fredrocko

Ford Motor Company (NYSE:F) didn’t help its case this week when it warned of higher, unexpected costs, creating a significant amount of negative sentiment for the stock and driving its price down by 12%.

The drop could be the start of a longer-term downward trend, as it becomes increasingly difficult for automakers suffering from high inflation to offset an earnings recession.

For those reasons, I recently advised against purchasing Ford Motor’s dividend, and I believe that the latest cost warning serves as a reminder that cyclical and cost-sensitive automakers currently have unappealing risk/reward relationships.

Ford Motor Is Warning Of Higher Costs

Ford Motor shocked the market several days ago when it issued a warning about an unexpected rise in supplier costs, which is expected to cost the company $1.0 billion in third-quarter earnings.

The warning caused Ford Motors’ stock to fall 12% on Tuesday, wiping out roughly $7 billion from the automaker’s market value. As I recently warned in Ford: Don’t Buy The 3.9% Dividend Yield, economic and operational risks for Ford Motor have recently escalated, and the cost warning is yet another indication that investors appear to be overly optimistic about the company and its stock.

Ford specifically warned that:

Inflation-related supplier costs during the third quarter will run about $1.0 billion higher than originally expected…

…implying that Ford Motor will lose money in the third quarter. Ford Motor’s 3Q-22 adjusted earnings before interest and taxes outlook is now $1.4 billion to $1.7 billion, which is significantly lower than the expected EBIT of $3.0 billion, explaining the sharp market reaction.

Furthermore, Ford Motor warned that supply shortages are causing a:

Higher-than-planned number of vehicles on wheels…

…which is Ford Motor’s term for unfinished product. The warning is the equivalent of a pre-release, which companies are required to issue in the event of a material change in operating conditions. The warning also refers to Ford Motor Company’s increasingly shaky free cash flow guidance, which was only recently reaffirmed.

Ford Motor expects to produce $5.5 billion to $6.5 billion in 2022, and the odds of the automaker withdrawing its free cash flow guidance in the third quarter or later have risen from about 50:50 to 60:40 in my opinion.

With costs rising faster than expected (annual inflation was 8.3% in August), a key bullish argument for buying Ford Motor stock, higher EBIT and free cash flow margins, may no longer be valid at all.

Ford Motor’s Stock Looks Cheap, But Really Is A Value Trap

One mistake I believe investors make with Ford Motor is being enticed by the company’s seemingly low P/E ratio of 6.7x.

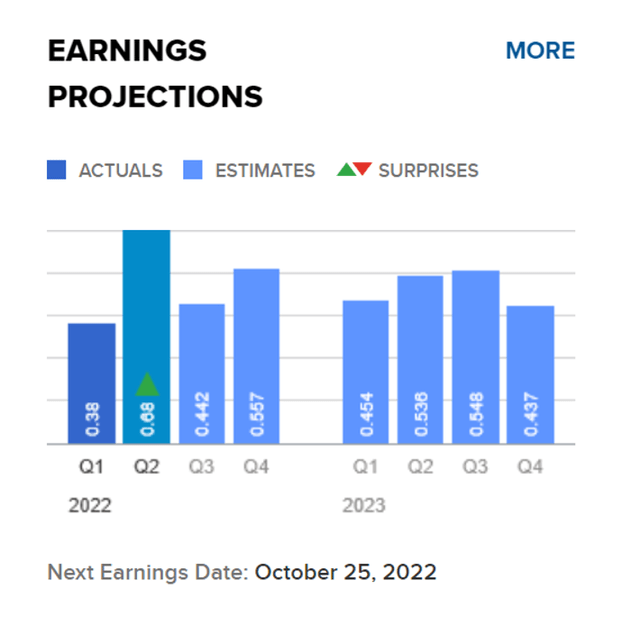

The cost warning from Ford Motor points to lower margins in the third and fourth quarters, which will almost certainly result in lower 2022 EPS estimates.

If this occurs, Ford Motor Company’s stock will have a higher P/E ratio even though business fundamentals are deteriorating. As a result, investors should expect analysts to lower Ford Motor’s earnings estimates for 2022 and 2023.

Earnings Projections (CNBC)

Why Ford Motor Could See A Higher Valuation

The one thing that still speaks for Ford Motor is the labor market’s strong constitution, which shows no signs of weakness, and for that reason alone, the central bank is set to keep raising interest rates.

As a result, I believe Ford Motor is likely to be a good investment only if consumer prices fall dramatically and recession risks decrease.

Ford Motor could theoretically increase its P/E valuation if the company reaffirms its 2022 guidance when it reports earnings on October 25, 2022.

My Conclusion

In my opinion, Ford Motor’s ominous warning is a game changer, because the automaker will struggle to recover from this shift in sentiment. Analysts will respond to this significant change in EBIT expectations by lowering estimates, which may hurt the stock for some time.

The warning was an effective pre-release that fueled my already-existing concerns about Ford Motor. Cyclical automakers are suffering from higher costs that they may not pass on to increasingly price-sensitive auto buyers, potentially leading to an earnings recession that is not yet fully reflected in Ford Motor’s valuation, despite the company trading at a low P/E-ratio.

Even though Ford Motor’s stock appears to be undervalued, I believe the market will become even more wary of the automaker in the future as it prices in the possibility that Ford Motor will have to withdraw its free cash flow guidance for 2022.

In my opinion, Ford Motor is a value trap that should be avoided.