[ad_1]

Published on March 17th, 2023 by Jonathan Weber

Real estate investment trusts, or REITs, can offer highly attractive income yields, as they are required to pay out the majority of their profits via dividends to their shareholders.

This is why many retirees and other income investors like to invest in REITs, although not all REITs are equally well-liked. Some are rather unknown, which includes H&R REIT (HRUFF).

H&R REIT is a somewhat special REIT as it makes monthly dividend payments. While there are some other REITs that make monthly dividend payments as well, most REITs offer quarterly dividend payments to their owners.

There are currently just 86 monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

H&R REIT offers a dividend yield of more than 4% at current prices, which is easily more than twice as high as the broad market’s dividend yield, as that stands at less than 2% right now.

The above-average dividend yield and the fact that H&R offers monthly dividend payments make the REIT worthy of research for income investors. This article will discuss the investment prospects of H&R REIT in detail.

Business Overview

H&R is a real estate investment trust that was founded in 1996 by Thomas J. Hofstedter. H&R REIT is based in Toronto, Canada and one of the largest REITs in the country. At the end of 2022, its asset base totaled more than CAD$10 billion. Its market capitalization is US$2.6 billion.

The REIT invests in commercial properties, including office buildings, retail properties, industrial properties, but the company also owns a significant base of residential properties. This diversification across different property categories has resulted in resilience versus downturns in a single sector, as H&R is able to offset that when other property segments are doing well.

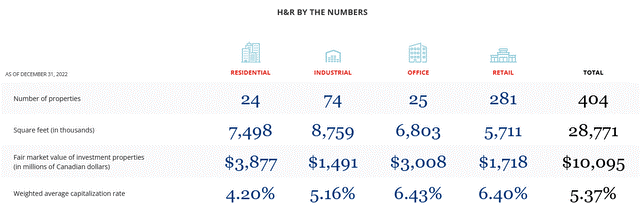

The current asset base can be seen here:

Source: Investor Relations

We see that residential properties are the largest single category, at close to 40% of the total asset base, but when we sum up the company’s commercial properties across different categories, that’s more than the value of the residential portfolio.

While H&R’s residential portfolio is lower-risk compared to commercial properties such as office and retail real estate, the residential portfolio also has the lowest average yield/capitalization rate. Overall, the total company-wide capitalization rate, or yield relative to the fair market value of these properties, is 5.4%.

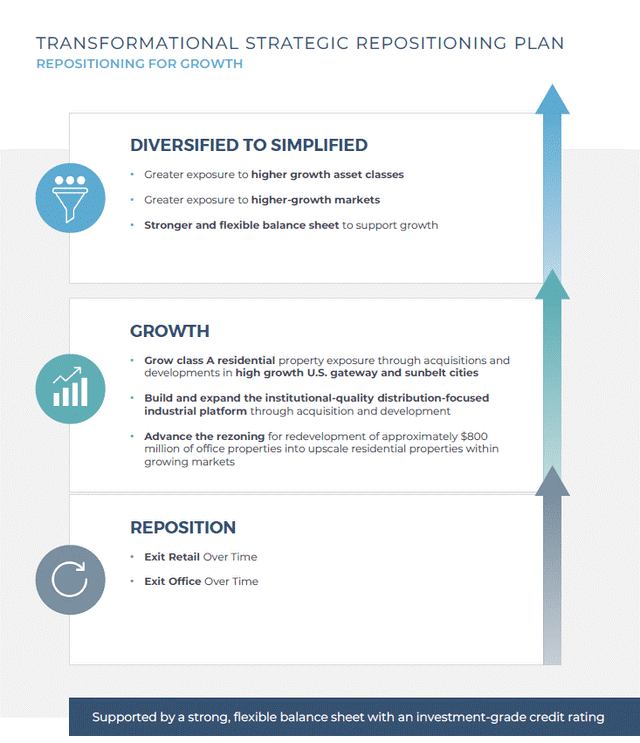

The company’s strategy is to increase its residential portfolio over time, while office and retail, which are seen as lower-growth categories, will be exited over time:

Source: Investor Presentation

While selling higher-yielding retail and office properties and redeploying those proceeds into lower-yielding residential assets will be a near-term headwind for profit growth, this strategy will make the REIT more resilient over time. Residential properties will always be in demand as people need a place to live, whereas office and retail properties may be less in demand in a recession.

Also, rent growth in residential properties has been higher than in retail and office properties in the recent past. If that trend continues, same-property rent growth should be higher in the future as the REIT increases its residential exposure, which will be positive for its organic FFO growth in the long run.

Growth Prospects

H&R REIT’s growth will rest on several pillars going forward.

First, the company can increase its same-property rents over time. This is especially true for its residential portfolio, where rents have grown faster than in other categories such as the office portfolio. It can be expected that the same will hold true going forward, as demand for residential properties is growing faster relative to demand for office properties, for example.

The fast same-property rent growth in the residential portfolio was showcased by the company’s results in the most recent quarter. During the fourth quarter of 2022, H&R REIT grew its same-property net operating income from CAD$29.4 million to CAD$34.1 million, which makes for a compelling 16% annual growth rate which outpaced the company-wide same-property net operating income growth rate of 11%.

H&R REIT will also continue to reinvest some of its cash flow into new properties, either by acquiring properties or portfolios of properties, or by developing growth projects themselves. Based on FFO for the last year of $0.86 per share, the payout ratio is close to 50%, giving H&R REIT ample surplus cash flows that can be reinvested in the business.

For acquisitions and new growth projects, H&R REIT can also utilize debt. It has a strong balance sheet and can thus increase debt levels, e.g. in order to finance 30%, 40%, or 50% of its new investments with debt while paying for the remainder with retained cash flows.

Dividend Analysis

Like many others in the sector, H&R REIT is seen as an income investment by many. And rightfully so, as the stock offers an attractive dividend yield of 4.7%, based on a monthly dividend payout of CAD$0.05, a current exchange rate of CAD$1.37 per USD, and a current share price of at US$9.30 right now.

Based on the funds from operations-per-share of CAD$1.19 that H&R REIT generated in 2022, the payout ratio is 50.3%. This indicates that the dividend is pretty safe, as that is a low payout ratio for a REIT — many peers operate with payout ratios of 60%, 70%, or even 80%.

The strong balance sheet further indicates that there is little reason to worry about a dividend cut. H&R REIT’s debt to assets stand at only 44%, which is rather conservative for a REIT.

Final Thoughts

H&R Real Estate Investment Trust is one of Canada’s larger REITs that combines a diversified high-quality asset base with a compelling dividend yield of close to 5% and a strong balance sheet.

Its strategy of increasing its focus on residential real estate could pay off in the long run, as this is a higher-growth area relative to markets such as office and retail properties.

In the recent past, H&R REIT’s same-property net operating income has grown at an attractive pace thanks to strong demand for the REIT’s high-quality assets.

At the end of the fourth quarter, H&R REIT’s net asset value was CAD$21.80 per share, which pencils out to US$15.90 at current exchange rates. With H&R REIT trading for just US$9.30 today, that makes for a 58% price to NAV ratio. In other words, H&R REIT could see its shares climb by 71% if they were to trade at net asset value in the future, although there is no immediate catalyst for that.

Based on a price to FFO ratio, H&R REIT looks inexpensive as well, as the multiple is just 10.7, which is rather undemanding.

With a well-covered dividend that yields close to 5%, this monthly-paying REIT has merit as an income investment.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link