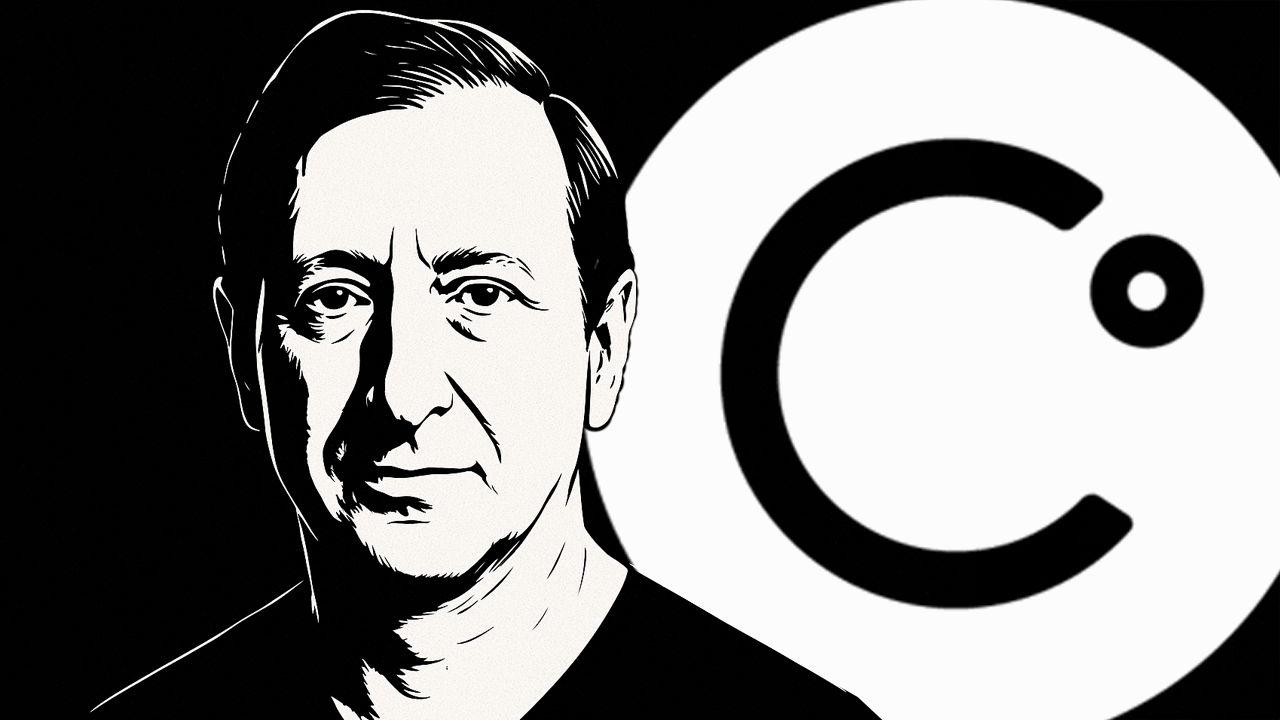

David Becker/Getty Images Entertainment

Microsoft (NASDAQ:MSFT) and Activision (NASDAQ:ATVI) are evaluating selling some of their cloud-gaming rights in the UK in order to appease the antitrust regulator that opposes the deal.

A potential resolution may involve selling off the cloud-based market rights for videogames in the UK to a telecom, gaming, or internet-based computing firm, according to a Bloomberg report, which cited people familiar with the matter.

Both Activision (ATVI) and Microsoft (MSFT) believe it’s still possible that the $69 billion deal could close by the Tuesday termination deadline, according to the report.

The report comes after a federal judge late Thursday denied the Federal Trade Commission’s request to temporarily block the combination as the regulator appeals an earlier decision that let the deal move forward.

After a pause in UK litigation requested by the two companies and UK regulator the Competition and Markets Authority earlier this week, Microsoft (MSFT) will still need to get a remedy accepted by the CMA to get the regulatory go-ahead in the UK.

Microsoft (NASDAQ:MSFT) is offering to make a small divestiture to meet the objections of the UK’s antitrust regulator to its planned Activision (ATVI) deal, CNBC’s David Faber said Tuesday. Microsoft (MSFT) is offering a “small and discrete” divestiture to the CMA that it believes the regulator will accept.