been more a steady march higher than anything else. The stock also got a nice boost when it was added to the S&P 500.

AI could be one reason why PANW has performed so well lately. And it’s not solely because the company is an AI-focused firm, although CEO Nikesh Arora does have a background in AI at his time at Google (GOOGL). It’s also because since the launch of ChatGPT, hackers have used AI to up their games as well. According to Morgan Stanley, “generative AI being used to create and mutate malware faster than ever before,” which “significantly increases the need for overburdened security organizations to invest in automation.”

Discussing AI on its fiscal Q3 call, Arora said:

“Needless to say, in the last 3 months, ChatGPT and generative AI have revived the interest in AI as a technology. As we have always maintained, AI is a data problem and security is a data problem and has an interesting — AI has an interesting role to play in security, both for its ability to help deliver superior security outcomes in near real time. And unfortunately, the potential threat associated with AI being used to generate attacks. We have and continue to work on these problems. …

“We also see significant opportunity as we begin to embed generative AI into our products and workflows. There are 3 ways that our concerted investment is generative AI will benefit us. First, generative AI will help us improve our core underhood detection and prevention efficacy by further advancing the state-of-the-art AI/ML in our products that I spoke of today. Second, manifests itself in how our customers engage with our products. We will leverage our large cybersecurity data set and telemetry to provide a more intuitive and natural language driven experience within our products, which should improve NPS and drive efficiency benefits to our customers. And finally, — as our employees leverage generative AI, it will drive significant efficiency in our own processes and operations across the enterprise.”

PANW also launched its first product build totally on AI, a next-generation platform call XSIAM. The offering is part of its Cortex platform, which is focused across endpoints, SOC automation, and attack surface management. The company said XSIAM is on track to be its fastest-growing new offering, saying since its late Q1 launch that it already had $30 million in bookings and that it had signed its first 8-figure deal for the solution. The company further noted that XSIAM gives it access to a broader sort of its customers’ budget and that it expect the product to reach $100 million in bookings faster than anticipated.

At a Bank of America Conference in June, meanwhile, Arora said he has not seen another security product build a faster pipeline in the history of security than XSIAM has. He noted that one pushback from potential customers has always been that PANW does not sell outcomes, but with XSIAM it can now deliver outcomes.

Outside of AI, one of the main drivers I talked about in my original article was around PANW’s SASE solution. Zero trust has been a big growth area in cybersecurity, and it is part of a larger SASE (secure access service edge) solution trend that PANW has been capitalizing on. That continued in Q1, with its SASE ARR growing over 50%. It says it now has over 4,200 SASE customers, and that it’s winning large deals across in geographies.

Valuation

SaaS companies are generally valued based on a sales multiple given their high gross margins and the companies wanting to pump money back into sales and marketing to grow. PANW currently gets about 80% of its revenue from recurring subscriptions and support.

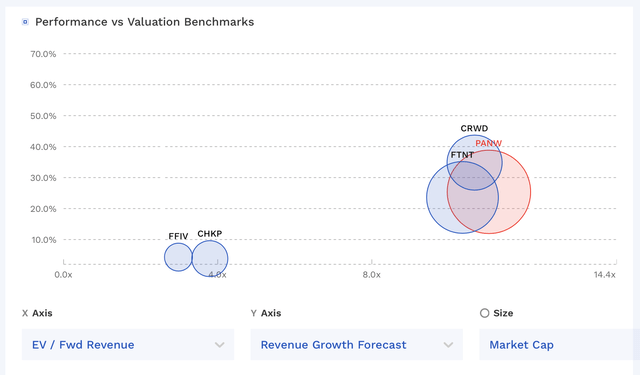

PANW is projected to generate $6.9 billion in revenue in 2023 (ending July) and $8.4 billion in 2024. 80% of those numbers are $5.5 billion and $6.7 billion, respectively. Thus, based on subscription revenue it trades at an EV/sub revenue multiple of 13.8x and 9.5x, respectively. That’s a now at a higher multiple that the like of a CrowdStrike (CRWD) even though CRWD is growing faster. PANW does offer a more complete cybersecurity solution, however, while CRWD is more an end-point security provider.

PANW Valuation Vs Peers (FinBox)

Conclusion

XSIAM and AI are certainly creating some renewed excitement around PANW. This new AI cybersecurity offering combined with its SASE solutions should help power growth and continue to diversify the company away from its more traditional firewall business. Meanwhile, growth in cyberattacks and subsequently spending to prevent these attacks does not look like it will slow down anytime soon.

Last time I looked at PANW, I thought the stock looked fairly valued, so with the stock price up over 40% and estimates largely unchanged, that view hasn’t changed. For new money buyers, I’d likely take a look at CWRD before PANW at this time.