Chip Somodevilla/Getty Pictures Information

Meta Platforms, Inc. (NASDAQ:META) inventory took a big dip on Tuesday, falling 4% when the market rallied almost 3%. On the day that Meta crashed, no materials information was launched, other than a DoJ settlement affecting a tiny share of the enterprise. The crash did coincide with some Fb posts by Mark Zuckerberg, however none of these posts contained information that might qualify as “materials” (i.e., having a measurable impression on monetary efficiency). Many buyers have been dismayed.

On the day Meta fell, I scoured the web on the lookout for attainable causes of the crash. I ultimately discovered studies that Meta would forego income cuts on creator funds till 2024. I discovered it unlikely that that alone would trigger Meta to fall so severely, as quickly “free” companies are recognized to draw customers/clients. So, I went on Fb to see what Mark Zuckerberg was saying concerning the income lower. After wanting on the broader context, I believed I had discovered the supply of the crash. I took to Twitter (TWTR) to share what I had discovered.

Principally, Zuckerberg’s announcement about influencer income was throughout the context of a bigger thread containing many issues buyers don’t wish to hear. Not solely did Zuckerberg pledge to provide influencers 100% of their income till 2024, he additionally re-affirmed his dedication to the Metaverse. The Metaverse is a large mission for Meta, one so huge it impressed the corporate’s current identify change. A whole division of Meta–Actuality Labs–is devoted to constructing the Metaverse, and it’s dropping cash. Typically talking, buyers don’t like listening to about Zuckerberg’s enthusiasm for the Metaverse, as many consider it’s a lengthy shot wager which will by no means repay.

It might be that the Metaverse gained’t repay. Actually, VR enterprise conferences aren’t anyone’s concept of “tried and true.” What buyers neglect is that Meta is a wildly worthwhile firm even with $3 billion being spent on the Metaverse each single quarter. In its most up-to-date 12 month interval, Meta had $119 billion in income, $96 billion in gross revenue, $43 billion in working revenue, and $31 billion in free money movement (“FCF”). Merely staggering ranges of revenue. An organization with 80% gross margins (that’s not a typo) can afford to take a position some cash in progress initiatives, and META is benefiting from its sturdy monetary efficiency to take action.

Given this peculiar mixture of excessive profitability, first rate income progress and a falling inventory value, it’s exhausting to keep away from evaluating Meta to Alibaba Group Holding Restricted (BABA, OTCPK:BABAF) at its lowest ranges. Following China’s re-imposition of lockdowns, BABA hit actually absurd lows at which it was barely buying and selling above liquidation worth. It has since rallied 38% off its all-time lows and is down lower than the S&P 500 this yr. FB will not be precisely an identical to BABA, because it doesn’t fairly have a value to ebook ratio barely above 1. On the flipside, it’s uncovered to fewer threat components, particularly excessive tail dangers, which makes it a worthy addition to a price oriented portfolio.

Meta Inventory Trades Beneath Truthful Worth in a Discounted Money Movement Mannequin

When you comply with Meta inventory carefully, you’ve in all probability heard about its notoriously low multiples. In short, it trades at simply 9.4 instances free money movement and the earnings multiples are equally low. I’ve coated this reality in previous articles–there’s little so as to add as we speak aside from to say that the multiples are even decrease now.

There may be, nevertheless, a unique valuation method we will take:

A reduced money movement valuation. That is the place you low cost just a few years’ price of money flows throughout a interval of progress after which add a terminal worth for a interval of slower progress. This provides you a value goal, which multiples don’t, as they’re simply ratios.

Usually in a reduced money movement mannequin you’ll take 5 or 10 years’ money flows, low cost them, after which add the terminal worth. In previous articles I’ve used this technique to worth shares. Nevertheless, in Meta’s case, we will skip the “progress interval” totally, because the inventory is undervalued assuming 0% perpetual progress in FCF.

A inventory’s “terminal worth” is outlined as:

Terminal money movement/(low cost charge – sustainable progress charge).

Let’s say that Meta doesn’t develop in any respect for the remainder of eternity. To sweeten the pot, we’ll assume that the ten yr treasury yield rises from the present 3.167% to three.5%. A really brutal set of assumptions that may indicate extreme draw back, proper?

Improper.

Meta’s trailing 12 month FCF was $14.3. Since we’re assuming no progress, the denominator is solely the three.5% low cost charge. Our terminal worth equation then is:

14.3/0.035.

The end result?

$408.50!

That’s greater than double as we speak’s inventory value and we’re assuming no progress right here. In fact, some DCF fashions use extra punishing low cost charges than the treasury yield. The web site valueinvesting.io, for instance, makes use of an 8.9% WACC of their META mannequin. They get a value goal of $258 with some assumed progress. Utilizing their low cost charge and no progress assumption, you get a terminal worth of $160, which remains to be upside to as we speak’s value.

After making an attempt just a few completely different DCF fashions with completely different inputs, I actually struggled to get PV outcomes beneath Meta’s present inventory value. The one one which labored was swapping out FCF for EPS and utilizing WACC. Utilizing these inputs and assuming no progress you get a PV decrease than the present inventory value, however take into account, it is a hand-picked assortment of probably the most unfavorable inputs attainable. Utilizing the extra standard FCF over EPS and assuming no progress, you get upside.

Aggressive Panorama

As I confirmed above, Meta Platforms, the enterprise, is price greater than META, the inventory, if it by no means grows once more for the remainder of eternity. It actually appears like a compelling worth. Nevertheless, we have to handle the opportunity of destructive progress. Have been Meta’s earnings to say no perpetually, a reduced money movement evaluation may produce a unique end result than the one I calculated above. So, we have to discover the corporate’s aggressive place, to see whether or not it might lose out to opponents so badly that its earnings go down long run.

As I’ve coated extensively in previous articles, Meta was on the dropping finish of some developments within the ad-tech trade final yr. Apple (AAPL) introduced in adjustments in IOS 14.5 that required advertisers to ask for permission earlier than monitoring them. Solely 25% opted in to monitoring. In consequence, Meta’s income progress declined to 7% within the first quarter. In the identical quarter, Alphabet (GOOG, GOOGL) managed 23% income progress.

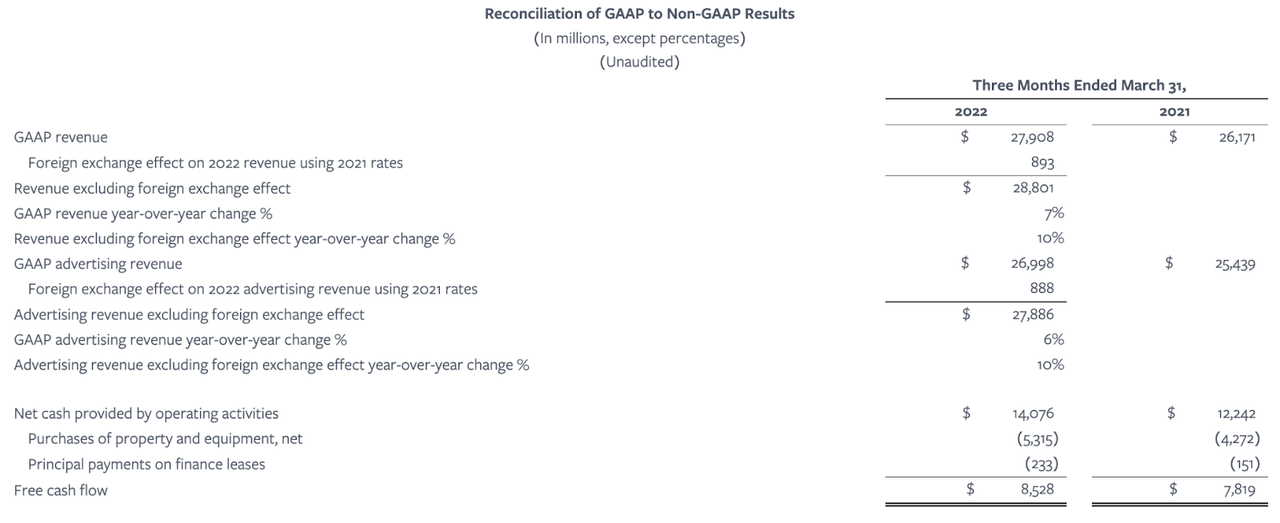

When you suspect that Meta misplaced income to Alphabet, you’re proper. Google Search doesn’t require wherever close to as a lot consumer knowledge as Fb/Instagram advertisements do, so it was damage by Apple’s privateness adjustments a lot lower than Meta was. Within the fourth quarter earnings name, Meta CFO David Wehner mentioned that Apple’s ATT adjustments would price Meta $10 billion in 2022. Within the first quarter, we noticed that income did certainly decelerate rather a lot. So, that $10 billion hit might be an actual factor. Nevertheless, Meta’s progress didn’t truly flip destructive. 7% income progress is gradual for a tech firm, positive, however it’s nonetheless optimistic, and the FCF progress (calculated with the desk beneath) was 9%. So, we’re nonetheless effectively forward of the 0% progress Meta wants with a purpose to be an excellent worth play.

9% free money movement progress (Meta Platforms)

Dangers and Challenges

As I’ve proven on this article, META inventory is priced decrease than the truthful worth of Meta Platforms as a enterprise. Actually, it appears like a successful mixture. There are dangers and challenges to be looking out for, as I’ve written in previous articles. Some noteworthy ones embody antitrust lawsuits, extreme Metaverse spending, and Apple’s privateness coverage. In my view, these threat components don’t outweigh the easy indisputable fact that Meta is undervalued underneath zero progress assumptions. Nevertheless, there’s one threat issue that could possibly be thought of severe sufficient to justify avoiding the inventory:

Time horizons.

In case your supposed holding interval is only some months to a yr, you can lose a good bit of cash buying and selling Meta inventory. Meta has its second quarter earnings launch developing, and it’s going to be a troublesome one. The second quarter of the earlier yr was very sturdy. In it, the corporate grew income by 56% and earnings by 101%. In that quarter, most Apple clients hadn’t opted into IOS 14.5 but. So, Meta nonetheless had full ad-targeting energy.

This time round, it gained’t have that benefit. Beating 1 / 4 the place income grew 56% is at all times robust, and Meta’s going into this one with one hand tied behind its again. I believe the chance of a dip following Q2 earnings is fairly excessive. So, quick time period buyers may wish to keep away.

The thought course of that goes right into a DCF evaluation doesn’t say something about timeframes. It may possibly take a few years for a inventory to rise to truthful worth. The sorts of outcomes that Meta must rise from its present degree long run will probably be fairly simple to attain. However that gained’t forestall the inventory from dropping after Q2 earnings. I believe there’s an honest likelihood that it’s going to.

The Backside Line

Placing all of it collectively, Meta Platforms has the makings of a price play much like Alibaba when it was buying and selling for $72. Very similar to BABA, META trades for lower than the truthful worth of its future money flows even with extraordinarily modest progress assumptions. Does that imply that Meta goes to rally in a single day? No. However it does make it a worthy decide for long run, buy-and-hold buyers.