Final week, we in contrast financial vs fiscal stimulus. Understanding the variations in how every manifests within the financial system is essential to understanding so many different points. The most important one recently issues rising costs and the way the FOMC would possibly act to cut back inflation. This sophisticated topic shouldn’t be oversimplified.

The Fed has been considering two distinct coverage objectives: 1) Getting off of the emergency footing they’ve been on for therefore lengthy — arguably, lengthy after the Nice Monetary Disaster (GFC) ended and now after the pandemic emergency 1 is over; and a couple of) Decreasing inflation.

Preventing inflation throughout the previous decade was fairly simple — the Fed was extra involved with disinflation or outright deflation. However getting off of the emergency footing has proved to be harder, largely due to the dearth of a strong fiscal response post-GFC. It was as if the Fed was working in direction of full employment with one hand tied behind their again.

The “Principally Financial Response” will be rightly blamed for widening the wealth hole between the wealthy and everybody else. However don’t ignore the affect this had on the Fed’s subsequent actions. A fiscal-free different made elevating charges into the weak restoration 2009-2015 undesirable, probably risking a recession. This isn’t a case of hindsight bias however one thing I’ve been kvetching about since 2009.

This long-term, macro framework explains partly why the FOMC was caught — unable to normalize Fed Fund charges or at the very least recover from 2% on a sustained foundation. It additionally explains why the Fed views inflation as transitory — it’s attributable to a novel set of pandemic circumstances which might be prone to move, albeit over an extended than anticipated time frame.

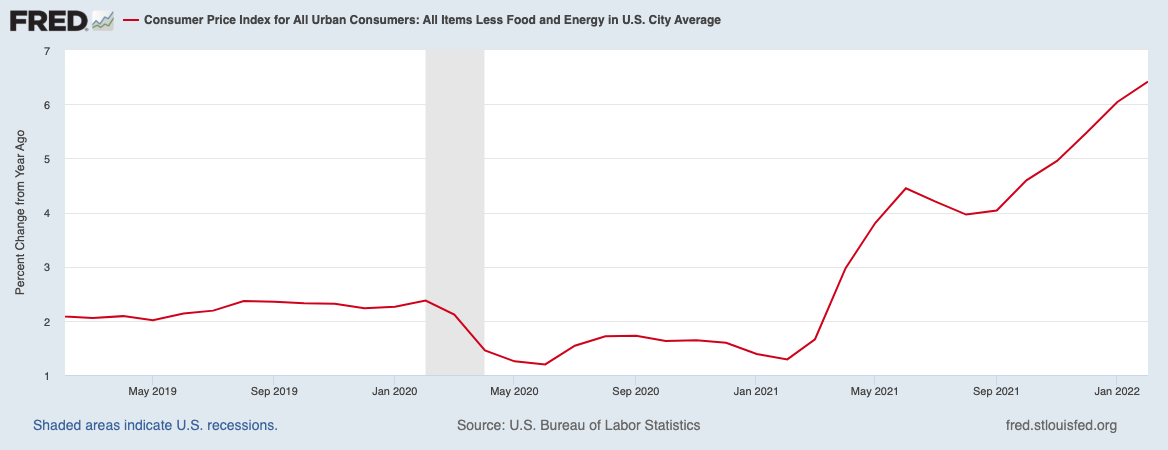

Once we take into account what have been the important thing drivers of inflation earlier than the conflict started, we see principally one-off points associated to the pandemic: large fiscal stimulus by way of the CARES Acts; shopper habits throughout lock-down; the discharge of pent-up demand upon re-opening. Earlier than Russia’s invasion of Ukraine, inflation was rising and many of the features of the value will increase have been on account of elements past the Fed’s rates of interest:

-Sudden enhance in demand for items over companies attributable to lockdown;

-Provide chain logistical points;

-Too few cargo ships, not sufficient bodily delivery containers;

-Not sufficient dock employees for main ports;

-Too few truck drivers;

-Large fiscal stimulus; 2

Now now we have a conflict raging, crude oil, pure gasoline, and power provides have surged, nickels and different metals have skyrocketed. Are any of those conscious of Fed charges within the current setting?

Alex Gurevich’s most up-to-date e book, “The Trades of March 2020: A Defend towards Uncertainty” factors out that whereas the Fed would possibly often shock the market with fee cuts, they by no means shock the market with sudden will increase,3 preferring to telegraph these to stop enhance market turmoil and volatility. The pundits calling for greater and extra will increase appear to be lacking this level.

The Fed desires to get off of its emergency footing. They’re jawboning towards inflation, however they perceive precisely how ineffectual will increase are within the present setting.

I wish to see the FOMC return to a extra regular footing — ultimately — however these anticipating quick, fats, and frequent fee hikes is likely to be setting themselves up for disappointment.

Beforehand:

Evaluating Stimulus: Financial vs Fiscal (GFC vs C19) (March 11, 2022)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

Lengthy Time ‘Coming (November 17, 2021)

Deflation, Punctuated by Spasms of Inflation (June 11, 2021)

Stimulus, Extra Stimulus and Taxes (January 25, 2021)

Go Large: The U.S. Wants Approach Extra Than a Bailout to Get well From Covid-19 (April 30, 2020)

________

1. Not the pandemic itself however the financial emergency it brought on.

2. As to the fiscal stimulus, most of that pig is thru the python, as Internet Saving have fallen again to close pre-pandemic ranges.

2. A minimum of not since 1994.