helen89/iStock Editorial via Getty Images

Introduction

Microsoft Corporation (NASDAQ:MSFT) is the company which has been disrupting our world for more than four decades since it started introducing its first operating systems. Microsoft’s iconic Office tools, such as Word and Excel, revolutionized the way people work and significantly boosted the productivity of workers worldwide compared to the times when office work was done on paper and numbers were manually summed up with calculators.

While Office tools boosted productivity by making the “content” electronic and more easily editable and analyzable, nowadays generative artificial intelligence, or AI, tools even can do all the routine work by themselves. And, once again, Microsoft is at the forefront of this new wave called “the AI revolution.”

The company leverages its strategic partnership with an emerging OpenAI startup, which enables it to add unmatched AI features across the whole set of its offerings spanning from Cloud to Office Productivity. My discounted cash flow, or DCF, analysis suggests that the stock is attractively valued with a 14% discount, and the current share price makes this stock a “Strong Buy.”

Fundamental analysis

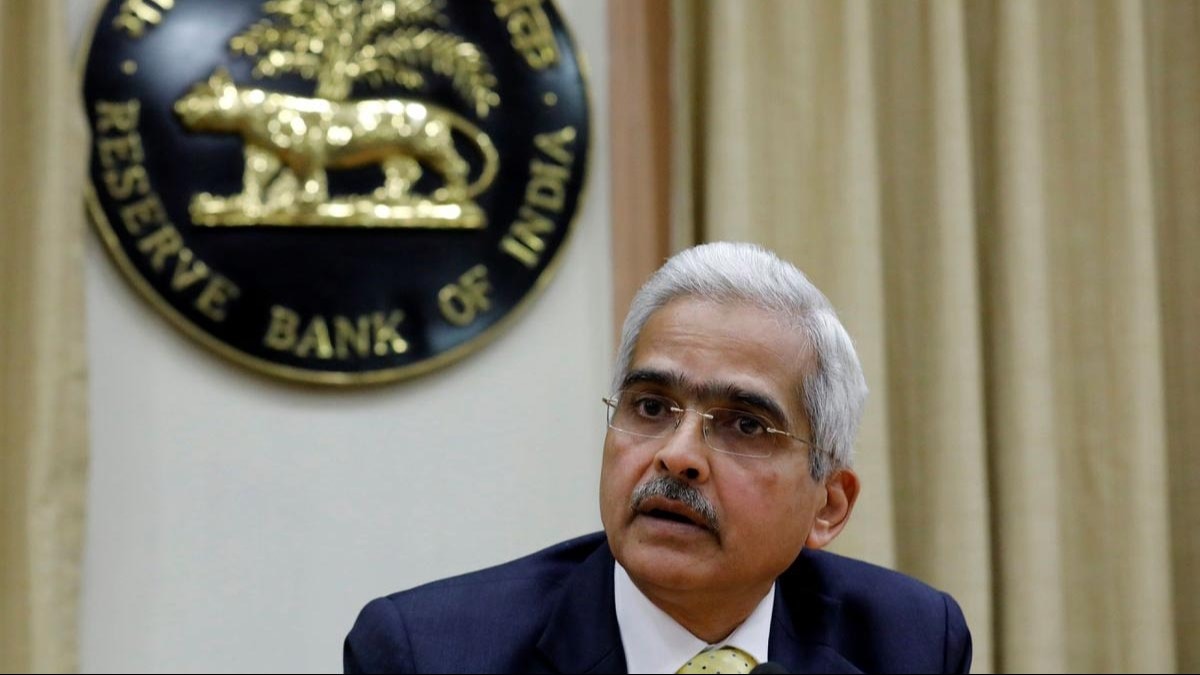

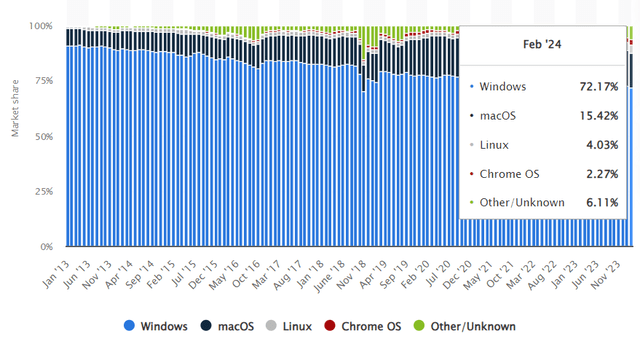

Microsoft, the world’s largest company by market capitalization, is one of the most well-known brands in the world. The company’s impact is huge since it holds 72% global market share for desktop PC operating systems. Over the past decade, the company’s market share in the industry declined from 90% to 72%, but MSFT’s consistent commitment to innovation enabled the company to unlock new growth and profitability drivers in recent years.

Statista

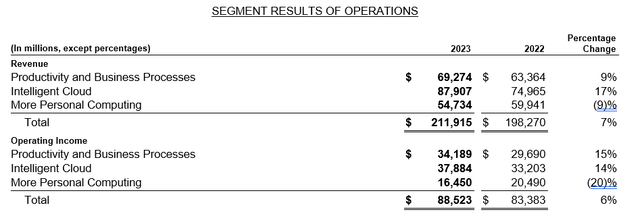

The company capitalized well on the emergence of cloud technologies, and its flagship Azure cloud offering became MSFT’s new star. As of FY2023 Intelligent Cloud was the largest segment both based on revenue and operating income with more than 40% share of the total. Despite becoming the largest segment, Intelligent Cloud is also the fastest growing segment with a 17% YoY growth in FY 2023.

Microsoft’s 2023 annual report

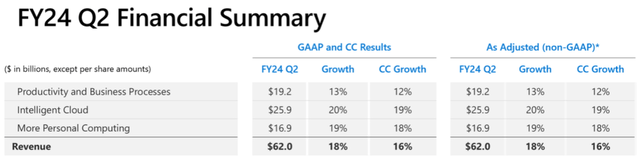

Strong growth momentum for the cloud is still there. According to the fiscal Q2 2024 results, Intelligent Cloud remains the major growth contributor for Microsoft. Growth in the broader cloud market is expected to accelerate in 2024 after cooling down during 2023. The emergence of AI functionality appears to be a strong growth driver for the cloud industry, which is a firm tailwind for Microsoft as one of the world’s leading cloud players. The company competes with Amazon.com, Inc. (AMZN) and Alphabet Inc. (GOOG) (GOOGL) in the cloud industry, where all three giants account for two-thirds of the global market.

Fiscal Q2 2024 presentation

The competition looks dangerous, but I am optimistic. As I mentioned earlier, the industry is still growing rapidly, meaning that there will be enough room for all three giants to enjoy industry growth. Microsoft’s substantial investment in one of the hottest companies of 2024, OpenAI, provides it with exclusive access to incorporate OpenAI’s (the company which developed ChatGPT) features into Microsoft’s products. And Microsoft uses this technological advantage across all its offerings, not only the cloud business. For example, Microsoft offers generative AI “Copilot” functionality across its office productivity suite Microsoft 365.

Microsoft

In an era of ecosystems and seamless integration of various tools, I believe that Microsoft’s comprehensive software business solutions, which complement each other (Cloud and Productivity), provide a solid competitive edge. While I don’t anticipate a sharp revenue spike thanks to Copilot this year, I expect steady and sustainable growth as more users recognize the vast economic benefits of leveraging generative AI functionality.

The strong positive indicator is that Microsoft and OpenAI continue collaborating closely to improve their technological edge in AI. The two companies are evaluating opportunities to initiate a new $100 billion data center with a new potential “Stargate” supercomputer, which will enable the partners to leverage new and more sophisticated AI capabilities. Another positive piece of information is that OpenAI plans to roll out a new GPT-5 version of its famous chatbot, meaning that Microsoft will also highly likely introduce new capabilities to its product set. This will likely be a strong reply to the recent Anthropic’s release of its Claude 3.

It appears that Microsoft does not only bet on its partnership with OpenAI to expand its footprint in the emerging AI industry, but also aims to build a strong AI team within the company. The company recently appointed one of the AI industry’s pioneers, Mustafa Suleyman as its head of AI. The company also has a partnership agreement with a startup called Inflection (where Mr. Suleyman was one of the founders) to leverage an AI startup’s models and algorithms through Azure. Microsoft also has a waiver from claims against the company related to hiring Inflection employees, meaning that it has the potential to fortify its AI team with new strong engineers.

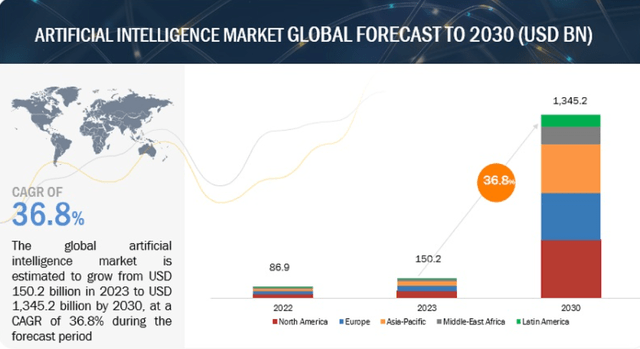

marketsandmarkets.com

To conclude, Microsoft’s massive bet on AI appears to be sound from a business perspective. The AI industry is expected to reach $1.3 trillion by 2030 and record a massive 37% CAGR over the next multiple years. I appreciate Microsoft’s firm commitment to becoming the number one software AI company, which may not have been publicly declared, but all the developments suggest that Microsoft indeed plans to be the cornerstone of the AI revolution.

Valuation analysis

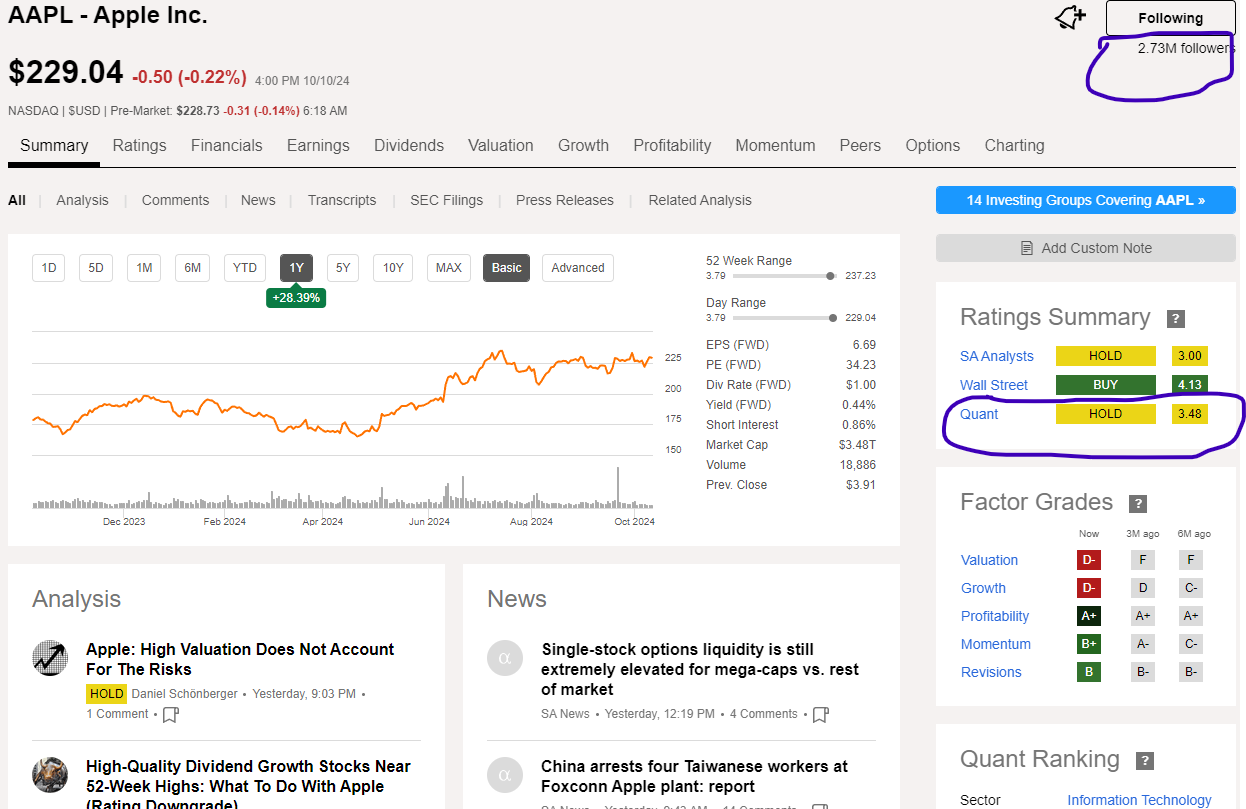

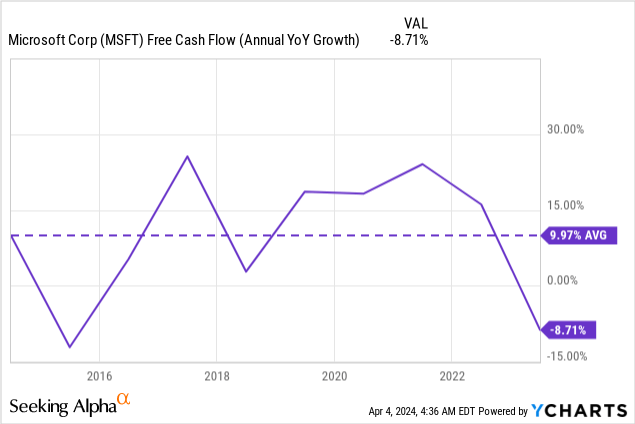

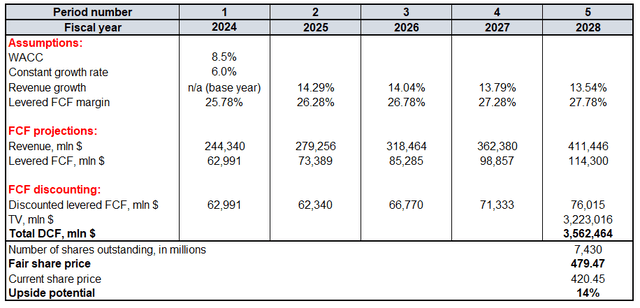

MSFT has demonstrated strong momentum across various timeframes within the last year. Microsoft is currently the world’s most valuable company with a $3.13 trillion market capitalization. To value MSFT I will run a discounted cash flow model with an 8.5% WACC. The DCF model is all about revenue growth rates and free cash flow (“FCF”) improvements. According to the below chart, MSFT’s FCF margin has been compounding with an average 9.97% rate over the past decade.

Considering historically rapid FCF growth together with MSFT’s status as one of the most crucial companies of the digital revolution, it appears fair to apply a 6% constant growth rate for my DCF model. I refer to revenue consensus estimates for FYs 2024-2025 and expect revenue growth to decelerate slowly, by 25 basis points per year after FY 2025. For the FCF margin, I use a TTM 25.78% level and project 50 basis points yearly expansion. According to Seeking Alpha, there are currently around 7.43 billion MSFT shares outstanding.

Calculated by the author

My DCF model suggests that MSFT has around 14% upside potential. The fair share price recommended by my DCF is around $480. A stock like MSFT trading with a 14% discount appears to be a bargain.

Mitigating factors

MSFT is currently close to all-time highs, and the stock price almost doubled within a relatively short period (around 18 months). In these circumstances, there is the risk that swing traders might start recording their profits and trim their positions in the stock. Increased selling pressure from profit-taking can potentially drive the stock price lower.

Moreover, having such a rapid share price growth reflects significantly improved sentiment around MSFT and much higher expectations regarding the company’s future. Therefore, any adverse deviation from expectations (negative news or earnings miss), could lead to a sharp price drop as investors might start reevaluating their positions.

As the world’s largest company and a software behemoth, Microsoft is likely to be a very attractive target for potential cyberattacks. The company recently revealed information that it prevented attacks from China, Russia, and Iran. All these countries have tense relationships with the United States, softly speaking. Therefore, cyberattacks on one of the U.S. business flagship entities from these unfriendly regimes might occur again. Any successful notable breaches could compromise sensitive data and undermine trust in Microsoft’s security measures.

While currently Microsoft is at the forefront of the AI revolution, technologies are evolving rapidly and there is no guarantee that Microsoft will never lose its competitive technological edge. The company had its “lost decade” when the stock price stagnated for several years at the beginning of the 21st century. Therefore, Microsoft’s current success does not guarantee that AI-driven growth will last for decades.

Conclusion

Microsoft is one of the most important companies in the ongoing digital revolution with its massive share in critical information technology areas: operating systems, cloud, and office productivity. The stock is attractively valued with a 14% discount and also offers a rapidly growing dividend, making it a “Strong Buy” for long-term investors. There might be a temporary pullback considering the stock is currently trading close to all-time highs, but from the long-term perspective, I consider Microsoft’s stock to be any investor’s must-have.