Pakistan’s financial system has been battered by rising inflation, COVID, provide chain shocks and excessive power costs over the previous few years. However in that world of fixed shocks, its booming startup sector is popping out to be a silver lining for the nation.

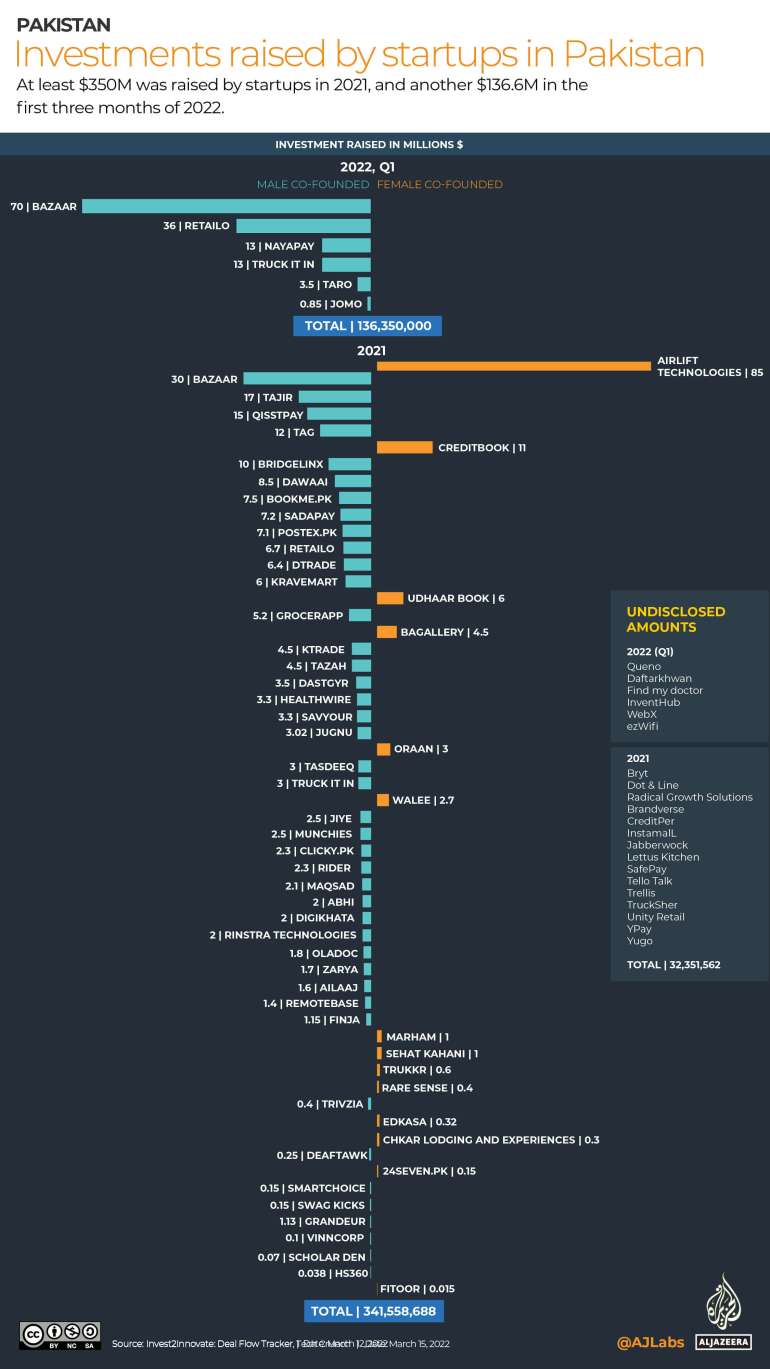

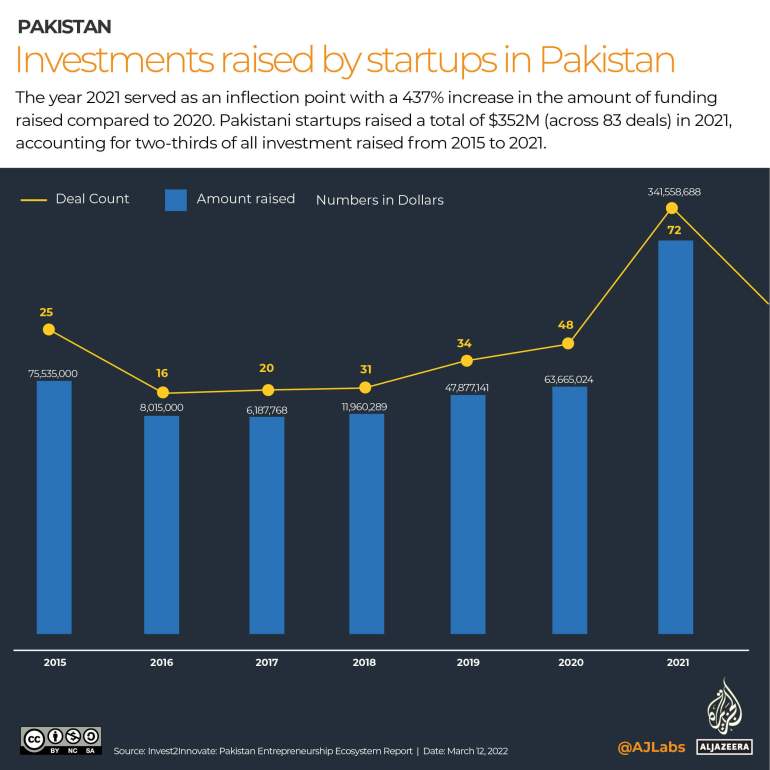

In 2021, 83 startups raised $350m in accordance with Invest2Innovate, a Pakistani consultancy agency. And to date this 12 months, the sector has already raised $136m.

Kalsoom Lakhani, the founding father of Invest2Innovate and basic companion at its sister agency i2iVentures, an early-stage investor, says 2021 was a record-breaking 12 months and says individuals will query if the momentum is sustainable.

“What’s actually essential is for the ecosystem to even be constructing the well being general,” she informed Al Jazeera, referring to startups and buyers making ready for issues comparable to the best way to develop the expertise pipeline to fulfill the wants of those fledgling companies, or the best way to enhance the coverage and regulatory atmosphere to assist them develop. “So whereas this momentum is thrilling, there must be strengthening of those pillars as a way to create sustainability and longevity and the persevering with development of the startup ecosystem,” she mentioned.

COVID-19 was a catalyst for the startup panorama in Pakistan, which noticed investments rise from $65m in 2020 to $350m in 2021. Prolonged lockdowns and quarantines offered entrepreneurs the chance to create digital merchandise with a human impression.

With greater than 250 startups since 2015, an rising web penetration pushed by low-cost smartphones – there have been 184 million cellphone customers on the finish of 2021 – and reasonably priced knowledge, Pakistan is among the remaining few untapped markets for startups and buyers to supply internet-based providers much like these in different elements of the world. These providers embrace ride-hailing, and meals and grocery supply, amongst others.

Faisal Aftab, CEO of Zayn Capital, a enterprise capital fund and one of many main buyers within the Pakistani startup panorama, estimates that Pakistani startups will likely be value $50bn by 2030.

“Right this moment the quantity sits at $1.8bn, if we rely Daraz and FoodPanda, which individuals ought to, then we’re sitting at $3bn to $4bn. We’re a simple 10 instances development right here,” says Aftab. Daraz, an e-commerce platform, was based in Pakistan and now gives its providers in a number of nations, and Foodpanda is a global meals and grocery supply enterprise.

“It’s profound what is occurring,” says Aftab, referring to the numerous first-time buyers which have mushroomed within the nation to pour cash into these startups in hopes of good-looking returns down the road. Many of those startups straddle elements of the casual financial system and can assist carry that underneath the formal financial system and the tax web for the primary time, he provides.

The 5 largest disclosed startup funding rounds in 2021 have been: Airlift ($85m), Bazaar ($30m), Tajir ($17m), Qisstpay ($15m), and TAG ($12m).

Invest2Innovate’s Pakistan Startup Ecosystem Report 2021 highlights the necessity for extra consideration directed in direction of startups to create a supportive ecosystem by which companies can flourish.

Alternatives for development, nevertheless, include the problem of discovering the proper human and capital sources to permit the constructing of infrastructure that may take in the 2 million new individuals getting into the workforce yearly, the report says.

Infrastructure

Current reforms, together with a authorized framework for Digital Cash Establishments arrange by the nation’s central financial institution, the State Financial institution of Pakistan, have allowed new companies to be arrange and have led to a rise in investments. One other coverage that led to investor cheer was the Digital Banking Coverage, which was finalised in January and permits digital banks to not simply be e-wallets, but in addition present credit score, investments, and different merchandise.

The Securities and Alternate Fee of Pakistan, which oversees non-banking firms, has established authorized definitions for startups, and the federal authorities has helped arrange Particular Know-how Zones.

Danish Lakhani, founding father of NayaPay, a digital pockets nonetheless in its testing part, has been accepted to be launched to the mass market by the State Financial institution of Pakistan after a nine-month pilot and inspection. NayaPay raised $13m in February from primarily native and overseas buyers and is the biggest funding for fintech in Pakistan.

“As an early digital cash establishment, we labored intently with numerous departments on the State Financial institution through the evolution of the EMI-licensing course of,” Lakhani informed Al Jazeera.

Bottlenecks for overseas buyers

Whereas the massive injection of cash into Pakistan’s struggling financial system bodes nicely for the startup scene, it nonetheless faces challenges comparable to lack of native buyers, restricted expert staff, and the gender hole in founders and staff.

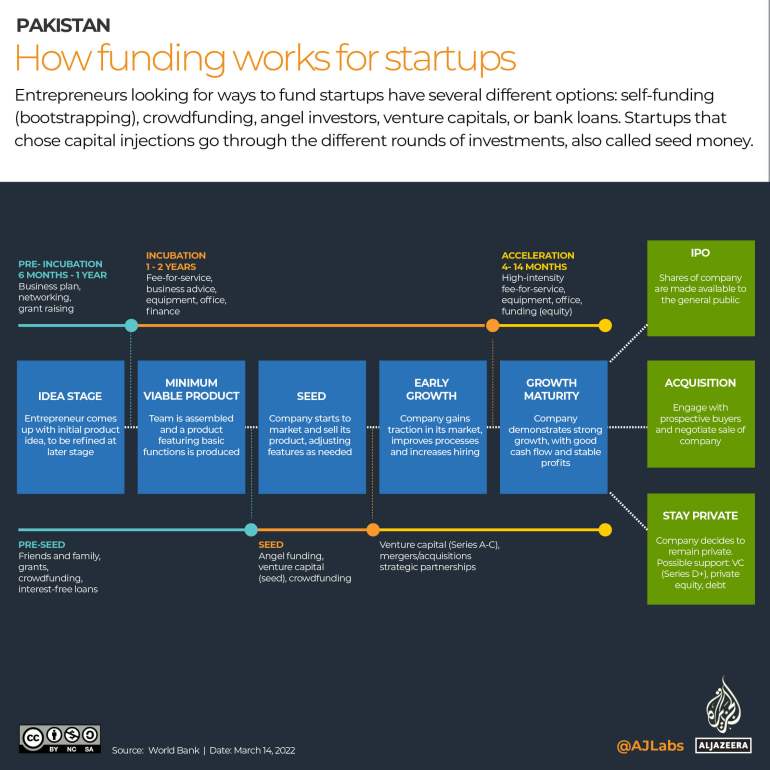

Based on the i2i funding tracker, angel buyers – excessive web value people who financially again a enterprise often in return for a share – invested $32m throughout 14 offers on the pre-seed stage, and $123m throughout 46 offers at seed levels. The pre-seed stage is when an thought wants sufficient fairness to kick-start operations for an early model of the product. The seed stage is when the corporate wants to lift funds with an angel investor or establishment formally.

Nevertheless, funding for later levels is a matter that must be addressed if firms need to scale and enter new markets. The vast majority of the early-stage investments are from exterior Pakistan. There have been 11 native angel buyers in 2021 who co-invested in six offers that totalled $6.9m.

Whereas there was progress by regulatory authorities for startups, there’s nonetheless an absence of authorized framework for overseas firms wanting to purchase shares in Pakistani corporations.

The federal government has allowed holding shares for startups to be exterior Pakistan, thus serving to to push overseas investments. Zayn Capital’s Aftab says firms really feel extra comfy figuring out they’ll maintain their shares exterior of Pakistan due to the shortage of religion in its judiciary and authorized frameworks.

Moreover, there’s a lack of readability on taxation legal guidelines for enterprise capitalists, and people desirous to promote their stakes in these startups.

William Bao Bean, a basic companion at SOSV – a worldwide enterprise capital fund with a portfolio of greater than a thousand firms and $1.2bn in property underneath administration – and managing director of Chinaccelerator, is an investor in lots of startups in Pakistan. He says the regulatory atmosphere, the forex, and the financial system does not likely matter to him. His firm is specializing in the mid to lower-income market in Pakistan and needs to supply providers that change lives, he says.

“When you may have know-how coming in and making a basic change to how individuals reside, as they’ll talk, they are often entertained, they’ll have their past love, they’ll purchase insurance coverage for the primary time, they’ll purchase their first pair of Nike’s….. individuals will gravitate in direction of [those] life-changing providers. And there’s not a complete lot you are able to do to cease it,” he informed Al Jazeera.

Lack of native buyers and scalability

There are extra worldwide buyers than native angel buyers – the variety of worldwide angel buyers grew from 5 in 2015 to 37 in 2021. Compared, there have been 11 native buyers in 2021 and 10 in 2018. Moreover, native investor investments totalled as much as $6.9m, which was 1.9 % of the full funds raised at pre-seed and 21.8 % on the seed stage. Worldwide buyers, nevertheless, made 14 offers totalling $147m.

Expert staff

There usually are not sufficient expert workers for senior positions or a educated workforce to fulfill the wants of the assorted startups. The supply of high quality technical workers, comparable to software program engineers and knowledge scientists, is restricted.

Based on the United Nations Convention on Commerce and Improvement’s (UNCTAD) Know-how and Innovation Report, out of 158 nations, Pakistan ranks 146 when it comes to know-how and growth. Usually, aggressive startups have the identical pool of staff and managers circulating inside the similar trade.

Universities usually are not geared up with curriculums that may be useful to new companies or allow college students to create their very own. Consequently, with the restricted pool of educated staff, firms find yourself providing raises to carry on to educated workers. As well as, with overseas funding, salaries are additional bumped up, including to strain on smaller corporations to have the ability to pay aggressive wages to get the proper expertise.

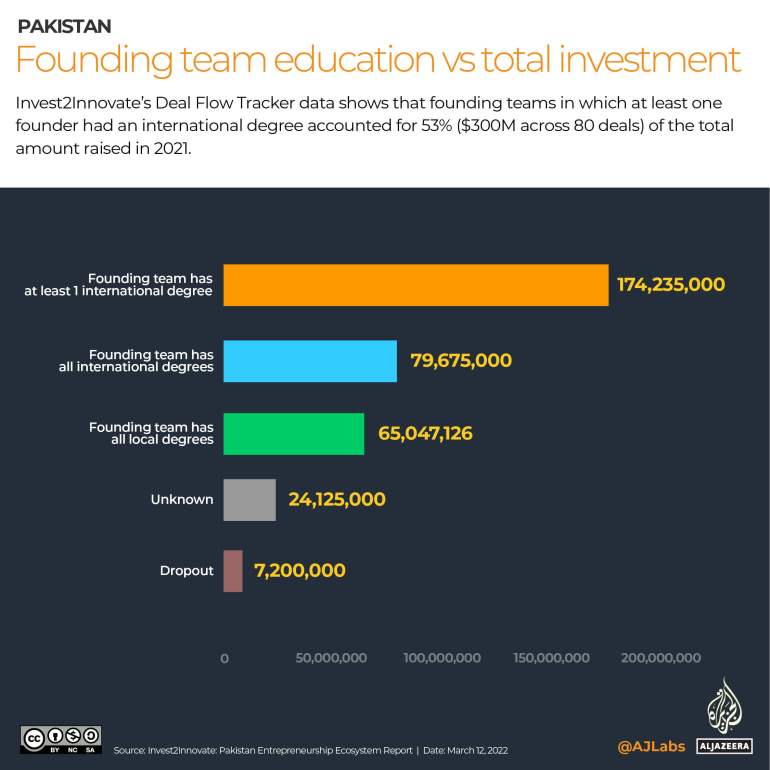

Founders who’ve worldwide levels raised extra money than those that graduated from native universities. Invest2Innovate’s knowledge confirmed that of 80 offers, there was at the least one founder in every startup that had a global diploma.

Regardless of the desire given to overseas graduates by buyers, senior managers discover native graduates have extra of a reference to the native market.

“There’s a clear desire of wanting to rent worldwide graduates due to how they perceive the know-how and a overseas diploma is a model,” says a feminine supervisor at an e-commerce web site who declined to be named for causes of job safety. She’s been working within the startup panorama since 2016 and believes there’s a vital distinction within the workforce inside Pakistan as nicely, not simply with worldwide graduates. Native college graduates between Karachi and Lahore are vastly completely different when it comes to their effectivity, understanding of know-how, and willingness to be taught.

Nevertheless, she provides, as a supervisor in a hiring place, she sees that worldwide graduates create an uneven atmosphere. The socioeconomic class variations in a office create an unstated boundary, which is additional amplified by the tutorial establishments individuals come from.

The drastic gender hole

The gender hole in Pakistan is among the worst on the earth, rating within the backside three, at 153 out of 156 nations, in accordance with the International Gender Hole Report.

Feminine participation is vastly unaccounted for as most of them are unskilled, or unpaid, labour. As for girls who’re within the formal workforce, their choices for development are restricted actually because their households aren’t comfy with them touring out of the home or to far locations or as a result of they should prioritise taking good care of members of the family and that always means dropping out of the workforce or not taking over roles that require longer hours at work.

Nevertheless, there’s progress so far as girls being linked to the web is worried. Entrepreneurship has allowed girls in city centres to progress to turning into enterprise homeowners.

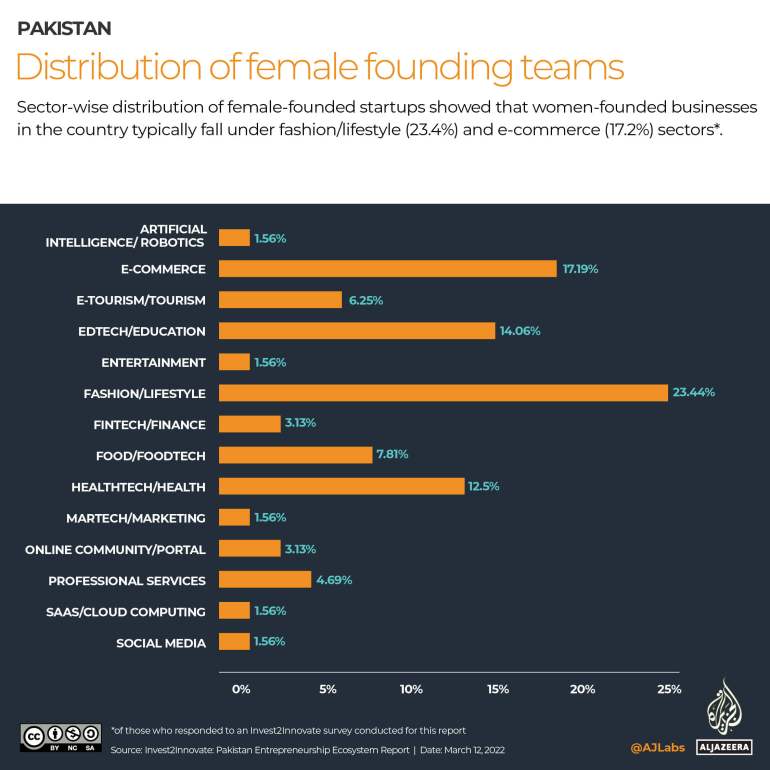

Based on Invest2Innovate’s report, gender disparities are prevalent within the startup ecosystem and forestall women-led startups from attaining their full potential. Only one.4 % of all investments raised inside the previous seven years in Pakistan have been by solely women-run startups.

Oraan, a fintech startup to assist girls lower your expenses, raised $4m final 12 months, making it probably the most funded female-led startup. Halima Iqbal, co-founder and chief government of Oraan says it was tough to safe funding, however they have been glad to have the backers who consider in the issue they’re fixing.

“A really tiny portion of VC funds on the earth go to women-led firms and there’s a relatability issue that performs a job in funding,” as a lot of the buyers are male.

Regardless of Oraan’s success, female-founded startups have been disproportionately at a drawback as women-led startups obtained a mere $8m from 2015-2021, in contrast with feminine cofounders, who obtained $138m, and male-led startups obtained $447m in accordance with the report printed by Invest2Innovate.

The feminine supervisor talked about above says in all of the years she has labored in startups, there have been only a few girls in senior positions, with nearly all of girls restricted to human sources or junior government workers.

“As a senior supervisor now, I’m typically alone in a boardroom with males and regardless of my confidence, I really feel intimidated. I’m additionally typically made to really feel that I’m being talked at,” she informed Al Jazeera.

NayaPay’s Lakhani says one of many core values at his agency is gender neutrality. “[We have] versatile working choices, on-site childcare amenities, coaching, and development alternatives are available for all our crew members. We’re partnering with organizations comparable to CodeGirls which encourage and prepare girls fascinated about know-how roles.”

Regardless of the progress some firms are making, on-site youngster care amenities and versatile hours usually are not the norm but. Girls are nonetheless extensively overlooked of the funding networks and mentorship. Assist packages have to be bespoke designed for female-founded startups, together with authorized and monetary providers, networking growth, and entry to mobility, acknowledged the insights report.

Shane Shin, of Shorooq Companions, an funding firm based mostly within the UAE, says startups in Pakistan are thrilling as a result of if they are often scaled to enter Saudi Arabia and Egypt, that’s the place firms change into value a number of billion {dollars}.

“Pakistan is on the juncture of accepting international capital from the US and Asia, and it is a very uncommon phenomenon,” says Shin.