trait2lumiere

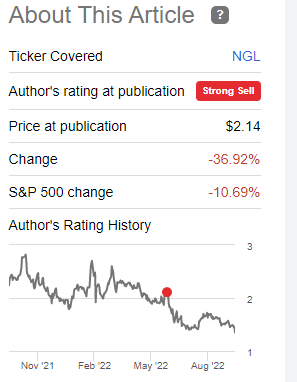

When we last covered NGL Energy Partners LP (NYSE:NGL) we gave our Strong Sell to the common and the preferred shares. In our defense, our hands were tied. “Get Out Of Dodge” is still not one of the choices available at Seeking Alpha. On the common shares, the timing was excellent. NGL went straight down from there like a lead balloon.

Pain Ahead, Sell Common And Preferreds

The preferred shares showed a bit of a divergence. The B’s (NYSE:NGL.PB) declined by about 26%.

Seeking Alpha

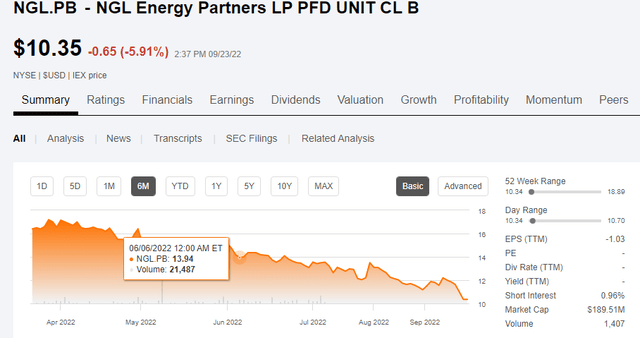

The C units (NYSE:NGL.PC) declined by just a little about 11%.

Seeking Alpha

We update the bear thesis with these and the general market moves and look at where a negative stance would be best served.

Q1-2023

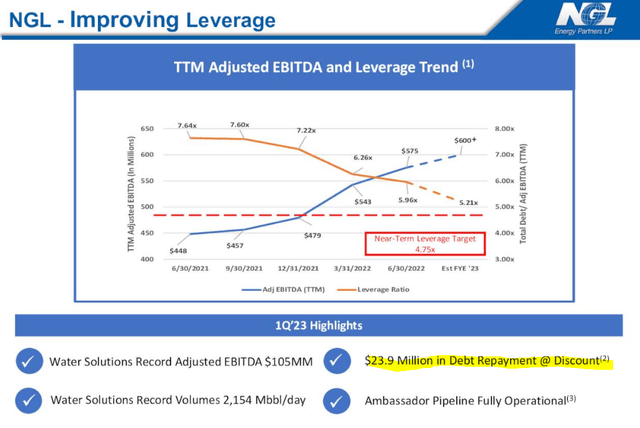

NGL has a fiscal year ending in March. The Q1-2023 results which were released after our last article were another disappointment. While adjusted EBITDA for the first quarter of fiscal 2023 increased to $123.9 million, compared to $91.1 million, it was still weaker than what one would anticipate in a climate of extremely strong oil prices. NGL benefits from crude oil prices directly and this can be seen in their commentary.

Revenues from recovered crude oil, including the impact from realized skim oil hedges, totaled $32.9 million for the quarter ended June 30, 2022, an increase of $16.9 million from the prior year period. This increase was due to increased skim oil barrels sold as a result of higher produced water volumes processed, higher skim oil volumes captured per barrel of produced water processed and higher realized crude oil prices received from the sale of skim oil barrels.

Source: NGL Press Release

On the bright side for the bulls, NGL actually did raise full year guidance for the water solutions segment to over $400 million and maintained the original adjusted EBITDA target for the company in excess of $600 million.

NGL Presentation

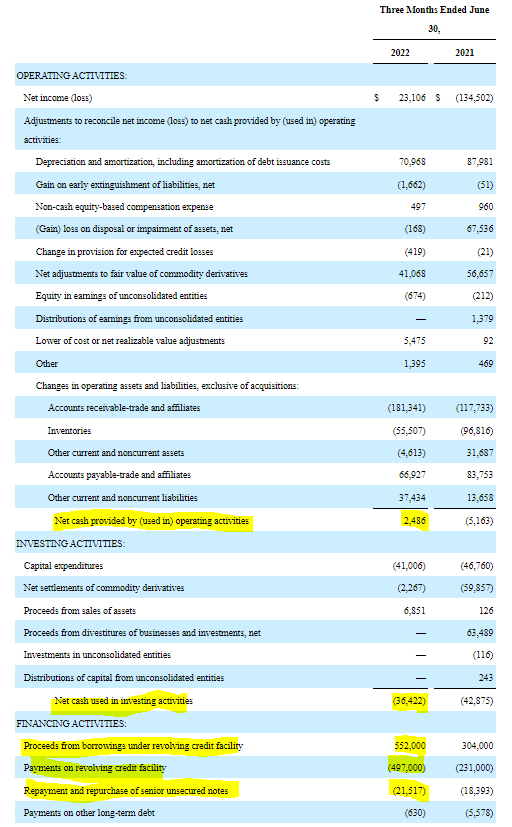

One thing that was unusual was that NGL did this tiny debt payment, not from organic cash flow, but from borrowing on its credit facility. Net cash from operating activities was just $2.5 million and after subtracting capex $36.4 million, baseline cash flow was heavily negative.

NGL 10-Q

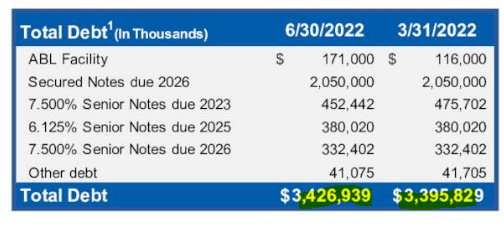

There is a lot of working capital movement in Q1 and this likely drove the reliance on credit facility to buyback debt. Total debt actually increased in the quarter.

NGL Presentation

Outlook

All other things being equal, the next quarter results, which include extremely strong oil prices with rolling off of some of the company’s oil price hedges, should be quite nice. It is beyond that, when the tailwind of these prices disappears, that we will have to see whether the company can meet the challenges of this environment. NGL will also have to deal with rising rates on its ABL facility and this will really add numbers in 2023.

At June 30, 2022, $171.0 million had been borrowed under the ABL Facility and we had letters of credit outstanding of approximately $143.6 million. The ABL Facility is scheduled to mature at the earliest of a) February 4, 2026 or b) 91 days prior to the earliest maturity date in respect to any of our indebtedness in an aggregate principal amount of $50.0 million or greater, if such indebtedness is outstanding at such time, subject to certain exceptions.

At June 30, 2022, the borrowings under the ABL Facility had a weighted average interest rate of 4.84% calculated as the prime rate of 4.75% plus a margin of 1.75% on the alternate base borrowings and the weighted average SOFR of 1.28% plus a margin of 2.75% for the SOFR borrowings. On June 30, 2022, the interest rate in effect on letters of credit was 2.75%.

Source: NGL 10-Q

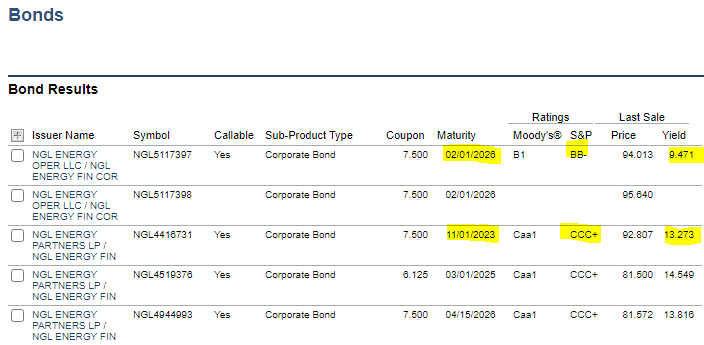

On its publicly traded debt, we are an interesting divergence as well. Below are the numbers from June 5, 2022 which we had in the last article.

FINRA June 5, 2022

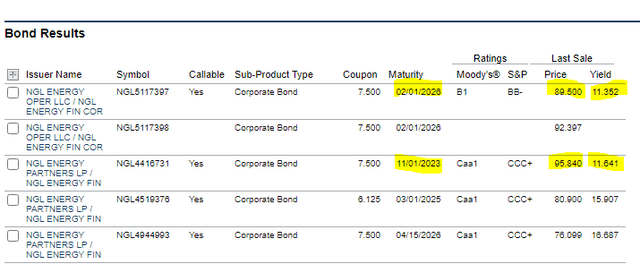

Here are today’s numbers. Outside of the November 2023 maturities, all other notes including the senior secured notes, are weaker today.

FINRA Sep 24, 2022

To us, this likely means that NGL is having a good quarter and is focusing all firepower on reducing that debt. That bid is keeping that one strong relative to others.

Verdict

The common shares have dived significantly since the last article and we are turning tactically neutral at this point, upgrading them to a Hold, from a Strong Sell. We would look to exert the bearish view after a likely bounce following next quarter’s results. We still don’t think that the debt paydown will occur fast enough over the next 14 months and NGL likely heads to chapter 11. But in trading, tactics are as important as strategy and here we are once again ready to declare victory on this call.

The preferred shares remain an enigma to us. We don’t see any outcome where a single cent will be paid on them, even if we are completely wrong about NGL not making it soundly through 2023. There are lots of hurdles ahead and all those notes above were done in an era of very benign credit conditions. The closest one after the 2023’s has an yield to maturity of 15.9%. The earliest we would think that the preferred dividends could be paid, would be after getting through the 2026 maturities. We maintain a Sell rating on the preferred shares, while noting that NGL.PC is a relatively better sell here.

For those looking for yield from NGL and maintaining the turnaround is happening before their eyes, we would consider the senior secured notes with a 11.3% yield to maturity over the preferred shares. The latter set unlikely to ever pay another cent.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.