[ad_1]

Some social media influencers and college graduates defy financial logic and sign leases for New York City apartments at record-high prices. Some of these kids who don’t have access to the “bank of mom and dad” are finding side hustles or draining their savings to afford the high cost of living expenses.

Bloomberg spoke with 21-year-old Macy Hung, who lives in a penthouse apartment overlooking the Brooklyn Bridge. Hung has four roommates, works ten hours a day, has several side hustles, and spends some of her savings to maintain her dream of living in NYC. Her financial struggles are absent on her TikTok page, which promotes nothing but luxury.

“I knew things were expensive in Manhattan, but it’s my dream to live in the city… If you’re not making six figures, it’s hard to get by,” said Hung.

According to appraiser Miller Samuel and brokerage Douglas Elliman Real Estate, renters in Manhattan spend upwards of $4,395 per month in May. This is a record high, while wage gains aren’t keeping pace with shelter inflation.

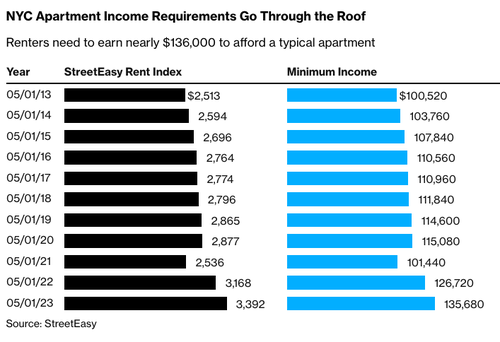

Real estate website StreetEasy said renters today need about $135,000 in average income to afford the most basic apartment in NYC. The rule of thumb for renters is to spend less than 30% of their income on shelter costs. As for Hung, that’s why she has four roommates.

The latest CPI data showed inflation continues to outpace wage gains for the 26th straight month (out of 28 months of Biden’s term)… For young renters, having roommates has become the norm to divvy up the shelter costs.

Lisette Nieves, president of the Fund for the City of New York, warned: “We’re in a once-in-a-generation housing crisis.”

Many influencers who don’t have credit lines with the ‘bank of mom and dad’ are embracing a ‘do whatever it takes’ altitude to live in the city and capture those TikTok-worthy moments. However, you won’t ever see their struggles in their videos — just a life of fake luxury.

Another influencer on TikTok, 22, Piper Phillips, said her priorities this year were to maintain living at a prime location in the city while documenting her life on social media. She admitted she has trouble affording $20 cocktails and $90 diners with her friends, who all have high-paying banking jobs.

Besides TikTok, she works in marketing and has multiple side hustles to maintain what appears to be a lifestyle of luxury on social media.

“I worked so hard to get here, I didn’t want to compromise on the life I wanted to live,” said Phillips. She explained, “The cost of living here is an investment in myself. It sounds crazy to justify $25 cocktails, but being here opens doors for my career. That’s worth the costs.”

What this all suggests is that universities and colleges are failing to teach basic financial literacy to the younger generation, who blow all their money on maintaining some fake luxurious lifestyle on social media while, in real life, they struggle to make ends meet.

[ad_2]

Source link